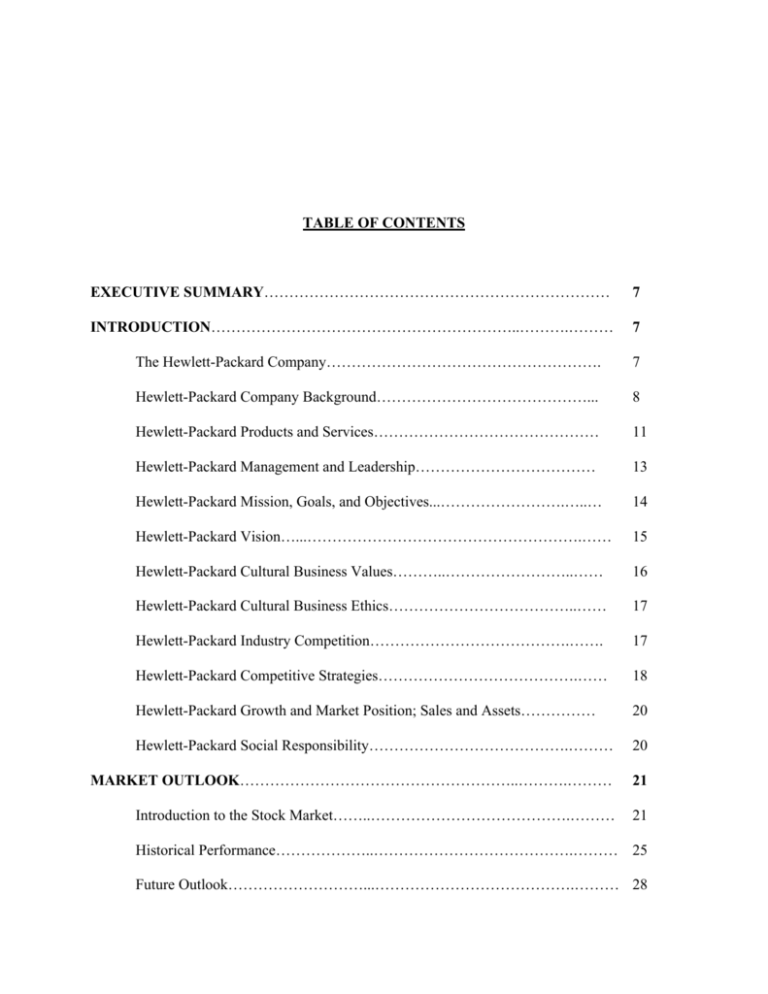

TABLE OF CONTENTS EXECUTIVE SUMMARY

advertisement