Solutions to Exercises in Chapter 12

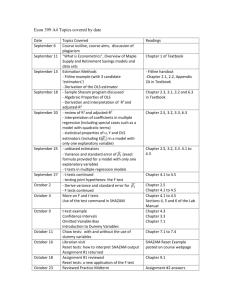

advertisement

1 Chapter 12 Solutions to Exercises Solutions to Exercises in Chapter 12 12.1 (a) The least-squares estimated equation is given by I!t = 6.22 + 0.770 Yt − 0.184 Rt (2.51) (0.072) (0.126) R2 = 0.816 Both b2 and b3 have the expected signs; income is expected to have a positive effect on investment whereas an increase in the interest rate should reduce investment. The standard errors for b1 and b2 are relatively small suggesting that the corresponding coefficients are significantly different from zero. However, the standard error of b3 is large, yielding a t ratio that is less than two. Based on this standard error, we can question whether we should include Rt in the equation, although economic theory suggests Rt should have a strong influence on It. (b) The plot of the least squares residuals in Figure 12.1 reveals a few long runs of negative and positive residuals, suggesting the existence of autocorrelation. e 8 4 0 0 5 10 15 20 25 30 35 t -4 -8 Figure 12.1 Residuals for Investment Equation (c) In this context, the Durbin-Watson test is a test for H0: ρ = 0 against H1: ρ > 0 in the firstorder autoregressive model et = ρet−1 + vt. We find the computed value for the DurbinWatson statistic is d = 0.852 and the p-value of the test if P(d < 0.852) = 0.000114. Because the p-value is less than 0.05, we reject H0 and conclude that autocorrelation does exist. (d) The estimator for ρ introduced on p. 248 of the text is not the one utilized by all software. Different programs often employ slightly different estimators that yield different estimates. Consequently, for this question we report three estimates for ρ and the three corresponding generalized least-squares estimated equations. The results from using SHAZAM, EViews and SAS are: 2 Chapter 12 Solutions to Exercises I!t = 8.43 + 0.742 Yt − 0.285 Rt (2.86) (0.114) (0.079) ρ̂ = 0.5677 (SHAZAM) Iˆt = 7.33 + 0.785Yt − 0.296 Rt (3.73) (0.147) (0.080) ρˆ = 0.6146 (EViews) I!t = 8.41 + 0.742 Yt − 0.285 Rt (2.90) (0.115) (0.081) ρ! = 0.5616 (SAS) Comparing these results with those form part (a), we find that there has been little change in the coefficient estimates, but a considerable change in the standard errors. The standard error on the coefficient of Yt has increased, suggesting that, if we did not correct for autocorrelation, our confidence interval for β 2 would be too narrow, giving us a false sense of the reliability of our estimate. The opposite has occurred for β 3. Here the standard error has dropped after correcting for autocorrelation. From the results in part (a) we might be misled into thinking that interest rate has no impact on investment (the estimated coefficient is not significant). After correcting for autocorrelation we have a relatively narrow confidence interval that does not include zero. (e) Given the next year values of Y and R are YT+1 = 36 and RT+1 = 14, the appropriate forecast using the SHAZAM results is I!T + 1 = β! 1 + β! 2 YT + 1 + β! 3RT + 1 + ρ! ~ eT = 8.43 + 0.742(36) − 0.285(14) + 0.5677(2.1513) = 32.356 With EViews and SAS, the result turns out to be 32.646 and 32.346, respectively. If autocorrelation is ignored, our prediction is I!T +1 = b1 + b2 YT +1 + b3 RT +1 = 6.22 + 0.77(36) − 0.184(14) = 31.363 There is not a large difference between the two predictions. 12.2 From the equation for the AR(1) error model we have var(et ) = ρ2 var(et −1 ) + var(vt ) + 2ρ cov(et − 1 , vt ) ( ) from which we get σ 2e = ρ2 σ 2e + σ 2v + 0 , or σ 2e 1 − ρ2 = σ 2v , and hence σ 2e = σ 2v 1 − ρ2 To find E (et et −1 ) we note that et et −1 = ρet2−1 + et − 1vt . Taking expectations, ( ) E (et et − 1 ) = ρE et2− 1 + 0 = ρσ 2e Similarly, et et − 2 = ρet − 1et − 2 + et − 2 vt , and E (et et − 2 ) = ρE(et − 1et − 2 ) + 0 = ρE (et et −1 ) = ρ2 σ 2e 3 Chapter 12 12.3 Solutions to Exercises (a) The least-squares estimated equation is ∧ ln( JVt ) = 3.5027 − 1.6116 ln(Ut) (0.2829) (0.1555) R2 = 0.8299 Using the value tc = 2.074, a 95% confidence interval for β 2 is b2 ± tcse(b2) = (−1.9342, −1.2890) (b) The value of the Durbin-Watson statistic is d = 1.09. In terms of its p-value, we find that P(d < 1.09) = 0.0088. Since this p-value is less than 0.05, we reject H0 and conclude that positive autocorrelation exists. The existence of autocorrelation means the original assumption for et , that the et are independent, is not correct. This problem also causes the confidence interval for β 2 in part (a) to be incorrect, meaning we will have a false sense of the reliability of the coefficient estimate. (c) After correcting for autocorrelation, the estimated equation is ∧ ln( JVt ) = 3.5137 − 1.616 ln(Ut) (0.2377) (0.123) ^ ln( JVt ) = 3.5034 − 1.600 ln(U t ) (0.2487) (0.132) ∧ ln( JVt ) = 3.5138 − 1.616 ln(Ut) (0.2437) (0.127) ρ! = 0.4472 (SHAZAM) ρˆ = 0.4486 (EViews) ρ! = 0.4318 (SAS) The results for SAS, EViews and SHAZAM differ slightly because they use different estimators for ρ. The 95% confidence intervals for β 2 from SHAZAM, EViews and SAS are, respectively, (−1.872, −1.360), (–1.875, –1.325) and (−1.879, −1.353). These confidence intervals are slightly narrower than that given in part (a). A direct comparison with the interval in part (a) is difficult because the least squares standard errors are incorrect in the presence of AR(1) errors. However, given the change in standard errors is not great, and that we know least squares is less efficient, one could conjecture that the least squares confidence interval is narrower than it should be, implying unjustified reliability. 12.4 (a) The marginal functions are obtained by differentiating the total functions. That is, mr = d ( tr ) = β1 + 2β 2 q dq mc = d ( tc) = α 2 + 2α 3q dq (b) If mc = mr, then β1 + 2β 2 q ∗ = α 2 + 2α 3q ∗ , and 2 q ∗ (β 2 − α 3 ) = α 2 − β1 , leading to the solution q∗ = α 2 − β1 2(β 2 − α 3 ) 4 Chapter 12 Solutions to Exercises (c) The least squares estimated models (with standard errors in parentheses) are ∧ tri = 174.28 qi − 0.5024 qi2 (4.54) (0.0235) ∧ tri = 2066.1 − 1.5784 qi + 0.22768 qi2 (727.2) (9.452) (0.02889) The statistical models that are appropriate for the above estimation are tri = β 1qi + β 2 qi2 + e1i tci = α1 + α2qi + α3 qi2 + e2i where e1i and e2i are both independent random variables with zero means and constant variances σ12 and σ 22 , respectively. The profit maximizing level of output suggested from the least squares estimates is q∗ = −1.5784 − 174. 28 = 120.43 2 ( −0. 5024 − 0. 2277 ) or q ∗ ≈ 120 . (d) For q = 120, total cost and total revenue predictions in each of the next three months are given by ∧ tr T + h = 174.28(120) − 0.5024(120)2 = 13679 h = 1,2,3 ∧ tc T + h = 2066.1 − 1.5784(120) + 0.22768(120)2 = 5155 h = 1,2,3 Thus, a prediction for profit is π! = 13679 − 5155 = 8524. (e) The Durbin-Watson statistics and p-values for each of the equations are Equation revenue cost DW-value 0.287 1.076 p-value 0.00000 0.00028 Both p-values are substantially below a nominal significance level of 0.05. We therefore conclude that the errors in both equations are autocorrelated. (f) The answers to the remaining parts of this question could depend on the computer software package that is being used. Different software packages often use different estimators for ρ and varying estimates of ρ flow through to the generalized least squares estimates and their standard errors, as well as predictions of future values. From this part on we report SHAZAM, EViews and SAS estimates. Generalized least squares estimates of the coefficients appear in the table below. Standard errors are in parentheses. 5 Chapter 12 Solutions to Exercises Equation tr Variable SHAZAM tc EViews SAS SHAZAM EViews SAS 2347.7 (608.4) 2354.7 (616.0) 2318.6 (633.2) constant qi 172.92 (5.90) 171.58 (8.01) 175.28 (4.60) −5.500 (7.920) -5.752 (8.020) −5.119 (8.263) qi2 −0.5123 (0.0188) -0.5085 (0.0248) −0.5190 (0.0155) 0.2410 (0.0244) 0.2415 (0.0247) 0.2396 (0.0254) ρ 0.8882 0.9495 0.7965 0.4439 0.4595 0.3629 (g) The profit maximizing level of output suggested by the SHAZAM results in part (f) is q∗ = −5.4999 − 172.92 = 118.42 2 ( −0.51233 − 0.24101) or, q ∗ ≈ 118 . Using the EViews and SAS results in part (f) we obtain q ∗ ≈ 118 and q∗ ≈ 119 , respectively. (h) In this case, because the errors are assumed autocorrelated, the total revenue and total cost errors for month 48 have a bearing on the predictions, and the predictions will be different in each of the future three months. For the total revenue function the SHAZAM estimated error for month 48 is ~ e = 8435 − [172.92(83) − 0.51233(83)2] = −2387.98 1,48 Therefore, for q = 118, total revenue predictions for the next 3 months (using the SHAZAM results) are given by ∧ ∧ ∧ ∧ ∧ ∧ tr T +1 = tr 49 = 172.92(118) − 0.51233(118)2 + (0.88817)1(−2387.98) = 11150 tr T + 2 = tr 50 = 172.92(118) − 0.51233(118)2 + (0.88817)2(−2387.98) = 11387 tr T + 3 = tr 51 = 172.92(118) − 0.51233(118)2 + (0.88817)3(−2387.98) = 11598 Using the EViews results the corresponding predictions are ∧ ∧ ∧ tr 49 = 10979 tr 50 = 11090 tr 51 = 11195 Using the SAS results the corresponding predictions are ∧ ∧ ∧ tr 49 = 11487 tr 50 = 11899 tr 51 = 12226 For the total cost function, the SHAZAM error for the last sample month is ~ e = 4829 − 2347.7 + 5.4999(83) − 0.24101(83)2 = 1277.45 2 , 48 6 Chapter 12 Solutions to Exercises Therefore, using the SHAZAM results, total cost predictions for q = 118 are ∧ ∧ tc T +1 = tc 49 = 2347.7 − 5.4999(118) + 0.24101(118)2 + (0.44394)1(1277.45) = 5622 ∧ ∧ ∧ ∧ tc T + 2 = tc 50 = 2347.7 − 5.4999(118) + 0.24101(118)2 + (0.44394)2(1277.45) = 5306 tc T + 3 = tc 51 = 2347.7 − 5.4999(118) + 0.24101(118)2 + (0.44394)3(1277.45) = 5166 The corresponding predictions from EViews are ∧ ∧ ∧ tc 49 = 5630 tc 50 = 5311 tc 51 = 5164 The corresponding predictions from SAS are ∧ ∧ ∧ tc 49 = 5569 tc 50 = 5272 tc 51 = 5164 Profits for the months of 49, 50 and 51 (obtained by subtracting total cost from total revenue) are (SHAZAM) π! 49 = 5528 π! 50 = 6081 π! 51 = 6432 (EViews) π! 49 = 5349 π! 50 = 5779 π! 51 = 6031 (SAS) π! 49 = 5918 π! 50 = 6627 π! 51 = 7062 Because ~ e1T is negative, and its impact declines as we predict further into the future, the total revenue predictions become larger the further into the future we predict. The e2 T is positive. Combining these opposite happens with total cost; it declines because ~ two influences means that the predictions for profit increase over time. These predictions are, however, much lower than 8524, the prediction for profit that was obtained when autocorrelation was ignored. Thus, even although autocorrelation has little impact on the optimal setting for q, it has considerable impact on the predictions of profit. This impact is caused by a relatively large negative residual for revenue, and a relatively large positive residual for cost, in month 48. 12.5 (a) For the AR(1) error model et = ρet −1 + vt , we are testing H0: ρ = 0 against H1: ρ > 0. The computed value of the Durbin-Watson statistic is 0.6634 and its p-value is 0.000182. Since 0.000182 < 0.01, we reject H0 and conclude that the errors are autocorrelated. (b) The least squares results yield b2 = −0.3857 and se(b2) = 0.0360. The generalized least squares results from SHAZAM are β! = −0.3752 and se(β! ) = 0.0527. Using EViews, 2 2 we obtain βˆ 2 = −0.5286 and se(βˆ 2 ) = 0.1129 . Using SAS, we obtain β! 2 = −0.3780 and se(β! 2 ) = 0.0497. The different results arise from using different estimators for ρ, and because EViews automatic command drops the first observation; the other two software packages do not. In small samples dropping the first observation can make a substantial difference. This is one of those occasions. The different estimates for ρ are ρ! = 0.5583 7 Chapter 12 Solutions to Exercises (SHAZAM), ρˆ = 0.6128 (EViews) and ρ! = 0.4691 (SAS). Using tc = 2.145 (14 degrees of freedom), the two confidence intervals for β 2 are: LS = (−0.463, −0.308) GLS = (−0.488, −0.262) GLS = (−0.771, −0.286) GLS = (−0.485, −0.271) (SHAZAM) (EViews) (SAS) The wider interval obtained using GLS estimates suggests that incorrect standard errors have made the least squares interval too narrow. The least squares interval suggests our information about β 2 is more reliable than it actually is. (c) To answer this question we need to predict unit cost for a cumulative production value of 3800. Our prediction will be different depending on whether or not we assume the existence of autocorrelated errors. (i) Without autocorrelated errors our prediction is computed from the least squares results ln(u!1971 ) = b1 + b2ln(3800) = 6.0191 − 0.3857(8.24276) = 2.83989 u!1971 = exp(2.83989) = 17.1139 (ii) When the existence of autocorrelated errors is recognized, the relevant prediction using the SHAZAM estimated value for ρ is ln(u!1971 ) = β! 1 + β! 2 ln(3800) + ρ! e~1970 = 5.9281 − 0.37524(8.24276) + 0.55826(−0.068952) = 2.79659 u!1971 = exp(2.79659) = 16.3886 Using the EViews estimated value for ρ, the results are ln(u!1971 ) = 2.7643 and u!1971 = 15.8684. Using the SAS estimated value for ρ, the results are ln(u!1971 ) = 2.80335 and u!1971 = 16.4999. Since unit cost is 16.4163 in 1970, the least squares prediction suggests cost will be greater in 1971, whereas the generalized least squares prediction suggests cost will be less. Intuitively, we would expect cost to decline with the increase in cumulative production. The least squares results do not predict a decline because the residual for 1970 is negative; the actual value for 1970 is below the value that would be predicted for that year. The generalized least squares results recognize the negative residual in 1970 and make allowance for the fact that another negative residual is likely for 1971. 12.6 (a) The least squares estimated equation is Q! t = 0.1973 − 1.044 Pt + 0.0033 It + 0.0035 Ft (0.2702) (0.834) (0.0012) (0.0004) R2 = 0.719 (b) The calculated t-value for the hypothesis H0: β 2 = 0 is −1.252, indicating that b2 is not significantly different from zero. From this result one might be tempted to conclude that price is not a relevant variable for explaining the demand. However, a close look at the data shows that there has been little variation in price. Thus, it is more likely that the 8 Chapter 12 Solutions to Exercises variation in price is too small to get an accurate estimate of its effect; not that price is unimportant. (c) The Durbin-Watson statistic is 1.0212. With k = 4 and T = 30 we have d L = 1.214 and dU = 1.650 . Since d = 1.0212 < d L , on the basis of this test we conclude that autocorrelation exists. This decision is confirmed by a p-value of 0.0003. The Lagrange multiplier test gives t = 2.0277 with a p-value of 0.0534. Thus, at a 5% significance level, the Lagrange multiplier test does not reject a null hypothesis of no autocorrelation. However, it is “close” to rejection. Gathering further evidence from the plot of least squares residuals in Figure 12.2, we see that these residuals tend to exhibit runs of positive and negative values. Thus, overall, there is evidence of autocorrelated errors. e 1E-01 8E-02 4E-02 0E+00 0 5 10 15 20 25 30 -4E-02 35 t -8E-02 Figure 12.2 Residuals for Ice Cream Equation (d) Using SHAZAM for the autocorrelation correction we find that ρ! = 0.40063 and the estimated equation is Q! t = 0.3374 − 1.176 Pt + 0.0022 It + 0.0033 Ft (0.2867) (0.835) (0.0015) (0.0006) With EViews, ρ! = 0.4007, and the estimated equation is Qˆ t = 0.1572 − 0.8924 Pt + 0.0032 I t + 0.0036 Ft (0.2998) (0.8295) (0.0016) (0.0006) With SAS, ρ! = 0.32977, and the estimated equation is Q! t = 0.3075 − 1.171 Pt + 0.0025 It + 0.0034 Ft (0.2895) (0.856) (0.0015) (0.0005) The reason that the estimated equations from EViews and SHAZAM are substantially different, despite the fact that they use virtually identical estimates of ρ , is that EViews drops the first observation when estimating the β s; SHAZAM does not. 9 Chapter 12 Solutions to Exercises (e) In this case we find that, in addition to β! 2 , β! 3 is also not significantly different from zero. Thus, some doubt is cast on the relevance of income in the demand for ice cream. Again, it may be that the variation in income is inadequate to capture its effect. 12.7 (a) The Durbin-Watson p-value computed from the residuals for the transformed model (from SHAZAM) is 0.0295. Thus, if we were testing H0: θ = 0 against H0: θ > 0 at a 5% level of significance, where θ is the autocorrelation parameter in the model vt = θvt −1 + ut , we would reject H0. The correction for autocorrelation in Exercise 12.6 does not seem to have cured the problem. A similar result is obtained with SAS. For EViews the Durbin-Watson statistic of 1.55 falls in the inconclusive region, suggesting there is still a potential problem. (b) If we combine the model in part (a) with the traditional AR(1) error specification, we have et = ρet −1 + vt vt = θvt −1 + ut where the ut are independent random errors with ut ~ ( 0, σ 2u ) . Note that et − 1 = ρet − 2 + vt − 1 and hence θvt − 1 = θet − 1 − θρet − 2 from which we obtain et = ρet − 1 + θet − 1 − θρet − 2 + ut = (ρ + θ)et − 1 − θρet − 2 + ut We call this model an AR(2) error process. Under this assumed process our SHAZAMestimated model is Q! t = 0.6381 − 0.9437 Pt − 0.0016 It + 0.0028 Ft (0.2925) (0.7516) (0.0021) (0.0007) The EViews estimated model is Qˆ t = 0.1106 − 0.8709 Pt + 0.0036 I t + 0.0037 Ft (0.304) (0.852) (0.0016) (0.0007) The SAS-estimated model is Q! t = 0.2887 − 1.2043 Pt + 0.0028 It + 0.0034 Ft (0.2905) (0.8637) (0.0014) (0.0006) The estimated model appears very sensitive to the way in which the AR(2) parameters are estimated. We again find that β! 2 and β! 3 are not significantly different from zero. Also, the SHAZAM results give β! < 0; a negative effect of income on the demand for 3 ice cream does not seem plausible. 10 Chapter 12 12.8 Solutions to Exercises (a) The estimate for the AR(1) parameter ρ is T ρˆ = ∑ eˆ eˆ t =2 T t t −1 ∑ eˆ t =1 = 2 t 55453 = 0.8758 63316 The approximate Durbin-Watson statistic is d * = 2(1 − ρˆ ) = 0.2484 . Based on T = 90 and K = 5 , d L = 1.566 and dU = 1.751 . Since d * is less than d L we conclude that positive autocorrelation is present. (b) The estimate for the AR(1) parameter of ρ is T ρˆ = ∑ eˆ eˆ t =2 T t t −1 ∑ eˆ t =1 2 t = 621 = 0.0505 12292 The approximate Durbin-Watson statistic is d * = 2(1 − ρˆ ) = 1.8990 . Based on T = 90 and K = 6 , d L = 1.542 and dU = 1.776 . Since d * > dU , we cannot reject a null hypothesis of no positive autocorrelation. 12.9 (a) From the residual plots the residuals tend to exhibit runs of positive and negative values, suggesting autocorrelated errors. The Durbin-Watson statistic is 1.124. With T = 26 and K = 2 we obtain d L = 1.302 and dU = 1.461 . Since the value of the Durbin-Watson statistic is less than d L , we conclude that there is evidence of positive autocorrelation. (b) The estimates, their standard errors and the confidence intervals obtained from least squares and generalised least squares (GLS) are presented in the table below. For the least squares method T = 26, K = 2 and the critical t value is t0.025 = 2.064 . For GLS, T = 25 and K = 2, so t0.025 = 2.069 . The estimates obtained from least squares and GLS are very similar. However, the standard errors from GLS are much higher than from least squares, resulting in GLS confidence intervals which are much wider than those obtained from least squares. Hence, ignoring autocorrelation means the estimates are less reliable than they appear. Least squares GLS Estimate (se) Confidence interval Estimate (se) Confidence interval β1 -387.97 (112.66) (-620.49, -155.45) -343.85 (192.17) (-741.45, 53.75) β2 24.7646 (0.9715) (22.759, 26.770) 24.3882 (1.5741) (21.131, 27.645) 11 Chapter 12 Solutions to Exercises (c) Because of the evidence of autocorrelation the forecasts are based on the GLS results. DISP86 = βˆ 1 + βˆ 2 DUR86 + ρˆ e"85 = −343.85 + 24.3882(190) + 0.4186( −277.2) = 4173.87 DISP87 = βˆ 1 + βˆ 2 DUR87 + ρˆ 2 e"85 = −343.85 + 24.3882(195) + 0.41862 ( −277.2) = 4363.28 DISP88 = βˆ 1 + βˆ 2 DUR88 + ρˆ 3 e"85 = −343.85 + 24.3882(192) + 0.41863 ( −277.2) = 4318.35 12.10 (a) The LS estimated equation is ln( POWt ) = −0.1708 + 0.0082 t − 0.000037 t 2 + 0.9365ln( PROt ) (0.4147) (0.0005) (0.000004) (0.0899) The positive sign for b2 and the negative sign for b3 , and their relative magnitudes, suggest that the trend for ln(POW) is increasing at a decreasing rate. A positive b4 implies the elasticity of power use with respect to productivity is positive. The value of the Durbin-Watson statistic is 0.3924 with a very small corresponding p-value of 0.0000. This suggests a problem of autocorrelation in the errors. (b) The table below compares the least squares results with those generalised least squares ones obtained using SHAZAM, EViews and SAS. Apart from β1 , the least squares and GLS estimates are similar, although the EViews estimator that drops the first observation has led to some discrepancies. The most noticeable change is the increase in standard errors when GLS is used. Ignoring autocorrelation conveys a false sense of reliability. GLS LS EViews SAS SHAZAM β1 -0.1708 (0.4147) -0.2551 (0.4904) -0.3013 (0.4819) -0.3035 (0.4805) β2 0.0082 (0.0005) 0.0070 (0.0015) 0.0083 (0.0011) 0.0083 (0.0011) β3 -0.000037 (0.000004) 0.000027 (0.000012) -0.000036 (0.000010) -0.000036 (0.000010) β4 0.9365 (0.0899) 0.9612 (0.1055) 0.9629 (0.1044) 0.9633 (0.1041) 12 Chapter 12 Solutions to Exercises (c) The p-values (from SHAZAM) for testing the hypothesis H 0 : β 4 = 1 are 0.4817 and 0.7249 before and after correcting for autocorrelation, respectively. We do not reject H 0 in both cases. Correcting for autocorrelation has led to a large change in the p-value, but the test decision is still the same. 12.11 The model with the restriction β 4 = 1 imposed is ln( POWt ) = β1 + β2 t + β3 t 2 + ln( PROt ) + et Or it can be written as POWt ln PROt 2 = β1 + β2 t + β3 t + et The estimated equation with the restriction β 4 = 1 imposed is ∧ POW t ln PROt = −0.4728 + 0.0082 t − 0.000036 t 2 (0.0271) (0.0011) (0.000010) (SHAZAM) ∧ POWt ln PROt = −0.4339 + 0.0069 t − 0.000026 t 2 (0.0403) (0.0015) (0.000012) (EViews) ∧ POWt ln PROt = −0.4724 + 0.0082 t − 0.000036 t 2 (0.0263) (0.0011) (0.000009) (SAS) We can use the exponential of the within sample prediction from this equation to plot the trend for ( POWt PROt ) as in the graph below. It appears that the trend is increasing at a decreasing rate over time. 1.1 POW_PRO 1.0 0.9 0.8 0.7 0.6 20 40 60 T 80 100 13 Chapter 12 Solutions to Exercises 12.12 (a) The model where β1 = α1 + δ1Dt and β 4 = α4 + δ4 Dt can be written as ln( POWt ) = α1 + δ1Dt + β2 t + β3 t 2 + α4 ln( PROt ) + δ4 Dt ln( PROt ) + et The dummy variable Dt is introduced to capture the structural change in power use (if any) after the year 1985. The LS estimation result is ^ ln( POWt ) = 0.3287 + 0.1995Dt + 0.0091t − 0.000041t 2 + 0.8257ln( PROt ) (0.6524) (1.0510) (0.0007) (0.000005) (0.1423) −0.051Dt ln( PROt ) (0.224) Both of the dummy variable parameters estimates δˆ 1 and δˆ 4 are not significantly different from zero. To test for autocorrelation we obtain the Durbin-Watson statistic as 0.4283 with a very small p-value of 0.0000, suggesting the presence of autocorrelation. After allowing for autocorrelation the GLS estimated equation is ^ ln( POWt ) = −0.5576 + 1.0625Dt + 0.0083 t − 0.000037 t 2 + 1.0182ln( PROt ) (0.5761) (1.1130) (0.0012) (0.000009) (0.1253) −0.2293Dt ln( PROt ) (SHAZAM) (0.2364) ^ ln( POWt ) = −0.5727 + 1.2259 Dt + 0.0069 t − 0.000027 t 2 + 1.0302ln( PROt ) (0.5901) (1.1333) (0.0017) (0.000012) (0.1279) −0.2626 Dt ln( PROt ) (EViews) (0.2408) ^ ln( POWt ) = −0.5532 + 1.0549 Dt + 0.0083 t − 0.000037 t 2 + 1.01732ln( PROt ) (0.5793) (1.1164) (0.0012) (0.000009) (0.1260) −0.2278Dt ln( PROt ) (SAS) (0.2373) The estimates for δ1 and δ 4 change substantially after allowing for autocorrelation. The others have changed slightly. (b) For testing H 0 : δ1 = δ4 = 0 the test outcomes appear in the table below. χ2 Test F Test χ2 Value p-value F value p-value LS 6.0901 0.0476 3.0450 0.0518 GLS (EViews) 1.4013 0.4963 0.7007 0.4986 GLS (SAS) 1.3524 0.5086 0.7760 0.4629 GLS (Shazam) 1.5539 0.4598 0.7769 0.4624 14 Chapter 12 Solutions to Exercises Allowing for autocorrelation changes the test values considerably. Before correcting for autocorrelation, the null hypothesis is bordering on rejection at a 5% significance level. After correcting for autocorrelation there is no support for the null hypothesis. (c) If H 0 : δ1 = δ4 = 0 is rejected, we can conclude there is a structural change in the pattern of power use from the year 1985.