Depreciation on Leasehold Land: Expert Opinion

Depreciation on buildings, etc., constructed

on

leasehold land

The following is the brief version of an opinion given by the Expert Advisory Committee of the Institute in response to query sent by a member. This is being published for the information of readers.

A. Facts of the Case

1. A government company has constructed buildings, roads, etc., on leasehold land, which was taken on lease from an lmprovementTrust under a lease agreement which was initially for a period of 30 years only . The land allotment letter (a copy of which has been provided by the querist for the perusal of the Committee) indicates that the land shall be used for office and staff colony.

2. The querist has stated that under clause 2(b) of the 'Terms ofTransfer in Leasehold Rights of

Plots in the Layout of the Improvement Trust'

(a copy of which is provided by the querist for the perusal of the Committee), it has been stat-

4. ed that"the lease shall be renewable at the option of the lessee for further terms of 30 years':

Further, as per the allotment letter, the entire lease premium of Rs. 21 lakh was payable upfront and annual ground rent of 2% of lease premium, i.e, Rs. 42,000 is payable in advance and falls due on 1 to the basis of which the useful life works

58 years . s

Companies t June of

During the course of each audit of the company for the year year of

.

3. The company has been charging depreciation on the buildings, etc., constructed on the leasehold land@ 1.63%on straight-line method

(SLM) as per the rates given in Schedule XIV

Act, 1956 (the 'Act'), on the out to be

2005 accounts

06, the

5. government auditors have raised provisional comment on the issue relating to charging9. off of depreciation on buildings, roads, etc., on the leasehold land. Their contention is that the depreciation on the buildings, etc., constructed on leasehold land should be charged over a period of 30 years only (i .e., over the lease period of the land) and not over a period of 58 years (i.e

. @ 1.63

% on SLM ) as specified in the

Act and followed by the company . According to them, the rate prescribed under the Act is

6. The issue was discussed in detail with the

Principal Director of Commercial Audit (the

'PDCA'). The PDCA agreed with the reply submitted by the company. However, while

B. applicable in respect of assets constructed on freehold land.

The provisional comment and the management's reply were as given in the table on the next page.

The statutory auditors agreed with the above reply issuing advised that the matter may be referred to the

Expert Advisory Committee of the Institute of

Chartered Accountants

Query

of the management. a nil comment

7. The querist has sought the opinion of the

Expert Advisory Committee as to whether depreciation charged by the company on buildings, etc., constructed on leasehold land

@ 1.63% on SLM as specified in Schedule XIV to the Companies Act, 1956 is correct or it should be charged over a period of 30 years (i.e., the initial term of the lease) .

C. Points considered

on the accounts, he of India for its opinion. by

the Committee

8. The Committee, while expressing its opinion, has considered only the issue raised in paragraph 7 above and has not touched upon any other issue arising from the Facts of the Case, such as, amortisation of the lease premium .

The Committee notes graphs from Accounting

(i) historical tuted for cost the the following

Standard of Chartered Accountants of India: para-

(AS) 6, 'Depreciation Accounting; issued by the Institute

"5. Assessment of depreciation and the amount to be charged in respect thereof in an accounting period following three factors are

: usually based on the or other amount substihistorical cost of the de-

200 The Chartered Accountant August 2007

Audit Memo

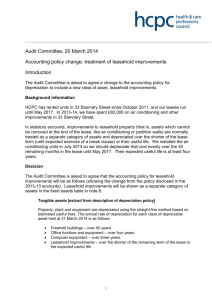

Provisional Comment No.1

Management's Reply

Profit

&

Loss Account Depreciation Rs.209.00 Profit

&

Loss Account Depreciation - Rs.209

.

00 lakh lakh.

Buildings, roads, parks and sheds of RJ-IV are Buildings of RJ-IV have been constructed on constructed on 7.07 hectares of leasehold land leasehold land taken from the Improvement taken from the Improvement Trust under two Trust under lease agreement which is initially lease agreements entered in the year 1999- for a period of 30 years. Under Clause 2(b) of the

2000 for a lease period of 30 years commencing "Terms of Transfer in Leasehold Rights of Plots in retrospectively from 1983 -84. The lease period the Layout of the Improvement Trust" which was expires in the year 2014. forwarded by the Secretary, Improvement Trust at

Depreciation on buildings, roads, parks and sheds is charged at the rate specified under Schedule XIV to the Companies Act, 1956, i.e.,@ 1.63%. However, such rates are applicable only in respect of assets constructed on freehold land. All buildings and other structures constructed on leasehold land are to be charged off within the lease period. the time of allotment of land, it has been stated that "the lease shall be renewable at the option of the lessee for further terms of 30 years': As such, the company has the option to renew the lease for the further period of 30 years. Also, it is the standard practice in case of lease made by Government that normally it is initially made for 30 years and thereafter it is renewed for next term of 30 years.

Moreover, the cost of the land, i.e., the lease rent is being amortised regularly over the lease period. Due to charging-off of depreciation at rates applicable to assets constructed on freehold land instead of charging off the cost of the assets within the lease period, depreciation for the year 2005-06 is understated and profit for the year is overstated by Rs. 9.09 lakh. Further, this has resulted in

Further, the depreciation on buildings constructed on the leasehold land has been charged consistently at the rate specified in Schedule XIV to the Companies Act, 1956, i.e., @ 1.63% on SLM

(depreciable life being 58 years). understatement of depreciation charged and overstatement of previous year's profit by Rs. 60.05 lakh. As such, thecontention thatthere is understatement of depreciation and overstatement of profit for the year 2005-06 and for the earlier years is not correct.

In view of the above, the memo may kindly be dropped. preciable asset when the asset has been revalued;

(ii) expected useful life of the depreciable asset; and

(iii) estimated residual value of the depreciable

asset:'

"7. The useful life of a depreciable asset is shorter than its physical life and is:

(i) pre determined by legal or contractual

202 Th e Chartered Accountant August 2007 limits, such as the expiry dates of related leases;

(ii) directly governed by extraction or consumption;

(iii) dependent on the extent of use and physical deterioration on account of wear and tear which again depends on operational factors, such as, the number of shifts for which the asset is to be used,

repair and maintenance policy of the enterprise etc.; and

(iv) reduced by obsolescence arising from factors as :

(a) technological changes;

(b) improvement in production methods;

(c) change in market demand for the product or service output of the asset; or

(d) legal or other restrictions.

8. Determination of the useful life of a depreciable asset is a matter of estimation and is normally based on various factors including experience with similar types of assets ... :'

"13. The statute governing an enterprise may provide the basis for computation of the depreciation . For example, the Companies

Act, 1956 lays down the rates of depreciation in respect of various assets. Where the management's estimate of the useful life of an asset of the enterprise is shorter than that envisaged under the provisions of the relevant statute, the depreciation provision is appropriately computed by applying a higher rate. If the management's estimate of the useful life of the asset is longer than that envisaged under the statute, depreciation rate lower than that envisaged by the statute can be applied only in accordance with requirements of the statute:'

10. The · Committee notes the management's observations that it is a standard practice in case of leases made by Government that normally they are initially made for 30 years and thereafter they are renewed for a further period of 30 years . Having regard to the terms of the lease and the use of the leasehold land

(i.e, office and staff colony), it seems that at the inception of the lease, the company intends to renew the lease for a further period of 30 years at the expiry of the initial period of 30 years.

11 . The Committee notes that neither Schedule

XIV to the Companies Act, 1956 (the 'Act') nor the main sections, viz., sections 205 and

350 of the Act state that the rates specified in

Schedule XIV are applicable only to the assets constructed on freehold land. The Committee is of the view that the rates specified in Schedule

XIV to the Act are equally applicable for assets constructed on leasehold land, subject to the considerations stated in paragraph 12 below.

12. From the above, the Committee is of the view that the management should estimate the useful lives of the relevant assets constructed on the leasehold land on the basis of considerations mentioned in paragraph 9 above. Thus, the useful life will be the expected period of the lease of the land, i _ the expected period of extension which is reasonably certain at the inception of the lease . The depreciation rate should be worked out on that basis . If the rate so worked out is lower than the rate specified in Schedule XIV to the Act, the rate specified in Schedule XIV to the Act should be adopted. A lower rate can be adopted only if permitted by the Central

Government in accordance with the provisions of the Act.

D. Opinion

13. On the basis of the above, the Committee is of the opinion that depreciation rate for buildings, etc., constructed on leasehold land should be determined in the manner stated in paragraph 12 above. o

Notes:

1 . The Opinion is only that: of the Expert Advisory Committee and does not necessarily represent the Opinion of the Council of the Institute.

2. The Compendium of Opinions containing the Opinions of Expert Advisory Committee has been published in twenty four volumes which are available for sale at the Institute's office at

New Delhi and its regional council offices at Mumbai, Chennai, Kolkata and Kanpur.

3. Recent opinions of the Committee are available on the website of the Institute at URL: http:// www.icai.org/icairoot/resources/resource _ index.jsp

204 The Chartered Accountant August 2007