Reward Policy - Surrey County Council

advertisement

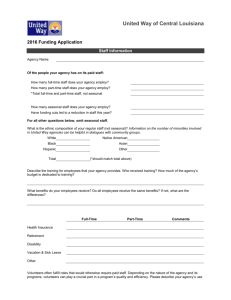

REWARD POLICY 2015 / 2016 Reward Policy 2015 - 2016 Last Updated 10/3/2015 REWARD POLICY 2015 / 2016 1. INTRODUCTION 2. DEFINITION & APPLICATION OF TERMS 3. KEY FACTS 3.1 3.2 3.3 3.4 3.5 3.6 3.7 3.8 Governance Reward Strategy Surrey Pay Grading Structure Determination of Individual Salaries Pay Progression (Pay Restraint) Annual Earnings and Sick Pay Additional Contractual Hours Payment Procedures 4. REWARD STRATEGY 4.1 4.2 4.3 4.4 4.5 Overview Grading Structure Policy Objectives Legal Obligations Negotiating Arrangements 5. GRADING STRUCTURE & SALARIES 2015 / 2016 5.1 5.2 5.3 5.4 Surrey Pay main grades Senior managers pay zones Legacy pay grades Other pay grades 6. DETERMINATION OF INDIVIDUAL SALARIES 6.1 6.2 6.3 6.4 6.5 6.6 Principles Starting salaries / Market supplements Salaries on Promotion / Re-grading Salaries on Transfer Pay Protection Acting Up Payments 7. PREMIUM PAYMENTS 7.1 7.2 7.3 7.4 7.5 Additional Hours (Overtime) Enhanced rates of pay (additional / unsocial hours) Shift allowances and payments Additional allowances (2015 / 2016 rates) Market-related pay scale adjustments / supplements 8. BUSINESS MILEAGE RE-IMBURSEMENT ARRANGEMENTS 9. RECOGNITION AWARD SCHEME 10. PAY PROGRESSION 10.1 Policy and Employment Contracts 10.2 Pay Restraint 2010–2016 10.3 Pay Progression Framework / Performance Management 11. PAY PROCEDURES 11.1 11.2 11.3 11.4 Payment Arrangements Calculation of Rates of Pay Payments on Joining and Leaving Deductions from Pay Last Updated 10/3/2015 REWARD POLICY 2015 / 2016 1 INTRODUCTION This policy sets out Surrey County Council’s reward strategy. The focus is on the arrangements for those on Surrey Pay, which applies to the majority of the council’s employees, but excludes Teachers and Fire Fighters. An Equality Impact Assessment has been carried out. The assessment found no evidence of an adverse effect on any equalities group caused by this policy. If you would like to print the whole Reward Policy this pdf document is located in the Localism and Transparency page on our external site. 2 DEFINITION & APPLICATION OF TERMS Use of the word ‘must’ refers to a statutory duty flowing from legislation. There is therefore no scope for considering an alternative course of action for any matter in this policy where the term ‘must’ is used. Use of the word ‘should’ indicates ‘best practice’ and a manager choosing to do adopt a different approach must expect to have to justify and support it e.g. with a robust business case, bearing in mind the requirement to comply with legislation such as the Equal Pay Act, 1970. 3 3.1 KEY FACTS Governance All decisions on pay and terms and conditions are made by the People, Performance and Development Committee (PPDC) which acts as the council’s Remuneration Committee under delegated powers, in accordance with the constitution of the County Council. Managers are accountable for ensuring that employees are remunerated fairly, reasonably and equitably, having regard to the council’s pay and equalities philosophies and policies, and to employment legislation and case law concerning equal pay. This includes ensuring that contracts do not involve or provide any tax avoidance arrangements, bearing in mind the guidance published on achieving Openness and Accountability in Local Pay, as required to comply with the Localism Act, 2011. 3.2 Reward Strategy The council’s total reward strategy is based on the local negotiation of Surrey Pay terms and conditions of service, and applies to the majority of the council’s employees, except Teachers and Fire Fighters. Surrey Pay rates and terms and conditions are reviewed annually, with any changes agreed by the PPDC normally implemented with effect from 1 April. All employees must be remunerated in accordance with the Surrey Pay and grading structures and grading arrangements. Last Updated 10/3/2015 REWARD POLICY 2015 / 2016 3.3 Surrey Pay Grading Structure The allocation of grades to jobs is by (HAY) job evaluation, or in accordance with a career guide scheme having a relationship to (HAY) job evaluation. 3.4 Determination of Individual Salaries Normally new starters should be appointed to the bottom of the pay scale or pay zone for the job. However, managers may make a business case, to be approved by a Head of Service, to appoint to a higher salary within the pay scale or zone for the post, having due regard to any relevant factors such as knowledge, skills and previous experience, and recognising for new appointees any need to attract the individual to Surrey. Market Related pay scale adjustments, or individual market supplements, may be approved by the PPDC (or by the Head of HR & OD under delegated powers) where these are regarded as essential to maintain adequate levels of jobs and services. Such supplements will be subject to regular / periodic review. On promotion, employees should be placed on a salary within the new grade or zone, which is at least 2.5% higher than their previous salary position. Employees who voluntarily apply for a transfer to a post that carries an equivalent grade to their existing post should normally be appointed at (or below) their current salary. On redeployment to a lower graded post, when otherwise redundant, in order to minimise the extent of any loss of earnings, the individual will normally be appointed to the maximum of the substantive scale for the redeployed post. If the salary of the redundant post exceeds that of the alternative job offered by not more than one grade (or 10% where no clear grade comparison can be made), the council will make an additional payment to preserve the earnings of the employee immediately prior to redeployment for 1 year, in accordance with the council’s pay protection policy. Employees who voluntarily apply for a transfer to a lower graded post, in order to minimise the extent of any loss of earnings, the Head of Service will have discretion to appoint above the grade minimum having due regard to any relevant factors such as knowledge, skills and previous experience. Managers have the responsibility to ensure that any additional Surrey Pay allowances or other premium payments are paid appropriately. 3.5 Pay Progression (Pay Restraint) At present the majority of staff are on “incremental” Surrey Pay contracts. These normally provide for an annual review, until they reach the top of the grade. Middle Pay Grade and Senior Pay Zone (S13 – CEX) contracts provide for an annual review of contribution. These reviews normally determine any subsequent personal progression through these pay zones subject to personal headroom being available. Note: The “normal” arrangements for determining pay progression, summarised in section 10 below, were suspended following a decision taken by the PPDC on 30 March 2010. The period of suspension was extended for a further two years, with effect from 1 April 2014, following a decision by PPDC on 24 February 2014 Last Updated 10/3/2015 REWARD POLICY 2015 / 2016 The intention is that this element of the council’s pay restraint strategy will be reviewed for the 2016/2017 financial year. 3.6 Annual Earnings and Sick Pay Annual earnings include any supplements directly paid for duties undertaken including any additional contractual hours worked. The calculation of sick pay should be based on full annual earnings. Note: This does not include any enhancements received for any non-contractual work undertaken at weekends or on shifts. 3.7 Additional Contractual Hours The calculation of a week’s pay is made up of the normal working hours fixed by contract. If additional contractual hours are agreed the number of normal working hours would be varies to include any compulsory additional contractual hours in excess of the hours set out in the original contract. Payment for additional contractual hours would then be included in any calculations required e.g. to determine holiday or sick pay. However the additional contractual hours are only included for pensionable pay when the contract states explicitly that they should be. 3.8 Payment Procedures Annual salaries are paid monthly in arrears by bank credit transfer. Responsibility lies with the employing Service to inform the Shared Service Centre of the date an employee commences or ceases employment to ensure correct payment. Any deductions from pay will only be lawful if required or authorised by virtue of statute, if it is provided for in the contract of employment, or written consent or agreement to the deduction(s) has been given. Please see section 11.4 below. 4 4.1 REWARD STRATEGY Overview 4.1.1 The aim of the council is to provide an affordable but competitive Total Reward package to attract, motivate and suitably reward the staff it needs to deliver its services. To that end the package covers not only pay and benefits but also provides access to flexible ways of working, learning and development and to the Local Government Pension Scheme (LGPS). 4.1.2 In order to maintain a competitive edge, the council plans for and manages the way employees are rewarded, having regard to cost and effectiveness, in addition to the aims expressed in the HR strategy, rather than just responding to pressures as they arise. 4.1.3 The council's remuneration strategy, “single status” Surrey Pay, is based on the local negotiation of pay and conditions. It applies to the majority of the council's employees and, through discussion with relevant local Surrey trade unions, has been developed to cover most county staff except teachers and fire-fighters. In addition to the Surrey Pay structure, the council operates a small number of different pay structures linked to national agreements, for example for Soulbury employees and Youth and Community Workers. Last Updated 10/3/2015 REWARD POLICY 2015 / 2016 4.1.4 In accordance with the Surrey Pay and single status agreement, pay, terms and conditions of the Surrey Pay grades are reviewed annually, normally with effect from 1 April. The council expects its remuneration practice broadly to take account of any nationally negotiated local government provisions, but also to have regard to other relevant indicators as well as to the particular circumstances of Surrey, including the reflection of employment market factors where justified, in the context of fairness and equity. 4.1.5 Managers are accountable for ensuring that employees are remunerated fairly, reasonably and equitably, having regard to the council’s pay and equalities philosophies and policies. All employees must be remunerated in accordance with the pay and grading structures and grading arrangements. 4.1.6 To maximise the value of the total reward package and to reflect the diversity of individual needs, the reward strategy includes the progressive development of a Staff Benefits Scheme (link My Benefits Scheme) 4.2 Grading Structure An equitable basis for paying employees forms a major part of the council’s total reward strategy. As a result the council's grade structure links its general pay policy to the salary scales determined for jobs or groups of jobs. The allocation of grades to jobs is by (HAY) job evaluation or in accordance with a career guide scheme having a relationship to (HAY) job evaluation. Please see section 5 below for details of grading and salary structure for 2015 / 2016. 4.3 Policy Objectives The council’s pay philosophy and objectives aims are:To be fair, open and readily understandable; To be sufficiently flexible to enable the council to recruit and retain sufficient staff of the required calibre to achieve its business aims; To enable effective pay-bill management reflecting affordability and the need for efficient administration of the council's policies and procedures relating to pay and conditions; To give employees and managers confidence in its operation; To recognise and reward individual personal development which adds value and leads to improved service; To have a fair, open and non-discriminatory basis for assessing the relative responsibility level of jobs and the allocation of jobs to grades; To maintain a clear and simple relationship between pay, performance management, appraisal and development. Last Updated 10/3/2015 REWARD POLICY 2015 / 2016 4.4 Legal Obligations In making decisions relating to the pay and grading of employees, managers must ensure that such decisions are made on an equitable and consistent basis, taking account of employment legislation and case law concerning:Equal Pay Act, 1970. Council’s Equal Pay Statement (link) National Minimum Wage Act, 1998. Council’s Contracts of Employment Localism Act, 2011. 4.4.1 Equal Pay for Work of Equal Value The concept of equal pay is primarily set out in two pieces of legislation:Article 141 (formally Article 119) of the Treaty of Rome (European Community Law) The Equal Pay Act 1970 (as amended) (UK Law) The Equal Pay Act 1970 provides that a woman may claim equal treatment in respect of pay and conditions with a man and vice versa where:They are employed on "like work" (situations where the woman's work is the same or broadly similar as that of a man), or They are employed on "work rated as equivalent" under a job evaluation scheme, or They are employed on work which, in terms of the demands made upon them (under headings such as effort, skill and decision-making), is of "equal value". The council is regarded as a single employer for the purposes of employment protection legislation. As part of its commitment to equal opportunities, the council’s Statement of Equal Opportunity also places an obligation on managers to ensure that terms of employment, benefits, facilities and services are afforded equally to all employees in the same or similar circumstances. It is, therefore, essential that the arrangements in place for the determination of pay are neither directly nor indirectly discriminatory. In addition, these arrangements must be objectively applied in such a way that discriminatory motives cannot be implied or inferred. 4.4.2 Circumstances where differences in pay are justified Equal pay legislation recognises two circumstances in which differences in pay may be justified: Where there are genuine material differences between the employees concerned, other than sex, such that the difference in pay can be justified. Where a genuine material factor exists which has resulted in different rates of pay for the employee's job and the comparator's job. Differences justified as a result of market factors will be reflected in different pay arrangements for the different market groups concerned and are not a matter for local discretion by managers. Equal pay legislation is a complex area and is becoming more so with the development of European law. Last Updated 10/3/2015 REWARD POLICY 2015 / 2016 4.4.3 Low Pay The council monitors and reviews its pay and grading structure on an annual basis to ensure that the rates it pays are at or above the rates needed to comply with the requirements of the National Minimum Wage Act, 1998. In 2008 the council agreed to the concept of a “minimum Surrey Pay Wage”. From 1 April 2015 the minimum hourly rate for staff on Surrey Pay will be £8.01 per hour; this will be £1.51p per hour higher than the National Minimum Wage and 16p higher than the current UK Living Wage, as promoted for employees working outside London by the Living Wage Foundation. 4.5 Negotiating Arrangements The council recognises two unions, the GMB and UNISON, for the purposes of negotiating locally determined single status Surrey Pay. 4.5.1 Process for Negotiating Pay and Conditions Locally The negotiating team comprises nominated staff from the county council human resources team led by the Deputy Head of HR & OD / Pay and Reward Team and nominated representatives from the Surrey County branches of the GMB and UNISON. The negotiating team consults and clears a negotiating strategy with the relevant council bodies and the branch committees respectively, seeking to reach agreement on proposals for annual review/changes to pay, terms and conditions. A wider group of the negotiating team and branch committees will normally meet at the commencement of the negotiating process to exchange views and set the framework for negotiations, and subsequently to discuss progress made by the negotiating team. Members acting in a consultative capacity are comprised of a small group drawn from the member board. Following consultation/discussion as appropriate with the relevant council bodies and branch committees, and agreement in principle on proposals, both sides consult more widely with their stakeholders (trade union membership and managers). All decisions on pay and terms and conditions are made by Elected Members on the People, Performance and Development Committee (PPDC). In the event of a failure to agree, the negotiating team will consult the relevant council bodies and the branch executive committees to decide on the involvement of the Advisory, Conciliation & Arbitration Service (ACAS). ACAS (or other independent mediator or conciliator if specifically agreed) will work with the negotiating team on resolving differences. 4.5.2 Framework for Negotiations In principle, this negotiating machinery will focus on the determination of Surrey Pay and terms and conditions of employment. Issues around the application of other policies and procedures will be discussed by other consultative forums. Last Updated 10/3/2015 REWARD POLICY 2015 / 2016 People, Performance and Development Committee (PPDC) Decisions Consultative County Council Management Team Resulting in: Decisions on ACAS involvement OFFICER GMB S UNISON 1. Annual review 2.Changes to pay, terms and conditions Branch Executive Committee Membership 5. GRADING STRUCTURE & SALARIES 2015 / 2016 The grade structure and rates of pay for 2015 / 2016, as agreed by PPDC on the 2 March 2015 and ratified by Full Council on 17 March 2015, are shown below. 5.1 Surrey Pay Main Grades 2015 / 2016 Job Evaluation Scores 0 119 120 142 143 165 166 194 195 231 232 313 314 437 438 477 478 518 519 611 612 660 Last Updated 10/3/2015 Grades S1/2 S3 S4 S5 S6 S7 S8 S9 S10 S11 S12 £’s Salary Ranges Minimum Maximum 15,039 15,699 15,156 17,145 16,407 19,194 18,228 21,261 20,424 23,435 23,340 27,539 26,798 31,856 33,569 38,312 38,015 42,992 42,503 47,615 47,273 55,298 REWARD POLICY 2015 / 2016 Senior Managers’ & Directors’ Grades and Pay Ranges 2015 / 2016 5.2 Job Evaluation Scores 661 734 735 880 881 1055 1056 1260 1261 1312 1358 1450 1451 1688 1689 2000 2001 2328 5.3 Grades S13 14 A 14 B & 15 B 15 C 15 D 16 E 16 F 16 G CEX £’s Salary Ranges Minimum Maximum 55,485 66,644 61,592 77,297 76,383 90,469 87,991 104,267 101,721 120,578 116,734 141,151 127,718 152,243 149,686 178,861 209,984 232,683 Other Pay Grades: 2015 / 2016 5.3.1 Social Worker Pay Grades Level ASYE Social Worker Social Worker Senior Social Worker Assistant Team Manager or Consultant Senior Practitioner Team Manager Salary £27,550 PCF Equivalent ASYE Social Worker £28,550 £31,050 £33,550 £36,050 £36,051 £38,425 £40,775 £43,150 £43,151 £44,550 £45,950 £47,282 £47,273 £49,950 £52,625 £55,298 Social Worker Experienced Social Worker Social Work Manager or Advanced Social Work Practitioner Strategic Social Work Manager In order to progress through the levels in the career framework, social workers will be expected to evidence the skills and behaviours that are detailed in the national Professional Capabilities Framework at the relevant level and across all nine dimensions. 6 6.1 DETERMINATION OF INDIVIDUAL SALARIES Principles There are a number of principles, which must be followed when determining the salary of an individual in any employee group. These are outlined below. Last Updated 10/3/2015 REWARD POLICY 2015 / 2016 6.1.1 Managers must ensure that: where a grade applies, starting salaries are fair and reasonable; on promotion or re-grading employees are placed on a salary within the new grade which is at least 2.5% higher than their previous salary position; on transfer, all relevant circumstances are taken into account when setting salary; the salary protection provisions of the council’s Change Management Policy are applied as appropriate; additional allowances are paid as appropriate; additional hours, shift, standby and other premium payment rates in respect of particular working arrangements are applied correctly; provisions applicable to specific groups of employees are applied appropriately. 6.2 Starting Salaries / Market Supplements 6.2.1 Normally new starters should be appointed to the bottom of the pay scale or pay zone for the job. 6.2.2 Managers may make a business case, to be approved by a Head of Service, to appoint to a higher salary within the grade or pay zone for the post, having due regard to any relevant factors such as knowledge, skills and previous experience, and also recognising for new appointees any need to attract the individual to work in Surrey. For reasons of equity, Managers will also have to weigh up carefully and sensitively the need to make appropriate appointments with regard to fairness in relation to any existing staff doing similar work. In setting starting salaries, managers must also consider the total remuneration package and ensure that the council’s allowances and benefits are applied appropriately. 6.2.3 In exceptional situations an additional reviewable Market Supplement may be appropriate to fill a vacancy. However this requires the approval of a specific business case by the People, Performance and Development Committee or by the Director of People & Development under delegated powers. Please see section 7.5 below for more detailed guidance. 6.3 Salaries on Promotion / Re-grading 6.3.1 A promotion is defined as appointment to a post with a higher, i.e. absolute maximum, salary. On promotion, employees must be placed on a salary within the new grade, which is at least 2.5% higher than their previous salary position. Often this will be the minimum point of the new grade. 6.3.2 Where an increase of 2.5% is not achieved through placement on the salary selected for the new job offer, the balance must be paid as a separate, pensionable allowance until progression within the higher grade occurs; at this point the allowance will cease. This provision does not prevent an appointing officer placing the individual on a salary, which provides for more than a 2.5% pay increase where this is warranted. 6.3.3 Where employees are in receipt of an allowance, which ceases on appointment to the promoted post, they should normally be appointed to a salary, which by Last Updated 10/3/2015 REWARD POLICY 2015 / 2016 consolidation of the allowance, provides the appropriate 2.5% increase, as detailed in the paragraph above. 6.3.4 When a post is moved to a pay scale, which has a higher scale maximum, salaries are adjusted in the same way as promotion. 6.3.5 Where a post is moved to a pay scale which has a lower scale maximum, individuals in post will continue to receive payment at the level paid in the former grade, including any pensionable salary increases, on a personal “cash marked time” protected basis in line with the council’s pay protection policy (i.e. for 1 year, with no further progression within grade). 6.3.6 Progression within a career guide from one range to another, which carries a higher maximum salary, or from one grade to another within a range is deemed to be a promotion. 6.3.7 For non-Surrey Pay employees promoted to Surrey Pay grades, the equivalent “annual earnings” previously received (see 3.6 above) should be compared with the Surrey Pay grades. The salary payable should normally be equivalent to their previous annual earnings. Note: For this purpose annual earnings includes any supplements directly paid for duties undertaken including any additional contractual hours worked. Enhancements for weekend and shift working should only be taken into account if the new job involves the same working pattern as the old job and only to the extent that similar enhancements are not payable under the new conditions of service. 6.4 Salaries on Transfer 6.4.1 Employees who voluntarily apply for a transfer to a post which carries the same grade as their existing post should normally be appointed at (or below) their current salary, having regard to relevant factors including their current skills and experience. 6.4.2 In cases of transfer which is employer led, where the employee has no or only limited individual choice, (e.g. alternative employment; staffing changes arising from reorganisation; transfer following disciplinary proceedings), employees should normally be appointed at their current salary. Entitlement to any existing progression arrangements will remain. 6.4.3 An employee who unreasonably refuses the offer to transfer to another post, where the salary matches or closely matches that of his/her former substantive post, will immediately loose any “POEA” see 6.5 below, they may have at the time. 6.4.4 Employees who voluntarily apply for a transfer to a lower graded post, in order to minimise the extent of any loss of earnings, the Head of Service will have discretion to appoint above the grade minimum having due regard to any relevant factors such as knowledge, skills and previous experience. Entitlement to any existing progression arrangement will cease. 6.5 Pay Protection 6.5.1 The Council endeavours to minimise any financial loss that an employee may incur as a result of having been re-deployed to a lower graded post as a result of a restructure. Managers should therefore make reasonable efforts to assist an Last Updated 10/3/2015 REWARD POLICY 2015 / 2016 employee(s) in securing a post at their previous grade and to end any period of pay protection as soon as possible. 6.5.2 In order to minimise the extent of any loss of earnings, on redeployment to a lower graded post, when otherwise redundant, an individual will normally be appointed to the maximum of the substantive scale for the redeployment post. In some circumstances, because of the overlap between some of the pay scales, the effect of this may be that some employees may receive a slight increase in salary. This can be regarded as some compensation for the loss of progression opportunities within the new substantive grade. 6.5.3 If the new post is graded up to one grade below the redundant post, the annual pay protection payment will be the difference between the employee’s contractual salary in the redundant post and the new post. Where no clear grade comparison can be made, one grade should be taken as a 10% difference in salary. Pay protection payment will be re-calculated to take account of any increase in the employee’s pay in the new post during the period of protection e.g. as a result of an annual pay awards. This means that the actual pay protection payment will reduce in line with any such increases in the employee’s level of remuneration during the period of protection. 6.5.4 Pay protection will continue for a period of one year or until the pay for the new post becomes higher than that of the redundant post, whichever is earlier. At the end of the one-year period, the individual will be paid the substantive salary (normally the maximum of the pay scale) of the new post and any pay protection allowance will cease. 6.5.5 Additional payments made previously to a member of staff, while working in the redundant post, such as payments for working additional/unsocial hours; allowances for acting up; or a contractual car users’ lump sum linked to the previous job, will not be included when the amount to be protected is calculated. 6.5.6 The individual’s salary preserved on redeployment will be that which applied at the date from which the previous post ceased. Employees will not be protected for loss of hours. Where this is accompanied by a lowering in grade, it is the rate of pay of the original post that will be protected. A difference in hours up to 10% of the original hours will be considered to be suitable alternative employment. 6.5.7 If an individual accepts an alternative offer of a post at a lower substantive grade, where the basic salary is more than one grade below their previous post, the protection provision described above may be applied, but at no more than the equivalent of one grade (measured from scale maximum to scale maximum). Again, where no clear grade comparison can be made, one grade should be taken as a 10% difference in salary. 6.5.8 Salary protection may also be considered in cases where an employee is to be re-deployed on health grounds and advice should be sought from the Shared Service Centre on individual cases. Last Updated 10/3/2015 REWARD POLICY 2015 / 2016 6.5.9 Example of Protection of Earnings (POEA) Calculation Redeployment from a job within grade S8 to job at S7 (salary rates quoted are for 2015/16). Old Job S8 £28,500 New Job S7 – salary band maximum Protection of Earnings Allowance (POEA) £28,500 - £27,539 Protected Salary paid for a 1 year period £27,539 £961 £28,500 Notes: (i) POEA may be paid over 4 years if terms for harmonisation onto Surrey Pay were agreed before 1 April 2012. (ii) POEA will normally be reduced to take account of any increase in an employee’s base salary in the new post during the period of protection e.g. a resulting from an annual Surrey Pay Award. (The only exception would be for “harmonisation cases” agreed before April 2012). An adjustment to the POEA would also be made in the event of an employee accepting another post with a higher level of pay during the period of pay protection. 6.6 Acting-Up Payments Acting Up (Honoraria payments) should not be used as an alternative means of making one off “bonus payments” as they adjust salaries on a temporary basis for undertaking additional duties for a limited period. However please see Recognition Award Scheme section 9 below. The definitions of full and partial duties are set out below. Full Duties ( Acting Up ) Employees undertaking, on a temporary basis, the full duties and responsibilities of a higher graded post for a continuous period over four weeks / up to six months, should receive payment in accordance with the grade of the post temporarily occupied as if they had been promoted into the post. Partial Duties ( Honorarium ) Senior managers have the facility to grant a partial acting up (honorarium) payment to an individual who, on a temporary basis performs some duties and responsibilities of a higher graded post for up to six months, or the full duties and responsibilities of a higher graded post for less than four weeks. The amount of the partial acting up (honorarium) payment should be assessed upon the specific circumstances of each case, having regard to the nature of the duties and responsibilities being undertaken and the potential cost to the council of undertaking the additional duties in an alternative way. Last Updated 10/3/2015 REWARD POLICY 2015 / 2016 Note: This facility is not intended to apply to permanent changes which affect the level of duties and responsibilities of a job. In these circumstances the grade of a job must be re-assessed by the appropriate method, e.g. job evaluation or review under the relevant career guide. 7 PREMIUM PAYMENTS This section explains when premium payments should be made to employees in addition to the basic hourly rates determined by the annual salary for their job. Further information on how working hours may/should be defined/determined for individual members of staff are set out in the Flexible Working Policy. 7.1 Additional Hours (Overtime) The Council’s policy is actively to avoid the need for employees to be required to work hours in excess of their normal contractual hours (overtime). In most cases, when additional hours are worked, time off in lieu (TOIL) must be considered first. For example whenever possible any employee, who is required to remain on duty in a residential home beyond the hours “rostered”, should be given equivalent TOIL over the ensuing seven days. Where insisting upon TOIL is impracticable managers may authorise payment for additional hours but they should satisfy themselves that the additional expenditure represents the most cost effective solution. Managers are accountable for controlling staffing costs. This includes controlling expenditure on additional hours against budget and so approval for such work to be undertaken should normally be authorised in advance. 7.2 Enhanced Rates of Pay (Additional / Un-social Hours) Enhanced rates of pay are increases in the effective hourly rate of pay when work is done on certain days, and/or a certain times of day, regardless of whether the hours worked are part of, or in excess of contractual hours. Last Updated 10/3/2015 REWARD POLICY 2015 / 2016 Summary Guidance On Enhanced Hours Payments TOIL Time Off In Lieu TOIL should be the first option used when additional hours are worked, see Flexible Working and Hours Policy. Enhancements should only be paid if TOIL is genuinely impractical for business reasons. Note : The enhanced rates, set out below, should only be paid for pre-planned and pre-authorised additional hours. Plain Time To be used on all occasions when payments are made to staff at S8 (formerly SP8 or Surrey E) and above. To be used for staff up to and including S7 (formerly SP7 or Surrey D) unless specific enhanced rates as set out below apply. Time + 0.2 “unsocial hours” Not payable to staff at S8 (formerly SP8 or Surrey E) and above. Time + 0.33 “night hours” Not payable to staff at S8 (formerly SP8 or Surrey E) and above. For staff up to and including S7 (formerly SP7 or Surrey D) for hours worked between 20.00 and 22.00. For staff up to and including S7 (formerly SP 7 or Surrey D) for hours worked between 20.00 and 06.00. Time + 0.5 Weekends Not payable to staff at S8 (formerly SP8 or Surrey E) and above. For staff working on Saturdays or Sundays up to and including S7 (formerly SP7 or Surrey D). Double Time Public Holidays Not payable to staff at S8 (formerly SP8 or Surrey E) and above. For staff working on Public Holidays up to and including S7 (formerly SP7 or Surrey D) Notes: (i) Time of less than ½ hour must not be counted as additional time worked. (ii) However, all payments are subject to Income Tax and National Insurance. Last Updated 10/3/2015 REWARD POLICY 2015 / 2016 7.3 Shift Allowances Where there is an operational requirement for an employee to work shifts on a regular basis and the basic rate of pay for the job does not reflect this requirement the employee shall be paid a shift allowance. 7.3.1 Alternating Shifts (a) An alternating shift allowance will be payable where; (i) the total period covered by the shifts is 11 hours or more; and where; (ii) there are at least 4 hours between the starting time of the earliest and the latest shifts; and (iii) the number of “normal office hour” shifts does not exceed one half of the total number of shifts in the rota. (b) Subject to the conditions above the alternating shift allowance of £1,241.51 per annum is payable on a pro rata basis where the two shifts on a rota, not including a night shift, are worked over 4, 5, or 6 days a week; Notes: (i) Shift allowances will be payable, where appropriate, in addition to the enhanced rate of pay for work on a Saturday or Sunday as part of the normal working week. (ii) Time worked beyond the normal shift will be regarded as additional hours and will be paid at the rate appropriate according to the day or time. 7.4 Additional Allowances 7.4.1 First Aid An allowance is payable to qualified First-Aiders; which is to be pro-rated for part-timers. For current rate please see table at 7.4.3 below. 7.4.2 Science Technicians - Qualifications Allowances Science Technicians possessing the City and Guilds Science Laboratory Technician's Certificate receive an allowance in addition to salary. Science Technicians possessing the City and Guilds Laboratory Technician's Advanced Certificate, receive a further allowance. Alternative qualifications are recognised by the council with the basic standard being the City and Guilds Science/Laboratory Technician's Certificate. (e.g. appropriate alternatives in the case of workshop employees would be the City and Guilds Machine Shop Engineering or Electrical Technician's Certificates). For current rates please see table at 7.4.3 below. Last Updated 10/3/2015 REWARD POLICY 2015 / 2016 7.4.3 Surrey Pay Allowances / Payments: Rates effective from 1 April 2015 Type of Allowance £’s Lab technicians qualification allowance: C&G C&G advanced 196.78 per annum 155.58 per annum Residential establishments*: Sleeping-in-duty Weekend working On-call disturbance 33.90 per night 733.57 per annum 254.48 per annum Relocation assistant B&B 39.51 per night Notional subsistence deduction 2.52 per meal First Aid allowance* 171.03 per annum Alternating Shift* 1,241.51 per annum Training allowances, Book allowances: BTEC first level BTEC national certificate BTEC high certificate and all stages Professional qualification 52.14 per annum 81.14 per annum 102.08 per annum Lodging allowance (two homes) Trainee allowance (sandwich course) 52.64 per week 20.44 per week Residential training course Out-of-pocket 4.65 per night 18.58 per week Notes:(i) Allowances marked with a star (*) are normally increased by the Council’s internal inflation, which for 2015/2016 will be 1%. (ii) All the other allowances are normally increased in line with any “across the board” annual pay award. (iii) With the exception of the Weekend Working Allowance all allowances are payable to part-timers on a pro-rata basis. 7.5 Market Related Pay Scale Adjustments / Supplements Within the constraints of affordability, pay rates need to be set for each grade, which enable the council to recruit and retain sufficient staff of the required calibre to meet its objectives. 7.5.1 Criteria & Process There may be exceptional circumstances from time to time when for a certain job or jobs at certain locations, acceptable recruitment and/or retention levels cannot be maintained. Where investigation shows that this is due to the pay levels used and Last Updated 10/3/2015 REWARD POLICY 2015 / 2016 current market rates, some adjustment to the normal council pay scales may be necessary, even though it is undesirable, to maintain adequate staffing levels. The principle of market pay scale adjustment is accepted nationally and locally. For example, it features in national agreements through London and Fringe Area Allowances. The council expects to continue to use this facility, as it has done in the past, only where it is regarded as essential to maintain adequate levels of jobs and services. Any proposed use of this facility for groups of jobs will happen only after alternative, acceptable ways of recruiting and retaining staff have been fully explored and exhausted, and after full negotiation with the relevant trade union(s) and approval by the PPDC (or the Head of HR & OD under delegated powers). It is expected that use of these adjustments will be extremely rare. These safeguards apply both to staff currently receiving adjustments and in the future. Widespread use across a range of jobs and/or locations has not been the experience to date. If this were to happen it would highlight a general weakness in the council's pay policy and practice, and steps would need to be taken to strengthen the pay system itself. Any adjustment will only be approved after a full investigation of the circumstances and will seek to balance the needs of that service with the need for equity and reasonable consistency across the council. The council will not propose or operate adjustments, which are outside equal value legislation. It is not the council's intention to introduce a scheme, which is either inequitable or illegal. Any adjustments made will be made for clear, sound business reasons, fully negotiated with the relevant trade union(s), monitored jointly and reviewed regularly. Therefore, any adjustment recommended by a senior line manager must be centrally co-ordinated and approved subject to the following criteria:- clear definition of the job or group of jobs affected; - evidence of pay-related recruitment and retention difficulties compared to other groups of staff, or to staff generally who are unaffected by the proposal, using the appropriate range of indicators, including:- turnover rates; - stability ratios; - number of responses to job advertisements; - quality assessment of applicants and interviewees; - comparison of competing employers' remuneration packages; whether the proposed adjustment would be likely to distort the employment market, adversely affecting the county council in relation to other groups within and/or outside the target group; - - how the proposed adjustment will affect new and existing staff within the group including any appropriate protection arrangements; - clear process for conducting regular reviews of the need for the adjustment, and a strategy for its eventual withdrawal/elimination if the exceptional factors justifying the change are no longer relevant; - evidence of appropriate consultation with the union representatives of the staff involved and of other staff in that work area; Last Updated 10/3/2015 REWARD POLICY 2015 / 2016 7.5.2 Monitoring Monitoring of all market adjustments in operation will be regularly undertaken centrally within HR & OD, and will be reviewed in conjunction with independent line management and the relevant trade union(s). In addition to the regular review of individual applications of this procedure, it is also open to further detailed discussion and to joint review with the relevant trade union(s) from time to time. 8 BUSINESS MILEAGE RE-IMBURSEMENT ARRANGEMENTS The council reimburses staff for business mileages driven at rates that reflect the guidance and limits published by the HMRC, at which no taxable benefit will accrue to the individual. 8.1 Privately Owned Vehicles Staff who drive their own privately owned cars on Council business are reimbursed at HMRC Approved Rates, currently 45p per mile for the first 10,000 business miles driven per year ( 25p per mile above 10,000 miles ) without incurring a tax liability. HMRC Approved Rates : with effective from 1st October 2011 Pence Per Mile All engine sizes Car Motorcycle Bicycle Up to 10,000 miles per year 45p 24p 20p Over 10,000 miles per year 25p 8.2 Leased Cars HMRC treat Lease Cars, obtained through Salary Sacrifice Schemes, as Company Cars which is why staff participating in such schemes can make savings in respect of National Insurance and Tax. As a consequence under Surrey Pay the drivers of lease cars are entitled to be re-imbursed at “lower” HMRC Advisory Rates depending upon the type of engine / fuel used. If the Council was to reimburse Lease Car users at a “higher” Approved rate those drivers would incur an additional tax liability. Last Updated 10/3/2015 REWARD POLICY 2015 / 2016 HMRC Advisory Rates : with effect from 1st March 2015 Engine Size Petrol LPG 1400cc or less 11p 8p 1401cc to 2000cc 13p 10p Over 2000cc 20p 14p Engine Size Diesel 1600cc or less 9p 1601cc to 2000cc 11p Over 2000cc 14p Notes : (i) Hybrid engined cars are treated as either petrol or diesel engined cars. (ii) There is no mileage reimbursement rate for drivers using Electric Cars. This is because HMRC do not regard electricity as a fuel. (iii) The Advisory rates are reviewed by HMRC on a quarterly basis. 8.3 Passenger Rate In line with HMRC guidance an additional non taxable 5p per passenger, per business mile may also be claimed by drivers of either privately owned or lease cars; this is to encourage car sharing and “greener business” travel. To qualify passengers must be council employees travelling on council business. 8.4 Contractual Users : Annual Lump Sums 8.4.1 Privately Owned Cars The council also has a mechanism for paying taxable “annual lump sums” to staff who use their own privately owned cars to fulfil a contractual requirement to provide and maintain a car for business use, or to those who use a privately owned car to travel a significant number of miles a year on council business. The aim is to reimburse staff for insuring and using their car for business purposes, which is subject to additional “wear and tear”, not to pay an additional allowance. The Contractual User Lump Sums may be claimed retrospectively and are banded to reflect the number of miles driven, as follows:Business Miles Driven Per Year Gross Taxable Annual Lump Sums Up to 1,500 380 1,501 – 3,000 400 3,001 – 4,500 420 4,501 – 10,000 440 Last Updated 10/3/2015 £’s REWARD POLICY 2015 / 2016 10,001 and above 8.4.2 460 Leased “Company” Cars Annual Lump Sums are not payable to staff who lease a Company Car via the Council’s mycar Lease Car Scheme, which is HMRC compliant. The cost of leasing a car includes payment for breakdown and motor insurance for business purposes and maintenance of the vehicle. This creates a Benefit in Kind, which is taxable, however the arrangement can still be tax efficient as it enables staff to make net savings on the total amount they sacrifice each month. 8.5 Public Transport Further guidance on how to re-claim other travelling expenses may be accessed by staff via the council’s intranet, s-net site. 9 RECOGNITION AWARD SCHEME There are no provisions under Surrey Pay contracts for council employees to be awarded performance related bonuses. However the Recognition Award Scheme provides a mechanism through which managers can recognise exceptional achievement by an individual or team, subject to approval by Heads of Service. 9.1 Recognition Awards can be used to reward - 9.2 Recognition Awards should not be used for making - 9.3 excellent, exceptional achievement over a sustained or specified period, or throughout the year in which performance is being assessed. excellent, exceptional achievement for a particular task, project or service delivery. innovation that significantly enhances productivity or that notably contributes to organisational effectiveness or service delivery. additional payments for meeting targets as part of routine business. “bonus” payments to staff on top of their grade. Limits on awards The maximum award that may be paid to an individual in a single financial year under the scheme is normally is limited to 10% of salary, for staff on Surrey Pay grades, or equivalent, up to S12 (formerly SP 12 or Surrey I), or to a maximum of £1,500 for those on senior pay contracts, S13 and above. 9.4 Pay Restraint Measures 2011–2016 (i) Additional guidance has been issued to restrict the level of recognition awards to a maximum of £500 during 2011 – 2016, as part of the council’s pay restraint strategy. This guidance may be found on the council’s intranet, s-net site. (ii) Recognition awards must not be used for making payments to staff on senior pay Last Updated 10/3/2015 REWARD POLICY 2015 / 2016 who are not currently eligible for a pay progression. 10 PAY PROGRESSION 10.1 Policy and Employment Contracts As noted, under section 3.5 above, staff on Surrey Pay may be on either “incremental” or “contribution” based pay progression contracts. At present the majority of staff are on “incremental” Surrey Pay contracts which would normally result in progression once a year until staff reach the top of the grade. Middle Pay Grades and Senior Pay Zones (S8 – CEX) contracts provide for an annual review of contribution. These reviews normally determine any subsequent personal progression through these pay zones subject to personal headroom being available. 10.2 Pay Restraint 2010 – 2016 The “normal” arrangements for determining pay progression were suspended following a decision taken by the PPDC on 30 March 2010. The initial suspension was extended further, with effect from 1 April 2014, following a decision taken by PPDC on 24 February 2014. It is intended that new arrangements will be developed for determining pay progression for all Surrey Pay grades with effect from 1 April 2016. However the following extracts, from the 2012 / 2013 Reward Policy, are reproduced for reference and for guidance as they continue to determine eligibility for receiving progression awards, salaries following promotion and payment of awards under the Recognition Award Scheme. 10.3 Pay Progression Framework / Performance Management 10.3.1 Lower Pay Grades S1/2 (formerly SP1/2 – SP7 or SY1 to Surrey I) The maximum salary paid at the top of the incremental grades recognises the highest level of competence in relation to the job requirements. A lower salary within the grade allows for growth and learning in the job to reach the level of full competence. 10.3.2 Eligibility For Progression Where progress is demonstrably below agreed expectations and objectives have not been met due to unsatisfactory performance, an increase will not be warranted. Where managers propose not to award an increase within the grade, specific steps, as set out below, must be followed. This will ensure that there is clear, open and early discussion with the person concerned. The manager must ensure that the following actions have been taken:(a) That the shortcomings have been brought to the attention of the individual. (b) That they have been informed of the level and quality standards of performance required of them. (c) That they have been given the opportunity for any reasonable training or level of support that may be required. (d) That they have been given the opportunity to improve. Last Updated 10/3/2015 REWARD POLICY 2015 / 2016 Note:(i) (ii) This action must be confirmed in writing to the individual concerned and managers must ensure that supporting evidence is available to justify all decisions. A decision to withhold an award does not require action to have been taken under the council's Capability or Disciplinary procedures. Managers should make it clear to the member of staff that the opportunity to use grievance procedure is available. The action outlined above should give the person considering any grievance a clear basis for judging whether the manager has acted reasonably throughout the period covered by the review. 10.3.3 Middle Pay Grades S8 – S12 & Senior Pay Grades S13 – CEX Contracts provide for progression within the salary range for the grade, subject to scope within the range being available, and the outcome of an annual individual salary review which assesses contribution during the previous twelve months. All assessments must be evidence-based and this is seen as fundamental to these arrangements in terms of maintaining both in year consistency and standards over time. Under these arrangements all staff have the scope to progress to the maximum of the pay range for their grade. (i) Relationship to Annual Surrey Pay Reviews Senior management contracts provide for the individual salary review to take account of any generally agreed market adjustment to pay rates. However, at present for all Senior Managers, this aspect of the review will be kept separate from any personal assessment of contribution, with senior pay rates being subject to the general adjustment agreement under Surrey Pay. (ii) Relationship to the Recognition Award Scheme (link) Consideration for a recognition award payment would be virtually identical to an assessment of 'outstanding contribution' and is therefore not available to those senior managers coming within these pay progression arrangements. But this does not mean that the recognition award scheme cannot be used to reward senior managers for excellent achievement of a particular task or special project. However the PPDC have determined that the limit on payments should be considerably lower than 10% of salary for senior managers, because of the relatively higher salaries they receive. Its application to senior managers should be more about recognition than financial reward. The maximum sum that can normally be agreed is currently set at £1,500 per annum. Last Updated 10/3/2015 REWARD POLICY 2015 / 2016 11 11.1 PAY PROCEDURES Pay Arrangements This section of the policy sets the arrangements by which staff are paid. 11.1.1 Frequency of Payment An annual salary is paid on a monthly basis in arrears. This arrangement applies whether employees are full or part-time, and payment is made towards the end of the month for that month's work; consequently employees receive 12 payments per annum. 11.1.2 Methods of Payment All employees are paid via bank credit transfers, directly into a bank or building society account (although there are a few employees who retain the right to payment by cheque on a personal basis). Salary details are provided on monthly pay slips either electronically via the SAP portal or on paper for those members of staff who do not have regular access to the S-net. 11.2 Calculation of Rates of Pay 11.2.1 Daily and Hourly Rates In certain circumstances the amount an employee is paid on a daily basis is required. For example, to complete a Certificate of Loss of Earnings Form for an employee summoned for Jury Service. The calculation of one day's pay is: Annual Salary x 7 365 36* = hourly rate for full and part-time employees *or the standard working hours per week (36 for Surrey Pay staff) The hourly rate is then multiplied by the requisite number of hours worked per day for the rate applicable on the day. Example: FTE salary £20,000 ÷ 365 x 7 ÷ 36 = = = = 20,000.00 54.79 383.56 10.65 per hour 11.2.2 Part-Time Salaries The following formula should be used for the calculation of part-time salaries:Calculate FTE figure, rounded up to 4 decimal places. Apply this FTE figure to the full time annual salary and round up to the nearest penny. Example:An employee is employed for 12 hours on grade S3, £16,000 per annum (full time rate) Last Updated 10/3/2015 REWARD POLICY 2015 / 2016 Calculation of annual salary:1 12 36 = 0.3333 FTE (to 4 decimal places) 2 0.3333 FTE x £16,000 = £5,333.33 (rounded up to nearest penny) 11.2.3 Term Time Only Salaries The pro rata annual salary for staff employed for term time only, or for a specific number of weeks throughout the year and have their annual leave entitlement rolled up into pay, which is calculated as follows: FTE Annual salary x hours worked per week [rounded up] x number of weeks worked per annum, divided by the appropriate denominator as detailed below:(a) Short – Service Denominator (less than 5 years’ service) Total number of working hours per year 36.00 X Subtract annual holiday entitlement 24 36.00 days annual leave plus public holidays x 365 7 32 5 Denominator = 1877 = - 230 = 1647 (b) Long – Service Denominator (5 years 36.00 or more service)Total number of working hours per year X 365 7 = 1877 subtract annual/holiday entitlement 28 36.00 annual leave plus public holidays x 36 5 = - 259 Denominator 11.3 = 1618 Payments on Joining and Leaving Responsibility lies with the employing Service to inform the Shared Service Centre of the date an employee commences or ceases employment with the council, to ensure correct payment(s). Specific guidance may be found on the S-net. When an individual joins or leaves the council's employment, payment will be made for the proportion of the month worked, whether full or part-time. Proportionate payments will be calculated from the monthly salary. Employing departments should give notice of termination of employment to the Shared Service Centre as soon as possible via the electronic leavers form. For staff paid monthly who are on weekly terms and conditions of employment, it is particularly important to notify Surrey payroll services of leavers as early as possible, by phone initially, to minimise difficulties of any possible overpayment of salary. When an employee leaves the council, they are paid up to and including the date employment ceases. The only exception is in the case of officers who transfer to the service of another Local Authority. The employing authority whose service the officer is Last Updated 10/3/2015 REWARD POLICY 2015 / 2016 leaving must pay a salary for any Saturday and/or Sunday and statutory and general national holiday(s) that immediately follow the last day of work with that Authority. Where payment is made in lieu of annual leave not taken, the calculation must be made using the individual hourly rate multiplied by the total number of hours outstanding. This is in line with the annual leave calculation under the Staff Benefits Scheme, and ensures a consistent approach to such calculations for both full and part time staff. 11.4 Deductions from Pay 11.4.1 Definition Part II of the Employment Rights Act 1996 (formerly the Wages Act 1986) provides that (with certain exceptions) deductions from wages, non-payment of wages, or payments made to an employer by a worker will only be lawful if one of the following conditions is satisfied:(a) it is required or authorised by virtue of any statute; or (b) it is provided for in any relevant provision of the worker’s contract of employment or any other contract they may have for providing work personally to the employer; or (c) the worker has previously given written agreement or consent to the deduction, non-payment or payment being made. Deductions authorised by statute include national insurance and income tax. In most cases these are made before any other deductions are made. A number of deductions where the worker’s prior agreement is required, are described in detail elsewhere e.g. by Payroll for a Salary Sacrifice Scheme. What constitutes "wages" and/or a "deduction" has been the subject of a number of legal cases. Therefore, it is important that managers wishing to make a deduction from the wages of a worker check whether the necessary authority to do so exists in law. Advice and guidance on individual cases is available from the My Helpdesk by phone on 0208 541 9000 or e-mail myhelpdeskhr@surreycc.gov.uk. If they cannot answer your query they will pass your query on to HR. 11.4.2 Trade Union Membership Deductions There are a limited number of recognised trade unions included within the facility to deduct trade unions subscription at source. Responsibility lies with the Trade Union concerned to interest members in this facility. The individual should send the completed form to Surrey payroll services, authorising them to deduct their membership fees from their monthly pay. The Trade Unions then receive a monthly list of the deductions made. 11.4.3 Sickness Deductions Deductions made in accordance with sick pay provisions are set out in the Absence Management policy. ____________________ Last Updated 10/3/2015