ESG

REPORT

Commercial Computing Market

Dynamics

Predicting the Future by Observing the Past

By Steve Duplessie

May, 2009

Copyright

2009, The Enterprise Strategy Group, Inc. All Rights Reserved.

ESG REPORT

Commercial Computing Market Dynamics

Table of Contents

Table of Contents..................................................................................................................................................... i

Executive Summary ................................................................................................................................................ 1

The Transactional Computing Era ........................................................................................................................ 1

Transactional Era Computing Characteristics ................................................................................................. 2

The Distributed Computing Era ............................................................................................................................. 4

A New Market ....................................................................................................................................................... 5

The Internet Computing Era .................................................................................................................................. 9

Creating, Accessing, Storing, and Finding Data in the Cloud........................................................................ 9

The Situation is Only Going to Get Worse ..................................................................................................... 10

New Infrastructure Demands ............................................................................................................................... 10

Conclusion ............................................................................................................................................................ 12

All trademark names are property of their respective companies. Information contained in this publication has been obtained by sources The

Enterprise Strategy Group (ESG) considers to be reliable but is not warranted by ESG. This publication may contain opinions of ESG, which

are subject to change from time to time. This publication is copyrighted by The Enterprise Strategy Group, Inc. Any reproduction or

redistribution of this publication, in whole or in part, whether in hard-copy format, electronically, or otherwise to persons not authorized to

receive it, without the express consent of the Enterprise Strategy Group, Inc., is in violation of U.S. copyright law and will be subject to an

action for civil damages and, if applicable, criminal prosecution. Should you have any questions, please contact ESG Client Relations at

(508)482-0188.

-iCopyright

2009, The Enterprise Strategy Group, Inc. All Rights Reserved.

ESG REPORT

Commercial Computing Market Dynamics

Executive Summary

Since its inception in the 1960s, commercial computing has gone through three distinctive periods. The

Transactional Computing Era led to the Distributed Computing Era, which continued until the 1990s. The newest

era, the Internet Computing Era, will dominate the next 50 years or more. Commercial computing capabilities

and the people who are responsible for computing operations will have to adapt quickly to the demands of this

new age.

The Transactional Computing Era

The foundation of modern commercial computing was the business transaction. As soon as machines were

capable of executing complex calculations faster than people, those machines became the tools of business.

Scientific advancements only drove the ―lesser‖ capabilities of commercial computing; while molecular modeling

or space telemetry were exciting fields of science, the universal appeal of the relatively simple business

transaction is what propelled (then and now) commercial computing. Science is a noble cause, but money is

what drives the modern world and, as such, it also drove the advancement of commercial computing. As soon

as business advantages could be gained by utilizing technology instead of people, the treadmill of technological

advancement started and never stopped.

The principles of business are fairly easy to understand: if you take more money in than you pay out, you have a

winner. A business function has a cost and when the cost can be lowered—by improving functional efficiency,

for instance—the laws of business dictate that it must be done.

As business functions migrated from humans to computers in the 1960s, it was almost always due to a

combination of cost savings and efficiency improvements of tactical human tasks. If you had 300 accountants

getting paid $10,000 per year and you could automate 90% of the services they provided via a computer, then as

long as the cost of doing so was lower than $270,000 per year (eventually), it made sense to do it. If, along the

way, you discovered that on top of cost reduction, the computer enabled incremental output improvements, so

much the better. Since the birth of commercial computing, task automation was the goal—whether anyone

realized it or not. Removing inconsistent, limited human beings from tactical tasks has proven to yield business

benefit. It has often been messy, sometimes sad, but as long as the basic principles of business remain the

same, it will always be that way.

Early adoption of commercial computing technologies differed from scientific environments in two key ways.

First, science was typically forward-looking—trying to solve the mysteries of what might be next. Business was

typically backward-looking—how do we get better at the things we have always done? Second, science normally

has not been encumbered by a quest for profit, only answers. Businesses seeking answers for the sake of those

answers do not remain viable businesses for very long.

The second wave of the Transactional Era really began in the 1970s. That is when the commercial computing

environment evolved from one primarily interested in cost savings via task automation to one that leveraged

technology to try to model new ways of generating profits. Instead of settling for automating only tactical

functions, early forward-thinking companies began to leverage technology for strategic and competitive

advantages. That is when the IT industry moved from a handful of big players to thousands of hopeful

participants. If all anyone wanted to do was count things or do payroll, no one could have ever competed with

IBM. It took different ways of thinking on the part of businesses and the industry to try to solve far different—and

often more complex—problems, such as how to extend business advantages, create competitive separation, and

apply intelligence and analytics to find new market opportunities.

Transactional Era systems share common market characteristics—they exist within the very core of the

business. That means transactional systems have the highest level of corporate visibility, pose the greatest

-1Copyright

2009, The Enterprise Strategy Group, Inc. All Rights Reserved.

ESG REPORT

Commercial Computing Market Dynamics

potential risk, and, while they once offered the greatest strategic potential, rapidly became a case of business

necessity. You either kept pace with the technology advancements of your competition or your cost structure

would lead to peril. Transactional systems also tended to have the most well-defined cost to value, meaning

businesses have always been able to attribute hard dollar values to the functions of those systems. You knew

how much each accountant made, so the return on investment was easy to calculate. If you were able to then

improve intangible factors such as increasing customer satisfaction, lowering business risk (hiring well qualified

accountants was not always easy), and increasing revenues (without the same increase in costs), then everyone

was happy. Knowing the exact measurable value of some business unit makes it relatively simple to calculate a

positive return on investment.

IT industry competition developed as it always does: with imitation first. Others attempted to build mainframes

cheaper, faster, and better, but by the time they posed any legitimate threat to IBM, the game was already over.

Building new value was the key. Trying to steal someone else‘s victory without lending any true new value rarely

(if ever) works without some massive environmental shift. The very nature of the business transacted on those

systems—and the data itself—had such obvious value that as long as the incumbent remains in the game, they

are almost assured of continued dominance in that customer account. The risk of change, be it real or

perceived, is much too high for the business to find a positive return on investment substantive enough to merit

actually taking that risk.

The second wave of the Transactional Era was predicated upon new value being created—most often by new

companies applying new usage models on top of, or next to, investments that had already been made. From

Oracle to SAP, no one made a significant long term threat to unseat IBM in the mainframe space. Instead, they

leveraged new usage models on the mainframe, which provided incremental value to the business by generating

new value on top of the existing infrastructure.

Within the three primary layers of commercial computing infrastructure, IBM once owned 90%+ of the core

computing (server/processor layer) market value even when competition was at its highest. Beating someone

who dominates a market they created is a losing proposition—again, until some significant environmental shift

occurs that alters the very dynamics of that market. It simply wasn‘t going to happen at the core. That is not to

say that others were not able to chip away at other areas. EMC was able to convince the entire marketplace that

the storage component of the transactional system should be considered an independent, primary acquisition

instead of an afterthought peripheral. By doing so, EMC created a new industry and spawned many new

imitators—who ultimately spent time fighting a battle that had already been won (core storage, within the data

layer). Like IBM in the very core of computing, EMC has defended it position almost perfectly over the decades.

Without a direct requirement to make a change, such as the inability to keep up with processing demand, a

highly visible business market will almost never move from something that works (no matter how badly) to

something that presents a potential risk.

Even ―free‖ products have been rebuked by consumers in lieu of continuing to spend millions of dollars on

incumbent infrastructure and applications when the ―business is at stake.‖ In essence, the more visible the

market, the more dominant the incumbent vendor has been.

When the transaction system is considered the heart of the business, few consumers are going to take any

substantial risk on an upstart or even an established brand, regardless of how great the technology is.

Due to visibility and businesses‘ ability to attach hard values to the functions and transactions performed on core

transactional systems, the players who dominated each sub-sector were able to effectively control pricing in the

market. As long as it was possible to articulate a clear return on investment, the business would continue to

make those investments. No sensible business person would refuse to spend $1 if they were all but assured

they could make a return of $1.50.

Transactional Era Computing Characteristics

The attributes required by the early transactional consumers of IT infrastructure were easily determined.

Consumers demanded non-stop, bulletproof equipment and services. Since the cost of a transaction was

known, the cost of downtime was also known. Downtime has always had a known hard cost in the core—one

-2Copyright

2009, The Enterprise Strategy Group, Inc. All Rights Reserved.

ESG REPORT

Commercial Computing Market Dynamics

that goes directly against the bottom line. The soft costs of downtime continue to escalate as the business

becomes more reliant on these systems, but those costs remain elusive in the justification of capital

expenditures. The hard costs of downtime, however, also continue to escalate and as such, consumers have

been willing to spend significantly above generic averages for technologies that offer the real or perceived ability

to deal with a mission-critical environment. Thus, reliability and fault-tolerance were considered the primary

attributes of the transactional computing era.

The next critical attribute of this ―core‖ market has been the ability to scale transactions. Buyers need to know

that they can keep up with demand in a world of ever-increasing unknowns. Being able to add users and

workloads in a predictable fashion has been paramount. Competitors are always quick to point out how they

might offer greater performance, but convincing buyers that they can do so while improving overall uptime has

proven disastrous. The same has held true for those who bring higher availability systems to the market but

force the buyer to risk limited transaction scale.

These characteristics created the foundational methodologies still employed by the vendors supplying goods to

this market. In order to meet market demands, these organizations incur heavy engineering, test, quality

assurance, and support costs. They are often restricted in bringing out new innovations as they are saddled with

legacy architecture and engineering elements that cannot be replaced without impacting perpetual uptime and

scale bonds with the customer. This keeps efficiencies in design, manufacture, and functionality on the part of

the vendor from reaching the customer in any short term, which in turn keeps costs high for all involved. That is

why it appears as though the core transactional world is the last market to receive advancements that have long

been mainstreamed in other areas. It is also why massive environmental change, such as the onslaught of

distributed computing, was thought to be the catalyst leading to the death of the entire core transactional

computing market. History shows us, however, that this is not the case.

TABLE 1: CORE DATA CENTER/MAINFRAME STORAGE IN THE CORE TRANSACTIONAL COMPUTING ERA

Data Growth (+26% CAGR)

Cost per GB (-24% CAGR)

1955 – 20 GB

1965 – 250 GB

1975 – 20,000 GB

1985 – 200,000 GB

1995 – 1,800,000 GB

$7,000,000/GB

$2,000,000/GB

$140,000/GB

$20,000/GB

$900/GB

2005 – 17,000,000 GB

$8/GB

Source: Enterprise Strategy Group, 2008

If you plot out growth on core transactional system capacity from its advent to today—with countless threats and

changes over almost 50 years—it has grown at approximately 26% CAGR, while the cost of capacity has

decreased at an almost linear pace.

After almost 50 years and endless technological, social, philosophical, and economic threats, the

core transactional systems born in the early 1960s have grown in capacity at an average of 26% per

year. The stock market isn’t even close to that growth rate.

The purported end of the Transactional Computing Era in the late 80s and early 90s was marketed with loud

celebration. The mainframe was too rigid, too expensive, and too ―old.‖ The positive results of such perceived

negative capabilities—such as discipline, process, planning, and a known outcome—were not valued in the

1980s by the new generation until systemic failure became apparent. Core transactional systems have historical

limitations in terms of physical connectivity—which was viewed as a negative at one point. With these systems,

all access was denied and IT had to provide both a physical and logical means to enable a user to access them.

The operational burden on IT was centered on getting users attached to the system. Security—both physical

and electronic—along with physical maintenance, had been easier simply because the systems and data assets

were all typically in one physical location.

-3Copyright

2009, The Enterprise Strategy Group, Inc. All Rights Reserved.

ESG REPORT

Commercial Computing Market Dynamics

To create digital content in a transactional computing system, you had to be invited, connected,

and allowed to do so.

As the Transactional Computing Era matured, new use (application) models, greater connectivity (accessibility to

more functional groups and employees), and widespread acceptance of commercial computing as a core

business function have carried the market steadily upward—even as newer capabilities at lower price points

entered. The primary incumbent vendors continue to dominate this overall segment despite the passing of 50

years—the visibility and perceived risk inherent in making any real change within that environment continue to far

outweigh any potential benefits in the eyes of the business.

The Distributed Computing Era

Technology advancements in commercial computing rapidly accelerated in the early 1980s. The application of

computing technologies outside of commercial computing spawned intense development in smaller and more

powerful processors and specialized interconnects. Specialized computing platforms succeeded by providing

specific turnkey application functions to specific industry—or departmental—needs. Wang built word processing

systems, DEC built manufacturing systems, Prime built engineering systems, and so on. At that point, systems

manufacturers followed the same method of attacking the market laid out by IBM many years earlier. The only

difference was they were attacking adjunct markets and not going directly after the core. They did not, however,

understand that simply finding a new market opportunity wasn‘t good enough to sustain a growing business. The

minicomputer companies believed their key was to be first—and if they were, they would dominate as IBM had in

the core. What they failed to realize was that the customer did not place anywhere near as much value on

departmental systems as they did on the mainframe systems. Mainframes were boardroom talk, VAXs weren‘t.

This batch of next generation commercial computing companies wisely specialized in areas outside of the core—

areas that were becoming more important to the business. The principles applied by the business to core

computing were founded on the same simple and basic business theory: cut costs and increase efficiency. This

was not restricted to the transactional systems alone; these companies, and many others, were able to create

brand new tangential industries by applying specialization to other areas of the business such as

design/engineering, manufacturing, and office automation.

What these companies did wrong was assume that, because it was necessary to design and build every single

component of the solution initially, they would have to continue down that path forever. They believed that

everything they did was a critical piece of intellectual property and eliminating any piece put them at competitive

risk. They certainly were not interested in gaining any leverage by using commodity components that could also

be used by their competitors—until it was too late.

IBM had the resources and depth of talent to participate in all areas of the computing spectrum. It was effectively

a monopoly and controlled prices in the core compute markets. Customers bought almost every piece of their

systems from IBM, so IBM was fine building its own processors, packaging, memory, and every other major

component. IBM was equally fine building all of the software it could. Since it controlled the operating system

and the hardware, who better to bring new value and new income to systems than IBM?

As the mini-computer folks reached their peak—all engineering and developing their own processors, drives,

memory, etc., along with the applications written to execute on their architectures alone—they suddenly found

themselves trapped. Lacking the sheer size and revenue base IBM had to support all of its development efforts

and facing a rapidly advancing environmental shift with a new market emerging in the shape of the workstation

and PC, they were doomed.

By 1988, the Unix workstation and PC markets were firmly established. These markets required commoditization

in order to meet the economic requirements of the consumer—who, it turns out, didn‘t value departmental

-4Copyright

2009, The Enterprise Strategy Group, Inc. All Rights Reserved.

ESG REPORT

Commercial Computing Market Dynamics

applications with the same zeal as the company valued core business applications. Companies entering this

space quickly learned that building all the components and software themselves was not feasible—even for IBM.

Instead, those who embraced commoditization were the victors early on. People didn‘t care as much about

mission-critical or bulletproof systems in that market; they cared about cost and application availability. Both

concepts were completely at odds with the philosophies of the core transaction systems and their smaller

brethren in the mini-computer space.

The PC technology wars were very short. Intel and Microsoft grabbed the lead and never looked back. Once

that occurred, hardware value shifted from component engineering to who had the best supply chain,

manufacturing, and distribution. The embedded software market was replaced by a slew of new companies that

could now afford to develop portable applications since Microsoft and Intel made their interfaces widely known

and open. These giants knew that the key to their ultimate success and dominance lay in having a vast library of

application software available. If enough good software was available to run on the PC, then they could ride the

demand wave of each successful software program—whether they invented it or not.

Traditional computer companies entered the PC market, usually begrudgingly, and immediately attempted to

control it by pushing the same philosophy of designing, developing, and controlling all of the pieces. While IBM

may have had all the right resources, it didn‘t have the right philosophy, nor did it have the willingness to adapt to

clear market changes. The company did better than most, but it was those without historical encumbrances who

won the day.

As the PC revolution took off, some hybrid players took the more open, commoditized concept of the PC and

applied it to the commercial world where the mini-computer ruled. Apollo and Sun created workstations that, in

essence, combined the benefits of commoditization and open architectures and applied them to specific tasks

within the business community. These workstations had significantly lower cost structures than mini-computers

and often outperformed them. They also opened up their operating systems and processor architectures to

encourage others to write software that could take specific advantage of what they brought to the party.

Accounting systems were the purview of the mainframe. Engineering was still manual. Just as the accountant

was a highly paid, highly skilled, and difficult to find employee years ago, engineers were even more so. Sun

and Apollo were able to build systems with tremendous compute performance characteristics at a fraction of the

cost of a time-shared mini-computer implementation, which allowed engineers to leverage software tools, such

as AutoCAD, which in turn made them so much more efficient and productive that the cycle of business ‗follow

the leader‘ occurred all over again. Soon, every engineer in business was armed with tools that made them so

much more effective—while unknowingly reducing business risk and increasing business value—that within a

few short years, a generation‘s worth of manual engineering tools and process were all but forgotten.

The functionality and market that the mini-computer once owned had been decimated. IBM and others built

applications to attack those functions (time shared) and Sun/Apollo built distributed systems that put the power in

the hands of the creator. There was no room for those in the middle, who had the worst of all possible worlds:

the cost and rigidity of a monolithic systems company with less application value to the user.

A New Market

The Distributed Computing Era began with a brand new market. None of the early participants had any desire or

need to compete with core transactional systems. As more and more PCs and workstations showed up on

employees‘ desks, the end of the first wave of the Distributed Era (mini-computers) drew nearer. It was clear that

individual productivity enhancement could be gained by putting semi-open compute power on each desk and

applying software tools to increase individual efficiency. No one even considered replacing a core business

system with a pile of PCs. Not yet, anyway.

All technology revolutions—whether market/usage- or tech-driven—create new sub-market opportunities. EMC

chipped off the storage in the core to create an entirely new industry. Once disk became a separate market, so

did tape, and so on. As PCs and workstations propagated like wildfire, the software industry came into its own.

For a while, imitators existed—those who wanted to beat Microsoft or Intel, but as before, once established,

those markets were closed without another revolutionary turbulent event or need. New market opportunities

happen when usage kicks in—and causes unforeseen problems along the way.

-5Copyright

2009, The Enterprise Strategy Group, Inc. All Rights Reserved.

ESG REPORT

Commercial Computing Market Dynamics

A ten person accounting firm was not going to buy a mainframe. When the PC market came into its own,

businesses were able to arm their accountants with systems and tools that rivaled the big companies. There was

no parallel in engineering, so companies large and small alike benefited from the workstation phenomenon

concurrently.

Commercial computing follows the same fundamental paths to market success—or failure.

Almost all commercial computing technology is adopted to create better individual task

efficiencies and to lower the cost per task.

This was true at the genesis of core computing and remains true today.

Realized value of investments made in commercial computing technology accelerates when

individual tools are connected to create larger “group” efficiencies.

Enhancing the productivity of an individual is critical, but accelerated value occurs when a collection of

individuals can provide greater efficiency and productivity gains (along with cost reductions) as a group than

each could alone. In the case of PCs and workstations, that meant enabling collaboration, asset sharing, and

repurposing—and that meant networking.

The quest for increasing or stealing share in existing markets kept Intel and Microsoft pushing ahead.

Companies such as Lotus and Word Perfect brought the world new reasons to invest in desktop technologies.

As businesses began adopting these tools in volume, new market opportunities emerged to solve the unplanned

problems that invariably occur with any new widespread technology wave: operating issues.

The business was capable of supporting core transactional systems, but was not ready to deal with the issues

created by these new individual nodes of compute and data resources. An immediate ―us vs. them‖ mentality

occurred in many commercial business environments. Transactional systems were run by professionals, while

distributed systems were run by mere mortals. Those mortals, especially engineers, were capable of supporting

themselves for the most part—or so they thought. Problems arose when the business realized that the individual

tools provided to individual contributors generated a new corporate asset—data—that had value (albeit nebulous

value) and therefore needed to be secured and protected. Those issues had been solved within the centralized

computing environment, but were brand new in the distributed world. Most corporate IT departments avoided

having anything to do with the new distributed world unless forced to do so.

The second principle of improved group efficiencies meant that once the business realized the benefit of

increased individual productivity, it became natural to extend those benefits beyond the individual. The business

gained huge efficiency by automating the tasks of individuals, but could gain even more by enabling the sharing

of tasks, functions, and information within and across groups. If one engineer developed a new and better way

to do something, it only stood to reason that others within the group would also benefit. But for this to work,

individual machines and data needed to be connected. That is when the networking industry exploded.

IP networking became the eventual de facto standard for connecting all of these pieces together. Centralized

computing centers required batch jobs to share assets, such as printers. IP networking enabled workgroups to

share smaller assets with each other. IP networking prevailed over all of the individual proprietary alternatives

because in the new business world, companies no longer used products from just one manufacturer. IBM

controlled the mainframe, but not the workstation or PC markets. Unless you remained committed to a single

vendor environment, you had to adopt a much more heterogeneous network infrastructure—and that meant IP.

-6Copyright

2009, The Enterprise Strategy Group, Inc. All Rights Reserved.

ESG REPORT

Commercial Computing Market Dynamics

The only time an imitating product can gain a foothold over an incumbent is when either the use

case caused by an environmental shift creates a situation where the incumbent can no longer

satisfy demand or when the technology/product is commoditized and standardized to a point

where price is the only primary differentiator.

The Distributed Computing Era created many multi-billion dollar industries given opportunity by new technology

use cases and was met with resistance from traditional transactional vendors and users alike. Problems were

created that didn‘t exist in the previous world, which also resulted in brand new opportunities. The IP networking

business found its opportunity because it was paramount to connect all distributed assets in order to best

leverage them. That created industry opportunity for products and expertise. It also pushed the model of

commoditization, which in turn created easier to use products and plummeting costs—further accelerating

adoption, and so on.

Distributed computing is a good idea, but distributed data is not. Having the output of this significant corporate

investment in tools scattered all around the enterprise made for lower operating efficiency and increased risk.

Consolidating that data on more centralized servers became critical in order to best address these newfound

issues. In a way, it is ironic that the answer to the unforeseen problems that occurred due to the unpredicted

success of the Distributed Era ended up being a consolidation effort. We refer to this phenomenon as a ―second

wave‖ market. Second wave markets are often much larger than the originating market—such as the networking

market versus the workstation market.

The client-server wave of distributed computing was a hybrid of individual function execution at the user‘s

desktop combined with central servers housing group data and processing group functions.

Network Appliance (NetApp) became a runaway success by enabling the consolidation of distributed data in the

Distributed Era. Veritas eventually dominated the distributed backup industry. Oracle and SAP were able to

offer their functionality on both mainframe and ―open systems‖ servers in the distributed world, eventually availing

themselves to previously unattainable parts of the market. Storage competitors from the transactional/block

space competed fiercely to move downstream to apply their wares to a net new market opportunity.

In the Distributed Computing Era, corporate computing and data spread to workgroups and individuals connected

via a network. Anyone with the asset on their desk had the ability to create digital content—which evolved from

disconnected individuals, to networked workgroups, to wide LANs, to campus-wide LANs, to corporate-wide

LAN/WANs, to Internet-connected VLANs, to eventually becoming ―Internet connected.‖

The Distributed Era has evolved from a connectivity perspective, but remains in the control of

the corporation—99% of the digital content created by corporations on distributed systems is

created by employees, business partners, or other trusted users within the business. Unlike

transactional systems built upon block data architectures, distributed systems were built on filebased data. Distributed systems have become accessible over ever-widening geographies, with

content creation occurring at both the client and server.

Growth in the Distributed Era far exceeded transactional data growth—but not at the expense of transactional

systems or the marketplace. Instead, distributed computing brought entirely new use cases for IT and the

business at large; an entirely new data paradigm (files vs. blocks); an entirely new usage and support paradigm

(decentralized vs. glass house); and countless issues ranging from security, to protection, to attempts to keep up

with the demands being set by newly exposed users.

-7Copyright

2009, The Enterprise Strategy Group, Inc. All Rights Reserved.

ESG REPORT

Commercial Computing Market Dynamics

TABLE 2. OPEN SYSTEMS STORAGE CAPACITY IN THE DISTRIBUTED COMPUTING ERA

Data Growth (+132% CAGR)

1985 - < 1 TB

1995 – 19,000 TB

2005 – 21,000,000 TB

Cost per GB (-37% CAGR)

$20,000,000/TB

$300,000/TB

$2,400/TB

Source: Enterprise Strategy Group, 2008

As Table 2 shows, the compound annual growth rate for distributed data in the corporate world has increased at

five times that of transactional data (132%), while the cost decrease of that capacity has only reduced by 37%

annually. The decline in pricing is at a higher rate than in transactional core systems, but the demand curve has

more than offset the discrepancy. This table makes it easy to see why the overall revenue of the commercial IT

market more than doubled when we added the distributed computing market to the transactional computing

market.

The new usage models that evolved in the Distributed Era altered the distribution of revenue (and capital market

value) from the systems providers to the networking, management, and application providers.

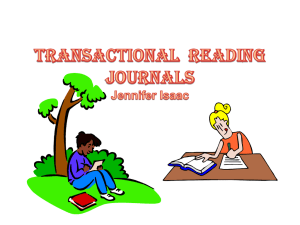

In a relatively short period of time, the world of corporate computing shifted from 100% block-based transactional

data to a world where 85% of all the data generated and utilized within a commercial entity was now file-based—

and born of the distributed computing age.

FIGURE 1. A NEW DATA CENTER PARADIGM

2006 Commercial Computing Data

Core

Transactional

Data (block),

15%

Distributed Data

(file), 85%

Source: Enterprise Strategy Group, 2008

The Internet has extended connectivity and enabled communication and collaboration pathways between users

both inside and outside the corporate domain. From a corporate ―business‖ perspective, the Internet has been

used primarily as a new forum through which a company could create or extend its brand, transact business, and

reduce the cost of connecting trusted users. Forward-looking companies also have leveraged the Internet by

using the corporate domain to enable customer-driven communications, but bi-directional communication and

content creation remains a very small minority of overall digital content in the corporate world. Customer forums,

service and support portals, ordering portals, etc. have all been mostly positive steps designed to improve

customer satisfaction and relations, but still remain largely private and single threaded.

Today, the Internet is the connective fabric that ties us all together, but corporate content creation, access, and

control continues to reside almost exclusively within the corporation itself. The non-corporate blogosphere is one

of the few places where content is created, debated, shared, accessed, and manipulated almost entirely by the

―community‖ itself—typically with very limited participation by the company that founded or sponsored the

community. That is going to change; that change has ramifications that will challenge not only how IT and the IT

industry operate, but the way business itself is conducted.

-8Copyright

2009, The Enterprise Strategy Group, Inc. All Rights Reserved.

ESG REPORT

Commercial Computing Market Dynamics

The Internet Computing Era

Creating, Accessing, Storing, and Finding Data in the Cloud

Any device connected to the Internet now has the potential to create, access, move, find, manipulate, delete,

store, or manage digital content. In this era, everyone—via almost every conceivable device—can be connected

to everyone else, eliminating geographic boundaries. As in the previous eras, corporations will be responsible

for creating the policies and methods that ensure the proper use and protection of digital assets. Unlike the

previous eras, however, any benefit associated with limited physical connectivity as a defense mechanism has

been effectively eliminated.

The Internet Era of commercial computing has been fueled by several factors:

1. The Internet itself has reached every corner of the world, effectively creating a flat global network where

there are no longer any barriers to connectivity.

2. Technology has enabled the creation of digital content to occur at every point of connection—from the

core transaction system to your desktop, in handheld devices, cell phones, laptops, smart cards,

household appliances, and countless other devices. Anything and everything that can connect to the

network has the potential to create, access, and move data.

3. The ability to share digital content with the world now occurs in real-time.

In previous eras, corporate information assets have been created and controlled almost exclusively by the

corporation itself. Corporate data may be displayed and accessed via the Internet, but rarely does the corporate

world allow non-trusted users to create or manipulate corporate information. Conversely, most consider even the

attempt to access that data to be a cyber-crime or hack. In the Internet Computing Era, we will see a rapid

increase in data creation and access points for trusted users. Eventually, we will open parts of ourselves and our

systems to the rest of the world. Customers and other interested parties will change the way business is

fundamentally done—by providing content, aiding in product development and support, making sales, and calling

you on your mistakes.

This is counterintuitive to hundreds of years of business principles—namely, controlling messages, keeping

secrets secret, and controlling customers‘ and competitors‘ spheres of influence.

Innovative technologies, global connectivity, and new usage models have enabled a new generation of people to

create and share digital content faster and easier than was even conceivable just five years ago. Corporate

computing environments, while lagging behind the consumer markets, are slowly but steadily moving into the

realm of Web 2.0. Whether through online communities, social networking sites, new media, or collaboration, the

commercial computing world must ready itself to participate in the rapidly evolving new realities of business.

Tools such as document collaboration portals, blogs, wikis, streaming media, and a host of other digital content

creation and management applications are enabling organizations to redefine themselves in almost real-time.

New media content is being created for everything from training to marketing and becoming a mandatory

component of everyday business. Whether it‘s blogs or video, content is easier than ever to create—and

management of that content will become harder than ever without significant changes.

The very nature of data has changed. No longer primarily concerned with block-based transactional data, new IT

initiatives must deal with this new breed of data—which is almost exclusively file-based. Furthermore, the files

themselves are changing—becoming larger and larger as their richness increases. With the ability to create data

becoming ever easier, it is no wonder that the amount of data we are forced to contend with is growing

explosively. Growth in both the volume of data and the already enormous complexity of enterprise infrastructure

can only lead to an inevitable—and catastrophic—breakdown.

Basic data management has been a never-ending problem for IT organizations for many years. New business

processes—coupled with the assault of new, large file-based digital content—will likely crush existing norms.

There is an absolute need to re-evaluate processes predicated upon the transaction-based computing of the past

-9Copyright

2009, The Enterprise Strategy Group, Inc. All Rights Reserved.

ESG REPORT

Commercial Computing Market Dynamics

and focus on finding new methods of dealing with the criteria of this new era. The ways we handle file storage,

backup, archiving, search and retrieval, content delivery, and collaboration will inevitably have to change—in

terms of both infrastructure and management. In addition, infrastructure files in the form of virtual machine

images, reusable web services, file systems, and management databases continue proliferating widely. IT

managers charged with protecting and managing such a dynamic range of formats face an almost untenable

situation.

The Situation is Only Going to Get Worse

1

ESG‘s file archiving market forecast projects that total worldwide file archive capacity will increase from 7,119

petabytes (PB) in 2007 to some 62,749 PB in 2012—a 55% compound annual growth rate . These surveys also

indicate that the growth in volume of archived file-based information exceeds all other categories—enterprises

show approximately 10X growth in the volume of unstructured information stored over the past two years, while

SMBs report almost 13X in the same timeframe. Most customers expect the growth of file-based archives to

continue unabated in the future. Over the next several years, 37% expect the size of these types of archives to

grow between 11% and 20% annually, while an additional 37% expect them to grow more than 20% annually.

As challenging as these rates may seem, ESG‘s analysis indicates that respondents actually underestimated

the real growth rates of files and related storage capacity requirements. For the most part, survey respondents

providing these forecasts focused on traditional file types. They did not generally consider such file types as

virtual machine or desktop images, reusable web services images, or other infrastructure software images and

file types. Furthermore, ESG‘s analysis shows that many customers significantly underestimated the size of files

created by new digital content formats such as audio, video, image, and streaming media.

When asked to identify the type of application that is responsible for generating the most content, office

productivity applications (22%) and document management systems (20%) are the most frequently mentioned.

As might be expected, more structured applications, such as ERP and CRM solutions, generate less content

because the core data supporting those systems is stored in structured database environments. Images used to

document ERP and CRM transactions do contribute to the unstructured information file somewhat, but not as

much as office productivity and document management solutions.

What IT has not yet realized is that the impact on their operations and infrastructure will not evolve seamlessly—

there is a dramatic difference between scaling Word documents and scaling huge rich media content. Every

company is becoming a media company and large files are going to rule the day. Customers, employees, and

markets are global—the content a business houses and protects needs to be stored and delivered globally. But

now, any predictive abilities we once had around the value, capacity, or scale requirements of this data type are

wild guesses at best.

New Infrastructure Demands

The Internet Computing Era widens the gap between the relatively known growth and cost attributes of the

Transactional Era and the less well understood Distributed Era. It was relatively easy to build products to support

the requirements of the Transactional Era—those requirements and attributes were clearly defined. It was much

more difficult to determine valuable and necessary attributes in the Distributed Era because most of the use

cases simply didn‘t exist previously. While many of the hardware architectures presented in that era have been

nothing other than scaled down examples of the same technologies from the Transactional Era, this new world

will require completely new architectures to support new demands and entirely new processes and constructs.

As Web 2.0 migrates from a world of questionable business value to mainstream business deliverables, IT

departments are increasingly finding themselves without a plan. How does an IT operation go from taking three

months to plan and provision infrastructure to support a business application to creating and scaling one in semi

1

All subsequent references to ESG research are from the ESG Research Report: 2007 File Archiving Survey, 2007.

- 10 Copyright

2009, The Enterprise Strategy Group, Inc. All Rights Reserved.

ESG REPORT

Commercial Computing Market Dynamics

real-time? Without any realistic method to determine what the extent of interactions will ultimately be or how fast

growth will occur, it is very difficult to make any plans.

The infrastructure attributes required in this era include:

Infinite Scale – in real-time, dynamically, with little to no human intervention.

Self-Management – infrastructure needs to automatically re-balance and optimize itself without human

intervention.

Self-Healing – infrastructure needs to withstand failures and automatically adjust/heal itself.

Perpetually Decreasing Commodity Costs – accelerate and leverage declining costs.

This era requires infrastructural ―scale-out‖ at the server, network, and information infrastructure/data layers in

ways that have rarely been done before. No matter whose data you look at, the growth of capacity is

accelerating. The makeup of that data will continue to change.

FIGURE 2. PERCENTAGE OF OVERALL COMMERCIAL DATA BY TYPE

100%

90%

80%

70%

65%

60%

50%

82%

100%

Internet Cloud Data

95%

100%

Distributed Data

85%

Transactional Data

40%

30%

20%

34%

10%

18%

0%

1975

1985

1995

5%

1%

0.10%

2005

2015

2025

Source: Enterprise Strategy Group, 2008

As occurred previously, the new era of Internet computing will ultimately dwarf the previous Distributed and

Transactional Computing eras in the capacity of data generated. It is important to reemphasize that, for the most

part, this will not be in replacement of the data created during those eras, but rather, in addition to it. Like the

Distributed Era prior, this era will compound commercial computing issues—not replace them.

The industry was able to largely react to the Distributed Computing Era by ―dumbing down‖ core transactional

systems to meet cost demands. With no other way to adapt, IT professionals used these same basic

technologies and attempted to force-fit the new usage models of their users into existing processes—again built

upon the knowledge and skills gained in the Transactional Era. It was only after many years that new vendors

embraced new technological implementations designed to deal with the scale issues presented by new models.

Infrastructure scale has always been an issue, as has ―people‖ scale within IT. In early 2000, new scale-out

capabilities began to arrive that addressed the dynamic and unknown requirements of the day, but continued to

be dwarfed in the market by architectures and processes fundamentally designed decades ago—for applications

and use models that simply don‘t work in the new world order.

- 11 Copyright

2009, The Enterprise Strategy Group, Inc. All Rights Reserved.

ESG REPORT

Commercial Computing Market Dynamics

Conclusion

1. It is not a matter of if commercial entities will adopt ―Web 2.0‖ technologies and demands, only a matter

of when.

2. In order to prepare for the inevitable, IT professionals and the industry must acknowledge reality: current

methods simply won‘t work in the new world order.

3. As an information-centric society, we need to acknowledge that there are three (at least) distinct types of

data to contend with—each with differing value (both inside and outside of the business), scale,

connectivity, management, protection, security, performance, and cost requirements.

4. Corporate entities will use—and therefore need to understand—the data generated during all three eras.

Remember, even Google (or pick your favorite Web 2.0 example):

a. runs transaction systems—just like the rest of us.

b. runs distributed systems—just like the rest of us.

c. runs Internet/Cloud infrastructural systems—just like the rest of us will.

Google just got to the breakdown of data types (by percentage) under management faster than the rest of us.

For IT to be successful in the coming age, it will have to demand much more from the industry. Ratios such as

―administrators to servers (or storage—or anything physical, really)‖ have to be completely upended. Function

per footprint is the only real variable—i.e., the quantity of a function that can occur in a given set of time or space,

such as how much data can be managed, protected, or recovered within the physical realities you face.

Infrastructure will simply have to scale in any dimension at any time and the need for manual human

management has to be almost completely eliminated. Neither people nor systems can be bottlenecks any

longer—the world is moving on Internet time, like it or not.

So while we have only just begun to leverage the technological compute and connectivity advances of the last

few decades, what has become apparent is that it is naïve to assume we can stop the momentum or ever get

back to ―the way it was.‖ The technology adopted by our kids at age four should be a clear indicator of where the

world is heading. Like our generation and those prior, to be successful, we must embrace new realities instead of

attempting to contain or thwart them.

You will have visible, mission-critical, transaction-based systems. You will have distributed/collaborative

systems. You will participate in your business communities in entirely different ways. You will lose the ability to

control certain elements of your world—from who creates and accesses information to what people say about

you and who hears it. You will keep some of your data (maybe most of it) outside of your direct control—in the

―cloud.‖ You will become a media company. You will create, house, stream, push, and pull huge rich content

files to and from every corner of the world.

The only question remaining is: will the vendors who have ruled the first two eras be able to rule—or even

participate—in the new one? If this era evolves as slowly as the Distributed Era did, then incumbent vendors

have plenty of time to make their moves—but if it happens as suspected, seemingly overnight, then we could be

looking at a massive inflection point not dissimilar to the disruption created when the automobile crossed the

chasm, the industrial revolution itself, or the relatively short 50 years of commercial computing. With hundreds of

billions of dollars in play annually (and trillions of market capitalization), the stakes are high. Regardless of who

wins or loses, it is safe to say that the next 10-15 years will make the last 50 seem like any other ancient time our

grandchildren may study in their history books.

- 12 Copyright

2009, The Enterprise Strategy Group, Inc. All Rights Reserved.

ESG REPORT

Commercial Computing Market Dynamics

20 Asylum Street

Milford, MA 01757

Tel: 508-482-0188

Fax: 508-482-0218

www.enterprisestrategygroup.com

- 13 Copyright

2009, The Enterprise Strategy Group, Inc. All Rights Reserved.