Personal Tax Return Guide, 2012 Taxation Year Table of

advertisement

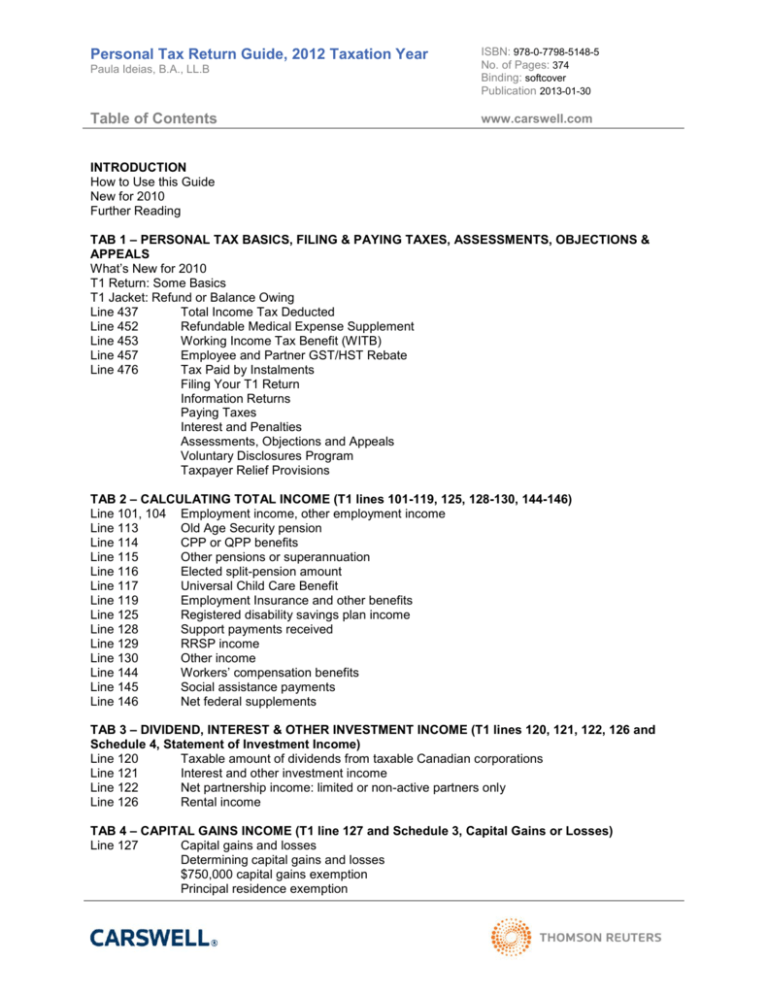

Paula Ideias, B.A., LL.B ISBN: 978-0-7798-5148-5 No. of Pages: 374 Binding: softcover Publication 2013-01-30 Table of Contents www.carswell.com Personal Tax Return Guide, 2012 Taxation Year INTRODUCTION How to Use this Guide New for 2010 Further Reading TAB 1 – PERSONAL TAX BASICS, FILING & PAYING TAXES, ASSESSMENTS, OBJECTIONS & APPEALS What’s New for 2010 T1 Return: Some Basics T1 Jacket: Refund or Balance Owing Line 437 Total Income Tax Deducted Line 452 Refundable Medical Expense Supplement Line 453 Working Income Tax Benefit (WITB) Line 457 Employee and Partner GST/HST Rebate Line 476 Tax Paid by Instalments Filing Your T1 Return Information Returns Paying Taxes Interest and Penalties Assessments, Objections and Appeals Voluntary Disclosures Program Taxpayer Relief Provisions TAB 2 – CALCULATING TOTAL INCOME (T1 lines 101-119, 125, 128-130, 144-146) Line 101, 104 Employment income, other employment income Line 113 Old Age Security pension Line 114 CPP or QPP benefits Line 115 Other pensions or superannuation Line 116 Elected split-pension amount Line 117 Universal Child Care Benefit Line 119 Employment Insurance and other benefits Line 125 Registered disability savings plan income Line 128 Support payments received Line 129 RRSP income Line 130 Other income Line 144 Workers’ compensation benefits Line 145 Social assistance payments Line 146 Net federal supplements TAB 3 – DIVIDEND, INTEREST & OTHER INVESTMENT INCOME (T1 lines 120, 121, 122, 126 and Schedule 4, Statement of Investment Income) Line 120 Taxable amount of dividends from taxable Canadian corporations Line 121 Interest and other investment income Line 122 Net partnership income: limited or non-active partners only Line 126 Rental income TAB 4 – CAPITAL GAINS INCOME (T1 line 127 and Schedule 3, Capital Gains or Losses) Line 127 Capital gains and losses Determining capital gains and losses $750,000 capital gains exemption Principal residence exemption Paula Ideias, B.A., LL.B ISBN: 978-0-7798-5148-5 No. of Pages: 374 Binding: softcover Publication 2013-01-30 Table of Contents www.carswell.com Personal Tax Return Guide, 2012 Taxation Year Personal use property Special Rules Relating to Capital Gains and Losses Completing Schedule 3 TAB 5 – SELF-EMPLOYMENT INCOME (T1 lines 135-143) Line 135 Business income Line 137 Professional income Lines 141, 143 Farming and Fishing Income TAB 6 – NET INCOME (T1 lines 206 – 236) Line 206 Pension adjustment Line 207 Registered pension plan deduction Line 208 RRSP deduction Line 209 Saskatchewan Pension Plan deduction Line 210 Deduction for elected split-pension amount Line 212 Annual union, professional, or like dues Line 213 Universal Child Care Benefit repayment Line 214 Child care expenses Line 215 Disability supports deduction Line 217 Business investment loss Line 219 Moving expenses Line 220 Support payments made Line 221 Carrying charges and interest expenses Line 222 Deduction for CPP or QPP contributions on self-employment and other earnings Line 223 Deduction for provincial parental insurance plan premiums on self-employment income Line 224 Exploration and development expenses Line 229 Other employment expenses Line 231 Clergy residence deduction Line 232 Other deductions Line 235 Social benefits repayment TAB 7 – TAXABLE INCOME (T1 lines 244 – 256) Line 244 Canadian Forces personnel and police deduction Line 248 Employee home relocation loan deduction Line 249 Security options deductions Line 250 Other payments deduction Line 251 Limited partnership losses of other years Line 252 Non-capital losses of other years Line 253 Net capital losses of other years Line 254 Capital gains deduction Line 255 Northern residents deduction Line 256 Additional deductions TAB 8 – FEDERAL TAX AND CREDITS (Schedule 1, Federal Tax, lines 300 – 427) Line 300 Basic personal amount Line 301 Age amount Line 303 Spouse or common-law partner amount Line 305 Amount for an eligible dependant Line 306 Amount for infirm dependants age 18 or older Line 308 CPP or QPP contributions through employment Line 310 CPP or QPP contributions on self-employment and other earnings Line 312 Employment insurance premiums Paula Ideias, B.A., LL.B ISBN: 978-0-7798-5148-5 No. of Pages: 374 Binding: softcover Publication 2013-01-30 Table of Contents www.carswell.com Personal Tax Return Guide, 2012 Taxation Year Line 313 Line 314 Line 315 Line 316 Line 318 Line 319 Line 323 Line 324 Line 326 Line 330 Line 331 Line 349 Line 363 Line 364 Line 365 Line 367 Line 369 Line 405 Line 409, 410 Line 412 Line 413, 414 Line 415 Line 424 Line 425 Line 426 Line 427 Adoption expenses Pension income amount Caregiver amount Disability amount Disability amount transferred from a dependant Interest paid on your student loans Tuition, education, and textbook amounts Tuition, education, and textbook amounts transferred from a child Amounts transferred from your spouse or common-law partner Medical expenses for self, spouse or common-law partner, and your dependent children born in 1992 or later Allowable amount of medical expenses for other dependants Donations and gifts Canada employment amount Public transit amount Children’s fitness amount Amount for children born in 1992 or later Home buyers’ amount Federal foreign tax credit Federal political contribution tax credit Investment tax credit Labour-sponsored funds tax credit Working Income Tax Benefit advance payments Federal tax on split income Federal dividend tax credit Overseas employment tax credit Minimum tax carryover TAB 9 – PROVINICAL AND TERRITORIAL TAXES AND CREDITS (T1 lines 428, 438, 440, 479) Line 428 Provincial or Territorial Tax Line 438 Tax Transfer for Residents of Quebec Line 440 Refundable Quebec Abatement Line 479 Provincial or Territorial Credits Provincial and Territorial Quick Reference: Alberta British Columbia Manitoba New Brunswick Newfoundland and Labrador Northwest Territories Nova Scotia Nunavut Ontario Prince Edward Island Saskatchewan Yukon Quebec TAB 10 – CANADIAN TAXATION OF NON-RESIDENTS AND DEEMED RESIDENTS Determining Canadian residency Taxation of Nonresidents, Deemed Residents and Part-Year Residents Filing Requirements for Nonresidents and Deemed Residents Paula Ideias, B.A., LL.B ISBN: 978-0-7798-5148-5 No. of Pages: 374 Binding: softcover Publication 2013-01-30 Table of Contents www.carswell.com Personal Tax Return Guide, 2012 Taxation Year Elective Returns for Nonresidents Emigrating from Canada TAB 11 –TAX PLANNING, REGISTERED PLANS AND U.S. TAX CONSIDERATIONS Income Splitting and the Attribution Rules Owner-Manager Remuneration Planning Registered Accounts (TFSAs, RESPs, RDSPs) U.S. Tax Considerations for Canadians with U.S. Connections APPENDICES Appendix A Appendix B Appendix C Appendix D Appendix E Appendix F Appendix G INDEX Key CRA Personal Tax Guides, Pamphlets, Forms, Schedules and Worksheets Important CRA Mailing Addresses, Website Addresses and Telephone Numbers Key Personal Tax Definitions Medical Expense Quick Reference Table E-1 Tax Planner Guide: The Principal Residence Exemption E-2 Tax Planner Guide: Tax on Split Income E-3 Tax Planner Guide: Post-Mortem Tax Planning and Tax Elections at Death F-1 Canadian Personal Tax Compliance Calendar F-2 U.S. Personal Tax Compliance Calendar Personal Tax Reference Tables G-1 Federal and Provincial/Territorial Income Tax Rates, Brackets and Surtaxes for 2010 and 2011 (I-1) G-2 Federal and Provincial/Territorial Non-Refundable Tax Credit Rates and Amounts for 2010 (I-2) G-3 2011 Federal Indexation Adjustment for Personal Income Tax and Benefit Amounts G-4 Combined Top Marginal Tax Rates for Individuals – 2010 (I-4) G-5 Eligible Dividend Tax Credit Rates and Amount of Dividends That May be Received without Incurring Tax in 2010 (I-5) G-6 Non-Eligible Dividend Tax Credit Rates and Amount of Dividends That May be Received without Incurring Tax in 2010 (I-6) G-7 Retirement Plan Contribution Limits (I-10) G-8 Automobiles – Deductions and Benefits (I-11)