cadillac and the toronto international film festival

advertisement

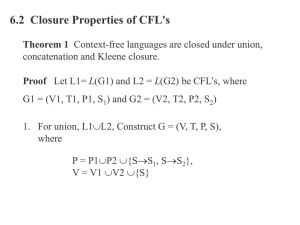

GIBSON’S FINEST & THE CFL CATEGORY: SPORTS A. OVERVIEW, OBJECTIVES & SPONSORSHIP SELECTION 1. Corporate Sponsor: Gibson’s Finest Canadian Whisky (Owned by William Grant & Sons / Distributed by PMA) Gibson’s Finest (GF) Canadian Whisky family of products consists of: GF 18 Yr Old Rare, GF 12 Yr Old, GF Sterling. Gibson’s Finest is the sales volume leader in the William Grant & Sons (WGS) portfolio, a family-owned Scottish company and the winner of the prestigious International “Distiller of the Year”. By sales volume, GF is the #4 Canadian Whisky brand in Canada. Sponsored Organization: The Canadian Football League (CFL) The Canadian Football League is a professional sports league representing the highest level of competition in Canadian football. It consists of eight teams across Canada competing for a century-old symbol of Canadian pride and tradition: The Grey Cup. The Grey Cup is Canada’s largest single day sporting event and most watched telecast. GF’s sponsorship of the CFL represents the only property association for any WGS brand. 2. Sponsorship fit within marketing plan/strategy. In 2010, GF’s strategy was re-focused around the overarching organizing concept of “Finest”. The “Finest” positioning suggests an emotional benefit and connects with our target and their life stage. From a product perspective, “Finest” is inherently part of the brand (GF is the #1 age-stated Canadian whisky) and is a functional benefit, reaffirming Gibson’s leadership position and reinforcing that Gibson’s Finest is Canada’s Finest Whisky. This concept also ladders up to the existing CFL assets – Gibson’s Finest Player Awards and Gibson’s Finest Fan Competition – which celebrate the Finest in achievements by players and fans alike. 3. GF’s Objectives for CFL sponsorship: a) BUILD BRAND AFFINITY - Connect emotionally with the target consumer. Increase brand relevance and consumer affinity/involvement, foster advocacy, and organically grow sales. Build the “Finest” platform by developing a stronger association between the Gibson’s Finest Fan competition and the Gibson’s Finest Player Awards Bring Finest Fan competition entry mechanism to “life” in the game day environment and increase number of entrants to competition by 10% Retain #4 position in National sales volume and #2 position in critical Western Provinces (AB, SK, MB) b) RECRUIT AND RETAIN TARGET CONSUMER - Use CFL as a platform to conduct consumer sampling and communicate functional advantage of “age declared” whisky. Create a National on-premise promotion Increase on-premise sales volume by a minimum of 5% of in highly competitive Ontario market c) WIN AT RETAIL – Extend exclusive CFL relationship to the highly regulated liquor retail environment and use point of sale programming to incent product purchase. Increase National retail sales volume by 5% Own “whisky season” / CFL playoffs in September – November 4. Process and strategic insights leading to the selection of the property: Independent research shows that the CFL delivers Canadian Whisky target consumers in both demographic and psychographic analysis. Northstar Research Partners state: On a National scale, 35% of Canadian Whisky drinkers are avid CFL fans. In Western Canada, 50% of are avid fans. Canadian Whisky drinkers and CFL fans both over index against key behaviours and attitudes describing the bull’s eye GF target consumer, such as: spirited, friendly, hard working, honest, unwavering, fraternity, and integrity. 5. Length of Sponsorship: GF has been a partner of the CFL since 2006. In 2008, the partnership expanded to the current agreement (entitlement to Player Awards, Player of the Week, and Player of the Month) and expires after the 2013 season. 6. Financial Investment: CFL Rights Fees Activation Costs Total Sponsorship Costs Rights Fee : Activation Ratio $585,000 $1,500,000 $2,085,000 1 : 2.56 B. MAXIMIZING THE SPONSORSHIP MARKETING INVESTMENT 1. Integration into MARCOM strategy: 2. Activation Duration: APR MAY JUN JUL AUG SEPT OCT NOV Activity Pre-Sea s on Regul a r Sea s on PS / GC GF Den GFF Comp. GFF Medi a GFF Tour CFL Programs GFF Reta i l BS On Premi s e BS Reta i l Grey Cup Fes ti va l Grey Cup Reta i l Bra nd Medi a Brand Activity Va l ue-Add PR/POS 3. Strategies and Tactics employed to achieve sponsorship objectives: Strategies: Extend CFL association beyond the regular/post season Leverage Finest Fan as a point of differentiation and incorporate into all communication channels to help build awareness (on-premise, retail, online, and in-stadium) Develop a National scalable sampling program that allows for consistent execution across all markets Deliver focused messaging and programming at retail point of sale to connect with target consumer lifestyle Tactic 1: Gibson’s Finest Den The Gibson’s Finest Den contest was a retail-based contest promotion executed in select markets (BC, AB, SK, MB, ON, NB) in April and May. The contest was supported by POS (backer cards, neck tags) that utilized the CFL and team logos and showcased the ultimate “man cave” where our target could hang out with his friends and watch the game. One winner per market won a room makeover designed by “Designer Guy” Allen Chan. Tactic 2: Gibson’s Finest Fan Competition – Finest Fan Tour Extension Gibson’s Finest Fan Competition (GFFC) was a consumer generated entry competition (video and photo) that was supported by a TSN media buy (TV, digital), retail POS, and on-premise POS. In 2010, an experiential extension was added to allow consumers to capture their CFL team spirit and submit their entry at the point of interception. The Tour components were modular, scalable, designed for flexibility within various footprints, and created a landmark destination for fan. Fans were intercepted by a team of 8 – 10 GF staff who lead them through the submission process using touch screen enabled kiosks. All data was delivered directly to TSN’s contest website for moderation. A CFL pocket schedule drove to TSN.ca to view their video, enter the Competition from home, or find broadcast details for upcoming games. Tactic 3: Gibson’s Finest Blind Side The Gibson’s Finest Blind Side program provided consumers with a CFL/football themed brand relevant and memorable trial experience. The program leveraged team rights Edmonton and Winnipeg and League rights in all other markets. The tool kits and staff briefing documents allowed for consistent execution in key accounts across Canada. Executions were scheduled in blitzes around key CFL events (ie. Canada Day, key rivalries). At the accounts, GF staff members were dressed in referee uniforms and asked consumers to take the GF Blind Side blind taste test. Consumers tasted GF 12YO and GF Sterling and then were offered a sample of “The Kicker” (official cocktail of the CFL) mixed with their favourite variant. Tactic 4: Retail Programming – POS and Glassware Giveaway With Canadian Whisky consumption shifting year-over-year more towards off-premise, dominating the point of sale is critical to brand success. Backer cards and neck tags were used to communicate the GFFC and broke in July to support the launch of the CFL season. Collectable CFL glassware featuring individual team logos and the Grey Cup were placed on pack in November. Tactic 5: Drawing the “Finest” connection between the Fan and the Players To reinforce the “Finest” connection and drive consumer awareness of the GF Player Awards, the GF activation footprint was located directly outside the Winspear Centre (home of the GF Player Awards). The eight GFFC winners were leveraged as unofficial brand ambassadors during the Grey Cup Festival. All winners were incorporated into the GF Player Awards as trophy handlers and were visible in both the live production of the Gibson’s Finest Player Awards and the TV broadcast which aired on TSN. The Fans were also given access to exclusive parties and events where they promoted (and enjoyed!) GF product. Tactic 6: Other Stakeholders With October being the kick-off to the key whisky season, GF used CFL and Grey Cup rights to build a sales incentive program for the PMA team across Canada. The top selling sales person was rewarded with a trip to Edmonton to enjoy the Grey Cup. The Grey Cup weekend was also used to host stakeholders from liquor boards in MB and SK and key account owners from AB. 4. INNOVATIVE APPROACH CFL fans are very passionate and loyal. They have a strong emotional connection to the League, their teams, and their favourite players. By creating a ‘face’ for GF through one-to-one interactions at CFL stadiums, key accounts, and key retail partners, GF was able to extend that emotional connection. In a highly regulated and very competitive industry, building an emotional connection and developing brand affinity is critical in delivering positive sales growth trends. C. RESULTS a) BUILD BRAND AFFINITY The Finest Den contest was a vehicle to engage CFL fans outside of the CFL season and opened the conversation with consumers about the return of the GF Fan Competition 2,585 unique entries 80% of entrants were from key Western provinces (MB, SK, AB) The addition of the Finest Fan Tour resonated with CFL fans, resulting in more contest entries and a higher level of personal investment 10 Gibson’s Finest Fan Tour events in 5 key Canadian markets 518% increase in video entries / 31% increase in total contest entries 41% of Tour entries were bulls eye target (Male 18-34) Significant personal investment in the brand as evidenced by the quality of entries (eg. Jayson Wall video and website) b) RECRUIT AND RETAIN TARGET CONSUMER The Blind Side program organically educated consumers about Gibson’s Finest, the two key variants, and the official cocktail of the CFL. 127 Blind Side events in 150 days across 9 cities (Calgary, Edmonton, Regina, Winnipeg, Toronto, Hamilton, Kitchener, London, & Moncton) Approximately 1,200 ounces sampled Ontario on-premise sales increased 6% over 2009 Not only did GF retain their #4 position in National sales volume but also gained significant ground on the current #3 ranked competitor. Sales results show a significant lift in markets where GF engaged in brand building and consumer recruiting activities with our Gibson’s Finest Sterling variant throughout 2010. Comparatively, Gibson’s Finest Sterling decreased significantly in BC, a market where there was no CFL activation activity: Market Tactics MB Finest Fan Tour w/ Radio Remotes x 4, Blind Side x 10, Retail POS SK Finest Fan Tour w/ Radio Remotes x 1, Blind Side x 6, Retail POS AB Finest Fan Tour x 3, On-Premise Blind Side x 22, Exclusive Retail Sampling Program x 74 NB Finest Fan Tour x 1, On-Premise Blind Side x 6 BC No CFL Activation * 2010 vs. 2009 (ACD Data Jan 2011) ** September 2010 (Touchdown Atlantic) vs. September 2009 (ACD Data Jan 2011) Sales Results +21%* +41%* +15%* +39%** -8%* c) WIN AT RETAIL – The demand for GF’s Grey Cup glassware allowed GF to secure coveted floor space and aisle displays in retail stores during whisky season and the lead up to Holiday (#1 sales period for Canadian Whisky). Canada saw increased growth of Gibson’s Finest Sterling with CFL Glassware VA by 6% in 2010 and some very positive results in key CFL provinces: Market NATIONAL MB SK AB NB Sales Results~ +6% +11% +18% +44% +26% ~September – November 2010 vs. September – November 2009