Becker CPA Review

advertisement

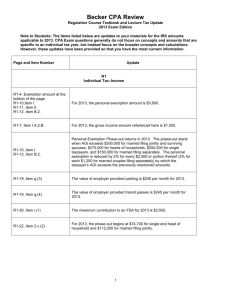

Becker CPA Review Regulation Course Textbook and Lecture Errata/Clarifications 2012 Exam Edition Note to Students: Many of the items listed below are updates to your materials for the IRS amounts applicable to 2012. CPA Exam questions generally do not focus on concepts and amounts that are specific to an individual tax year, but instead focus on the broader concepts and calculations. However, these updates have been provided so that you have the most current information. Date 1/1/12 Page & Item R1-4, Exemption amount at bottom of page R1-10, Item I. R1-11, Item II. R1-12, Item B.2 Erratum/Clarification For 2012, the personal exemption amount is $3,800. 1/1/12 R1-19, Item g.(3) The value of employer provided parking is $240 per month for 2012. 1/1/12 R1-19, Item g.(4) The value of employer provided transit passes is $125 per month for 2012. 1/1/12 R1-22, Item 2.c.(2) For 2012, the phase out begins at $72,850 for single and head of household and $109,250 for married filing jointly. 1/1/12 R1-25, Item E. Page R1-25, Item E: “Payments Pursuant to a Divorce” Additional Information Additional information is provided and can be deemed Item E.4 in your textbooks. Click here for a detailed explanation. 1/1/12 R1-28, Item 2.e For 2012, the standard mileage rate is 55.5 cents per mile. The 2010 Tax Relief Act provided that for the year 2011, the 12.4% rate was reduced to 10.4%. However, the deduction for one-half the self-employment tax will continue to be 7.65% of self-employment income up to $106,800 and 1.45% of self-employment income in excess of $106,800. The Social Security Wage Base increased to $110,100 in 2012 1/1/12 R1-29, Item 4.a.(2)(a) & (c) 1/1/12 R1-47, Item P.7. For 2012, the amount excludable from income goes to $95,100. 1/1/12 R1-55, Items d. & e. The Year 2010 information at the top of this page can be deleted as it will not be tested on the Regulation exam in 2012. 1/1/12 R2-5, Item c.(1) For 2012 the phase-out for Single/HH is $58,000-$68,000 and Joint is $92,000-$112,000. 1 of 7 Becker CPA Review Regulation Course Textbook and Lecture Errata/Clarifications 2012 Exam Edition Date Page & Item 1/1/12 R2-5, Item c.(2)(b) 1/1/12 R2-6, Notes on bottom of page 1/1/12 R2-7, Item 3.e. Erratum/Clarification For 2012, the phase-out for an individual who in not an active participant in an employer sponsored retirement plan, but whose spouse is increases to $173,000-$183,000. For 2012 the phase-out for Joint is $92,000-$112,000. For 2012, the phase-out for an individual who in not an active participant in an employer sponsored retirement plan, but whose spouse is increases to $173,000-$183,000. The 2012 phase-out for Roth Contributions increases to $110,000$125,000 for Single and HH; and $173,000-$183,000 for Joint filers. The text should be modified as follows (changes highlighted): f. 1/1/12 R2-8, Item f. Roth IRA Distributions Qualified Nontaxable Distributions of Roth IRAs are Those Made at Least Five Years After the Taxpayer’s First Contribution to A Roth IRA and Made: Cumulative distributions from Roth IRAs are first considered to be a tax-free return of cumulative contributions. Subsequent distributions are distributions of earnings and will be taxable unless those distributions are qualified nontaxable distributions. Qualified nontaxable distributions of Roth IRA earnings are those made at least five years after the first day of the year of the taxpayer’s first contribution to a Roth IRA and made: (1) After the taxpayer reaches age 59 ½, or (2) To a beneficiary after the taxpayer’s death, or (3) Because the taxpayer is disabled, or (4) For use by a “first time” (taxpayer not owning a principal residence in the two year period before buying this residence) homebuyer to acquire a principal residence. There is a lifetime limit on qualified distributions for this purpose. 1/1/12 R2-10, Item D.2. The 2012 phase-out for student loan interest for joint filers increases to $125,000-$155,000. Single filers remain the same as 2011. 1/1/12 R2-11, F.1. For 2012, pre-tax contributions increase to $3,100 ($6,250 for families). 1/1/12 R2-12, 4.c. For 2012 $3,050 goes to $3,100 and $6,150 goes to $6,300. 2 of 7 Becker CPA Review Regulation Course Textbook and Lecture Errata/Clarifications 2012 Exam Edition Date Page & Item Erratum/Clarification 1/1/12 R2-12, 4.d. For 2012, $2,050 goes to $2,100, both $4,100 numbers go to $4,200, and $7,500 goes to $7,650. 1/1/12 R2-13, Item 3.a(1) For 2012, the standard moving mileage rate is 23 cents per mile. 1/1/12 R2-13, Item J.1. For 2012, the $49,000 deductible amount increases to $50,000 1/1/12 R2-14, Item J.2. For 2012, the $49,000 additional amount above the deductible amount increases to $50,000. 1/1/12 R2-16, Item III.A. For 2012, the standard deduction for single goes to $5,950, Head of Household $8,700, Married filing joint $11,900, and married filing separately $5,950. 1/1/12 R2-20, Item d.(5)(b) For 2012, the standard medical mileage rate is 23 cents per mile. 1/1/12 R2-29, Item (2) For 2012, the standard mileage rate is 55.5 cents per mile. 1/1/12 R2-40, Item II.D.2.e. For 2012, the credit phase-out begins with MAGI exceeding $52,000 ($104,000 on a joint return), with full phase-out at $62,000 ($124,000 for joint returns). 1/1/12 R2-41, Item F.1. The adoption credit goes to $12,650 for 2012. 1/1/12 R2-41, Item F.2. For 2012 the phase-out for the adoption credit goes to $189,710$229,710. 1/1/12 R2-42, Item 3.d. For adoption assisted programs the 2012 amount goes from $13,360 to $12,650 and the phase out goes to $189,710-$229,710. 1/1/12 R2-42, Item F.5 The credit for 2012 is $12,650, not the $12,170 in the textbook. 3 of 7 Becker CPA Review Regulation Course Textbook and Lecture Errata/Clarifications 2012 Exam Edition Date Page & Item Erratum/Clarification The current text material indicates that life insurance proceeds are “not taxable income.” This has been the general rule for several years, and has been the rule that has been tested on the exam in the past. However, for clarification purposes, be aware that life insurance proceeds received on the death of the insured may not be 100% tax-free to a company. For life insurance contracts that were issued after August 17, 2006, limitations exist regarding the amount of proceeds that are excluded from income relating to company-owned life insurance (COLI) contracts, unless certain requirements are met. The general rule is that the portion of the proceeds that equals the previously paid premiums and other non-deductible amounts paid in is tax-free, and the balance is generally taxable. 1/1/12 R3-6, Item B.1.b(2) and Item R3-22, Life Insurance Proceeds Of course, there are exceptions to the rule, and these exceptions (notice and consent requirements) will keep the excess benefits from being included in income, if the taxpayer qualifies. The exceptions will apply if certain notice and consent requirements are met, and only if the insured is a United States citizen or resident. Further, the insured must have been (1) an employee of the policyholder during the 12-month period before the insured’s death, or (2) a director or other highly compensated employee at the time the contract was issued. Proceeds paid to a member of the insured’s family, a designated beneficiary, a trust for the beneficiary, or an estate of the insured are also not included if the notice and consent requirements are met. In addition to annual reporting and record retention requirements, the notice and consent requirements that must be satisfied in order to make the benefits non-taxable include: (1) written notification to the employee that the company plans to insure the life of the employee, (2) disclosure to the employee of the maximum face amount of insurance, (3) written consent of the employee being insured that this policy may be continued even if the employee terminates employment, and (4) written notification to the employee of the policyholder that will be the beneficiary of the proceeds payable upon the death of the employee. Item C. Expense Deduction in Lieu of Depreciation (Section 179) covers the 2012 and 2013 Section 179 rules. The following covers the rules applicable to 2011: 1/1/12 R3-28, Item C. For tax years 2010 and 2011 the taxpayer can expense up to $500,000 of the cost of qualifying property (generally up to $250,000) of qualified real property, personal property, and computer software. This maximum expensing amount is reduced dollar-for-dollar if the taxpayer purchases and places in service during the year more than $2,000,000 of qualifying property. 4 of 7 Becker CPA Review Regulation Course Textbook and Lecture Errata/Clarifications 2012 Exam Edition Date Page & Item Erratum/Clarification Item C. Expense Deduction in Lieu of Depreciation (Section 179) covers the 2012 and 2013 Section 179 rules. The following covers the rules applicable to 2011: 1/1/12 1/1/12 R3-28, Item C. R3-30, Item V. Bonus depreciation is extended through 2012. The depreciation rate is 50% for assets placed in service before September 9, 2010. The rate is increased from 50% to 100% (full write-off) for new, qualified assets acquired and placed in service after September 8, 2010 and before January 1, 2012. The depreciation rate is 50% for assets placed in service after December 31, 2011 and before January 1, 2013. The $8,000 additional first-year depreciation for vehicles on which bonus depreciation has been claimed continues through 2012. Bonus depreciation is not an adjustment for, or a preference for, AMT purposes. Bonus depreciation is claimed after the depreciation expense deduction. The National Instructor asks that everybody add the words “GAAP: Impairment test/Not amortized” in the margin. This addition is not correct for all assets. It is correct for goodwill because goodwill is not amortized for financial accounting purposes and is tested for impairment. However, other intangible assets (e.g., those with finite lives) are still amortized over those lives. They are also tested for impairment. Intangible assets with indefinite lives are not amortized, but they are tested for impairment. This issue is discussed in more detail in F2. 5 of 7 Becker CPA Review Regulation Course Textbook and Lecture Errata/Clarifications 2012 Exam Edition Date Page & Item Erratum/Clarification As indicated in item VI.C.2, the rule for Section 1250 recapture requires only the difference between the accelerated depreciation taken on the real estate (typically those assets placed into service before 1987) and what straight-line depreciation would have been if it had been taken on the asset instead. This rule has the effect of the overall gain being taxed at 25%, as indicated in item VI.C.3. [Phase-out provisions may apply in some cases, all of which are beyond the scope of the CPA exam.] A few students have inquired of the special rules regarding Section 1250 additional recapture for corporations. While this topic has historically not been tested on the CPA exam, we are providing the information in this update to address the issue. 1/1/12 R3-32, Item 3. Per Internal Revenue Code section 291, for corporations, “in the case of section 1250 property which is disposed of during the taxable year, 20 percent of the excess (if any) of (a) the amount which would be treated as ordinary income if such property was section 1245 property, over (b) the amount treated as ordinary income under section 1250 (determined without regard to this paragraph), shall be treated as gain which is ordinary income under section 1250 and shall be recognized notwithstanding any other provision of this title.” Effectively, the calculation above means that the TOTAL amount of the taxable recapture as ordinary income for a corporation subject to the provisions of Section 1250 is equal to the amount of the ordinary income under the general Section 1250 rules (see above) plus 20% of the straight-line depreciation that was not recaptured under the general rules. As always, the total depreciation recaptured is limited to the recognized gain. Please add the following Pass Key to the end of this page: “Outside basis” is a partnership concept that refers to the basis a partner has in their ownership interest in the partnership. This partnership interest has a tax basis similar to ownership interests in other property. 1/1/12 R4-5 “Inside basis” refers to the basis that the partnership itself has in the assets it owns. This inside basis can come from contributions made by the partners. As a general rule, the basis of an asset contributed by a partner would carry over and be the basis of the asset in the hands of the partnership. In addition, inside basis can come from purchases the partnership makes with partnership funds. 6 of 7 Becker CPA Review Regulation Course Textbook and Lecture Errata/Clarifications 2012 Exam Edition Date 1/1/12 1/1/12 1/1/12 1/1/12 (updated 8/22/12) Page & Item R4-22, Items D.1.c and D.2.b R4-30, Item III. A. R4-31, Bottom of chart R4-33, Items E.1. E.2. and E.3. R4-35, Item IV R4-38, Item V R4-67, Item 2. Erratum/Clarification For 2012, the “applicable exclusion amount” increases from $5,000,000 to $5,120,000. This amount provides for a unified estate and gift tax credit of $1,772,800 for 2012. For 2012, the per-year-per-donee exclusion remains at $13,000 per donee and $26,000 for married couples who elect gift splitting. With respect to the generation-skipping transfer tax, the maximum total exemption for married couples is $10,240,000 for 2012. The textbook states that the Sarbanes-Oxley Act (SOX) is not covered on the Regulation Exam. This statement is incorrect. SOX is covered on the Regulation Exam. Coverage of SOX can be found in the Auditing textbook on pgs. A6-11 to A6-14 and in the Business textbook on pgs. B1-5 to B1-9. Please review this information before you take the Regulation Exam. If you do not have the 2012 Audit and Business materials, please click here for a summary of the Sarbanes-Oxley Act and click here for a document containing related multiple-choice questions. For returns required to be filed after December 31, 2011, the tax return preparer penalty has increased from $100 to $500 for each failure to comply with IRS due diligence requirements with respect to the earned income tax credit. 3/16/12 R4-47, Item J.1. 8/22/12 New Topic – Employee Stock Options Click here for coverage of Employee Stock Options, including practice multiple choice questions and simulation tasks. R2-13, Item H. For 2011 and 2012, the self-employed Social Security/Medicare tax is actually equal to greater than 50% of the total tax because of the decrease in the employee’s portion of the tax. For 2011 and 2012, the employee’s social security portion of the tax is reduced from 6.2% to 4.2% of the social security wage base. The employer’s portion remains 6.2%. 8/22/12 7 of 7