H O S P I T A L I T Y - Brinker International

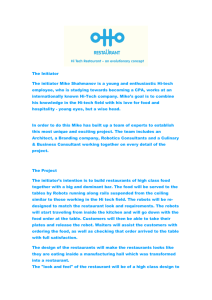

advertisement