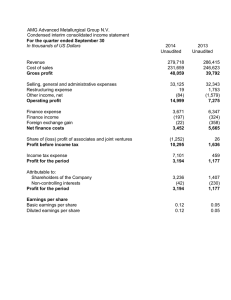

management's statement of responsibility for financial

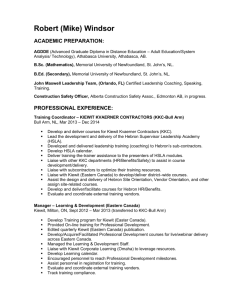

advertisement