Barriers to entry in electricity generation

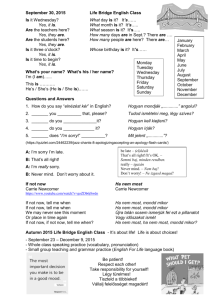

advertisement