USA TODAY Online Marketing on the WWW

advertisement

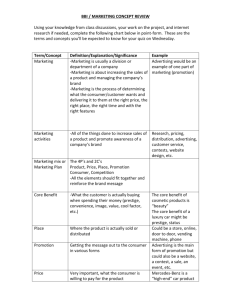

Group Case Study USA TODAY Online prepared by Brian Bright, Ximena Canjura, Priya Mathur Gerwin Schalk, Fredrik Vitzthum Marketing on the WWW Dr. Shikhar Sarin Rensselaer Polytechnic Institute Albany/Troy, NY March 2001 Contents 1 Introduction 1.1 The Market . . . . 1.2 The Product . . . . 1.3 The Revenue Model 1.4 Competitors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 Analysis 2.1 Strengths . . . . . . . . . . . . . . . . . . . . . . 2.1.1 Strong Brand Name . . . . . . . . . . . . 2.1.2 Own Content . . . . . . . . . . . . . . . . 2.1.3 Experienced Staff . . . . . . . . . . . . . . 2.1.4 Information Product . . . . . . . . . . . . 2.2 Weaknesses . . . . . . . . . . . . . . . . . . . . . 2.2.1 Non-Tech Savvy Staff . . . . . . . . . . . . 2.2.2 Brand-Name Dilution . . . . . . . . . . . . 2.2.3 Revenue Model Depends on Advertisement 2.2.4 Channel Cannibalization . . . . . . . . . . 2.2.5 Customer Loyalty . . . . . . . . . . . . . . 2.3 Opportunities . . . . . . . . . . . . . . . . . . . . 2.3.1 Content Syndication . . . . . . . . . . . . 2.3.2 Classified Advertising . . . . . . . . . . . . 2.3.3 Limited Customization . . . . . . . . . . . 2.4 Threats . . . . . . . . . . . . . . . . . . . . . . . 2.5 Finances . . . . . . . . . . . . . . . . . . . . . . . 3 Strategic Recommendations 3.1 General Recommendations 3.2 Content Syndication . . . 3.3 Classified Advertising . . . 3.4 Lock-In Strategies . . . . . 3.5 Pricing Model . . . . . . . 3.6 Financial Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 Executive Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 2 2 3 3 . . . . . . . . . . . . . . . . . 5 5 5 5 5 6 6 6 6 6 7 7 7 7 7 7 8 8 . . . . . . 12 12 13 13 13 13 14 15 1 1 Introduction In this report, we summarize the situation of USA Today Online, as it is presented in the provided case (Section 1). We then use SWOT analysis to analyze (in Section 2) the company’s strengths, weaknesses, opportunities, threats, and financial situation. Based on these analyses, we then present strategic recommendations (Section 3) for USA Today Online in order to remain a healthy and competitive operation. 1.1 The Market Advances in electronic communication and, specifically, the Internet have over the last ten years radically changed the way information is distributed. Scarcity of information and the traditional trade-off between richness and reach changed into abundance of information with the trade-off removed. Traditional content creators and distributors, e.g., newspaper publishers, early on started to explore the Web as a new medium that could deliver an almost unlimited amount of information and that could still reach a huge target population. USA Today Online was started in 1995 at a time, when the popularity of the Internet started to reach critical mass. In an attempt to investigate how to take the USA Today Online brand into new markets, executives drove the experiment (similarly to other early adopters) by a vision of technical feasibility and potentially unlimited possibilities of information distribution rather than by a clear business model. 1.2 The Product Early on, USA Today Online was positioned as an online newspaper with sports statistics - targeted mainly at fantasy baseball fans. It was originally distributed through a subscription-based proprietary dial-up service. With the WWW literally exploding, management decided to expand the concept to a more complete source for a large variety of information grouped into categories, with a focus on sports, weather, and breaking news. Quickly, they realized that with the increasing abundance of information on the Web, they had to change the revenue model from the original subscription-based model to an advertising revenue base. By 1997, USA Today Online covered 227 college football teams, 601 basketball teams, women’s volleyball and NCAA hockey. Statistical analysis of browsing behavior gave important feedback on which sections were popular and thus were a potential target for expanded coverage. 2 1.3 The Revenue Model As mentioned in Section 1.2, management had changed the revenue model to an advertisement based model early on. The strong brand name and the quality of information resulted in a large number of page visits (e.g., 20.08 million in October 1997). USA Today Online charged customers for the number of times an advertisement appeared on a user’s screen ($30 per thousand page visits, a figure comparable to other media). USA Today Online had a significant market penetration - significant enough that (even in local markets) that management explored the possibility for classified advertising. However, even though preliminary data seemed promising, there was not enough data to judge the efficacy of this revenue source. 1.4 Competitors USA Today Online faces competition from two main sources: established news agencies and the increasing ease of information distribution that results in new and aggressive ”pure play” information distributors and syndicators. USA Today Online closely watched the following established established companies: • CNN Interactive (CNNI) • ESPNet SportsZone • MSNBC.com • Yahoo.com Figure 1 graphically illustrates USA Today Online’s competitors, roughly categorized in entertainment, news, sports, and online print publications. 3 entertainment sports news online print publications Figure 1: USA Today Online and its competitors. Estimated Monthly Advertising Revenue $5,000 $4,500 $4,000 Thousand US$ $3,500 USA Today $3,000 Yahoo! $2,500 CNN Interactive $2,000 ESPN $1,500 $1,000 $500 Ju ly Au gu st Ju ne ay M Ap ril O ct ob er No ve m De ber ce m be Ja r nu a Fe ry br ua ry M ar ch $0 Month (in 1996/1997) Figure 2: Estimated monthly advertising revenue for USA Today Online and some of its competitors for October 1996-August 1997. 4 2 Analysis In this section, we analyze USA Today Online’s strengths (section 2.1), weaknesses (Section 2.2), opportunities (Section 2.3), threats (Section 2.4), and finances (Section 2.5). Based on this analysis, we will present our recommendations for USA Today Online’s strategy in Section 3. 2.1 Strengths USA Today Online’s strengths fall in different categories: • Strong brand name • Content coming from own research (e.g., extensive sports coverage) • Experienced staff in a stable environment • Information Product 2.1.1 Strong Brand Name One of USA Today Online’s most valuable resources is certainly the USA Today brand name. Most of the content, except from sports news and columnists’ opinions, is generated from the same Associated Press feed that every other news source receives. For this reason is the brand name certainly an asset that drives the audience to the site. 2.1.2 Own Content Aside from the mentioned Associated Press wire feed that other agencies receive as well, USA Today Online produces its own content, especially its extensive sports coverage. This coverage, both on the local and national level, gives the company an edge over its competitors and has, as mentioned before, the potential to become a seperate revenue stream. 2.1.3 Experienced Staff One of the major problems in today’s fast society is the high turnover rate, which hurts every company that is dependent on experienced staff. USA Today Online has an experienced base of journalists and, since the company is well established, creates the kind of stable environment that is necessary to attract and retain employees. 5 2.1.4 Information Product USA Today Online’s product is an information product. Therefore, the company does not own any inventory, which is one of the biggest risks for any company. In addition, information products have the potential to be copied, re-packaged, and sold. 2.2 Weaknesses USA Today Online’s weaknesses fall in different categories: • Non-tech savvy staff • Brand-name dilution • Strong dependence of revenue model on advertisement • Channel Cannibalization • Customer Loyalty 2.2.1 Non-Tech Savvy Staff Of of USA Today Online’s strengths at the same is one of its weaknesses. While the employees that comprise the editorial staff have a strong background in journalism, computer skills have not been their most important skill in the past. This is a situation that would inhibit USA Today Online’s growth, if it would go in directions that require computer savvy staff. In addition, it seems that (maybe because of the company’s roots) the whole operation is not centered around a strong competence in IT (even though USA Today Online operates the web site in-house). 2.2.2 Brand-Name Dilution Another inhibiting internal factor in USA Today Online’s growth stems from the fact that its brand is one of the company’s major assets. Uncontrolled growth in new directions could easily dilute the brand and take away one of their major advantages. 2.2.3 Revenue Model Depends on Advertisement USA Today Online’s revenue model almost exclusively centers on online advertisement. This fact can potentially be very dangerous, in case competition became fiercer, or if online advertisement lost in importance (exactly which seems to be happening in 2001). 6 2.2.4 Channel Cannibalization Even though preliminary studies showed that its online operation only had a minor effect on the printed medium, it is likely to anticipate increased channel cannibalization, since market penetration is already very high. 2.2.5 Customer Loyalty It is very likely that customer loyalty on the web is lower compared to the printed medium, because the switching costs are lower (e.g., no subscription has to be cancelled) and competition (i.e., other sites) is only a mouse click away. 2.3 Opportunities USA Today Online’s opportunities fall in the following categories: • Content syndication • Classified advertising • Limited customization 2.3.1 Content Syndication One of the dangers of the Information Age, content that is easily replicable, at the same time opens up a lot of opportunities. Content syndication is a largely untapped (not even 0.1% of the revenues come from content sold to 3rd parties) revenue source. 2.3.2 Classified Advertising Classified advertising could supplement banner-based advertisements, since the large online audience provides much deeper market penetration compared to the printed newspaper. However, in early 1997, USA Today Online explored ways to generate classified advertising revenue (i.e., with the ’Marketplace’), but time was too early to tell the impact. 2.3.3 Limited Customization While unrestrained customization might be against the traditional role of a newspaper, i.e., to inform about a large variety of news instead of providing very customized pieces of information, subtle and limited customization and community building might lead to increased switching costs and thus effectively locking in customers. 7 2.4 Threats One of the direct consequences of an information society is that it becomes more and more difficult to protect content. This represents the major threat to USA Today Online’s long-term operation. While in ’real’ print publications the resources required to replicate content are substantial, in the online world they are negligible. This opens up the door for increased competition and new competitors. Therefore, USA Today Online has to anticipate increased competition from portals (e.g., Yahoo, Netscape’s Netcenter) that extend their services to news and content, from other traditional news agencies (e.g., CNN) to new ’pure-play’ infomediaries. 2.5 Finances In the 12 months to April 1997, USA Today Online generated $6.5 million in advertising revenue and $500,000 and $50,000 in transaction income and sale of content, respectively. After taking all expenses into account, the company balanced approximately even. In USA Today Online’s pricing model, the company relies on accurate predictions of the future number of exposures. USA Today Online charges a fee for the predicted number of exposures and provides refunds, if the number of exposures was lower than predicted. On the other hand, if the number of exposures exceeded the predicted number, that resulted in a bonus for the advertising company. In order to estimate the costs of a potential underestimation, we analyzed the estimated and actual number of page views for April 1997. Table 1 shows the actual number of page visits for the months April, May, June, and July of 1997 (linearly interpolated for May and June) and Table 2 illustrates the estimation error for both over- and underestimation. The results show that the estimation error might be substantial (given the limited amount of data) and that USA Today Online should consider changing its pricing model to charge for the actual number of exposures rather than charging for estimated number of page views. An interesting observation is that, although General Administration (which we assume includes the costs to generate the in-house content) accounts for $3.5 million (with 50% the major component of the expenses), in-house content only generates a fraction of direct revenue and in addition, access statistics show that the Sports Section (thought to be one of the most valuable assets) generated only a fraction of the total advertising revenues (e.g., about half of the revenues generated by the Money Section in June 1997). Figures 3 and 4 illustrate the annual national and local expenditures by medium. They indicate that advertising volume is on a steady rise (especially for media capable of direct marketing), both nationally and locally, thus suggesting that at 8 Visits per month Per page avg. Home Money Sports News Weather Life Sports Stocks College % Views 55% 65% 14% 7% 4% 6% 23% 22% 2% April May (est.) 12,830,000 13,230,000 June (est.) 13,630,000 July 14,030,000 7,056,500 8,339,500 1,796,200 898,100 449,050 705,650 2,886,750 2,822,600 192,450 7,496,500 8,859,500 1,908,200 954,100 477,050 749,650 3,066,750 2,998,600 204,450 7,716,500 9,119,500 1,964,200 982,100 491,050 771,650 3,156,750 3,086,600 210,450 7,276,500 8,599,500 1,852,200 926,100 463,050 727,650 2,976,750 2,910,600 198,450 Table 1: This table illustrates the number of actual and estimated page views for the months April, May, June, and July 1997. least in the short term (see comments in section 2.2.3) USA Today Online can expect a steady rise in advertising revenue. In order to calculate a growth estimate for advertising revenue, we modeled the category DirectMail in national advertising with a first and second order model. Since the first order model was able to describe almost as much of the variance as the second order model (r2 > 0.99), we calculated a linear regression in order to be able to extrapolate USA Today Online ’s potential growth in advertising revenue (the provided estimated monthly advertising revenues shown in Figure 2 only cover a period of 11 months, which might be too short to generate accurate predictions). The growth of DirectMail was described by the equation y = 1628.8x + 5621.3 (with 1980 being the first year). We then calculated the predicted advertising expentitures for the years 1997, 1998, and 1999 (years 18, 19, and 20, respectively), which yielded (in million US $) 34,939.7, 36,568.5, and 38,197.3, respectively. This translates into an approximate annual growth rate of 5%. We then used USA Today Online’s advertising revenue for the 12 months to April 1997 ($6.5 million) as a basis for our predictions (we used this value as an estimate for USA Today Online’s 1996 advertising revenue). Based on a predicted 5% annual growth rate and our estimate for USA Today Online’s 1996 revenue, we calculated the expected advertising revenue for USA Today Online for the years 1997, 1998, and 1999: $6.8, $7.2, and $7.5 million, respectively. This expected additional revenue can be used to finance our strategic recommendations. 9 Est. Exp. Est. Cost Home 6,701,378 $201,041 Life 873,407 $26,202 Money 4,014,528 $120,436 News 2,346,406 $70,392 Sports 2,407,434 $72,223 Weather 657,402 $19,722 Average 2,833,425 $85,002 Act. Exp. 7,056,500 705,650 8,339,500 898,100 1,796,200 449,050 3,207,500 Error Underest. Overest. -355,122 $10,654 167,757 $5,033 -4,324,972 $129,749 1,448,306 $43,449 611,234 $18,337 208,352 $6,251 -374,074 $70,201 $18,267 Table 2: This table illustrates the estimation error between estimated and actual number of page exposures for different sections. Underestimation directly results in decreased revenue for USA Today Online. Annual National Advertising Expenditures by Medium Expenditures (million $) $80,000 DirectMail $70,000 Magazines Newspaper $60,000 Outdoor $50,000 Radio TV Sum Linear (DirectMail) $40,000 $30,000 $20,000 $10,000 19 96 19 94 19 92 19 90 19 88 19 86 19 84 19 82 19 80 $0 Year Figure 3: Annual national advertising expenditures by medium. The dotted black line illustrates a linear regression for the DirectMail category that provides the basis of growth estimates (see text). 10 Annual Local Advertising Expenditures by Medium $60,000 $40,000 Cable SpotRadio $30,000 Outdoor Newspaper Sum $20,000 $10,000 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985 1984 1983 1982 1981 $0 1980 Expenditures (million $) $50,000 Year Figure 4: Annual local advertising expenditures by medium 11 3 3.1 Strategic Recommendations General Recommendations As analyzed in Section 2, USA Today Online’s operation depends on few and static sources of information (i.e., its input), only produces one product (i.e., the online publication), and generates only one major source of revenue (i.e., its output = advertising revenue). Our general belief is that that such a rigid structure will prove disadvantageous in today’s rapidly changing environment. Therefore, we propose a general shift from this rigid model to a more flexible and diversified model. Both the ’traditional’ model and our suggested model are illustrated in Figure 5. The initial costs to finance this paradigm shift can be offset by the expected increase in advertising income. Traditional Model Advertising Revenues few and static sources of information one source of revenues Associated Press Wire Feed Online Print Publication Self-Generated Content one product Suggested Model many and dynamic sources of information Advertising Revenues, Content Syndication, Classifieds more sources of revenue Associated Press Wire Feed Online Print Publication Self-Generated Content Packaged Content Acquired Content From Different Sources more products Figure 5: The current model of USA Today Online’s operation (i.e., traditional model, upper figure) and our suggested new model (lower figure). We do not recommend immediate horizontal expansion (i.e., diversifying content), because of the potential unfavourable effect on one of the company’s key 12 assets - the brand name. After an initial phase that implemented our general suggestions, we do not object against vertical expansion (i.e., deeper content in USA Today Online’s key segments). 3.2 Content Syndication One of the key features of our proposed strategy is content syndication. We believe that USA Today Online should leverage its in-house generated content in order to create new sources of revenue. As summarized in Table 3, we reserve a major part of the expected revenue growth for the technical and operational (i.e., internal training) costs for this transition. 3.3 Classified Advertising One of the key sources for additional revenue will be classified advertising; a strategy that (at the end of the time covered by the case) seemed promising. Since there are no brand name problems and no problem with channel cannibalization, we recommend this strategy to be continued. 3.4 Lock-In Strategies During the transition period, USA Today Online will still heavily depend on advertising revenue. Since advertising revenue is directly related to ’eyeballs,’ we propose a strategy that produces a subtle lock-in effect for visitors: limited customization and community building in key areas will effectively raise the switching costs for existing customers. Specifically, we propose an expansion of this strategy (limited customization is in place) in the sections Money and Sports. Since customization of ’News’ would go against the company’s roots as a medium of news dissemination (rather than entertainment), we do not recommend this strategy for the section ’News.’ 3.5 Pricing Model The accuracy of the predictions on future page exposures is not mentioned in the case. In case it was significantly below 100%, USA Today Online should revise this model such that they, at the end of each month, charge for the actual number of exposures. 13 3.6 Financial Summary Table 3 effectively summarizes the estimated effect of our strategic recommendations1 . For advertising income, we assumed a 5% growth as calculated in Section 2.5. We assumed a 2% (inflation-based) increase in income or expenses for transaction income, sales and marketing, and general administration. We assumed an annual growth rate for 1997-1999 of 100% for the income coming from the sale of content. We believe that this assumption is valid given the tiny income in 1996 and the strategic focus. In addition, we assumed an 8% increase in and product development and technical and development support due to product development and R&D costs resulting from our strategic recommendations. We found it difficult to estimate the potential additional revenue from classified advertising; we have therefore not included this position in our summary. We also want to note that this projected income has been calculated fairly conservatively. The case does not provide advertising income for the complete year of 1997, but extrapolating the provided eight months to 12 months would represent a growth by far higher than our assumed 5%. Revenues Advertising income Transaction income Sale of content Expenses Sales and marketing Product development Technical/devel. support General administration Net profit before taxes 1996 1997 (est) 1998 (est) 1999 (est) $6,500,000 $500,000 $50,000 $6,800,000 $510,000 $100,000 $7,200,000 $520,200 $200,000 $7,500,000 $530,604 $400,000 $1,000,000 $500,000 $2,100,000 $3,500,000 -$50,000 $1,080,000 $540,000 $2,268,000 $3,570,000 -$48,000 $1,166,400 $583,200 $2,449,440 $3,641,400 $79,760 $1,259,712 $629,856 $2,645,395 $3,714,228 $182,413 Table 3: This table illustrates a sample income statement for 1996-1999. The numbers for 1997-1999 are estimated based on parameters described in the text. 1 We used the provided disguised sample income statement for the 12 months to April 1997 as a measure for the income in 1996 14 4 Executive Summary To conclude our analyses and recommendations: • USA Today Online is a healthy operation with a solid brand name • Changes in the business environment will demand a change in operation and revenue model • General paradigm shift resulting in a more flexible operation • Implementation of strategies that will result in additional revenue streams, without causing channel conflict or cannibalization • Restricted community building and customization to lock-in customers • Hold off on horizontal diversification in order not to dilute brand name 15