Citi Profile - Skills Development Scotland

advertisement

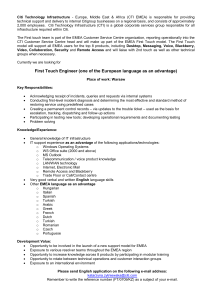

Citi Profile The Organisation Citi is the largest financial services company in the world. We have offices in more than 140 countries and employ over 260,000 people. Citi Markets and Banking has become a market leader, expertly serving the needs of corporations, governments and institutions with a broad range of financial products and services. From stock brokerage to research analysis, investment banking to global transaction services, Citi provides more industry-leading solutions to more clients in more countries than any of its competitors. Our Edinburgh office is centrally based and only a short walk from Waverley train station. Our main activity in our Edinburgh office is fund administration operations. We manage all operational, administrative and regulatory activities in a single package allowing our clients to concentrate on their core business of asset management. Citi Edinburgh Operations has become our European centre of excellence and currently employs approximately 300 individuals in the following areas: Fund Accounting and Reporting, Derivatives, Tax Services, Business Change, Data Management, Business Adoption, Corporate Actions, Business Controls, Performance Measurement, Training, Client Services and Product Management. Our culture It will take more than just our leading business model to get us where we want to go. It means attracting, developing and retaining the most talented people available, and fostering an entrepreneurial culture that encourages individual success while enabling us to leverage those talents to grow our company in the years ahead. Bureaucracy is discouraged, decision-making is streamlined by an "open-door" management style and people are promoted on their merits rather than on their tenure, and rewarded for their performance. All applications may be made through https://Careers.Citigroup.com Entry Level Opportunities - Edinburgh Throughout the year, many of our business areas in Edinburgh will recruit what can be deemed ‘entry level’ positions. These roles can sit within several of our Departments including Valuations (Fund Administration), Client Reporting, Corporate Actions, Derivatives, and Performance Measurement. Whilst not limited to candidates from any particular background, or academic qualification; we would typically recruit candidates who can display the following Skills and Competencies: - Numerical, Investigative, and Analytical Skills & abilities - Desire & Motivation to work within Investment Operations* - Strong interpersonal skills - Accuracy and attention to detail - Good PC skills - Ability to work to deadlines Interview & Selection for these roles would typically include a 2-stage interview process, covering Biographical and Competency based interview questions. Graduate Opportunities Graduates are recruited in each of our four operating divisions - Europe, Middle East and Africa (EMEA), Asia Pacific, North America and Latin America. Full-time and internship opportunities exist across a broad set of businesses including Consumer Banking, Investment Banking, Capital Markets Origination, Sales & Trading, Global Transaction Services, Private Banking, Risk, Human Resources, Operations and Technology. In EMEA we also offer spring programmes aimed at first year students who are looking for an introduction to financial services and a programme aimed at female undergraduates ‘Women of Tomorrow’. We hire to offices in 22 locations around the EMEA region. Typically students will undertake an internship at the bank in the summer of their penultimate year at university. If that internship is successful they will be offered a full time position the following September (after graduating). Citi also hires students directly – but a more limited number. Candidates can apply online via www.oncampus.citi.com Training & Benefits Training Citi is a great place to build a career. At Citi we know that to get the most talented work force we need to invest in our people and our future. Citi offers classroom, web based and on-the-job training to help you grow professionally whilst also increasing you confidence and contribution by maintaining you knowledge base with the most up to date information. Benefits In addition to a competitive salary, we also offer a number of benefits to our employees. We will pay you overtime or a discretionary bonus (which option is dependent on your level) and we offer a non-contributory pension scheme. We also offer free life assurance cover, health insurance and private medical cover. Our work life balance benefits include a full Employee Assistance Programme (EAP) designed not only to offer confidential counseling but also practical legal and financial advice and a Lifestyle Management programme that offers you an on-line concierge and discounts with many well known local and national retailers. Recruitment Contact - Edinburgh Andrew Kermack Recruitment Manager Andrew.Kermack@citi.com +44 (0) 131 550 6017 Address: Citi, Holyrood Park House, 106 Holyrood Road, Edinburgh, EH8 8AE Employee Case Study - Aideen O’Leary Age: 28 Hometown: Dublin Job Title: Product Manager Location: Edinburgh What does your role involve? As a product manager I liaise with clients and internal parties. It’s a relationship role but it also involves business management.There's a lot of variety, something can come up during the day that becomes priority and I have to drop everything else and go and work on that. I work with a range of big clients on investor services products including fund accounting, global custody, middle office and securities finance. How did you get this job? I studied French and geography at university and decided to move to France after my degree. I did work experience in the European parliament, and worked in Tourism Ireland. I wanted to do a post grad in a subject different to my degree so I found a finance course in Dublin for non-business graduates, then I decided to look for graduate schemes. I was looking for an international bank because I wanted to have the opportunity to move around. I joined Citi in Dublin in 2008 and since then I have done 18 months in Dublin and the last of my rotations was in London and after that I moved to Edinburgh. What was the recruitment process like? The first part of the process was an online mathematical ability test. After that it was on to the assessment centre. I was given a case study and had to write a summary of the case study and prepare a presentation. During the course of the day I had 4 separate interviews with 3 directors and one person from HR. Then I had a group interview with other managers observing how we interacted with each other and how we worked together. I had a voicemail when I got home and they had made a decision straight away. The feedback that I got was that out of all the candidates I was the one with the least financial knowledge and I was the one who didn’t have a business background, but I was chosen because of my soft skills, so that was quite interesting. I suppose there is a minimum ability when it comes to numbers but it’s not the be all and end all. What’s a typical day like for you? I don’t know if I have a typical day! I track my own list of actions and my manger is partly based out of London so I don’t see him all the time. I think that’s quite common in Citi. I go through my list in the morning and see what I have on. I came in this morning I had a call at 7am, from someone in the Middle East. After that I had to prepare a presentation for our monthly business review. Then, some of the guys from London are up, from the sales team, I know them because I worked on a pitch with them before. So I met with them and discussed another pitch they’re doing today. What do you enjoy most about your job? I really enjoy talking to people. I also enjoy doing financial analysis because it’s quite testing on your brain. If I wasn’t challenged on a daily basis I don’t think I could be happy. What do you enjoy the least? Citi is so big and you get to meet and work with people from different places. Its really interesting, and the different cultures bring a different viewpoint. However sometimes its probably more difficult to get things done just because of the size but that’s probably the only thing. What qualities do you need to succeed? I think you have to be determined, you have to be positive, and very good at networking. And hardworking! What did you find most surprising about working in finance? I wasn’t necessarily surprised, but a lot of people have an image of this sector as just being a load of accountants doing number crunching all day long. Whereas there are people with different backgrounds and different abilities doing sales, you have someone doing marketing, you have someone doing HR, there are so many different functions within the industry its not just accountants. What’s the culture at Citi like? Citi believe in having a diverse mix of people. I think it works because you don’t have the same types of people making decisions. You don’t have he same types of people working in teams. Team work is very important here. Respect is also very much emphasised, it’s a respectful place. It can be fun of course, but respect and diversity are the two things that are very important. The other thing is being client centric there is a big focus on that because obviously we have a service and that is the aim of Citi bank. What advice would you give to someone who wants to do your job? You have to be flexible, be prepared to be challenged and work hard. Do you get involved in any charity work? Everyone is encouraged to do volunteer days so that’s something everyone is entitled to take time off for. What are the benefits like? For me, the global aspect of Citi is important. I don’t know where I’d like to settle or if I’d like to move somewhere else, but I like the fact there’s more of an opportunity through Citi bank. There’s a big focus on the middle east, and I also went to Israel recently so its very interesting, in the sense that you can go to these places, and work with people in these places. What’s the next step in your career? I would like to be 100% client facing. I just have to figure out where the gaps are in my knowledge and decide the type of role I want to go to. Employee Case Study - Sarah Olszok Age: 26 Hometown: Edinburgh Job title: Senior Supervisor – Reporting Location: Edinburgh What does your job involve? People managing, making sure things are done in time, answering client queries, dealing with auditors, if we’ve got recruitment dealing with getting people trained up. We have contracts with clients so it’s the same reports we produce each month. Occasionally they do ask for additional reports so then different people in the team would get involved in building a new report, making sure the client’s happy with it, making sure the process works and getting sign off from the client. How did you get in to the job? I came in as a service rep, so came in at the very bottom. I did accounting at university, and I wanted to do more accountancy that’s why I went into reporting, so I could use my degree and do something relevant. I got the job through a recruitment agency; I had an interview and then had a second interview with HR and head of the team at the time. I’ve been in the same team all that time. If you perform really well, you can get promotion without there necessarily being a job available at another level. So I’ve had a few promotions. Then my superviser left in November so I’ve been doing this role since November. What’s a typical day like? At month end it’s more time restricted because we’re making sure that the reports are done within the timescales given, making sure reports are going out to clients in time, making sure client queries are answered, also maybe getting a few internal people needing reports and information. What do you enjoy most about your job? I like being involved in the preparing side of things. Getting to analyse a report find out how it could be improved and putting new controls in. I find it quite interesting doing the managing side of things because it’s quite new to me just now. What do you like least? Nothing really: I quite like the fact I get to do a whole lot of different things. What qualities do you need to do well? You have to be determined to where you want to be because sometime you do get knockbacks but it’s how you get there in the end that matters. You have to be driven as well, if there’s something you want to do make sure you have time to do it. Is it a typical 9-5 job? Generally at month end, which is the first week of the month, we’ll have to work late. And at quarter end, the first 3 weeks of the quarter, we’ll maybe have to do a Saturday. Other than that its 9-5. What’s the culture like at Citi? Everybody’s really friendly, really approachable. What advice would you give to anyone wanting to do your job? Have a look at the background of what’s involved in the financial sector. There are so many different avenues. If you don’t feel like you want to stay in the same job there’s scope to move about but stay within the same company. Can you take part in volunteer work? There’s volunteer day once a year in October time where you can go paint fences or plant gardens. Are there any benefits of working at Citi? They do lots of different clubs that you can get involved with, for example there’s an adventure club where they go off to Aviemore for a weekend. And these things are subsidised. What would you like to do next in your career? I want to do what I’m doing for at least another 6 months so that you can see the benefits in the team. At the minute we’ve got a couple of new people in the team so I want to have it more bedded down and then start thinking about what’s next because I don’t really know at the minute.