FOCUSED ON LONG TERM TOTAL RETURN VIA A DIVERSIFIED

advertisement

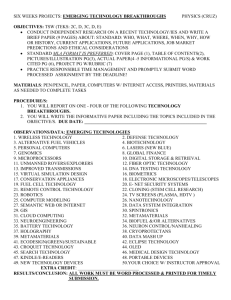

FOCUSED ON LONG TERM TOTAL RETURN VIA A DIVERSIFIED PORTFOLIO OF OPERATIONAL CASH GENERATIVE INVESTMENTS Investments by Geography and Sector as at 30 September 2015 Oth er ina Ch Brazil ma ni Ro a si a ay al M nd ila a Th Ports Gas Water Airport Satellites Electricity Toll Roads Renewables - An established closed end fund on a stable financial footing -S ecuring long term returns from emerging markets - Proven investment strategy focused on long term total return -S trong management team with impressive track record in the sector - Asset portfolio mitigates market risk Financial Performance Outperformed the MSCI Emerging Markets Total Return Index. Over five years, UEM achieved a total return of 20.9% versus the MSCI Emerging Markets Index total return (GBP adjusted) of negative 11.8%. Comparative Performance Dividend per Ordinary Share Dividend per Ordinary Share Rebased to 100 at 31 September 2010 150 140 130 September asas atat 3130 March 2013 2015 7.00p UEM Net Asset Value total return 6.00p MSCI Emerging Markets Index (GBP adjusted) 5.00p 120 4.00p 110 3.00p 100 2.00p 90 1.00p 80 Sep 2010 Sep 2011 Sep 2012 Sep 2013 Sep 2014 Sep 2015 0.00p 4.80p 4.80p 4.80p 5.20p 5.50p 5.80p 6.10p 6.10p 3.15p 2.70p 1.50p 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 HY2016 2014 WINNER Emerging Markets GLOBAL EMERGING MARKETS Utilico Emerging Markets GLOBAL EMERGING MARKETS Utilico Emerging Markets For more information go to www.uem.bm www.icm.limited www.icmim.limited MATURE, OPERATIONAL INVESTMENTS WITH STRONG CASHFLOWS Malaysia Airports Holdings Berhad Sector: Airports Kuala Lumpur International Airport APT Satellite Telecommunications Holdings Limited Sector: Satellite Earth Station, Hong Kong Ocean Wilsons Holdings Limited Sector: Ports Tecon Salvador port terminal China Gas Holdings Limited Sector: Gas Natural Gas Storage Facility in Wuhu City, Anhui Province An established closed end fund on a stable financial footing - Launched in 2005 and listed on the London Stock Exchange - Gross assets less current liabilities of £401.7m - Low gearing of 3.8% (limited at 25% of gross assets) with a £50m bank facility - NAV annual compound total return of 10.7% since inception - Multi award-winning performance Proven investment strategy focused on long term total return - Total return underpinned by operational and cash generative investments - Investment managers focused on businesses with operational assets rather than greenfield investments, thus “mitigating” risk - 97.2% of portfolio invested in listed entities which are predominantly established, profitable and paying dividends, enhancing liquidity and transparency - Investment decisions based on in-depth fundamental research including financial analysis, management meetings and frequent site visits Asset portfolio mitigates market risk - Effective risk mitigation achieved via geographic and sector diversification (China 28.4%, Malaysia 14.9%, Brazil 9.6%, Romania 7.6%) - Single country exposure limited to 50% of gross assets, with individual stock exposure at 20% - Current largest single holding accounts for 7.9% of gross assets and the top ten amount to 49.4% - Majority of investments pay a dividend, providing fundamental resilience in weak markets This document is only directed at persons in the United Kingdom who are investment professionals as defined in Article 19 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, high net worth companies, unincorporated associations and other persons as defined in Article 49 of that Order or others to whom this document can lawfully be distributed or given, inside the United Kingdom, without approval of an authorised person. Any other person should not rely on it or act on it and any investment or investment activity to which it relates will not be engaged in with them. The information presented on this document is solely for information purposes and Securing long term returns from emerging markets - Emerging markets GDP forecast to continue to outperform developed markets - Rapid growth of urban middle class instrumental in driving need for better infrastructure, utilities and environmental policies, resulting in opportunities often delivering GDP+ growth rates - Focus on undeveloped and developing markets with positive investment attributes such as political stability, economic development, an acceptable legal framework and a positive disposition to foreign investment Strong management team with impressive track record in the sector - Managed by ICM Investment Management Limited (“ICMIM”) and ICM Limited (“ICM”), a strong dedicated utilities and infrastructure team with a wealth of experience investing in emerging markets utilities and infrastructure sectors - ICM team travels extensively visiting investee companies and seeking new investment opportunities - A bespoke comprehensive database containing analysis of over 900 companies - The global ICM team has over 30 staff in six offices managing over £1.5bn in specialist mandates which supports the utilities and infrastructure team * all figures as at 30 September 2015 is not intended to be, and should not be construed as an offer or recommendation to buy and sell investments. If you are in any doubt as to the appropriate course of action, we would recommend that you consult your own independent financial adviser, stockbroker, solicitor, accountant or other professional adviser. Past performance is no guide to the future. The value of investments and the income from them may go down as well as up and investors may not get back the full amount they originally invested. The information presented has been obtained from sources believed to be reliable but no representation or warranty is given, or may be implied that they are accurate or complete. For more information go to www.uem.bm www.icm.limited www.icmim.limited