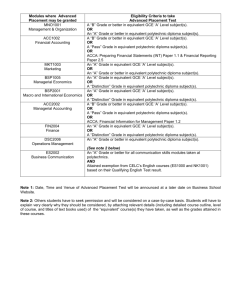

PDF Version - Republic Polytechnic

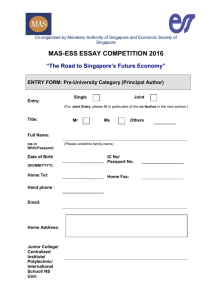

advertisement