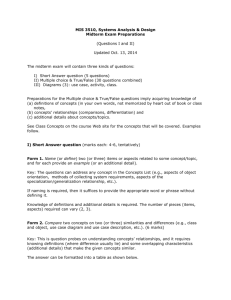

Performance Measures and Costs, Cost

advertisement