Financials

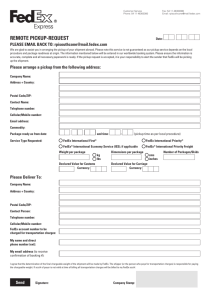

advertisement