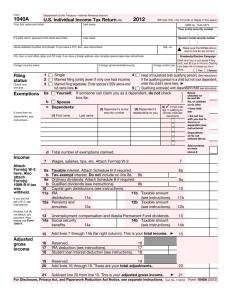

view Anthony's taxes by clicking here

advertisement

5 1 040 ill"dilff,;ffirH"ffTi:,. *Ji'"," Qr tqIq4al:l-D,e9:-1! 2014 919!!gl tal yqqlbgqinnilq Your first name and initiel 2@14 OMB No. 1545-0074 , 2014, ending Only-Do IRS Use Last name a A Apt. no iiyou nave i roreigri iddresi, jiso compiiie ipacei netow tse-e instructions). Foreign postal FilingStatus 1x sinsre 2 ,Married filing jointly (even if only one had income) Check only 3' Married filing separately. Enter spouse's SSN above one box. and full name here. > 6a Exemptions 4_, dependents, name Last (g) ^]2]Dependents social security number lnCOme Attach Formts) W.2 here. Also attach Forms W-2G and 1099-R if tax was withheld. lf you did not get a W-2, see instructions. , ,-ggellsrrudtions) l d Total number of exernptions claimed 7 b . .t', ,,,.', . . b Qualified dividends .. .1. 15a lRAdistributions , !ilr. 16a Pensionsandannuities. .... t6a' . f E 101, 1',I 12 check 13 h 1!. 16b Farmincomeor(loss).Attara.iii$eh;dubF Unemployment compen-satioii rglpl'ts- j) 15b, b Taxable t9 ... . . 17 18 j 19 20b " ?0" 21 Other income..t i6i'tipe-iio amount 22 Combine the amounts in the far 23 24 Educatorexpenses .. 21 column for lines 7l 21. This is total income >22 5.101 23 Certain business expenses of reservists, performing artists, and . fee'basis government officials. Attach Form 2106 or 2106-EZ . . Health savings account deduction. Attach Form 88Bg . Moving expenses. Attach Form 3903 Deductible part of self-employment tax. Attach Schedule SE . . . . . 29 Self-employed SEP, SIMPLE, and qualified plans . Setf-employed health insurance deduction 30 Penalty on early withdrawal of savings paid b Recipient's SSN > lRAdeduction .............. 31a Alimony 34 51 ', 18 33 not entered above ooo,XtTff" 10. . Rental real estate, royalties, partriitstrips, S cotpoijtions, irusts, etc. Attach 32 : ' 9a 17 28 (see instruc$ons) -::..' 9b . 27 or saParation ga ... ., 10 Taxable refunds, credits, or offsets of state and local income taxes 11 Alimony received 12 Business income or (loss). Attach Schedufe Cql,GEZ 13 Capital gain or (loss). Attach Schedule D if required.:lf not required, 14 Other gains or (losses). Attach Form 4797.:..' 25 ;"i 3,l."tj,I?#l* Tax-exempt interest. Do not include on line 8a 9a Ordinarydividends.Attach ScheduleBifrequired . .. 25 ..; " '.''.',r."''..,.'.....'..,lines ...,'.' ....,.... 7 ','"" . 8a Taxable interest. Attach Schedule B if required Wages,salaries,tips,etc.AttachForm(s)W-2 20a Social security Adiusted Gross lncome f,-ff;$'my* li,ilI,li; *,, ...-, ,.:.. ,,1 >' spouse I *i:""."[T["d pependent's" four see nere refund You . relatior name Presidontial Electlon Campaign Check here if you, or your spouse if filing jointly, wanl $3 to go to lhis fund. Checking a box below witl not change your tax or this child's name here, > Qualifying widow(er) with dependent child 5 instructions and cnecK Code Make sure the ssN(s) above ano on une 6c are correcl. Head of household (with qualifying person). (See instructions.) lf the qualifying person is a child but not your dependent, enter Yourself. lf someone can claim you as a dependent, do not check box 6a i-Defeno-nG: (1) First rf more than not write or staple in lhis space. See separate instructions .20 Student loan interest deduction Tuition and fees. Attach Form 8917 . 24 25 2E 27. 28. ?9,, q0.rla 32 . 31 . 34 . i i i ,,,,, ,,,' i :