Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

CHAPTER 19

PENSIONS AND OTHER EMPLOYEE FUTURE

BENEFITS

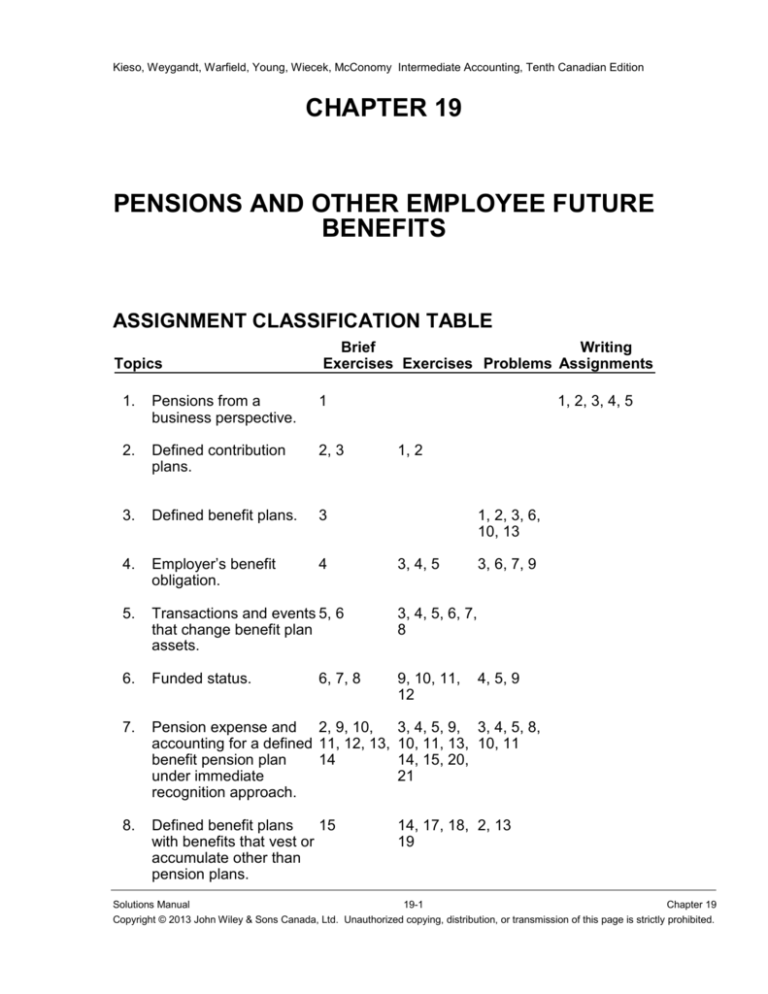

ASSIGNMENT CLASSIFICATION TABLE

Topics

Brief

Writing

Exercises Exercises Problems Assignments

1.

Pensions from a

business perspective.

1

2.

Defined contribution

plans.

2, 3

3.

Defined benefit plans.

3

4.

Employer’s benefit

obligation.

4

5.

Transactions and events 5, 6

that change benefit plan

assets.

3, 4, 5, 6, 7,

8

6.

Funded status.

9, 10, 11,

12

7.

Pension expense and 2, 9, 10,

accounting for a defined 11, 12, 13,

benefit pension plan

14

under immediate

recognition approach.

3, 4, 5, 9, 3, 4, 5, 8,

10, 11, 13, 10, 11

14, 15, 20,

21

8.

Defined benefit plans

15

with benefits that vest or

accumulate other than

pension plans.

14, 17, 18, 2, 13

19

6, 7, 8

1, 2, 3, 4, 5

1, 2

1, 2, 3, 6,

10, 13

3, 4, 5

3, 6, 7, 9

4, 5, 9

Solutions Manual

19-1

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

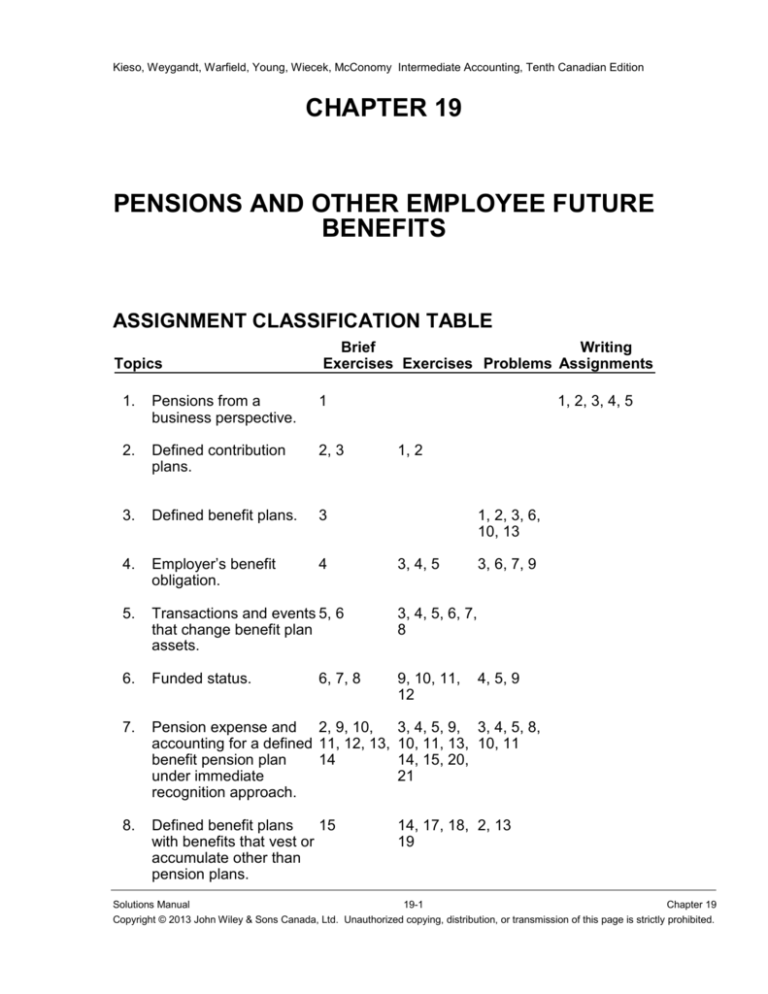

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

ASSIGNMENT CLASSIFICATION TABLE (CONTINUED)

Topics

9.

Brief

Writing

Exercises Exercises Problems Assignments

Presentation and

disclosure.

3, 7, 8, 12, 4, 6, 7

20

10. Differences between

IFRS and ASPE.

9, 10, 11, 5, 8, 10

15, 16, 21

*11. One-person plan.

16

22

1, 6

14

*12. Deferral and

7, 8, 11, 13,5, 7, 8, 9, 2, 4, 5, 6, 7,

amortization approach. 14, 16, 17 10, 11, 12, 8, 9, 10, 11,

15, 16, 20, 12

21, 23

3

*This material is dealt with in an Appendix to the chapter.

Solutions Manual

19-2

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

ASSIGNMENT CHARACTERISTICS TABLE

Item

E19-1

E19-2

E19-3

E19-4

E19-5

E19-6

E19-7

E19-8

E19-9

E19-10

E19-11

E19-12

E19-13

E19-14

E19-15

E19-16

E19-17

E19-18

E19-19

E19-20

E19-21

*E19-22

E19-23

Description

Defined Contribution Plan.

Defined Contribution Plan.

Calculation of pension expense – IFRS.

Preparation of work sheet for E19-3.

Defined benefit plan – Immediate Recognition

versus Deferral and Amortization.

Calculation of actual return.

Deferral and Amortization.

Pension work sheet for E19-7.

Immediate Recognition..

Calculation of pension expense.

Calculation of pension expense and journal

entries.

Calculation of pension expense, journal entries

and disclosures.

Calculation of pension expense.

Post-retirement benefit expense.

Calculation of pension expense.

Actuarial gains and losses..

Post-retirement benefit expense..

Post-retirement benefit work sheet.

Post-retirement benefit reconciliation schedule.

Pension calculations and disclosures.

Accounting for past service costs.

Calculation of current service cost and ABO –

one person plan.

Corridor approach.

Level of

Time

Difficulty (minutes)

Simple

Simple

Moderate

Moderate

Moderate

5-10

10-15

15-20

15-25

25-30

Simple

Moderate

Moderate

Moderate

Simple

Moderate

10-15

35-45

30-35

30-35

10-15

25-35

Moderate

20-25

Simple

Moderate

Moderate

SImple

SImple

Simple

Simple

Moderate

Moderate

Moderate

5-10

30-35

20-30

15-20

10-12

15-20

10-15

25-35

25-30

25-30

Moderate

20-25

Solutions Manual

19-3

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

ASSIGNMENT CHARACTERISTICS TABLE (Continued)

Item

P19-1

P19-2

P19-3

P19-4

P19-5

P19-6

P19-7

P19-8

P19-9

P19-10

P19-11

P19-12

P19-13

*P19-14

Description

Journal entries for a long-term disability benefit.

Defined benefit plan for sabbatical leave.

Immediate Recognition Approach under IFRS Three-year continuity schedules, journal entries,

and statement presentation.

Comparison of Deferral and Amortization

Approach under ASPE vs. Immediate

Recognition Approach under IFRS.

ASPE versus IFRS – DPB analysis.

DPB – ASPE deferral and amortization approach

Deferral and Amortization Approach - Pension

expense, journal entries, note disclosure and

worksheet.

Calculation of past service cost amortization,

journal entries, net gain or loss and amortization,

and determination of funded status under

Deferral and Amortization versus Immediate

Recognition Approach.

Deferral and Amortization versus Immediate

Recognition Approach – options available for

actuarial gains/losses.

Funded status for DPB under Immediate

Recognition (IFRS) versus Deferral and

Amortization (ASPE) versus Immediate

Recognition Approach (ASPE).

Comprehensive work sheet and journal entries.

Comprehensive pension work sheet and journal

entries.

Post-retirement benefit expense, amortization of

transitional amount, and continuity of ABO and

plan assets.

Calculation of DBO and past service cost – one

person plan

Level of

Time

Difficulty (minutes)

Moderate

Complex

Complex

20-25

35-45

45-55

Moderate

40-50

Complex

Complex

Complex

40-50

45-55

45-55

Complex

45-60

Moderate

35-45

Complex

45-60

Complex

Moderate

40-45

30-35

Moderate

30-35

Complex

40-45

Solutions Manual

19-4

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

SOLUTIONS TO BRIEF EXERCISES

BRIEF EXERCISE 19-1

(a)

With $6 million in total assets less $6.5 million in total

liabilities, the company’s statement of financial position as

of December 31, 2014 shows total shareholders’ equity of

$(0.5 million). With annual pension expense of $2 million in

2014, it appears that the pension plan caused profit and

retained earnings to decrease by $2 million in 2014, and

caused retained earnings to decrease to a deficit and

shareholders’ equity to become negative. The pension plan

is underfunded by $1.5 million ($7.5 million obligation less

$6 million fair value of plan assets) as of December 31,

2014, resulting in a net defined benefit liability of $1.5

million. The net defined benefit liability represents 23% of

total liabilities, and will affect the company’s solvency

ratios such as debt to total assets ratio.

(b)

In addition to the cash contributions the company makes

to the plan, the company incurs the cost of administering

the plan, the opportunity cost of using the cash for other

purposes in the business, and the potentially higher

financing costs due to higher solvency risk as a result of

the underfunded pension plan.

Solutions Manual

19-5

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

BRIEF EXERCISE 19-2

(a)

IFRS

Past service cost recognized immediately in expense

Current service cost ($2,732,864 * 3%)

$845,350

81,986

Pension expense for 2014

$927,336

(b)

ASPE

Past service cost amortized over five years

($845,350 / 5 years)

Current service cost ($2,732,864 * 3%)

$169,070

81,986

Pension expense for 2014

$251,056

Solutions Manual

19-6

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

BRIEF EXERCISE 19-3

A Defined Contribution Plan (DC)

A defined contribution (DC) plan is a post-employment benefit

plan that specifies how the entity’s contributions or payments

into the plan are determined, rather than identifying what

benefits will be received by the employee or the method of

determining those benefits.

For a DC pension plan, the amounts that are contributed are

usually turned over to an independent third party or trustee who

acts on behalf of the beneficiaries (the participating employees).

The trustee assumes ownership of the pension assets and is

responsible for their investment and distribution. The trust is

separate and distinct from the employer.

The ultimate risks and rewards of the DC pension plan rests with

the employees as the employer’s involvement is essentially

limited to making the annual contribution each year.

Therefore, the accounting for a DC pension plan is relatively

straight-forward. The employer’s obligation is dictated by the

amounts to be contributed. Therefore, a liability is reported on

the employer’s statement of financial position only if the

required contributions have not been made in full, and an asset

is reported if more than the required amount has been

contributed.

The annual benefit cost (i.e., the pension expense) is simply the

amount that the company is obligated to contribute to the plan.

Solutions Manual

19-7

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

BRIEF EXERCISE 19-3 (Continued)

A Defined Benefit (DB) Plan

A defined benefit (DB) plan is any benefit plan that is not a

defined contribution plan. It is a plan that specifies either the

benefits to be received by an employee or the method of

determining those benefits.

Similar to a DC plan, for a DB pension plan, the amounts that are

contributed are usually turned over to an independent third

party or trustee who acts on behalf of the beneficiaries.

The ultimate risks and rewards of the DB pension plan rests with

the employer since the employer must guarantee that a set

retirement benefit will be paid to the employees. The benefits

typically are a function of an employee’s years of service and

compensation level in the years approaching retirement.

To ensure that appropriate resources are available to pay the

benefits at retirement, there is usually a requirement that funds

be set aside during the service life of the employees.

Therefore, accounting for a DB pension plan is much more

complex. The pension cost and defined benefit obligation

depends on many factors such as employee turnover, mortality,

length of service, and compensation levels, as well as

investment returns that are earned on pension assets, inflation,

and other economic conditions over long periods of time.

Because the cost to the company is affected by a wide range of

uncertain future variables, it is not easy to measure the pension

cost and liability that have to be recognized each period as

employees provide services to earn their pension entitlement.

Note: This is not intended to be a comprehensive discussion of

all issues associated with the DB pension plan, but rather, to

highlight some of the key differences between a DB and DC

pension plan.

Solutions Manual

19-8

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

BRIEF EXERCISE 19-4

Defined benefit obligation, opening balance

Interest cost

Current service cost

Benefits paid to retirees

Past service cost

Defined benefit obligation, ending balance

$92

9

21

(8)

13

$127

BRIEF EXERCISE 19-5

Ending plan assets

Beginning plan assets

Increase in plan assets

Deduct: Contributions

Less: benefits paid

Actual return on plan assets

$1,750,000

1,350,000

400,000

$170,000

(140,000)

(30,000)

$ 370,000

BRIEF EXERCISE 19-6

Plan assets, opening balance

Actual return on plan assets

Contributions from employer

Benefits paid to retirees

Plan assets, ending balance

Defined benefit obligation (BE 19-4)

Plan assets at fair value

Plan’s funded status

$100

11

20

(8)

$123

$(127)

123

$ (4)

Since the defined benefit obligation exceeds the plan assets, the

plan is underfunded.

Solutions Manual

19-9

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

BRIEF EXERCISE 19-7

Accrued benefit obligation

Fair value of plan assets

Funded status – net liability

Unrecognized past service cost (debit)

Net defined benefit (liability)/asset

$3,400,000

2,420,000

980,000

990,000

$ 10,000

BRIEF EXERCISE 19-8

Current service cost

Interest on ABO

Expected return on plan assets

Amortization of unrecognized prior service cost

Amortization of unrecognized net actuarial loss

Pension expense

$29,000

22,000

(20,000)

15,200

500

$46,700

BRIEF EXERCISE 19-9

Past service cost

Current service cost

Interest cost

Expected return on plan assets using discount rate

$35

19

11

(11)

Pension expense

$54

Remeasurement gain or loss (OCI):

Actuarial loss on fund assets ($11 - $9)

Actuarial loss on DBO

$2

15

Total remeasurement loss – OCI

$17

Under IFRS, the pension plan results in total pension expense

and decrease in net income and shareholders’ equity of $54, and

total remeasurement loss – OCI and decrease in accumulated

other comprehensive income of $17.

Solutions Manual

19-10

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

BRIEF EXERCISE 19-10

Current service cost

Interest cost ($210,000 X 10%)

Expected return on plan assets using discount rate

[$200,000 + ($77,000 X 6/12)] X 10%

(23,850)

Pension expense

$55,150

Remeasurement gain or loss (OCI):

Actuarial gain on fund assets ($25,000 - $23,850)

Actuarial loss on DBO

Total remeasurement loss – OCI

$58,000

21,000

$(1,150)

14,000

$12,850

Under IFRS, the pension plan results in total pension expense

and a related decrease in net income and shareholders’ equity of

$55,150, and a total remeasurement loss – OCI and decrease in

accumulated other comprehensive income of $12,850.

Solutions Manual

19-11

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

BRIEF EXERCISE 19-11

(a) IFRS

UDDIN CORPORATION

General Journal Entries

Memo Record

RemeasuNet Def.

rement

Annual

Benefit

Defined

(Gain)

Pension

Liability/

Benefit

Plan

Loss- OCI Expense

Cash

Asset

Obligation Assets

-0250,000 Cr 250,000 Dr

27,500 Dr

27,500 Cr

25,000 Cr

25,000 Dr

25,000 Cr

25,000 Dr

Items

1/1/13

Service cost

Interest cost

Exp. return

Remeasurement

5,000 Cr

gain

5,000 Dr

29,000 Cr

Past svce cost

29,000 Dr.

20,000 Dr

Contributions

20,000 Cr

17,500 Dr 17,500 Cr

Benefits Paid

000 Dr29,

51,500 Cr

Exp. Entry

5,000 Cr 56,500 Dr

Contr. entry

20,000 Cr 20,000 Dr

Bal. 12/31/13

31,500 Cr 314,000 Cr 282,500 Dr

Solutions Manual

19-12

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

BRIEF EXERCISE 19-11 (Continued)

(b) ASPE

UDDIN CORPORATION

General Journal Entries

Memo Record

Net Def.

Annual

Benefit

Accrued

Liability/

Pension

Benefit

Plan

Items

Expense

Cash

Asset

Obligation Assets

1/1/13

250,000 Cr 250,000 Dr

Service cost

27,500 Dr

27,500 Cr

25,000 Cr

Interest cost 25,000 Dr

Exp. return

25,000 Cr

25,000 Dr

Asset gain

5,000 Dr

29,000 Cr

0

Past svce cost

0,0

20,000 Dr

Contributions

20,000 Cr

17,500 Dr 17,500 Cr

Benefits Paid

00 Dr

Exp. Entry

000

000,

27,500 Dr 00,000 Dr 27,500 Cr

Contr. entry

,000 Cr

000 Cr

20,000 Cr 20,000 Dr

Bal. 12/31/13

7,500 Cr 314,000 Cr 282,500 Dr

Unrecog- Unamornized

tized

Past Svce. Actuarial

Cost

Gain

5,000 Cr

29,000 Dr

29,000 Dr

Solutions Manual

19-13

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

5,000 Cr

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

BRIEF EXERCISE 19-12

Current service cost

Interest on ABO

Actual return on plan assets

Pension expense

$27,500

25,000

(30,000)

$22,500

BRIEF EXERCISE 19-13

(a)

Under IFRS, only the immediate recognition approach is

permitted and past service costs are recognized immediately in

net income. Therefore, the entire $1,125,000 will be included in

pension expense for 2013.

(b)

Under the ASPE deferral and amortization approach, the

$1,125,000 of past service costs is amortized to expense over 15

years, which is the expected period of benefit from the time of

adoption or amendment until the employees are eligible for the

plan’s full benefits. Therefore, the portion of past service costs

included in the 2013 pension expense is $75,000 ($1,125,000 /

15).

Solutions Manual

19-14

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

BRIEF EXERCISE 19-14

Based on the actuarial report, there is a $31,300 actuarial loss.

(a)

Under IFRS, the entire $31,300 actuarial loss is recognized

immediately in other comprehensive income.

(b)

Under ASPE, there are two options available to account for

the actuarial loss:

•Deferral and amortization approach: the $31,300

actuarial loss can remain unrecognized until the total

unrecognized gain/(loss) exceeds the corridor

amount; however, a larger amount can be

recognized, even to the extent of immediate

recognition.

•Immediate recognition approach: the entire $31,300

actuarial loss is recognized immediately in net

income.

BRIEF EXERCISE 19-15

Current service cost

Interest cost

Expected return on plan assets

Post-retirement expense

$80,000

65,500

(48,000)

$97,500

Solutions Manual

19-15

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

BRIEF EXERCISE 19-16

Pension expense for 2013 related to past service costs:

Past service costs

Average years full eligibility of employee group

Amortization per year

$775,000

÷

17.5

$ 44,286

BRIEF EXERCISE 19-17

Unrecognized net actuarial loss

Corridor (10% X $3,300,000)

Excess

Average remaining service life

Minimum amortization

$475,000

330,000

145,000

÷

7.5

$ 19,333

Solutions Manual

19-16

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

SOLUTIONS TO EXERCISES

EXERCISE 19-1 (5-10 minutes)

(a) Pension Contributions Payable ...................... 26,300

Cash .........................................................

26,300

(b) Pension Expense for December 2014:

$276,100 x 5% = $13,805

(c) Current liability:

Pension Contributions Payable ($13,805 x 2)

$ 27,610

This assumes amounts for previous months were remitted

as required each month. At December 31, 2014 all that

remains payable is the amount withheld from employees in

December and the required employer matching amount.

EXERCISE 19-2

(a) Pension Expense ............................................. 135,000

([$2,000 x 40] + [$1,000 x 55]) = $135,000

(b) Pension Expense ............................................. 135,000

Employee Pension Contributions Payable

35,000

Cash .........................................................

170,000

Employer portion: ([$2,000 x 40] + [$1,000 x 55]) = $135,000

Employee contribution: ([$2,000 x 10] + [$1,000 x 15]) = $35,000

(the $35,000 would have been included as a payable at the time

that the related Salaries and Wages Expense was calculated).

Solutions Manual

19-17

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 19-3 (15-20 minutes)

(a) Defined benefit obligation, 1/1/14

Interest cost ($2,000,000 x 10%)

Current service cost

Past service cost

Benefits paid out

DBO, 12/31/14

$2,000,000

200,000

225,000

25,000

(100,000)

$2,350,000

(b) Plan assets, 1/1/14

Actual return on plan assets

Contributions

Benefits paid out

Plan assets, 12/31/14

$1,600,000

160,000

262,500

(100,000)

$1,922,500

(c) Pension expense 2014:

Current service cost

Interest cost on DBO ($2,000,000 x 10%)

Actual return on plan assets

Past service cost

Pension expense for 2014

$225,000

200,000

(160,000)

25,000

$290,000

(d) Pension Expense ......................................... 290,000

Net Defined Benefit Liability/Asset ......

290,000

Net Defined Benefit Liability/Asset ............. 262,500

Cash........................................................

262,500

(e) Net defined benefit liability/(asset), 1/1/14

Contributions

Pension expense

Net defined benefit liability/(asset), 12/31/14

$ 400,000

(262,500)

290,000

$ 427,500

Alternatively, the amount could also be reconciled as follows:

Defined benefit obligation

$(2,350,000)

Plan assets at fair value

1,922,500

DBO in excess of plan assets (funded status) or

Net defined benefit (liability)/asset

$(427,500)

Solutions Manual

19-18

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

Solutions Manual

19-19

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 19-4 (15-25 minutes)

(a)

Rebek Corporation

Pension Work Sheet—2014

General Journal Entries

Annual

Net Def.

Pension

Benefit

Expense

Cash

Liab/Asset

Balance, 01/01/2014

Service cost

*Interest cost

Actual return

Past service cost

Contributions

Benefits paid

Journal entry

Balance, 01/31/2014

*

400,000 Cr.

225,000 Dr.

200,000 Dr.

160,000 Cr.

25,000 Dr.

000,000 Dr.

290,000 Dr.

Memo Record

Defined

Benefit

Plan

Obligation

Assets

2,000,000 Cr.

225,000 Cr.

200,000 Cr.

160,000 Dr.

25,000 Cr.

262,500 Cr.

000,000 Dr.

262,500 Cr.

27,500 Cr.

427,500 Cr.

100,000 Dr.

000,000 Dr.

2,350,000 Cr.

$200,000 = $2,000,000 X 10%.

Calculation of funded status

Defined benefit obligation

Plan assets at fair value

Funded status

1,600,000 Dr.

$(2,350,000)

1,922,500

$(427,500)

Solutions Manual

19-20

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

262,500 Dr.

100,000 Cr.

000,000 Dr.

1,922,500 Dr.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 19-4 (Continued)

(b) Pension Expense ......................................... 290,000

Net Defined Benefit Liability/Asset ......

290,000

Net Defined Benefit Liability/Asset ............. 262,500

Cash........................................................

262,500

Solutions Manual

19-21

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 19-5 (25-30 minutes)

(a) Assume that the company uses the immediate recognition approach under IFRS:

Defined

benefit

obligation

Pension plan

assets

Funded

status*

Pension

expense

Current service cost

Actual return on plan

assets

I

NE

NE

I or D,

depending

on whether it

is positive (I)

or negative

(D)

Expected return on plan

assets

Past service costs on date

of plan revision (inception)

Actuarial gain

Actuarial loss

Employer contributions

Benefits paid to retirees

An increase in the average

life expectancy of

employees.

NE

NE

D

I

I or D,

NE

depending

on

whether it

is positive

(I) or

negative

(D)

NE

D

I

NE

D

I

D

I

NE

D

I

NE

NE

I

D

NE

I

D

I

NE

D

NE

NE

NE

NE

NE

Remeasurement

Gain

(Loss) OCI

NE

NE

NE

NE

I

D

NE

NE

D as this

is an

actuarial

loss

*Assumes an increase in the DBO decreases the funded status and that an increase in

the pension plan assets increases the funded status.

Solutions Manual

19-22

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 19-5 (Continued)

(b) Assume that the company uses the deferral and amortization approach under

ASPE:

Current service cost

Actual return on plan assets

Expected return on plan

assets

Past service costs on date of

plan revision (inception)

Amortization of past service

costs

Actuarial gain/loss

Amortization of actuarial gain

or loss

Employer contributions

Benefits paid to retirees

An increase in the average

life expectancy of employees.

Accrued

benefit

obligation

I

NE

Pension plan

assets

Funded

status*

Pension

expense

D

I or D,

depending

on whether

it is positive

(I) or

negative (D)

NE

I

NE

NE

NE

I or D,

depending

on whether it

is positive (I)

or negative

(D)

NE

I

NE

D

NE

NE

NE

NE

I

D/I

NE

NE

NE

I/D

NE

NE

D

I

I

D

NE

I

NE

D

NE

D (gain)

I (loss)

NE

NE

NE

D

*Assumes an increase in the ABO decreases the funded status and that an increase in

the pension plan assets increases the funded status.

Solutions Manual

19-23

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 19-6 (10-15 minutes)

Calculation of Actual Return on Plan Assets

Fair value of plan assets at 12/31/14

$1,596,875

Fair value of plan assets at 1/1/14

1,418,750

Increase in fair value of plan assets

178,125

Deduct: Contributions to plan during 2014 $212,500

Less: benefits paid during 2014

218,750

6,250

Actual return on plan assets for 2014

$ 184,375

Solutions Manual

19-24

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 19-7 (35-45 minutes)

(a) Actual = (Ending – Beginning) – (Contributions – Benefits)

Fair value of plan assets,

December 31, 2013

$2,096

Deduct: Fair value of plan assets,

January 1, 2013

1,360

Increase in fair value of plan assets

736

Deduct: Contributions

$640

Less: benefits paid

160

480

Actual return on plan assets in 2013

$ 256

(b) Calculation of pension liability gains and losses and pension

asset gains and losses.

1.

Difference between 12/31/13 actuarially calculated ABO and

12/31/13 recorded Accrued benefit obligation (ABO):

ABO at end of year

$2,916

ABO per memo records:

1/1/13 ABO

$2,240

Add interest (10%)

224

Add service cost

320

Less benefit payments

(160)

2,624

Liability loss

$292

2.

Difference between actual fair value of plan

assets and expected fair value:

12/31/13 actual fair value of plan assets

$2,096

Expected fair value

1/1/13 fair value of plan assets $1,360

Add expected return

($1,360 X 10%)

136

Add contributions

640

Less benefits paid

(160)

1,976

Asset gain

(120)

Unrecognized net actuarial (gain) or loss

$ 172

Solutions Manual

19-25

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 19-7 (Continued)

(c) Because no net actuarial gain or loss existed at the beginning

of the period, no actuarial gain or loss amortization occurs.

Therefore, the corridor calculation is not needed.

In 2014, the amortization of the actuarial loss will be as follows:

Beginning-of-the-Year

Year

ABO

Plan

Assets

(FV)

2014

$2,916

$2,096

10%

Corridor

Unrecognized

Net Loss

Loss

Amortization

$292

$172

–0–

(d) Past service cost amortization:

$880 X 1/20 = $44 per year.

(e) Pension expense for 2013:

Service cost

Interest cost ($2,240 X 10%)

Expected return on plan assets ($1,360 X 10%)

Amortization of past service cost

Pension expense for 2013

(f)

Reconciliation schedule:

Accrued benefit obligation

Fair value of plan assets

Funded status

Unrecognized past service cost

($880 – $44)

Unrecognized net actuarial (gain) or loss

Net defined benefit (liability)/asset

$320

224

(136)

44

$452

$(2,916)

2,096

(820)

(836

172

$ 188

Solutions Manual

19-26

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy Intermediate Accounting, Tenth Canadian Edition

EXERCISE 19-8 (30-35 minutes)

(a)

Berstler Limited

Pension Work Sheet—2013

General Journal Entries

Items

Balance, Jan. 1, 2013

(a) Service cost

(b) Interest cost

(c) Expected return

(d) Unexpected gain

(e) Amortization of PSC

(f) Contributions

(g) Benefits paid

(h) Liability loss

(increase)

Expense entry—2013

Contributions

Balance, Dec. 31, 2013

(b)

(c)

(d)

(e)

(h)

Annual

Pension

Expense

Cash

Net Def.

Benefit

Liability/

Asset

Memo Record Entries

Accrued

Benefit

Obligation

2,240 Cr.

320 Cr.

224 Cr.

320 Dr.

224 Dr.

136 Cr.

Plan

Assets

1,360 Dr.

Unrecognized

Past

Service Cost

Unrecognized

Net Actuarial

Gain

or Loss

880 Dr.

136 Dr.

120 Dr.

120 Cr.

44 Dr.

44 Cr.

640 Cr.

000 Dr. 000 Dr.

452 Dr.

640 Cr.

452 Cr.

640 Dr.

188 Dr.

160 Dr.

640 Dr.

160 Cr.

292 Cr.

0,000 Cr.

0,000 Cr.

0,000 Cr.

292 Dr.

000 Dr.

2,916 Cr.

2,096 Dr.

836 Dr.

172 Dr.

$2,240 X 10%

$136 = $1,360 X 10%

$120 = $2,096 – ($1,360 + $136 + $640 - $160)

$880 X 1/20 = $44

$292 = $2,916 – ($2,240 + $320 + $224 – $160)

Solutions Manual

19-27

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 19-8 (Continued)

(b)

Journal entries 12/31/13

Pension Expense....................................................

Net Defined Benefit Liability/Asset ................

452

Net Defined Benefit Liability/Asset .......................

Cash .................................................................

640

(c) Reconciliation schedule:

Accrued benefit obligation

Fair value of plan assets

Funded status

Unrecognized past service cost

($880 – $44)

Unrecognized net actuarial (gain) or loss

Net defined benefit (liability)/asset

452

640

$(2,916)

2,096

(820)

(836

172

$ 188

Solutions Manual

19-28

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 19-9 (30-35 minutes)

(a) Accrued benefit obligation, 1/1/13

Past service cost

Interest cost ($330,000 x 9%)

Current service cost

Benefits paid out

ABO, 12/31/13

$280,000

50,000

330,000

29,700

29,000

(20,000)

$368,700

(b) Plan assets, 1/1/13

Actual return on plan assets

Contributions

Benefits paid out

Plan assets, 12/31/13

$273,100

26,140

27,500

(20,000)

$306,740

(c) Pension expense 2013:

Current service cost

Interest cost ($330,000 x 9%)

Actual return on plan assets

Past service cost

$ 29,000

29,700

(26,140)

50,000

$ 82,560

Pension Expense .........................................

Net Defined Benefit Liability/Asset.......

82,560

82,560

Additionally, though not required, the entry to record the

company’s 2013 contribution:

Net Defined Benefit Liability/Asset .............

Cash........................................................

27,500

(d) Plan’s Funded Status

ABO, 12/31/13

Plan assets, 12/31/13

Balance of Net Defined Benefit Liability/(Asset)

on the statement of financial position

27,500

$368,700

306,740

$ 61,960

Solutions Manual

19-29

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 19-9 (Continued)

(e) Pension expense 2013:

Current service cost

Interest cost ($330,000 x 9%)

Expected return on plan assets (9% of $273,100)

Amortization of past service cost ($50,000 / 5)

$29,000

29,700

(24,579)

10,000

$44,121

(f) Deferral and amortization pension expense:

Deduct: amortization of past service cost

Add: 100% of past service cost

Add: Expected return on plan assets

Deduct: Actual return on plan assets

$44,121

(10,000)

50,000

24,579

(26,140)

$82,560

(g) Under the immediate recognition approach, pension

expense increases and net income decreases by $82,560,

and net defined benefit liability increases by $55,060

($82,560 - $27,500). Under the deferral and amortization

approach, pension expense increases and net income

decreases by $44,121, and net defined benefit liability

increases by $16,621 ($44,121 - $27,500). In this case, the

immediate recognition approach will result in lower

profitability ratios (such as return on assets and return on

equity), and weaker solvency ratios (such as debt to total

assets and cash debt coverage ratio), compared to the

deferral and amortization approach. A creditor should

review the notes to the financial statements describing the

company’s accounting policies related to its pension plan,

and note the effect of the accounting policies on the

company’s financial statements and ratios.

Solutions Manual

19-30

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 19-10 (10-15 minutes)

(a) Calculation of pension expense under IFRS using the

immediate recognition approach:

Service cost

$65,000

Interest cost ($500,000 X .10)

50,000

Expected return on plan assets (discount rate)

(15,000)

Pension expense for 2013

$100,000

Pension Expense ............................................ 100,000

Remeasurement Gain - OCI ....................

2,000*

Net Defined Benefit Liability/Asset ........

98,000

*Actuarial gain on assets = $17,000 - $15,000

Net Defined Benefit Liability/Asset ................ 95,000

Cash .........................................................

95,000

(b) Calculation of pension expense under ASPE using the

deferral and amortization approach:

Service cost

$ 65,000

Interest cost ($500,000 X .10)

50,000

Expected return on plan assets

(15,000)

Pension expense for 2013

$100,000

Pension Expense ............................................ 100,000

Net Defined Benefit Liability/Asset ........

100,000

Net Defined Benefit Liability/Asset ................ 95,000

Cash .........................................................

95,000

Solutions Manual

19-31

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 19-11 (25-35 minutes)

(a) Accrued benefit obligation, 1/1/13

Past service cost

Interest cost ($455,400 x 10%)

Current service cost

Benefits paid out

ABO, 12/31/13

$315,000

140,400

455,400

45,540

63,000

(43,200)

$520,740

Plan assets, 1/1/13

$297,000

Actual return on plan assets ($297,000 x 8%)

23,760*

Contributions

79,200

Benefits paid out

(43,200)

Plan assets, 12/31/13

$356,760

*Note: expected return = 7%X $297,000 = $20,790, therefore

there is an actuarial gain on the assets of $23,760 - $20,790 =

$2,970.

Amount of Net Defined Benefit Liability/Asset on the balance

sheet:

Accrued benefit obligation

Plan assets at fair value

ABO in excess of plan assets

Unrecognized past service cost

$112,320

Unrecognized actuarial gain

( 2,970)

Net defined benefit (liability)/asset

(b) Pension expense 2013:

Current service cost

Interest cost ($455,400 x 10%)

Expected return on plan assets (7% of $297,000)

Amortization of past service cost ($140,400 / 5)

$(520,740)

356,760

(163,980)

109,350

($54,630)

$ 63,000

45,540

(20,790)

28,080

$115,830

Solutions Manual

19-32

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 19-11 (Continued)

(c) Accrued benefit obligation, funding basis, 1/1/13

Past service cost

Interest cost ($395,400 x 10%)

Current service cost

Benefits paid out

ABO, 12/31/13

$255,000

140,400

395,400

39,540

63,000

(43,200)

$454,740

Plan assets, 1/1/13

Actual return on plan assets ($297,000 x 8%)

Contributions

Benefits paid out

Plan assets, 12/31/13

$297,000

23,760

79,200

(43,200)

$356,760

Amount Reported on the balance sheet:

Accrued benefit obligation

Plan assets at fair value

Funded status and Net defined benefit

(liability)/asset

(d) Pension expense 2013:

Current service cost

Interest cost ($395,400 x 10%)

Actual return on plan assets

Past service cost

$(454,740)

356,760

($97,980)

$ 63,000

39,540

(23,760)

140,400

$219,180

Solutions Manual

19-33

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 19-12 (20-25 minutes)

(a) Pension expense for 2013 comprised the following:

Current service cost

$ 56,000

Interest on accrued benefit obligation

90,000

(9% X $1,000,000)

(54,000)

Expected return on plan assets

Amortization of past service cost

40,000

Pension expense

$132,000

(b) Pension Expense ............................................ 132,000

Net Defined Benefit Liability/Asset ........

132,000

Net Defined Benefit Liability/Asset ................ 145,000

Cash .........................................................

145,000

(c) Accrued benefit obligation (credit) (1)

$(1,146,000)

Plan assets at fair value (debit) (2)

799,000

ABO in excess of plan assets (or funded status)

(347,000)

Unrecognized past service cost (debit):

Beginning balance, 1/1/13

$400,000

Less amortization

(40,000)

360,000

Net defined benefit asset

$ 13,000

(1) Accrued benefit obligation 31/12/13: $1,000,000 +

$56,000 + $90,000 = $1,146,000

(2) Plan assets 31/12/13: $600,000 + $54,000 + $145,000

= $799,000

Solutions Manual

19-34

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 19-12 (Continued)

(d) Income Statement:

Pension expense

Balance Sheet:

Assets

Net defined benefit asset

$132,000

$13,000

Note X: The company sponsors a defined benefit pension

plan covering the following group of employees and

providing the following benefits.

For the year ending December 31, 2014, the net expense for

the company’s pension plan is $132,000. The present value

of the accrued benefit obligation at December 31, 2014, is

$1,146,000 and the market related value of the fund assets is

$799,000 based on the fair market value of the assets on that

date. This results in an underfunded obligation of $347,000.

Employer and employee contributions during 2014

amounted to $145,000 and no benefits were paid out. At

December 31, 2014, the accrued pension cost asset is

$13,000.

Other information to be disclosed:

assumptions that

underlie the plan such as the discount rate, the rate of

increase in compensation levels, and the expected longterm rate of return on plan assets, as well as significant

accounting policies governing the pension plan.

(e) Accrued benefit obligation 1/1/13 (credit)

$(1,000,000)

Plan assets at fair value 1/1/13 (debit)

600,000

ABO in excess of plan assets (or funded status)

(400,000)

Unrecognized past service cost 1/1/13 (debit)

400,000

Net defined benefit liability/asset, 1/1/13

$

0

Solutions Manual

19-35

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 19-13 (5-10 minutes)

Pension expense 2014 – to net income:

Current service cost

$ 13,000

Interest on ABO (10% of $176,000 + $34,000)

21,000

Expected return on plan assets (10% of $155,000) (15,500)

Past service cost

34,000

$ 52,500

Solutions Manual

19-36

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 19-14 (30-35 minutes)

(a) Service cost

Interest on defined post-retirement benefit

obligation (10% X $110,000)

Expected return on plan assets – 10%

Post-retirement benefit expense 2014

$ 57,000

11,000

(4,200)

$63,800

(b) Actuarial loss on assets (3,000 – 4,200)

Actuarial loss on obligation

Post-retirement benefit remeasurement

loss – OCI

$1,200

31,000

$32,200

(c) Plan assets, 1/1/14

Actual return on plan assets

Contributions

Benefits paid out

Plan assets, 12/31/14

$42,000

3,000

22,000

(6,000)

$61,000

Defined post-retirement benefit obligation, 1/1/14

$110,000

Interest cost ($110,000 x 10%)

11,000

Service cost

57,000

Actuarial loss

31,000

Benefits paid out

(6,000)

Defined post-retirement benefit obligation,12/31/14 $203,000

Defined post-retirement benefit obligation,12/31/14 $(203,000)

Plan assets at fair value

61,000

Defined post-retirement benefit obligation in

excess of plan assets (funded status)

$(142,000)

(d) Net post-retirement benefit liability/(asset), 1/1/14

$ 68,000

Post-retirement benefit expense 2014

63,800

Remeasurement loss –OCI

32,200

Contributions (funding) during 2014

(22,000)

Net post-retirement benefit liability/(asset),12/31/14 $142,000

(e) There is no need to reconcile – these two now have the

same balance.

Solutions Manual

19-37

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

Solutions Manual

19-38

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 19-15 (20-30 minutes)

(a)

Yorke Inc.

Pension Work Sheet—2013

General Journal Entries

Items

Balance, January 1, 2013

(a) Service cost

(b) Interest cost

(c) Expected return

(d) Gain on plan assets

(e) Contributions

(f) Benefits

Journal entry, December 31

Balance, Dec. 31, 2013

Annual

Pension

Expense

Cash

Net Def.

Ben. Liab/

Asset

40,000 Dr.

41,650 Dr.

41,650 Cr.

00,000 Dr.

40,000 Dr.

30,000 Cr.

00,000 Dr.

30,000 Cr.

10,000 Cr.

10,000 Cr.

Memo Record

Defined

Benefit

Obligation

490,000 Cr.

40,000 Cr.

41,650 Cr.

33,400 Dr.

000,000 Dr.

538,250 Cr.

Plan

Assets

490,000 Dr.

41,650 Dr.

8,050 Dr.

30,000 Dr.

33,400 Cr.

000,000 Dr.

536,300 Dr.

Unrecognized

Gain

(Loss)

8,050 Cr.

0,000

8,050 Cr.

(b) $41,650 = $490,000 X .085.

(c) $41,650 = $490,000 X .085.

(d) $8,050 = $49,700 – $41,650.

Yorke Inc.

Pension Work Sheet—2008

General Journal Entries

Solutions Manual

19-39

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

1.1.1.1 Items

Annual

Pension

Actuarial

Gain in

Pension

Funded

Status

Memo Record

Chapter 19

Accrued

Benefit

Plan

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 19-15 (Continued)

Pension expense 2013:

Service cost

Interest on defined benefit obligation

(8.5% X $490,000)

Expected return on plan assets (8.5% X $490,000)

$ 40,000

41,650

(41,650)

$ 40,000

Pension Expense.................................................

Net Defined Benefit Liability/Asset .............

40,000

Net Defined Benefit Liability/Asset ....................

Cash ..............................................................

30,000

40,000

30,000

These calculations could be completed through a worksheet as

shown on the previous page.

(b) If the immediate recognition approach was used under IFRS,

the following changes to the calculation of pension expense in

part (a) would be required:

1. The $8,050 difference between the actual return on plan

assets of $49,700 and the return on the asset portion of

the net interest cost of 8.5% X $490,000 or $41,650, would

be recorded in the books of the company as a credit to

Remeasurement (Gain) Loss – OCI and a debit to Net

Defined Benefit Liability/Asset. Therefore, the pension

expense included in net income under IFRS is still

$40,000, but there is also a $8,050 remeasurement gain

recognized in OCI.

2. The Net Defined Benefit Liability/Asset under IFRS is

$8,050 less than under ASPE as the $8,050 benefit is

“booked.” The balance of the Net Defined Benefit

Liability/Asset is therefore $10,000 - $8,050 = $1,950

credit.

Solutions Manual

19-40

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 19-15 (Continued)

Note: In addition, under IFRS the discount rate used for the

obligation is also used for the reduction in benefit expense

due to the return on plan assets. i.e., it is used to calculate the

net interest cost. In this case, co-incidentally, the expected

rate of 8.5% is the same as the discount rate, but often would

not be.

Solutions Manual

19-41

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 19-16 (15-20 minutes)

(a) The excess of cumulative net gain or loss over the corridor

amount is amortized by dividing the excess by the average

remaining service period of employees.

Amortization of Net (Gain) or Loss

Year

2013

2014

2015

2016

Minimum

Accrued

Cumulative

Amortization

Benefit

Plan

Unrecognized

of (Gain)

Obligation (a) Assets (a) Corridor (b) (Gain) Loss (a)

Loss

$4,000,000

$2,400,000 $400,000

$

0 (d)

$

0 (c)

4,520,000

2,200,000

452,000

480,000 (d)

2,333 (c)

4,980,000

2,600,000

498,000

777,667 (d) (

23,306 (e)

4,250,000

3,040,000

425,000

544,361 (f)

9,947 (g)

(a) As of the beginning of the year.

(b) The corridor is 10% of the greater of accrued benefit obligation or plan

assets.

(c) $480,000 – $452,000 = $28,000; $28,000/12 = $2,333

(d) $480,000 + $300,000 – $2,333 = $777,667

(e) $777,667 – $498,000 = $279,667; $279,667/12 = $23,306

(f) $777,667 – $23,306 – $210,000 = $544,361

(g) $544,361 – $425,000 = $119,361; $119,361/12 = $9,947

(b) IFRS requires the immediate recognition approach to

account for actuarial gains or losses. The actuarial gains or

losses are recognized in other comprehensive income

instead of net income.

(c) The ASPE deferral and amortization approach provides an

option to recognize actuarial gains or losses immediately as

well; however, unlike IFRS, the actuarial gains or losses

must be recognized in net income as opposed to other

comprehensive income. In addition, under ASPE, the

approach in part (a) determined the minimum amount to

include in expense. The company could have a policy that

recognizes more than the minimum, but less than all of the

gains or losses.

Solutions Manual

19-42

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 19-17 (10-12 minutes)

Current service cost

Interest on defined post-retirement benefit

obligation (9% X $1,822,500)

Expected return on plan assets (9% X $1,597,500)

Post-retirement benefit expense

$ 202,500

164,025

(143,775)

$222,750

Remeasurement gain or loss – OCI:

Actuarial loss on fund assets

$143,775 - $141,750 ......................................

$2,025

Post-Retirement Benefit Expense ............... 222,750

Net Retirement Benefit

Liability/Asset .................................

222,750

Remeasurement Loss (OCI).........................

Net Retirement Benefit

Liability/Asset ................................

Net Retirement Benefit

Liability/Asset ........................................

Cash .................................................

2,025

2,025

47,250

47,250

Solutions Manual

19-43

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 19-18 (15-20 minutes)

(a) See work sheet on next page.

(b) Retirement Benefit Expense ........................ 222,750

Net Retirement Benefit

Liability/Asset .................................

222,750

Remeasurement Loss (OCI).........................

Net Retirement Benefit

Liability/Asset ................................

Net Retirement Benefit

Liability/Asset ........................................

Cash .................................................

2,025

2,025

47,250

47,250

Solutions Manual

19-44

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 19-18 (a) (Continued)

(a) Opsco Corp. Post-retirement Benefit Plan Worksheet 2013

Remeas.

Benefit

Cash

Defined

(Gain)/Loss Expense

Benefit

OCI

Liab/Asset

Opening

balance

Service cost

225,000 Cr. 1,822,500 Cr. 1

202,500

Dr.

164,025

Dr.

143,775

Cr.

Interest cost

Expected return

Remsmt. loss

Contributions

Benefits paid

Expense entry

Funding entry

Total

DBO

202,500 Cr.

164,025 Cr.

2,025 Dr.

47,250

Cr.

90,000 Dr.

2,025 Dr.

222,750

Dr.

224,775 Cr.

47,250

Cr.

47,250 Dr.

402,525 Cr. 2,099,025 Cr. 1

Solutions Manual

19-45

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 19-19 (10-15 minutes)

(a) Accrued post-retirement benefit obligation

(Credit)

Plan assets at fair value (Debit)

Funded status (Credit)

Unrecognized past service cost (Debit) *

Accrued Benefit Liability/Asset (Credit)

$(190,000)

130,000

(60,000)

(

11,000

$ (49,000)

* $12,000 – $1,000 (amortization)

(b)

Defined post-retirement benefit obligation

(Credit)

Plan assets at fair value (Debit)

Funded status (Credit) and Net Defined Benefit

Liability/Asset (Credit)

$(190,000)

130,000

$ (60,000)

Solutions Manual

19-46

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 19-20 (25-35 minutes)

(a) Note A: Significant Accounting Policies

Employee Benefit Plans

The company accrues its obligations under employee

benefit plans and the related costs, net of plan assets, using

the deferral and amortization approach. The company has

adopted the following policies:

• The cost of pensions earned by employees is actuarially

determined using the accrued benefit method prorated on

service and management's best estimate of expected plan

investment performance, salary escalation, retirement ages

of employees.

• For the purpose of calculating the expected return on plan

assets, those assets are valued at fair value.

• Past service costs from plan amendments are amortized

on a straight-line basis over the average remaining service

period of employees active at the date of amendment.

• The excess of the net actuarial gain (loss) over 10% of the

greater of the benefit obligation and the fair value of plan

assets is amortized over the average remaining service

period of active employees. The average remaining service

period of the active employees covered by the pension

plan is 16 (assumed) years (2012) and 15 (assumed) years

(2013).

Note X: The company sponsors a defined benefit pension

plan covering the following group of employees and

providing the following benefits.

As of December 31, 2013, the net expense for the company’s

pension plan is $171,320 ($94,000 + $253,000 – $175,680).

The present value of the accrued benefit obligation at

December 31, 2013, was $2,737,000 and the market related

value of the fund assets was $2,278,329 based on the fair

market value of the assets on that date. This results in an

underfunded obligation of $458,671. Employer contributions

during 2013 amounted to $92,329 and benefits paid

amounted to $140,000. At December 31, 2013, the accrued

pension liability is $(412,991).

Solutions Manual

19-47

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 19-20 (Continued)

Other information to be disclosed:

assumptions that

underlie the plan such as the discount rate, the rate of

increase in compensation levels, and the expected longterm rate of return on plan assets.

(b)and (c)

Note A: Significant Accounting Policies

Employee Benefit Plans

The company accrues its obligations under employee

defined benefit plans and the related costs, net of plan

assets, using the immediate recognition approach.

Note X: The company sponsors a defined benefit pension

plan covering the following group of employees and

providing the following benefits.

Information about the company’s defined benefit plan is as

follows:

Defined benefit obligation:

Balance at beginning of year, therefore

Interest cost—given

Current service cost—given

Benefits paid—given

Balance at end of year—given

$2,530,000

253,000

94,000

(140,000)

$2,737,000

Plan assets:

Fair value at beginning of year, therefore

Actual return on plan assets—given

Employer contributions—given

Benefits paid—given

Fair value at end of year—given

$2,196,000

130,000

92,329

(140,000)

$2,278,329

Solutions Manual

19-48

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 19-20 (Continued)

Net defined benefit (liability)/asset:

Defined benefit obligation

Plan assets at fair value

Funded status and

Net defined benefit (liability)/asset

Pension expense:

Current service cost—given

Interest cost—given

Expected return on plan assets—given

Pension expense

Remeasurement (Gain) Loss - OCI:

Actuarial loss on fund assets:

$175,680 - $130,000 =

Remeasurement (Gain) Loss - OCI

$(2,737,000)

2,278,329

$(458,671)

$ 94,000

253,000

(175,680)

$ 171,320

$ 45,680

$ 45,680

Other information to be disclosed:

assumptions that

underlie the plan such as the discount rate, the rate of

increase in compensation levels, what type of assets make

up the pension fund assets, the dates of the most recent

actuarial revaluations, etc.

Solutions Manual

19-49

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 19-20 (Continued)

(c) The beginning balances of defined benefit obligation, and

pension plan assets are shown in part (b) on the previous page.

Net defined benefit liability/(asset):

Defined benefit obligation, 1/1/13

Plan assets at fair value, 1/1/13

Funded status liability/(asset) and

Net defined benefit liability/(asset), 1/1/13

$2,530,000

2,196,000

$334,000

Alternatively,

Net defined benefit liability/(asset), 12/31/13

Pension expense

Employer contributions

Remeasurement Gain (Loss) - OCI

Net defined benefit liability/(asset), 1/1/13

$458,671

(171,320)

92,329

(45,680)

$334,000

Solutions Manual

19-50

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 19-21 (25-30 minutes)

(a) Past service costs under ASPE are amortized on a straightline basis over the period the firm expects to realize the

economic benefits from the change in the plan.

Calculation of Service-Years

Expected Years of

Employee

Service

Brandon

3

Chiara

5

Mikayla

6

Angela

5

Paolo

4

Erminia

7

Total

Total

3

5

6

5

4

7

30

Expected average remaining service life

= 30 ÷ 6 employees = 5 years

Past service cost 2013 through 2017 = $340,000 ÷ 5 = $68,000

Past service cost amortization would be complete at the end of

2017, therefore, there would be no amortization in 2018.

(b) Past service costs under IFRS are expensed immediately in

net income. Therefore, the $340,000 of past service costs will

be expensed immediately in 2013, resulting in no

amortization in 2014 and beyond.

Solutions Manual

19-51

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

*EXERCISE 19-22 (25-30 minutes)

(a) The employee’s expected final salary in 2032 would be

calculated as follows:

$40,000 X (1.04)26 = $110,899

(in 27 years there would be 26 raises)

(b) Step 1: Calculate annual pension benefit on retirement from

working in 2014:

Annual pension benefits on retirement

= 2.5% X $110,899 X 1 year

= $2,772 per year of retirement

Step 2: Discount the present value of the annuity of $2,772

for 21 years at 6% to December 31, 2032.

Present value of an annuity of $2,772 discounted at 6% for

21 periods:

($2,772 X 11.76408) = $32,610

Using a financial calculator:

PV

I

N

PMT

FV

Type

$

$ ?

6%

21

(2,772)

$ 0

0

Yields $32,610

Excel formula: =PV(rate,nper,pmt,fv,type)

Solutions Manual

19-52

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

*EXERCISE 19-22 (Continued)

Step 3: Discount the present value of the annuity in 2032 to

its present value at 2014:

Present value of $32,610 discounted at 6% for 18 years

($32,610 X .35034) = $11,425

(18 years = 2013 to 2032)

Using a financial calculator:

PV

I

N

PMT

FV

Type

$ ?

6%

18

$ 0

$ (32,610)

0

Yields $11,425

Excel formula: =PV(rate,nper,pmt,fv,type)

The current service cost relative to this plan for 2014 would

be $11,425.

(c) Pension benefits earned from January 1, 2009 to December

31, 2014

= 2.5% X $110,899 X 6 years = $16,635 per year of retirement.

Present value at December 31, 2032 of an annuity of $16,635

discounted at 6% for 21 periods:

($16,633 X 11.76408) =

$195,676

Solutions Manual

19-53

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

*EXERCISE 19-22 (Continued)

Using a financial calculator:

PV

I

N

PMT

FV

Type

$

$ ?

6%

21

(16,633)

$ 0

0

Yields $195,676

Excel formula: =PV(rate,nper,pmt,fv,type)

The defined benefit obligation represents the present value of

this amount discounted at 6% for 18 years:

Present value of $195,676 discounted at 6% for 18 years

($195,676 X .35034) = $68,558

Using a financial calculator:

PV

I

N

PMT

FV

Type

$ ?

6%

18

$ 0

$ (195,676)

0

Yields $68,558

Excel formula: =PV(rate,nper,pmt,fv,type)

The defined benefit obligation at December 31, 2014 would

be $68,558.

Solutions Manual

19-54

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

EXERCISE 19-23 (20-25 minutes)

Corridor and Minimum Loss Amortization

Accrued

Benefit

Obligation

Year

(a)

2012 $3,500,000

2013 4,200,000

2014 5,075,000

2015 6,300,000

(a)

(b)

(c)

(d)

(e)

(f)

Plan

Asset

Value (a)

10%

Corridor

$3,325,000 $350,000

4,375,000 437,500

4,550,000 507,500

5,250,000 630,000

Unrecognized

Cumulative

Net Loss in

(a)

$

0(

490,000 (

642,250 (c)

648,521 (e)

Minimum

Amortization

of Loss

$

0(

5,250 (b)

11,229 (d)

1,543(f)

As of the beginning of the year.

($490,000 – $437,500) ÷ 10 years = $5,250

$490,000 – $5,250 + $157,500 = $642,250

($642,250 – $507,500) ÷ 12 years = $11,229

$642,250 – $11,229 + $17,500 = $648,521

($648,521 – $630,000) ÷ 12 years = $1,543

Solutions Manual

19-55

Chapter 19

Copyright © 2013 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kieso, Weygandt, Warfield, Young, Wiecek, McConomy

Intermediate Accounting, Tenth Canadian Edition

TIME AND PURPOSE OF PROBLEMS

Problem 19-1 (Time 20-25 minutes)

Purpose—to provide the student with an opportunity to determine the appropriate

accounting for the costs of a long-term disability benefit and prepare the journal

entries.

Problem 19-2 (Time 35-45 minutes)

Purpose—to provide a problem that requires calculation of the liability for a

vested benefit plan for sabbatical leave. This is a challenging problem that

requires the student to apply the principles of vested benefit plans to a new

situation.

Problem 19-3 (Time 45-55 minutes)

Purpose—to provide a problem that requires a comparison of the immediate

recognition approach under IFRS versus the immediate recognition approach

under ASPE, and preparation of continuity schedules for defined benefit obligation,

fund assets and pension expense for three years’ pension transactions, three

years of general journal entries for the pension plan, and reconciliation schedules

at the end of each year.

Problem 19-4 (Time 40-50 minutes)

Purpose—to provide a problem that requires a detailed analysis of the reporting

standards (and differences) for accounting for a defined benefit plan under both

the deferral and amortization approach versus the immediate recognition

approach.

Problem 19-5 (Time 40-50 minutes)

Purpose—to provide a problem that requires a detailed analysis of the reporting

standards (and differences) for accounting for a defined benefit plan between the