Annual Report 2013 - HBL Power Systems

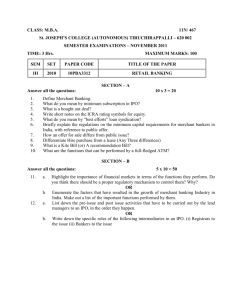

advertisement