VDC Research Group

Electronic Components and

Advanced Materials Practice

An Executive Brief

SMART FABRICS, INTERACTIVE TEXTILES,

AND RELATED ENABLING TECHNOLOGIES:

Market Opportunities and Requirement Analysis, Third Edition

Prepared by:

Rehab Al Mahfudh, Analyst

Christopher Rezendes, Executive Vice President

Electronic Components and Advanced Materials Practice

VDC Research Group

December 2007

All rights reserved

An Executive Brief, SMART FABRICS, INTERACTIVE TEXTILES, AND RELATED ENABLING TECHNOLOGIES

1

The following executive brief presents top-level findings from VDC’s recently released report, Smart

Fabrics, Interactive Textiles, and Related Enabling Technologies: Market Opportunities and

Requirements Analysis, Third Edition.

Smart Fabrics and Interactive Textiles – SFIT

Smart fabrics and interactive textiles are fabrics or textiles that react to the environment or to stimuli from

electrical, mechanical, thermal, chemical, or magnetic sources. These reactions provide an intelligent

environment in one of two ways:

1. Conducting, transferring, or distributing properties, such as:

–

Electrical Current

–

Light Energy

–

Molecular or Particulate Matter

–

Thermal Energy

2. Changing physical characteristics or phase, such as:

–

Color

–

Permeability

–

Porosity

–

Rigidity

–

Shape

–

Size

Electronic devices and technologies are integrated into the fabric or textiles. The resulting system can

provide advanced useful features to the consumer, such as: safety, comfort, convenience, fashion, and

mobility. Features provided to industrial applications and business operations include: improved

efficiency, better functionality, and lighter weight.

SFIT Technical Value Chain

SFIT final solutions undergo a number of development stages and incorporate a unique blend of

materials and technologies, in order to reach their final commercial form.

SFIT Enabling

Technologies:

Advanced Materials &

Components

SFIT-Based

Modules:

Smart Fabrics

& Interactive

Textiles

SFIT Final

Solution

© 2007 VDC Research Group, Inc.

An Executive Brief, SMART FABRICS, INTERACTIVE TEXTILES, AND RELATED ENABLING TECHNOLOGIES

2

SFIT Enabling Technologies: Include enabling materials and enabling components.

Enabling Materials

Enabling materials are advanced elements or chemical structures used to treat or coat fibers, threads and

yarns. These materials represent the enabling element, and are a prerequisite for all SFIT final solutions.

Enabling materials include metals, silver nanocomposites, ceramics, and iron oxide.

Enabling Components

•

SFIT enabling components are the platform that enables smart functionality to the fabric or

textile. SFIT enabling components include electronic components and fabric components.

Electronic Components: Electronic components are discrete electronics that are externally applied. SFIT

functionality can be provided by adding and implementing external devices. Examples include:

•

Data processing (CPU, MPU, DSP, MCU)

•

Power supply (photovoltaics, batteries, micro batteries, fuel cells)

•

Input/output devices (sensors, accelerometers, touch pads, keyboards)

•

Display (LED, Electroluminescent lighting, fiber optics)

•

Data communication (LAN, WAN)

Fabric Components: Fabric components are the fibers, filaments, films, and other beginning stages of a

textile. Fabric components are manufactured into the fabric or textile in several different ways. Fabrics

may be woven or non-woven via adhesive or thermal bonding, tufting, felting, or mechanical interlock.

The result is a fabric or textile structure within which resides (or upon which rests) the SFIT enabling

element.

SFIT-Based Modules: In this level of the SFIT technical chain, the matrix that comprises the SFIT

solution is assembled. SFIT-based modules are the smart fabrics or the interactive textiles. They can take

many forms, such as:

•

Non-woven fabric, which is a matrix of fibers, thermally or adhesively bonded

•

Woven and knit fabric

•

Conductive thread sewn into a fabric

•

Conductive polymer woven into the fabric

Example: Carbotex Seat-heating technology

Catobtex technology, developed by W.E.T Automotive Systems Ltd, is a combination of insulated copper

wiring and carbon fiber material. Carbotex is durable, thin, and soft, which makes the process of sewing it

into leather and cloth easier.

© 2007 VDC Research Group, Inc.

An Executive Brief, SMART FABRICS, INTERACTIVE TEXTILES, AND RELATED ENABLING TECHNOLOGIES

3

Example: ElekTex technology

ElekTex has two outer layers of conductive textiles; these conductive layers are separated by a partially

conductive layer. The inner layer conducts when pressure is applied, and by doing so, connecting the two

outer layers. The drop in resistance that results from the applied pressure causes a voltage differential

that can be measured at the edges of the outer layers; the amount as well as the location of the pressure

can be measured. ElekTex is Eleksen’s core technology, and it is incorporated into the ElekTex Bluetooth

fabric keyboard.

SFIT Complete Solutions: This is the final marketable form the SFIT solution takes. These solutions

incorporate several of the previously mentioned SFIT technologies. Examples of SFIT final solutions

include:

•

Accessories (hat, helmets, gloves, textile cables)

•

Building Materials (structural support, warming)

•

Clothing (jackets, shirts, shoes, vests, bras)

•

Durables (blankets, seat covers, tents)

Example: Rosner’s multimedia lifestyle jacket

The jacket enables mobile phoning via Bluetooth, an mp3 player is also built inside the jacket. The wearer

can control the electronic system by the buttons on the jacket’s sleeve.

Example: MET5 Jacket

The MET5 jacket developed by North face utilizes Polartec HeatTM, a fabric technology developed by

Malden Mills. The jacket has heated panels that are activated and controlled by the user.

Example: Burton Amp Smart Ski and Snowboard Jacket

Through a partnership between Burton Snowboards and Apple, the Amp Smart Ski and Snowboard

Jacket was introduced. Using Softswitch technology, the jacket has a fabric-based keypad on the sleeve.

This keypad controls an integrated iPod from Apple. The soft keys on the mounted on the sleeve allow

the wearer to adjust song tracks and volume.

© 2007 VDC Research Group, Inc.

An Executive Brief, SMART FABRICS, INTERACTIVE TEXTILES, AND RELATED ENABLING TECHNOLOGIES

4

SFIT Commercial Value Chain

Exhibit 1

Commercial Value Chain

Research and Development Institutions

SFIT Enabling Technologies Suppliers

(Advanced Materials & Components)

Processing

SFIT Based Module Suppliers

Smart Fabrics and Interactive Textiles

Assembly

SFIT Application Suppliers

Actuation &

Response

Computing &

Communication

Heat & Energy

Management

Location &

Position

Lighting

Sense &

Monitor

End Users

Industrial/

Commercial

Government/

Military

Medical/

Health

Consumer/

Retail

Transportation

SFIT MARKET DRIVERS AND INHIBITORS

Market Drivers

Market Awareness: There is ample interest from the general public in SFIT products; media sources help

generate a lot of buzz. Some SFIT final solutions received extensive coverage from high-profile media

sources. All of this helped create an atmosphere of enthusiasm and excitement. Many companies have

capitalized on this situation; relying on media coverage, industry trade shows, conferences, and featured

articles as a substitute for pricey marketing campaigns.

Partnerships and Collaboration: Industry partnerships are playing an increasingly important

developmental role. For many firms, participation in the SFIT industry was facilitated, and only became

possible through partnerships. This has enabled a network of supporting industries, and has led to the

emergence of SFIT final solutions within various applications.

© 2007 VDC Research Group, Inc.

An Executive Brief, SMART FABRICS, INTERACTIVE TEXTILES, AND RELATED ENABLING TECHNOLOGIES

5

Funding and Investments: Patents have helped firms recover a portion of their R&D expenses. SFIT

suppliers vary in their funding strategies; some rely on venture funds, while others are more fiscally

conservative and fully dependent on retained earnings. Several SFIT vendors sell non-SFIT products, or

are engaged in non-SFIT project work for client companies. Revenue generated from these non-SFIT

sources is a reliable cash flow, and has been used by these companies to fund SFIT R&D.

OEM Knowledge / Demand: Most SFIT suppliers that develop SFIT modules and/or solutions suggested

apparent improvements over the last couple of years in OEM knowledge of their technologies and

offerings, and thus higher OEM demand. Some went further to say that OEMs are creating demand for

the whole industry.

Competitive Environment: The SFIT industry has not yet moved into fierce competition. Each participant

in this market has carved out its own corner, and found its own niche. Naturally, as demand picks up so

will competition.

SFIT enabling technologies suppliers pushing strategies and SFIT solution suppliers pulling strategies:

Initially, SFIT suppliers adopted a pushing strategy to push their technologies on the market. However,

after incurring high costs in developing and marketing a less than desirable technology, some SFIT

suppliers abandoned their pushing strategies for SFIT enabling technologies and modules.

In an attempt to improve efficiency and thus profitability, SFIT suppliers have started to research a market

area before entering; seeking markets with an already established need. SFIT suppliers also constantly

listen to their clients, and tailor their SFIT products based on their needs.

Market Inhibitors:

Commercial Prices: Today, high commercial prices represent the largest barrier to wide-scale market

penetration. Economies of scale and efficient manufacturing practices have not been achieved yet;

therefore, high margins are demanded on SFIT products and solutions.

Safety: One pressing issue when it comes to safety standards is the significant variation from one country

to another on what is acceptable, and the minimum safety levels required. This causes a lot of confusion,

and may increase perceptions of unsafe SFIT technologies that have no scientific base, or are

exaggerated.

Lack of Standards: There is a lack of common standards and practices in the SFIT industry; this seems to

be generating frustration and confusion across the industry. There is no defined body that has been

delegated the task of setting the standards for the SFIT industry. Therefore, there is a vital need today for

a common body or consortium to emerge and lead the way in defining these standards. This common

body should consist of SFIT participants from each and every level of the technical and commercial value

chains.

Performance / functions / features: SFIT products and solutions have improved over the last couple of

years in terms of functionality and performance. The electronic components are more integrated and the

technology is more robust.

© 2007 VDC Research Group, Inc.

An Executive Brief, SMART FABRICS, INTERACTIVE TEXTILES, AND RELATED ENABLING TECHNOLOGIES

6

User skepticism / Demand: In an area where people do not really know the possibilities; much needs to

be done. First users need to be shown the fully working system, and then feedback needs to be

collected, and alterations made to the system based on this feedback. SFIT solutions can then be

developed to better meet consumers’ needs, habits, and tastes.

SFIT Market Analysis

SFIT Market Size and Growth

Growth will pick up at a faster pace in comparison with the last five years, VDC estimates the compound

annual growth rate (CAGR) for 2006-2010 five-year horizon to be 32%. This increase in revenues will

help provide for further R&D funding; in addition, SFIT participants will be able to expand the scope of

their products, and ultimately achieve efficiencies in manufacturing, and cost savings in production.

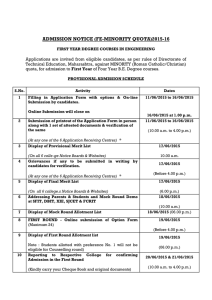

Exhibit 2

Forecasted Total SFIT Sales for 2006 – 2010 Segmented by Function

(Millions of Dollars)

Conduct/Distribute Electrical Current

Conduct/Distribute Light Energy

Conduct/Distribute Thermal Energy

Transfer/Distribute Matter

Total

Base Year 2006

141.6

71.4

155.5

0.7

369.2

Forecast 2010

706.1

160.9

258.4

4.1

1129.5

CAGR 2006-2010

49.4%

22.5%

13.5%

55.9%

32.3%

Potential SFIT Suppliers

Specialty chemical companies, nanotechnologies suppliers, and high-performance fabrics and textiles

suppliers, which have no involvement in the SFIT industry yet, showed different levels of interest for

potential SFIT offerings. Some are actively watching SFIT developments and have set benchmarks that

need to be met before they do support SFIT offerings, while others expressed lower levels of interest.

SFIT Research and Development

Much SFIT-related research is being pursued, mainly from academic institutions, government agencies,

and industry participants. Scholastic research at academic institutions represents the majority of all SFIT

research activities. Alliances are commonplace among research bodies and funding sources; government

agencies have funded SFIT research at academic institutions, and academic institutions have formed

alliances and worked on research projects with SFIT industry participants.

OEM Analysis

OEMs will act only upon existing demand from consumers; however, when demand is sensed, OEMs

spend a lot of resource to seek out the best SFIT technologies available. OEMs are receptive to

technology push strategies, often perused by SFIT vendors, in cases where SFIT vendors are able to

show compelling evidence of existing consumer demand. Furthermore, SFIT vendor strategies of

assisting OEMs in various ways, from tailored products to co-branding seem to act as an incentive for

OEMs to be more open and receptive to SFIT technologies.

© 2007 VDC Research Group, Inc.

An Executive Brief, SMART FABRICS, INTERACTIVE TEXTILES, AND RELATED ENABLING TECHNOLOGIES

7

SFIT Industry Trends – Vertical Integration

Vertical integration is quite a common trend in the SFIT industry; most of it is happening among the

suppliers of SFIT-based modules and final solutions. Vertical integration is mostly beneficial in SFIT

consumer softgood markets, with the integration trend expected to increase in this market. The primary

driver of this strategy is necessity; accelerated SFIT market development is requiring that suppliers go to

market with integrated solutions.

Evolution of Partnerships

Each and every SFIT final solution represents an amalgamation of elements, components, and

technologies from various industries. Capacity limitation and scarce resources have led many SFIT firms

to enter into strategic alliances. SFIT participants have sought to share financial and operational risks,

and to achieve mutual benefits. Through strategic alliances, SFIT firms have been able to pool their

resources and complement their capabilities.

SFIT Competitive Advantage Source and Sustainability

A competitive advantage can be achieved and sustained in the SFIT industry from the following sources:

1. Innovation

2. Manufacturing and Marketing

3. Dominant Design and Standards

These three sources of competitive advantage are interrelated. Given the threat of competitors imitating a

technology, firms tend to invest in manufacturing and marketing, which will help their innovation become

the industry’s dominant design, and will set industry standards. To the same extent, firms with excellent

manufacturing techniques and effective marketing strategies, but are not innovative and do not own any

patents, will be at a competitive disadvantage.

© 2007 VDC Research Group, Inc.

An Executive Brief, SMART FABRICS, INTERACTIVE TEXTILES, AND RELATED ENABLING TECHNOLOGIES

8

ABOUT THE STUDY

VDC Research Group recently released the new research report, Smart Fabrics, Interactive Textiles, and

Related Enabling Technologies: Market Opportunities and Requirements Analysis. This is VDC’s third

publication assessing the SFIT market. The report covers the global market opportunity for the

consumption of products that incorporate SFIT technologies.

Product Offering / Technology

Product Segmentation

•

Conduct/distribute electrical current

•

SFIT Enabling Technologies

•

Conduct/distribute light energy

•

SFIT-Based Modules

•

Conduct/distribute thermal energy

•

SFIT Application

•

Conduct/distribute matter

Vertical Segmentation

Application Segmentation

•

Industrial /Commercial

•

Actuation and Response

•

Government /Military

•

Computing and Communication

•

Medical /Health

•

Heat and Energy Management

•

Consumer /Retail

•

Location and Position

•

Transportation

•

Lighting

•

Sense and Monitor

ABOUT VDC

VDC Research Group (VDC) is an independent technology market research and strategy consulting firm

that specializes in a number of components, mobile & wireless, industrial, embedded, defense and niche

enterprise IT markets. VDC has been operating since 1971, when graduates of the Harvard Business

School and Massachusetts Institute of Technology founded the firm. Today, we employ a talented

collection of analysts and consultants who offer a rare combination of expertise in the market research

process; experience in technology product and program management, and formal training in engineering

and marketing. VDC’s clients include thousands of the largest and fastest-growing tech suppliers in the

world and the most successful investors participating in the markets we cover.

For further information about, Smart Fabrics, Interactive Textiles, and Related Enabling Technologies:

Market Opportunities and Requirement Analysis Third Edition contact:

Chris Rezendes, Vice President, 508.653.9000, Ext. 120, cjr@vdcresearch.com

For purchasing information, contact:

Gerrald Smith, Account Executive, 508.653.9000 ext. 113, gsmith@vdcresearch.com

VDC RESEARCH GROUP, INC.

679 Worcester Road | Suite 2 | Natick, MA 01760 | USA

T: 508.653.9000 | F: 508.653.9836 | E: info@vdcresearch.com | W: www.vdcresearch.com