Sample Formula Sheet for CIMA Certification

advertisement

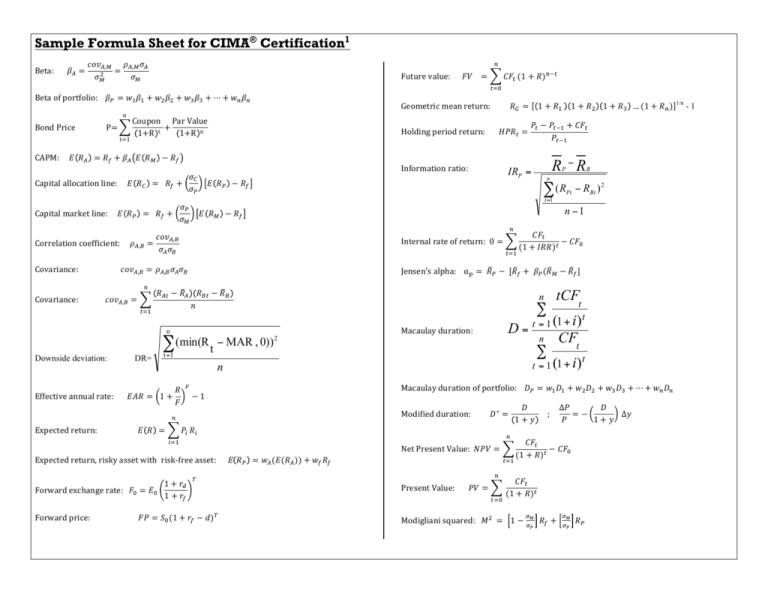

Sample Formula Sheet for CIMA® Certification1 Beta: 𝛽! = 𝑐𝑜𝑣!,! 𝜌!,! 𝜎! = ! 𝜎! 𝜎! ! Beta of portfolio: 𝛽! = 𝑤! 𝛽! + 𝑤! 𝛽! + 𝑤! 𝛽! + ⋯ + 𝑤! 𝛽! n Coupon Par Value Bond Price P= + 1+R t 1+R n !!! Geometric mean return: 𝑅! = Holding period return: 𝐻𝑃𝑅! = t=1 CAPM: 𝐸 𝑅! = 𝑅! + 𝛽! 𝐸 𝑅! − 𝑅! Capital market line: 𝐸 𝑅! = 𝑅! + Correlation coefficient: 𝜌!,! Information ratio: 𝜎! = 𝑅! + 𝜎! Capital allocation line: 𝐸 𝑅! 𝜎! 𝜎! ! Internal rate of return: 0 = ∑ (min(R t − MAR , 0)) !!! n 2 ! − 1 ! 𝑃! 𝑅! !!! Bt )2 𝐶𝐹! − 𝐶𝐹! (1 + 𝐼𝑅𝑅)! ∑ n Expected return: 𝐸 𝑅 = B Jensen's alpha: α! = 𝑅! − [𝑅! + 𝛽! (𝑅! − 𝑅! ] D= Macaulay duration: Expected return, risky asset with risk-­‐free asset: E 𝑅! = 𝑤! (𝐸(𝑅! )) + 𝑤! 𝑅! ! 1 + 𝑟! Forward exchange rate: 𝐹! = 𝐸! 1 + 𝑟! Forward price: 𝐹𝑃 = 𝑆! (1 + 𝑟! − 𝑑)! tCFt t = 1 (1 + i) n ∑ t =1 𝑅 Effective annual rate: 𝐸𝐴𝑅 = 1 + 𝐹 P n n −1 !!! R −R ∑ (R − R t =1 𝑐𝑜𝑣!,! = 𝜎! 𝜎! DR= 𝑃! − 𝑃!!! + 𝐶𝐹! 𝑃!!! Pt 𝐸 𝑅! − 𝑅! n Downside deviation: 1 + 𝑅! 1 + 𝑅! 1 + 𝑅! … (1 + 𝑅! ) IRP = 𝐸 𝑅! − 𝑅! Covariance: 𝑐𝑜𝑣!,! = 𝜌!,! 𝜎! 𝜎! ! 𝑅!" − 𝑅! 𝑅!" − 𝑅! Covariance: 𝑐𝑜𝑣!,! = 𝑛 𝐶𝐹! (1 + 𝑅)!!! Future value: 𝐹𝑉 = t CFt t = 1 (1 + i) t Macaulay duration of portfolio: 𝐷! = 𝑤! 𝐷! + 𝑤! 𝐷! + 𝑤! 𝐷! + ⋯ + 𝑤! 𝐷! 𝐷 ∆𝑃 𝐷 Modified duration: 𝐷 ∗ = ; =− ∆𝑦 𝑃 1+𝑦 1+𝑦 ! 𝐶𝐹! Net Present Value: 𝑁𝑃𝑉 = − 𝐶𝐹! (1 + 𝑅)! !!! ! Present Value: 𝑃𝑉 = !!! 𝐶𝐹! (1 + 𝑅)! ! Modigliani squared: 𝑀 ! = 1 − ! 𝑅! + ! ! !! !! 𝑅! 1/n -1 Sample Formula Sheet for CIMA® Certification1 Price of Present Put-­‐call parity: underlying + Price = Price + value of Equity of put of call exercise price 1 + 𝑅! Real rate of return: 𝑅! = − 1 1 + 𝑅! 𝑅! − 𝑅! Sharpe ratio: 𝑆! = 𝜎! Sortino ratio: SRP = RP − R f n ∑ (min(R Pt − MAR , 0)) Standard deviation of two risky assets: 𝜎! = Treynor ratio: 𝑇! = Value from normal position return: 2 𝑁𝑜𝑟𝑚𝑎𝑙 𝑝𝑜𝑠𝑖𝑡𝑖𝑜𝑛 𝑓𝑜𝑟 𝐶𝑙𝑎𝑠𝑠 (𝐶𝑙𝑎𝑠𝑠 𝑏𝑒𝑛𝑐ℎ𝑚𝑎𝑟𝑘 𝑟𝑒𝑡𝑢𝑟𝑛) !!! Value added from active asset management: 𝑅!"# = 𝐴𝑐𝑡𝑢𝑎𝑙 𝑟𝑒𝑡𝑢𝑟𝑛 − (𝑁𝑜𝑟𝑚𝑎𝑙 𝑝𝑜𝑠𝑖𝑡𝑖𝑜𝑛 𝑟𝑒𝑡𝑢𝑟𝑛) Value added from asset mix (timing) decisions: 𝑅! = ! 𝑃! (𝑅! − 𝐸(𝑅))! !!! !!! ! n 𝑅!"# = ∑(R t − R ) σ= 2 t =1 n n −1 !!! 𝑉! (−𝛼) 𝐷! ∑(R t − R )2 t =1 𝐹𝑢𝑛𝑑 𝑤𝑒𝑖𝑔ℎ𝑡 𝑓𝑜𝑟 𝐶𝑙𝑎𝑠𝑠 X 𝐹𝑢𝑛𝑑 𝑟𝑒𝑡𝑢𝑟𝑛 𝑓𝑜𝑟 𝐶𝑙𝑎𝑠𝑠 − (𝐶𝑙𝑎𝑠𝑠 𝑏𝑒𝑛𝑐ℎ𝑚𝑎𝑟𝑘 𝑟𝑒𝑡𝑢𝑟𝑛) Value at Risk: 𝑉𝑎𝑅 = 𝑉! 𝜎! n = 𝐹𝑢𝑛𝑑 𝑤𝑒𝑖𝑔ℎ𝑡 𝑓𝑜𝑟 𝐶𝑙𝑎𝑠𝑠 − 𝑁𝑜𝑟𝑚𝑎𝑙 𝑝𝑜𝑠𝑖𝑡𝑖𝑜𝑛 𝑓𝑜𝑟 𝐶𝑙𝑎𝑠𝑠 X 𝐶𝑙𝑎𝑠𝑠 𝑏𝑒𝑛𝑐ℎ𝑚𝑎𝑟𝑘 𝑟𝑒𝑡𝑢𝑟𝑛 − (𝑁𝑜𝑟𝑚𝑎𝑙 𝑝𝑜𝑠𝑖𝑡𝑖𝑜𝑛 𝑟𝑒𝑡𝑢𝑟𝑛) Value added from asset selection decision: Standard deviation of a sample: s 𝑅! = ! Standard deviation of a population: 𝑅! 𝑅! ! n Standard deviation, ex ante: 𝜎 = 𝑅! − 𝑅! 𝛽! Upside-­‐downside capture ratio: 𝐶𝑅 = 100 t =1 𝑤!! 𝜎!! + 𝑤!! 𝜎!! + 2𝑤! 𝑤! 𝜌!,! 𝜎! 𝜎! Standard deviation, risky asset A with risk-­‐free asset: 𝜎! = 𝑤! 𝜎! ! Variance of a population: 𝜎 ! = !!! ! Variance of a sample: 𝑠 ! = !!! (𝑅! − 𝑅)! 𝑛 (𝑅! − 𝑅)! 𝑛−1 _____________________________________________________________________________________________________________________________________________________________________________________________________________ 1 ® This formula sheet, which is provided during CIMA certification exams, is intended only as a resource and not as a substitute for understanding the formulae and studying the topics in the Candidate Handbook’s detailed content outline. The formula list, which may be updated periodically, is not inclusive of all formulae that may be needed for an exam form. Conversely, all formulae on the list are not necessary for any one exam form. These formulae may be expressed differently in some textbooks. Likewise, the format or nomenclature used by academic publishers and providers of study/review materials may vary. Candidates are encouraged to learn to read formulae and recognize them in different formats, selecting the ones they find most useful to perform the necessary calculations. IMCA® and INVESTMENT MANAGEMENT CONSULTANTS ASSOCIATION® are registered trademarks of Investment Management Consultants Association Inc. CIMA®, CERTIFIED INVESTMENT MANAGEMENT ANALYST®, CIMC®, CPWA®, and CERTIFIED PRIVATE WEALTH ADVISOR® are registered certification marks of Investment Management Consultants Association Inc. Investment Management Consultants Association Inc. does not discriminate in educational opportunities or practices on the basis of race, color, religion, gender, national origin, age, disability, or any other characteristic protected by law. 01-140212.02.617