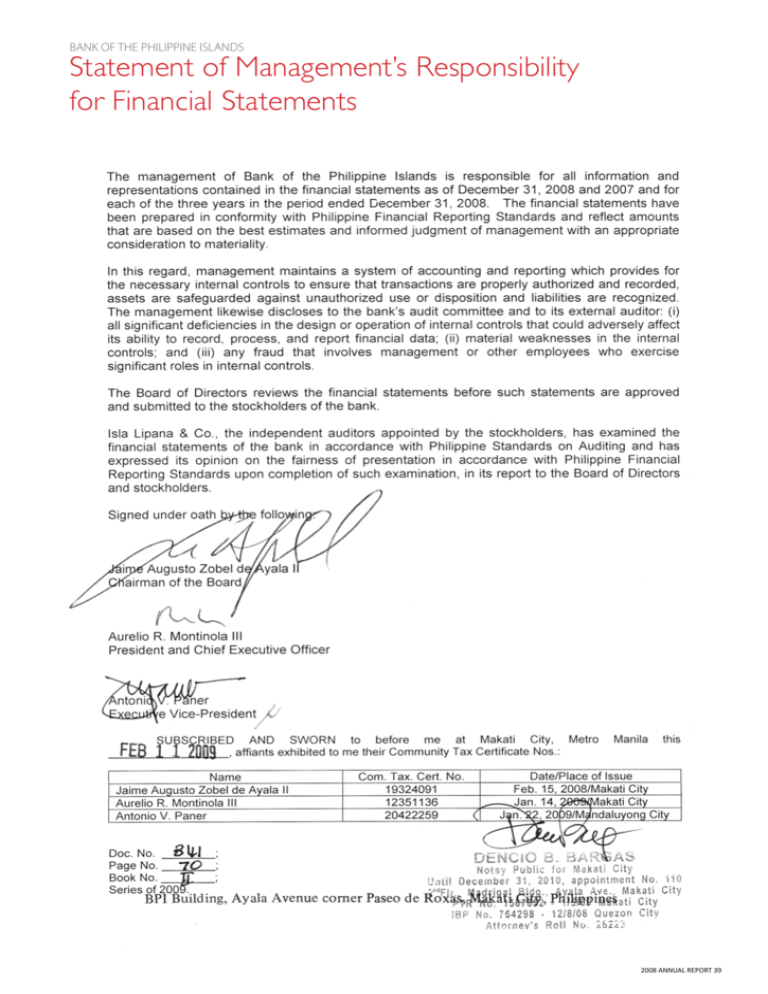

Statement of Management's Responsibility for

advertisement