Do Not File - Wikispaces

advertisement

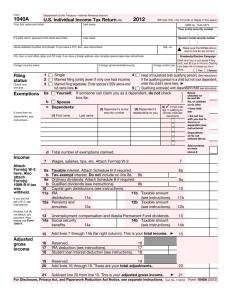

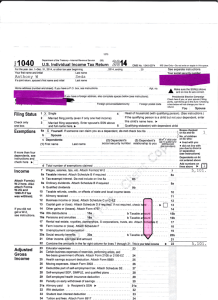

Electronic Filing Instructions for your 2009 Federal Tax Return Important: Your taxes are not finished until all required steps are completed. Melinda F Hughes 9743 Waters Ave So Seattle, WA 98118 | | Your federal tax return (Form 1040) shows a refund due to you in the | amount of $2,147.00. Your tax refund should be direct deposited into | your account within 8 to 14 days after your return is accepted. The | account information you entered - Account Number: 77284172 Routing | Transit Number: 325081665. ______________________________________________________________________________________ | | Where’s My | Before you call the Internal Revenue Service with questions about Refund? | your refund, give them 8 to 14 days processing time from the date | your return is accepted. If then you have not received your refund, | or the amount is not what you expected, contact the Internal Revenue | Service directly at 1-800-829-4477. You can also check www.irs.gov | and select the "Where’s my refund?" link. ______________________________________________________________________________________ | | No | No signature form is required since you signed your return Signature | electronically. Document | Needed | ______________________________________________________________________________________ | | What You | Your Electronic Filing Instructions (this form) Need to | Printed copy of your federal return Keep | ______________________________________________________________________________________ | | 2009 | Adjusted Gross Income $ 33,063.00 Federal | Taxable Income $ 23,713.00 Tax | Total Tax $ 3,141.00 Return | Total Payments/Credits $ 5,288.00 Summary | Amount to be Refunded $ 2,147.00 | Effective Tax Rate 9.50% ______________________________________________________________________________________ | "D oN ot Fil e" Balance Due/ Refund Page 1 of 1 Consent to Use Your Tax Return Information Federal law requires this consent form be provided to you. Unless authorized by law, we cannot use, without your consent, your tax return information for purposes other than the preparation and filing of your tax return. You are not required to complete this form. If we obtain your signature on this form by conditioning our services on your consent, your consent will not be valid. Your consent is valid for the amount of time that you specify. If you do not specify the duration of your consent, your consent is valid for one year. Before we continue, we need your permission to check your tax return to see if you are eligible for certain options in our program. Specifically, we would like to check your age, whether you have a refund and the amount, your state of residence, and whether you are a U.S. Resident. e" The following statements apply: I authorize Intuit, the maker of TurboTax to use the 2009 tax return information described above to determine my eligibility to place all or a portion of my refund on a debit card. Fil Sign this agreement by entering your name: Melinda Hughes Taxpayer’s First Name Taxpayer’s Last Name Melinda F Hughes Enter today’s date: 04/13/2010 Date Spouse’s Last Name (if applicable) ot Spouse’s First Name (if applicable) "D oN If you believe your tax return information has been disclosed or used improperly in a manner unauthorized by law or without your permission, you may contact the Treasury Inspector General for Tax Administration (TIGTA) by telephone at 1-800-366-4484, or by email at complaints@tigta.treas.gov. CONSENT2 FDIY8001 03/05/10 Form Department of the Treasury 1040 ' Internal Revenue Service U.S. Individual Income Tax Return For the year Jan 1 - Dec 31, 2009, or other tax year beginning Label (See instructions.) Your first name MI Melinda If a joint return, spouse’s first name Use the IRS label. Otherwise, please print or type. 2009 F Hughes MI Last name Spouse’s social security number Home address (number and street). If you have a P.O. box, see instructions. Apartment no. Exemptions A WA X 1 2 3 6a b Single Married filing jointly (even if only one had income) Married filing separately. Enter spouse’s SSN above & full name here X Enclose, but do not attach, any payment. Also, please use Form 1040-V. 4 5 You J Spouse Head of household (with qualifying person). (See instructions.) If the qualifying person is a child but not your dependent, enter this child’s name here Qualifying widow(er) with dependent child (see instructions) Boxes checked on 6a and 6b b (4) if qualifying child for child tax credit (see instrs) d Total number of exemptions claimed 7 Wages, salaries, tips, etc. Attach Form(s) W-2 8 a Taxable interest. Attach Schedule B if required b Tax-exempt interest. Do not include on line 8a 8b 9 a Ordinary dividends. Attach Schedule B if required b Qualified dividends (see instrs) 9b 10 Taxable refunds, credits, or offsets of state and local income taxes (see instructions) 11 Alimony received 12 Business income or (loss). Attach Schedule C or C-EZ 13 Capital gain or (loss). Att Sch D if reqd. If not reqd, ck here 14 Other gains or (losses). Attach Form 4797 15 a IRA distributions 15 a b Taxable amount (see instrs) 16 a Pensions and annuities 16 a b Taxable amount (see instrs) 17 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E 18 Farm income or (loss). Attach Schedule F compensation in excess of $2,400 19 Unemployment per recipient (see instructions) Add numbers on lines above 7 8a 1 No. of children on 6c who: ? lived with you ? did not live with you due to divorce or separation (see instrs) Dependents on 6c not entered above 1 34,606. 9a 10 11 12 13 14 15 b 16 b 17 18 19 20 b 21 22 Social security benefits 20 a b Taxable amount (see instrs) Other income Add the amounts in the far right column for lines 7 through 21. This is your total income Educator expenses (see instructions) 23 Adjusted Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 or 2106-EZ 24 1,543. Gross Income 25 Health savings account deduction. Attach Form 8889 25 26 Moving expenses. Attach Form 3903 26 27 One-half of self-employment tax. Attach Schedule SE 27 28 Self-employed SEP, SIMPLE, and qualified plans 28 29 Self-employed health insurance deduction (see instructions) 29 30 Penalty on early withdrawal of savings 30 31 a Alimony paid b Recipient’s SSN 31 a 32 IRA deduction (see instructions) 32 33 Student loan interest deduction (see instructions) 33 34 Tuition and fees deduction. Attach Form 8917 34 35 Domestic production activities deduction. Attach Form 8903 35 36 Add lines 23 - 31a and 32 - 35 36 37 Subtract line 36 from line 22. This is your adjusted gross income 37 BAA For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see instructions. FDIA0112 09/17/09 34,606. "D 20 a 21 22 23 24 You must enter your social security number(s) above. Checking a box below will not change your tax or refund. 98118 Yourself. If someone can claim you as a dependent, do not check box 6a Spouse (2) Dependent’s (3) Dependent’s c Dependents: social security relationship number to you (1) First name Last name ot If you did not get a W-2, see instructions. ZIP code Check here if you, or your spouse if filing jointly, want $3 to go to this fund? (see instructions) oN Attach Form(s) W-2 here. Also attach Forms W-2G and 1099-R if tax was withheld. State Seattle If more than four dependents, see instructions and check here Income J 9743 Waters Ave So e" Check only one box. OMB No. 1545-0074 Your social security number 136-50-3444 Fil Filing Status , 20 Last name City, town or post office. If you have a foreign address, see instructions. Presidential Election Campaign IRS Use Only ' Do not write or staple in this space. (99) , 2009, ending 1,543. 33,063. Form 1040 (2009) Melinda F Hughes Form 1040 (2009) Married filing jointly or Qualifying widow(er), $11,400 Head of household, $8,350 Other Taxes Payments If you have a qualifying child, attach Schedule EIC. Refund Direct deposit? See instructions and fill in 73b, 73c, and 73d or Form 8888. Amount You Owe 53 Other crs from Form: a 3800 b 8801 c 53 54 Add lines 47 through 53. These are your total credits 55 Subtract line 54 from line 46. If line 54 is more than line 46, enter -056 Self-employment tax. Attach Schedule SE 57 Unreported social security and Medicare tax from Form: a 4137 b 8919 58 Additional tax on IRAs, other qualified retirement plans, etc. Attach Form 5329 if required 59 Additional taxes: a AEIC payments b Household employment taxes. Attach Schedule H 60 Add lines 55-59. This is your total tax 61 Federal income tax withheld from Forms W-2 and 1099 61 62 2009 estimated tax payments and amount applied from 2008 return 62 63 Making work pay and government retiree credit. Attach Schedule M 63 64 a Earned income credit (EIC) 64 a b Nontaxable combat pay election 64 b 65 Additional child tax credit. Attach Form 8812 65 66 Refundable education credit from Form 8863, line 16 66 67 First-time homebuyer credit. Attach Form 5405 67 68 Amount paid with request for extension to file (see instructions) 68 69 Excess social security and tier 1 RRTA tax withheld (see instructions) 69 70 Credits from Form: a 2439 b 4136 c 8801 d 8885 70 71 Add lns 61-63, 64a, & 65-70. These are your total pmts 72 If line 71 is more than line 60, subtract line 60 from line 71. This is the amount you overpaid 73 a Amount of line 72 you want refunded to you. If Form 8888 is attached, check here G b Routing number 325081665 G c Type: X Checking G d Account number 77284172 74 Amount of line 72 you want applied to your 2010 estimated tax 74 75 Amount you owe. Subtract line 71 from line 60. For details on how to pay, see instructions 76 Estimated tax penalty (see instructions) 76 Do you want to allow another person to discuss this return with the IRS (see instructions)? Joint return? See instructions. Keep a copy for your records. Paid Preparer’s Use Only 41 27,363. 42 3,650. 43 23,713. 44 45 46 3,141. 3,141. 54 55 56 57 58 59 60 3,141. 3,141. 4,888. 400. 5,288. 2,147. 2,147. 71 72 73 a Savings 75 Yes. Complete the following. Designee’s Phone Personal identification name G no. G number (PIN) Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. "D Third Party Designee Sign Here e" Single or Married filing separately, $5,700 Fil ? All others: 5,700. 40 a ot Standard Deduction for ' ? People who check any box on line 39a, 39b, or 40b or who can be claimed as a dependent, see instructions. Blind. Total boxes Blind. checked 39 a b If your spouse itemizes on a separate return, or you were a dual-status alien, see instrs and ck here 39 b 40 a Itemized deductions (from Schedule A) or your standard deduction (see left margin) b If you are increasing your standard deduction by certain real estate taxes, new motor vehicle taxes, or a net disaster loss, attach Schedule L and check here (see instructions) 40 b 41 Subtract line 40a from line 38 42 Exemptions. If line 38 is $125,100 or less and you did not provide housing to a Midwestern displaced individual, multiply $3,650 by the number on line 6d. Otherwise, see instructions 43 Taxable income. Subtract line 42 from line 41. If line 42 is more than line 41, enter -044 Tax (see instrs). Check if any tax is from: a Form(s) 8814 b Form 4972 45 Alternative minimum tax (see instructions). Attach Form 6251 46 Add lines 44 and 45 47 Foreign tax credit. Attach Form 1116 if required 47 48 Credit for child and dependent care expenses. Attach Form 2441 48 49 Education credits from Form 8863, line 29 49 50 Retirement savings contributions credit. Attach Form 8880 50 51 Child tax credit (see instructions) 51 52 Credits from Form: a 8396 b 8839 c 5695 52 Page 2 33,063. 38 oN Tax and Credits 136-50-3444 38 Amount from line 37 (adjusted gross income) 39 a Check You were born before January 2, 1945, if: Spouse was born before January 2, 1945, Your signature A Date Your occupation X No G Daytime phone number Program Support Assistant Spouse’s signature. If a joint return, both must sign. Date Spouse’s occupation A Preparer’s signature Date A Firm’s name (or yours if self-employed), address, and ZIP code A Preparer’s SSN or PTIN Check if self-employed Self-Prepared EIN Phone no. Form 1040 (2009) FDIA0112 09/17/09 Form 2106-EZ Department of the Treasury Internal Revenue Service OMB No. 1545-0074 Unreimbursed Employee Business Expenses 2009 Attachment Sequence No. G Attach to Form 1040 or Form 1040NR. (99) Your name Occupation in which you incurred expenses Social security number Melinda F Hughes Registered Counselor 136-50-3444 129A You Can Use This Form Only if All of the Following Apply. ? You are an employee deducting ordinary and necessary expenses attributable to your job. An ordinary expense is one that is common and accepted in your field of trade, business, or profession. A necessary expense is one that is helpful and appropriate for your business. An expense does not have to be required to be considered necessary. ? You do not get reimbursed by your employer for any expenses (amounts your employer included in box 1 of your Form W-2 are not considered reimbursements for this purpose). ? If you are claiming vehicle expense, you are using the standard mileage rate for 2009. Part I e" Caution: You can use the standard mileage rate for 2009 only if: (a) you owned the vehicle and used the standard mileage rate for the first year you placed the vehicle in service, or (b) you leased the vehicle and used the standard mileage rate for the portion of the lease period after 1997. Figure Your Expenses Vehicle expense using the standard mileage rate. Complete Part II and multiply line 8a by 55f (.55) 1 2 Parking fees, tolls, and transportation, including train, bus, etc, that did not involve overnight travel or commuting to and from work 2 Fil 1 4 5 6 Travel expense while away from home overnight, including lodging, airplane, car rental, etc. Do not include meals and entertainment 3 675. Business expenses not included on lines 1 through 3. Do not include meals and entertainment 4 868. Meals and entertainment expenses: $ x 50% (.50) (Employees subject to Department of Transportation (DOT) hours of service limits: Multiply meal expenses incurred while away from home on business by 80% (.80) instead of 50%. For details, see instructions.) 5 Total expenses. Add lines 1 through 5. Enter here and on Schedule A (Form 1040), line 21 (or on Schedule A (Form 1040NR), line 9). (Armed Forces reservists, fee-basis state or local government officials, qualified performing artists, and individuals with disabilities: See the instructions for special rules on where to enter this amount.) 6 Part II ot 3 Information on Your Vehicle. Complete this part only if you are claiming vehicle expense on line 1. When did you place your vehicle in service for business use? (month, day, year) 8 Of the total number of miles you drove your vehicle during 2009, enter the number of miles you used your vehicle for: a Business 10 oN 7 9 1,543. b Commuting (see instr) c Other Was your vehicle available for personal use during off-duty hours? Yes No Do you (or your spouse) have another vehicle available for personal use? Yes No Yes No "D 11 a Do you have evidence to support your deduction? b If ’Yes,’ is the evidence written? BAA For Paperwork Reduction Act Notice, see separate instructions. FDIA7501 Yes No Form 2106-EZ (2009) 06/10/09 SCHEDULE M Department of the Treasury Internal Revenue Service (99) OMB No. 1545-0074 Making Work Pay and Government Retiree Credits (Form 1040A or 1040) G Attach to Form 1040A, 1040, or 1040NR. 2009 Attachment Sequence No. G See separate instructions. Name(s) shown on return Your social security number Melinda F Hughes 136-50-3444 166 1 a Important: See the instructions if you can be claimed as someone else’s dependent or are filing Form 1040NR. Check the ’No’ box below and see the instructions if (a) you have a net loss from a business, (b) you received a taxable scholarship or fellowship grant not reported on a Form W-2, (c) your wages include pay for work performed while an inmate in a penal institution, (d) you received a pension or annuity from a nonqualified deferred compensation plan or a nongovernmental section 457 plan, or (e) you are filing Form 2555 or 2555-EZ. Do you (and your spouse if filing jointly) have 2009 wages of more than $6,451 ($12,903 if married filing jointly)? Yes. Skip lines 1a through 3. Enter $400 ($800 if married filing jointly) on line 4 and go to line 5. No. Enter your earned income (see instructions) 1a b Nontaxable combat pay included on line 1a (see instructions) 2 Multiply line 1a by 6.2% (.062) e" X 1b 2 Enter $400 ($800) if married filing jointly) 4 Enter the smaller of line 2 or line 3 (unless you checked ’Yes’ on line 1a) 5 Enter the amount from Form 1040, line 38*, or Form 1040A, line 22 5 33,063. 6 Enter $75,000 ($150,000 if married filing jointly) 6 75,000. 7 Is the amount on line 5 more than the amount on line 6? X No. Skip line 8. Enter the amount from line 4 on line 9 below. Yes. Subtract line 6 from line 5 Multiply line 7 by 2% (.02) 9 Subtract line 8 from line 4. If zero or less, enter -0- 400. 7 8 9 400. 10 0. 11 0. oN Did you (or your spouse, if filing jointly) receive an economic recovery payment in 2009? You may have received this payment if you received social security benefits, supplemental security income, railroad retirement benefits, or veterans disability compensation or pension benefits (see instructions). X 11 4 ot 8 10 3 Fil 3 No. Enter -0- on line 10 and go to line 11. Yes. Enter the total of the payments received by you (and your spouse, if filing jointly). Do not enter more than $250 ($500 if married filing jointly) Did you (or your spouse, if filing jointly) receive a pension or annuity in 2009 for services performed as an employee of the U.S. Government or any U.S. state or local government from work not covered by social security? Do not include any pension or annuity reported on Form W-2. No. Enter -0- on line 11 and go to line 12. Yes. ? If you checked ’No’ on line 10, enter $250 ($500 if married filing jointly and the answer on line 11 is ’Yes’ for both spouses) ? If you checked ’Yes’ on line 10, enter -0- (exception: enter $250 if filing jointly and the spouse who received the pension or annuity did not receive an economic recovery payment described on line 10) "D X 12 13 Add lines 10 and 11 Subtract line 12 from line 9. If zero or less, enter -0- 12 13 0. 400. 14 Making work pay and government retiree credits. Add lines 11 and 13. Enter the result here and on Form 1040, line 63, Form 1040A, line 40; or Form 1040NR, line 60 14 400. *If you are filing Form 2555, 2555-EZ, or 4563 or you are excluding income from Puerto Rico, see instructions. BAA For Paperwork Reduction Act Notice, see Form 1040A, 1040, or 1040NR instructions. Schedule M (Form 1040A or 1040) 2009 FDIA8501 10/27/09 Tax Payments Worksheet 2009 G Keep for your records Name(s) Shown on Return Social Security Number Melinda F Hughes 136-50-3444 Estimated Tax Payments for 2009 (If more than 4 payments for any state or locality, see Tax Help) Federal Date State Amount Date Amount Local ID Date Amount 04/15/09 04/15/09 2 06/15/09 06/15/09 06/15/09 3 09/15/09 09/15/09 4 01/15/10 01/15/10 e" 1 04/15/09 09/15/09 01/15/10 6 7 8 9 oN "D Forms W-2 Forms W-2G Forms 1099-R Forms 1099-MISC and 1099-G Schedules K-1 Forms 1099-INT, DIV and OID Social Security and Railroad Benefits Form 1099-B St Loc Other withholding St Loc Other withholding St Loc Other withholding St Loc Total Withholding Lines 10 through 18c Total Tax Payments for 2009 Prior Year Taxes Paid In 2009 (If multiple states or localities, see Tax Help) 21 22 23 24 State ID Local ID Overpayments applied to 2009 Credited by estates and trusts Totals Lines 1 through 7 2009 extensions Taxes Withheld From: 10 11 12 13 14 15 16 17 18 a b c 19 20 Federal ot Tax Payments Other Than Withholding (If multiple states, see Tax Help) Fil 5 Tot Estimated Payments ID Tax paid with 2008 extensions 2008 estimated tax paid after 12/31/08 Balance due paid with 2008 return Other (amended returns, installment payments, etc) Federal State Local 4,888. 4,888. 4,888. State ID Local ID Federal Carryover Worksheet 2009 G Keep for your records Name(s) Shown on Return Social Security Number Melinda F Hughes 136-50-3444 2008 State and Local Income Tax Information (See Tax Help) (b) Paid With Extension (c) Estimates Pd After 12/31 (d) Total Withheld/Pmts Totals Other Tax and Income Information (f) Total Overpayment Filing status Number of exemptions for blind or over 65 (0 - 4) Itemized deductions after limitation Check box if required to itemize deductions Adjusted gross income Tax liability for Form 2210 or Form 2210-F Alternative minimum tax Federal overpayment applied to next year estimated tax (g) Applied Amount 2008 1 2 3 4 5 6 7 8 2009 1 Fil 1 2 3 4 5 6 7 8 (e) Paid With Return e" (a) State or Local ID Single 4,000. 33,063. 2,741. Excess Contributions Taxpayer’s excess Archer MSA contributions as of 12/31 Spouse’s excess Archer MSA contributions as of 12/31 Taxpayer’s excess Coverdell ESA contributions as of 12/31 Spouse’s excess Coverdell ESA contributions as of 12/31 Taxpayer’s excess HSA contributions as of 12/31 Spouse’s excess HSA contributions as of 12/31 oN 9a b 10 a b 11 a b ot QuickZoom to the IRA Information Worksheet for IRA information "D 2009 2008 2007 2006 2005 2004 2009 2008 2009 9a b 10 a b 11 a b Loss and Expense Carryovers 12 a Short-term capital loss b AMT Short-term capital loss 13 a Long-term capital loss b AMT Long-term capital loss 14 a Net operating loss available to carry forward b AMT Net operating loss available to carry forward 15 a Investment interest expense disallowed b AMT Investment interest expense disallowed 16 Nonrecaptured net Section 1231 losses from: a b c d e f 2008 12 a b 13 a b 14 a b 15 a b 16 a b c d e f