ManEconPrice199

advertisement

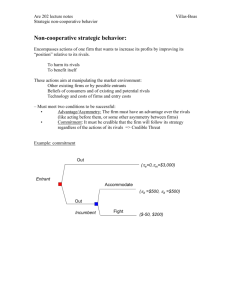

Topic 9: Pricing Decisions: Theoretical Aspects Davies: Chapter 12 Objectives: 1. To review the implications of the simple profit-maximising model for pricing decisions 2. To identify the implications of different market structures for pricing 3. To introduce the concept of limit-pricing 4. To identify how price discrimination may increase profits 1 Pricing in the Simple Model • REVIEW: • What is the equilibrium condition for maximum profit? • What is the relationship between price, marginal cost and elasticity in the profit-maximizing position? – ( can you derive that result from the basic calculus?) • Draw the diagram showing profit-maximising price for a monopolist 2 Pricing in the Simple Model • REVIEW: • What is the equilibrium condition for maximum profit? MC=MR • What is the relationship between price, marginal cost and elasticity in the profit-maximizing position? (P-MC)/P = (-) 1/Ed • • • • • • How to derive that? $ = p(q).q - c(q); to maximise $ d$/dq = dp/dq.q + p(q) - dc/dq = 0: OR P-MC = -dp/dq.q Divide both sides by P gives (P-MC)/P = -dp/dq.q/p = -1/Ed 3 Pricing in the Simple Model • REVIEW: • Draw the diagram showing profit-maximising price for a monopolist $ Marginal Cost Optimal Price Demand =AR MR Output 4 Pricing and Market Structure • In PERFECT COMPETITION, Ed = infinity, P=MC • MONOPOLY, Ed depends on closeness of substitutes – the value of (P-MC)/P = (-) 1/Ed is sometimes referred to as “Lerner’s Index of Monopoly Power” • In OLIGOPOLY, the best price to set depends on the behaviour of rivals. They may react in a number of ways – independent – leader/follower behaviour – collusion • The most productive approach to pricing in oligopoly has been through GAME THEORY 5 Pricing and Barriers to Entry • When deciding on prices, firms may find it profitable to set price below the short-run profit-maxing level, in order to DETER ENTRY. • THREE ISSUES TO CONSIDER • WHAT ARE ENTRY BARRIERS, AND HOW DO THEY ARISE? • WHAT IS THE MAXIMUM PRICE WHICH WILL DETER ENTRY? • WHEN WILL IT BE PROFITABLE TO SET THE ENTRY-PREVENTING PRICE INSTEAD OF THE SHORT RUN PROFIT-MAXING PRICE? 6 What Are Entry Barriers? • In some simple cases, entry to an industry may be BLOCKADED. (as in the pure monopoly model). Entry is not possible because of government regulations or some other absolute barrier. • In most cases, entry is not blockaded but existing firms - ‘incumbent’ firms - have some advantage over new entrants • ENTRY BARRIERS are advantages which incumbent firms have over new entrants 7 What are the Sources of Entry Barriers? • Absolute Cost Advantages – patented technology – uniquely favourable location, not available to entrants – learning effects - those who start first may have lower cost • Economies of Scale – large amounts of capital need to be raised – entry must EITHER take place at a low level of output, in which case the entrant has a cost disadvantage OR at a high level of output which requires taking most customers from the incumbent firm/s. • Product Differentiation – brand loyalty to incumbents means that entrants have to spend more to secure the same sales volume (a kind of absolute cost advantage) 8 Can We Identify the Limit Price? • The Limit Price is the “highest price which can be charged by incumbent firms without inducing new entry”. • New firms will enter if they believe that they can make a profit after they enter. • This depends on what entrants believe about the actions of the incumbent firms after entry takes place. – will they attack the new entrant by cutting prices and increasing output (as Oriental Press did)? – will they ‘make room’ for the entrant, reducing output so that prices can remain about the same? – will they keep output the same, accepting some reduction in prices • Again, game theory offers an analytical tool 9 A Simple Approach is Offered by the ‘Sylos Postulate’ • The Sylos Postulate is the assumption that incumbents will keep their output constant when entry takes place. Entrants know that and incumbents know that they know it. • In that case, for an undifferentiated product, the demand-curve facing an entrant is the ‘unused’ portion of the industry’s demand-curve P1 P2 Dindustry Dentrant x x Q1 Q2 10 A Simple Approach is Offered by the ‘Sylos Postulate’ • • • In the diagram. If existing firms set the price at P1, total demand is Q1. If the entrant sets a price P1, demand for his product will be zero because the incumbent firms are supplying all customers. If the entrant sets a price P2 total demand at that price is Q2. As existing firms keep their output constant, they only supply Q1, leaving x as the demand for the entrant. Incumbents can shift the demand-curve for the entrant by shifting their own price P 1 P Dindustry 2 Dentrant x x Q1 Q2 11 So Where is the Limit Price? • The case of Absolute Cost Advantages – – If incumbents set the price at PH, the demand curve for the entrant will be D entry encouraged. An entrant can make a profit with any level of output between 0 and Q1. Entry will take place. PH is too high to be the limit price If incumbents set price PL, the entrant’s demand curve is always below his cost curve. No profit can be made. No entry will take place. PL is the limit. price ATC entrant PH PL Dentry encouraged ATC incumbent Dentry discouraged x x Q1 Q2 12 So Where is the Limit Price? • The case of Economies of Scale This price is too high This gap is infinitely small This is the Limit Price This Price is Too Low 13 How Useful is This Analysis? • It shows the importance of entrants’ expectations of incumbents behaviour • BUT, it only covers the case where incumbents leave output unchanged • A more rational approach for incumbents would be for them to set a monopoly price but to THREATEN to cut that price and increase output if other firms try to enter. For that to be effective, the threat must be CREDIBLE. For that reason, firms sometimes build plants which are bigger than they need (or exaggerate their production capacity). 14 Will the Limit Price Be Set? • If the limit price is below the short-run profit-maxing price the firm must make a choice. This depends upon: – the speed of new entry – the amount of extra profit which can be made by charging the profitmaxing price – the discount rate which represents the relative valuation of future profits versus present profits • If entry is slow, AND a large amount of extra short-term profit can be made by charging a higher price and allowing entry, AND the discount rate is high, it will be better to ignore the limit price - set the profitmaxing price. If entry is quick, higher price gives little extra profit and discount rate is low, better to charge the limit price 15 Price Discrimination • REVIEW: • What is price discrimination? • What are the conditions which must exist for price discrimination to be possible and profitable? 16 Price Discrimination • REVIEW: • What is price discrimination? Where different customers are charged different prices for the same product • What are the conditions which must exist for price discrimination to be possible and profitable? • 1.It must not be possible for buyers to re-sell the product. If it were possible, no-one would need to buy at higher prices. • 2. Elasticities in the different sub-markets must be different or it would be most profitable to charge the same price in all markets 17 Two Forms of Price Discrimination • 1.First degree price discrimination. Every buyer may be charged a different price for the product. Personal, or domestic or professional services may be an example. – The demand curve is also the marginal revenue curve (notice also that this produces an economically efficient result because output is where MC = marginal valuation by consumers.However, all of the surplus is producer surplus). • 2. Third degree price discrimination. There are sub-markets, each containing a significant number of buyers. Markets may be segmented by: • AGE of buyers - e.g. Student discounts - but how to prevent re-sale? Most useful for nonstorable goods or services - public transport is the most common example • TIME of purchase - non-storable products (or are they different products at different times) • LOCATION - cars in UK cost 30% more than in Europe • FAMILY STATUS - Railcards • In this case, produce the level of output where MC = MR1 = MR2. Price will be higher in sub-markets having lower elasticities of demand • NOTE THAT PRICE DISCRIMINATION IS CHARGING DIFFERENT PRICES FOR THE SAME PRODUCT , WHERE THE DIFFERENCE IS NOT ACCOUNTED FOR BY DIFFERENT COSTS 18 Seminar Work • What are the entry-barriers into the following industries? How significant are they? – Internet service provision – Operating systems for personal computers – Daily newspapers • Evaluate the behaviour of the major newspapers in Hong Kong before the entry of Apple Daily. Did they set entry-preventing prices? Did they do anything to deter Apple’s entry? What could they have done to deter Jimmy Lai? Do you think it would have been effective? 19 Review Questions • What is the Sylos Postulate and what are the limitations of the entry-pricing theory based on it? Consider what might happen if the Sylos Postulate is not valid. • What recommendations would you make with respect to the pricing of MTR journeys at different times of day? Provide a full theoretical justification for your answers and consider the objections which might be made to your proposals. 20