Model Assessment and Adaptive Design

advertisement

Model Assessment and Adaptive

Design Group (MAAD)

Carlos M. Carvalho

Summary Report

1

Model Assessment and Adaptive Design

• General Goal: Enhance, explore and demonstrate the potential of

particle based methods to represent sequential model uncertainty.

• Specifics...

I

Explore the ability of SeqMC methods to effectively explore

very large discrete model spaces.

I

Parallel computation issues... connections to Shotgun

methods of Jones et. al (2005) and Hans, Dobra and West

(2006)

I

Reinvent chapter 11 of West and Harrison (1997). Model

monitoring and intervention.

• Models and Applications...

I

Different specification of the economy... again, DSGE models

in Macroeconomics.

I

Finance models...

I

Dynamic variable selection

I

...

2

Summary of Discussion: Week 1

Three main topics were discussed:

1. Marginal Likelihood Computation via SMC

I

Many examples in Finance and Economics...

I

Astrophysics...

2. SMC Exploration of Large Model Spaces

I

Variable selection problems

I

DLM model specification

3. Adaptive Design and Control

I

Astrophysics context

I

Dynamic control and decision making

3

Five Months Later...

1. Marginal Likelihood Computation via SMC

I

Astrophysics (Tom Loredo et al.)

I

Non-parametric regression (Dunson, Das and Shi)

2. SMC Exploration of Large Model Spaces

I

Variable selection problems (Dunson, Das and Shi)

I

DLM model specification (Hao, Reeson and Carvalho)

3. Adaptive Design and Control

I

Dynamic Control and Sequential Decision Making (Argon,

Rodriguez and Bain)

I

Adaptive Sampling (Liu, Li and Dunson)

4

Papers in preparation...

1. “Bayesian Distribution Regression via Augmented Particle

Learning” (Dunson and Das, 09)

2. “Particle Stochastic Search for High-dimensional Variable

Selection” (Shi and Dunson, 09)

2. “Sequential Learning in Dynamic Graphical Models” (Wang,

Reeson and Carvalho, 09)

2. “Adaptive Sampling for Bayesian Variable Selection” (Liu, Li

and Dunson, 09)

5

Sequential Learning in Dynamic

Graphical Models

Hao Wang

Craig Reeson

Carlos M. Carvalho

Application Context

High-dimensional asset allocation problems

9 “Structured” models for the time-varying covariance

matrix of a large number of assets

9 Tractable models in very many dimensions

2

Gaussian Graphical Models

9 A graph G=(V,E) defines conditional independence relationships for

a set of random variables

3

Hyper-Inverse Wishart

9 Conjugate prior (local) distribution for

9 Unique hyper-Markov law with consistent componentmarginals

4

Exchange Rate Example

Explore distribution of weights

Carvalho, Massam and West (2007) – Biometrika

6

Exchange Rate Example

Smaller variability of portfolio weights

7

Portfolios and Graphs

Stevens (1998)

“… the amount of money invested in asset i depends on the

ratio of the expected return that cannot be explained by the

linear combination of assets to the nondiversifiable risk.”

8

DLMs and Graphs

Conditional independence in multivariate time series models

Common components defining each individual DLMs

General, fully-conjugate framework

9

Extension to Graphs

Closed-form sequential update

9 Forecasting

9 Filtering – retrospective analysis

10

Sequential Update

Posterior at time t-1:

Prior at time t:

11

Sequential Update

One-step forecast:

Posterior at time t:

12

Time-Varying Covariance

9 Treat the covariance matrix as a state in the model, allowing it to

vary stochastically in time

9 Define an evolution equation -- transition distribution

Stochastic map established through multiplicative beta shocks to the

diagonal elements of the Cholesky decomposition of the precision

9 Generalizes Uhlig(1994) and extends Quintana(2003) to graphs

13

Time-Varying Covariance

“Locally Smooth” – Dynamic Discounting

Information loss – discount factor

Prior has the same “location” of the previous posterior

Implies a random walk in the transition equation of log-variances

14

Sequential Update

Posterior at t-1:

Prior at t:

Posterior at t:

Approximate EWMA for the harmonic mean

15

EX Example Revisited

16

EX Example Revisited

δ = 0.99

δ = 0.90

17

Dynamic Portfolios (EX)

Variance of Portfolio Weights

18

EX Example Revisited

9 Higher realized cumulative returns – structure

helps in practical terms

9 Lower risk portfolios in terms of one-step ahead

predicted variances

9 Lower volatility of the optimal portfolio weights –

more stable portfolios

19

S&P 500 – Model Selection

9 346 stocks in the index from 1999 until 2004

Challenge: uncertainty about the graph.

Efficient exploration of model space

Metropolis Search

Shotgun Stochastic Search

Jones, Carvalho et. al. (2005) – Stat. Sci.

20

Marginal Likelihood for Graphs

Computations facilitated by one-edge moves

Small changes to allow for time dependence

22

S&P 500

Top graph with 29,181 edges

23

Modelling time-varying Gt

Recursively conditional sufficient statistic for (Gt , Σt ):

St = δSt−1 + yt yt0

Information set Dt = {y1 , · · · , yt } and update Gt as follows

i Posterior at time t:

p(Gt | Dt ) = p(Gt | St ) ∝ π(Gt )p(Y1:t |Gt , St )

ii Prior at time t + 1 : p(Gt+1 | Dt ) ∝ π(Gt+1 )p(Y1:t |Gt+1 , δSt )

iii Posterior at time t + 1 :

p(Gt+1 | Dt+1 ) = p(Gt+1 | St+1 ) ∝ π(Gt+1 )p(Y1:t+1 |Gt+1 St+1 )

Wang, Reeson and Carvalho

Sequential Graph DLM

Sequential Learning of Gt

Particle Learning (Carvalho et al., 2008) + Particle

Stochastic Search (Shi & Dunson, 2009)

Suppose at time t, most probable graphs

(i)

{Gt } ∼ p(Gt | Dt )

Re-sample: ∝ p(Y1:t+1 |Gt , St+1 )

Propagate:

i Update estimation of edge inclusion probabilities of

p(Gt+1 | Dt+1 )

ii Sample new particles using edge inclusion probabilities

iii Repeat until “some” stop criteria is satisfied.

Wang, Reeson and Carvalho

Sequential Graph DLM

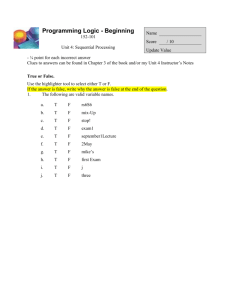

Exchange Rate Data

1

2

0.8

4

1

2

0.8

4

0.6

6

0.6

6

0.4

8

0.4

8

0.2

10

2

4

6

8

10

0.2

10

0

2

4

6

8

10

1

2

0.8

4

0

1

2

0.8

4

0.6

6

0.6

6

0.4

8

0.4

8

0.2

10

2

4

6

8

10

0

0.2

10

2

4

6

Figure:

Sequential Graph DLM

Wang, Reeson and Carvalho

8

10

References

n Carvalho and West (2007) “Dynamic Matrix-Variate Graphical

Models”

o Wang, Reeson and Carvalho (2009) “Sequential Learning in

Dynamic Graphical Models”

p Carvalho and Scott (2009) “Objective Bayesian Model Selection in

Gaussian Graphical Models”

q Reeson, Carvalho and West (2009) “Financial Time Series Graphical

Modeling and Portfolio Analysis”

r Quintana, Carvalho, Scott and Costigliola (2009)“Futures Markets,

Bayesian Forecasting and Risk Modeling”

26