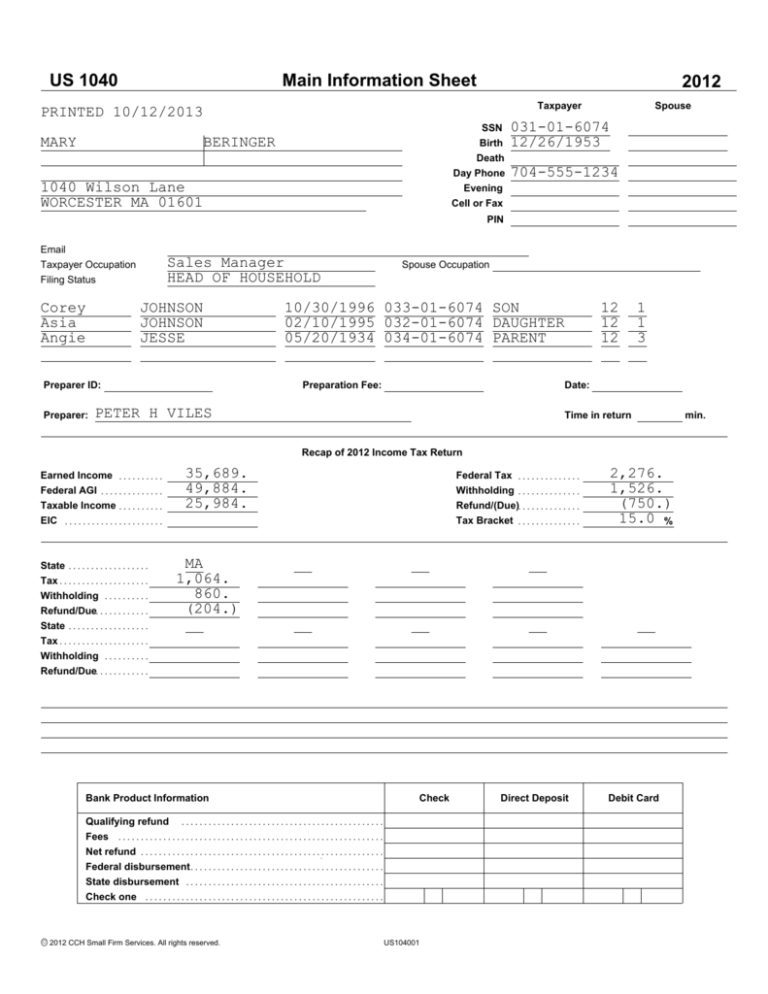

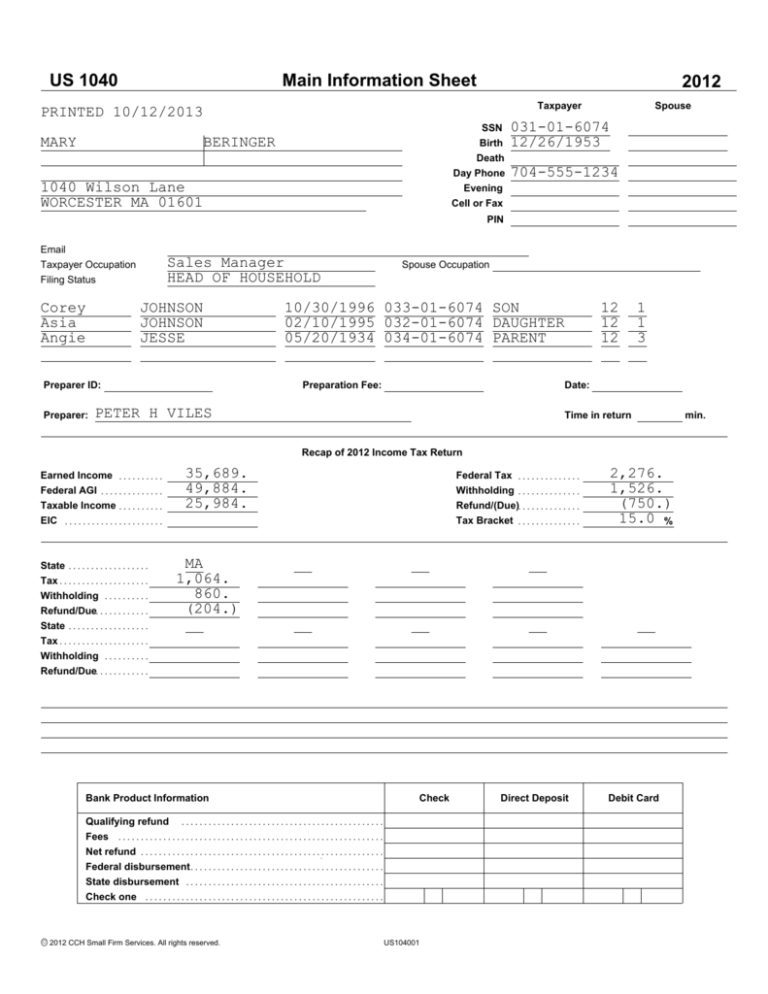

US 1040

Main Information Sheet

2012

Taxpayer

PRINTED 10/12/2013

MARY

SSN

Birth

Death

Day Phone

Evening

Cell or Fax

BERINGER

1040 Wilson Lane

WORCESTER MA 01601

Spouse

031-01-6074

12/26/1953

704-555-1234

PIN

Email

Taxpayer Occupation

Filing Status

Corey

Asia

Angie

Sales Manager

HEAD OF HOUSEHOLD

JOHNSON

JOHNSON

JESSE

Preparer ID:

Preparer:

Spouse Occupation

10/30/1996 033-01-6074 SON

02/10/1995 032-01-6074 DAUGHTER

05/20/1934 034-01-6074 PARENT

Preparation Fee:

12

12

12

1

1

3

Date:

PETER H VILES

Time in return

Recap of 2012 Income Tax Return

Earned Income ..........

Federal AGI ..............

Taxable Income ..........

EIC ......................

State ..................

Tax ....................

Withholding ..........

Refund/Due............

State ..................

Tax ....................

Withholding ..........

Refund/Due............

35,689.

49,884.

25,984.

Federal Tax ..............

Withholding ..............

Refund/(Due)..............

Tax Bracket ..............

2,276.

1,526.

(750.)

15.0 %

MA

1,064.

860.

(204.)

Bank Product Information

Check

Qualifying refund .............................................

Fees ...........................................................

Net refund ......................................................

Federal disbursement...........................................

State disbursement ............................................

Check one .....................................................

Oc 2012 CCH Small Firm Services. All rights reserved.

US104001

Direct Deposit

Debit Card

min.

2012

Department of the Treasury

Form 1040-V

Internal Revenue Service

What Is Form 1040-V

How To Prepare Your Payment

It is a statement you send with your check or money

order for any balance due on the "Amount you owe" line

of your 2012 Form 1040, Form 1040A, or Form 1040EZ.

|

Make your check or money order payable to "United

States Treasury." Do not send cash.

| Make sure your name and address appear on your

check or money order.

| Enter your daytime phone number and your SSN on

your check or money order. If you are filing a joint return,

enter the SSN shown first on your return. Also enter

"2012 Form 1040," "2012 Form 1040A," or "2012 Form

1040EZ," whichever is appropriate.

| To help us process your payment, enter the amount on

the right side of your check like this: $ XXX.XX. Do not

use dashes or lines (for example, do not enter "$ XXX-"

or "$ XXX xx/100").

You can also pay your taxes online or by phone either by a

TIP direct transfer from your bank account or by credit or debit

card. Paying online or by phone is convenient and secure

and helps make sure we get your payments on time. For

more information, go to www.irs.gov/e-pay.

How To Fill In Form 1040-V

Line 1. Enter your social security number (SSN). If you are

filing a joint return, enter the SSN shown first on your

return.

Line 2. If you are filing a joint return, enter the SSN shown

second on your return.

Line 3. Enter the amount you are paying by check or

money order.

Line 4. Enter your name(s) and address exactly as shown

on your return. Please print clearly.

How To Send In Your 2012 Tax Return,

Payment, and Form 1040-V

| Detach Form 1040-V along the dotted line.

| Do not staple or otherwise attach your payment or Form

1040-V to your return or to each other. Instead, just put

them loose in the envelope.

| Mail your 2012 tax return, payment, and Form 1040-V to

the address shown on page 2 that applies to you.

US1040V1

Form

BCA

2012

|Use this voucher when making a payment with Form 1040

|Do not staple this voucher or your payment to Form 1040

|Make your check or money order payable to the "United States Treasury"

|Write your Social Security Number (SSN) on your check or money order

031-01-6074

MARY BERINGER

1040 Wilson Lane

WORCESTER MA 01601

j

j

Department of the Treasury

Internal Revenue Service

Detach Here and Mail With Your Payment and Return

1040-V (2012)

Form 1040-V Payment Voucher

Amount you are

paying by check

or money order

Dollars

j

1045

PO Box 37008

Hartford CT 06176-0008

031016074 ZW BERI 30 0 201212 610

Cents

750.

Form

Department of the Treasury - Internal Revenue Service

(99)

U.S. Individual Income Tax Return

For the year Jan. 1-Dec. 31, 2012, or other tax year beginning

Your first name and initial

2012

OMB No. 1545-0074

,2012, ending

IRS Use Only-Do not write or staple in this space.

See separate instructions.

Your social security number

,20

Last name

MARY BERINGER

If a joint return, spouse's first name and initial

031-01-6074

Last name

Spouse's social security no.

Home address (number and street). If you have a P.O. box, see instructions.

Apt. no.

1040 Wilson Lane

City, town or post office, state, and ZIP code. If you have a foreign address, also complete spaces below (see instructions).

WORCESTER MA 01601

Foreign country name

Foreign province/county

Foreign postal code

k

l

1040

Make sure the SSN(s) above

and on line 6c are correct.

Presidential Election Campaign

Check here if you, or your spouse if filing

jointly, want $3 to go to this fund. Checking a box below will not change your tax

or refund.

You

Spouse

Single

4 X Head of household (with qualifying person). (See instructions.)

Filing Status

Married filing jointly (even if only one had income)

If the qualifying person is a child but not your dependent, enter

Married filing separately. Enter spouse's SSN above

this child's name here.j

Check only

one box.

and full name here. j

5

Qualifying widow(er) with dependent child

X Yourself. If someone can claim you as a dependent, do not check box 6a ................ Boxes checked on

Exemptions

6a

j

1

b

Spouse .................................................................................. 6a and 6b

No. of children

/

(3)

(4)

if

child

under

Dependent's

V

If more than

c

Dependents:

(2) Dependent's

under age 17 quali- on 6c who:

relationship to

fying for child tax

2

four depen- (1) First name

Last name

social security no.

you

lived with you

credit (see instr.)

did not live with

Corey JOHNSON

033-01-6074SON

X

dents, see

you due to divorce

or separation

Asia JOHNSON

032-01-6074DAUGHTER

0

instr. and

(see instr.)

Dependents

on 6c

Angie JESSE

034-01-6074PARENT

1

check

not entered above

here j

Add numbers

4

d Total number of exemptions claimed ............................................................................ on lines abovej

Income

7 Wages, salaries, tips, etc. Attach Form(s) W-2

35,689.

7

8a

Taxable

interest.

Attach

Schedule

B

if

required

..........................................

8a

Attach

Form(s) W-2 here.

b Tax-exempt interest. Do not include on line 8a .......... 8b

Also attach Forms

9a Ordinary dividends. Attach Schedule B if required ........................................ 9a

W-2G and

b Qualified dividends ...................................... 9b

1099-R if tax

was withheld.

10 Taxable refunds, credits, or offsets of state and local income taxes ........................ 10

11 Alimony received .......................................................................... 11

12 Business income or (loss). Attach Schedule C or C-EZ .................................... 12

13 Capital gain or (loss). Attach Schedule D if required. If not required, check here j

13

If you did not

get a W-2,

14 Other gains or (losses). Attach Form 4797 ................................................ 14

see instructions.

15a IRA distributions .......... 15a

b Taxable amount .......... 15b

16a Pensions and annuities .... 16a

b Taxable amount .......... 16b

17 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E .... 17

18 Farm income or (loss). Attach Schedule F ................................................ 18

Enclose, but do

19 Unemployment compensation ............................................................ 19

not attach, any

24,750. b Taxable amount .......... 20b

14,195.

payment. Also, LSE 20a Social security benefits .. 20a

please use

21 Other income. List type and amount (see instr.)

21

Form 1040-V.

49,884.

22 Combine the amounts in the far right column for lines 7 through 21.This is your total income

j 22

23 Educator expenses ........................................ 23

Adjusted

24 Certain business expenses of reservists, performing artists,

Gross

and fee-basis gov. officials. Attach Form 2106 or 2106-EZ .. 24

Income

25 Health savings account deduction. Attach Form 8889 ...... 25

26 Moving expenses. Attach Form 3903 ...................... 26

27 Deductible part of self-employment tax. Attach Schedule SE 27

28 Self-employed SEP, SIMPLE, and qualified plans

........ 28

29 Self-employed health insurance deduction ................ 29

30 Penalty on early withdrawal of savings .................... 30

31a Alimony paid b Recipient's SSN j

31a

32 IRA deduction

.......................................... 32

33 Student loan interest deduction

.......................... 33

34 Tuition and fees. Attach Form 8917 ........................ 34

35 Domestic production activities deduction. Attach Form 8903 35

36 Add lines 23 through 35 .................................................................. 36

49,884.

37 Subtract line 36 from line 22. This is your adjusted gross income .................... j 37

BCA For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions.

US1040$1

Form 1040 (2012)

1

2

3

.

.

MARY BERINGER

Form 1040 (2012)

Tax and

Credits

031-01-6074

38 Amount from line 37 (adjusted gross income) ..............................................

39a Check

You were born before Jan. 2, 1948,

Blind.

j Total boxes

if:

Spouse was born before Jan. 2, 1948,

Blind.

checked j 39a

j 39b

b If your spouse itemizes on a separate return or you were a dual-status alien, check here

40 Itemized deductions (from Schedule A) or your standard deduction (see left margin) ......

41 Subtract line 40 from line 38 ..............................................................

42 Exemptions. Multiply $3,800 by the number on line 6d ....................................

43 Taxable income. Subtract line 42 from line 41. If line 42 is more than line 41, enter -0- ......

44 Tax (see instructions). Check if any tax is from:

a Form(s) 8814 b Form 4972 c

962 election

.

45 Alternative minimum tax (see instructions). Attach Form 6251 ............................

46 Add lines 44 and 45 ................................................................... j

47 Foreign tax credit. Attach Form 1116 if required ............ 47

48 Credit for child and dependent care expenses. Attach Form 2441

...... 48

49 Education credits from Form 8863, line 19 .................. 49

50 Retirement savings contributions credit. Attach Form 8880 .. 50

1,000.

51 Child tax credit. Attach Schedule 8812, if required .......... 51

52 Residential energy credits. Attach Form 5695

52

53 Other credits from Form:

a

3800 b

8801 c

53

54 Add lines 47 through 53. These are your total credits ......................................

55 Subtract line 54 from line 46. If line 54 is more than line 46, enter -0- .................. j

Page 2

38

49,884.

40

41

42

43

44

45

46

8,700.

41,184.

15,200.

25,984.

3,276.

j

Standard

Deduction

for| People who

check any

box on line

39a or 39b or

who can be

claimed as a

dependent,

see

instructions.

| All others:

Single or

Married filing

separately,

$5,950

Married filing

jointly or

Qualifying

widow(er),

$11,900

Head of

household,

$8,700

Other

Taxes

3,276.

1,000.

2,276.

54

55

56

57

58

59a

59b

60

61

56 Self-employment tax. Attach Schedule SE ................................................

57 Unreported social security and Medicare tax from Form: a

4137

b

8919 ....

58 Additional tax on IRAs, other qualified retirement plans, etc. Attach Form 5329 if required ..

59a Household employment taxes from Schedule H ............................................

b First-time homebuyer credit repayment. Attach Form 5405 if required ......................

60 Other taxes. Enter code(s) from instructions

61 Add lines 55 through 60. This is your total tax ........................................ j

1,526.

FORM

62 Federal income tax withheld from Forms W-2 and 1099 .... 62

Payments

63 2012 estimated tax payments and amount applied from 2011 return

.... 63

If you have a

NO

64a Earned income credit (EIC) ..............................

64a

qualifying child,

combat

b Nontaxable

........

64b

attach Schedule

pay election

EIC.

65 Additional child tax credit. Attach Form 8812................ 65

66 American opportunity credit from Form 8863, line 8.......... 66

67 Reserved ................................................

........ 67

68 Amount paid with request for extension to file

............ 68

69 Excess social security and tier 1 RRTA tax withheld ........ 69

70 Credit for federal tax on fuels. Attach Form 4136

70

Re71 Credits from Form: a 2439 b served c 8801 d 8885

71

72 Add lines 62, 63, 64a, and 65 through 71. These are your total payments .............. j 72

73 If line 72 is more than line 61, subtract line 61 from line 72. This is the amount you overpaid 73

Refund

74a Amount of line 73 you want refunded to you. If Form 8888 is attached, check here j

74a

Routing

Savings

j

b number

j c Type: Checking

Account

Direct deposit? j

d number

See instructions

75 Amount of line 73 you want applied to your 2013 estimated tax j 75

76 Amount you owe. Subtract line 72 from line 61. For details on how to pay, see inst. .... j 76

Amount

You Owe

77 Estimated tax penalty (see instructions) .................... 77

Yes. Complete below.

Third Party Do you want to allow another person to discuss this return with the IRS (see instructions)?

j

BCA

j

Your signature

k

l

750.

X

No

Date

j

Your occupation

Daytime phone number

Sales Manager

Spouse's signature.If a joint return, both must sign.

Print/Type preparer's name

Paid

Preparer's

Use Only

1,526.

Designee's

Personal identification

Phone

number (PIN)

name

no.

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and

belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Designee

Sign

Here

Joint return?

See instr.

Keep a copy

for your

records.

2,276.

1099

Date

Preparer's signature

PETER H VILES

PETER H VILES

Firm's name

j AARP Foundation TaxAide

Firm's address

j

US1040$2

704-555-1234

Spouse's occupation

Date

If the IRS sent you an Identity

Protection PIN,

enter it here

(see inst.)

Check

if

PTIN

self-employed

Firm's EIN j

Phone no.

Form

1040 (2012)

US

Name:

1040, 1040A, 1040EZ, 1040NR Income Worksheet

MARY BERINGER

2012

SSN:

031-01-6074

Interest. List all interest on Schedule B, regardless of the amount.

Unemployment and/or state tax refund. Fill out 1099G worksheet

Taxpayer

Spouse

Total

Social Security/Railroad Tier 1 Benefits

Taxpayer

Spouse

Total

Social Security received this year ................................................

Railroad tier 1 received this year ................................................

Total ..........................................................................

Medicare to Schedule A ..........................................................

Federal tax withheld ............................................................

24,750.

Additional Earned Income

Scholarship income - no W2 ......................................................

Household employee income - no W2 ............................................

24,750.

24,750.

500.

Married Filing Separately

If the filing status is married filing separately and the taxpayer and spouse lived together at any

time during the year, up to 85% of social security and railroad benefits received are taxable. See Main

Information Sheet, filing status 3 ..............................................................................................

All others

Modified adjusted gross income for this computation consists of AGI (without social security or railroad benefits) + Form 8815,

35,689.

line 14, + Form 8839, line 30 + Form 2555 (EZ) exclusions + student loan interest adjustment

+ tax-exempt interest:

and excluded income from American Samoa (Form 4563) or

12,375. ................................

Puerto Rico:

+ 50% of the benefits received:

48,064.

If the modified AGI is less than $25,001 ($32,001 married filing jointly), none of the Social Security and RR Benefits are taxable

....

If the modified AGI is between $25,000 and $34,000 ($32,000 and $44,000 married filing joIntly), 50% of the benefits

received is taxable............................................................................................................

If the modified AGI is greater than $34,000 ($44,000 married filing jointly):

85% of the social security and railroad benefits received is taxable ..........................A

48,064.

Modified AGI ....................

34,000.

$34,000 ($44,000)................

14,064. X 85%=

11,954.

Subtract..........................

21,038.

Minimum 50% of the benefits received or $4,500 ($6,000 married filing

4,500.

jointly) .................................................................

16,454.

Add........................................................................................ B

Taxable social security and railroad retirement tier 1. Minimum of A or B ................................................

16,454.

Lump Sum Payment of Social Security and Railroad Tier 1 Benefits

Taxpayer

Spouse

8,250.

Gross amount received attributable to 2012 ......................................

Using the above modified AGI, this is the taxable amount of the 2011 benefit ..................................................

Amounts taxable from previous years..........................................................................................

Taxable benefits using the lump-sum election method ....................................................................

Oc 2012 CCH Small Firm Services. All rights reserved.

USW10401

Total

8,250.

7,013.

7,182.

14,195.

US

Name:

Child Tax Credit, Federal Extension Payment, and Carryovers Worksheet

2012

MARY BERINGER

SSN: 031-01-6074

Child Tax Credit (CTC)

1 $1,000 X 1 qualifying children ..................................................

2 Modified AGI is AGI plus excluded income from Forms 2555 (EZ) and 4563,

and excluded income from Puerto Rico ..............................................

3 Modified AGI limitation $110,000 married filing jointly; $55,000 married filing

separately; all others $75,000 ........................................................

4 Subtract line 3 from line 2. If -0-, go to line 7 ........................................

5 Round up to next $1,000 ............................................................

6 Multiply line 5 by 5% ................................................................

7 Maximum child tax credit. Subtract line 6 from line 1.

You cannot take the credit if this amount is -0- ......................................

8 Amount from Form 1040, line 46, Form 1040A, line 28, or Form 1040NR, line 43........

9 Credits for foreign tax, dependent care, elderly, education, retirement savings,

adoption, mortgage interest, DC first-time homebuyers and residential energy .........

1,000.

49,884.

75,000.

1,000.

3,276.

CTC Worksheet for Forms 8396, Mortgage Interest Credit, Form 8839, Adoption Credit,

Form 8859, DC First-time Homebuyers Credit, and Form 5695, Residential Energy Credits

1 Foreign tax credit + dependent care credit + elderly credit + education credit +

retirement savings credit .....................................................

2 Amount from line 7 above ....................................................

3 Social security or RR tier 1 + Medicare ........................................

4 Form 1040, line 27 + line 59; or Form 1040NR, line 54 + uncollected social

security and Medicare taxes listed on W2 ......................................

5 Add lines 3 and 4 ............................................................

6 Earned income credit and excess FICA/RRTA ..................................

7 Subtract line 6 from line 5 ....................................................

8 Maximum child tax credit, line 7 above, minus the larger of line 7 of this

worksheet or Form 8812, line 6. This is the child tax credit for the purpose of

figuring Forms 5695, 8396, 8839 and 8859. Use this amount in place of the child

tax credit amount asked for on these forms ....................................

9 Total of adoption credit, mortgage interest credit, DC first-time homebuyer

credit, and residential energy credits as refigured.................................

10 Add lines 1 and 9 ..............................................................

10 Subtract line 9 from line 8 ........................................................................................

11 Child tax credit

................................................................................................

Amount paid with Federal extension (Form 4868 or 2350) ............................................................

Carryovers from 2012 to 2013

3,276.

1,000.

1 Section 179 expense disallowed, Form 4562, accumulative total......................................................

2 Net operating loss from 2012 only, Form 1045 ......................................................................

Amt. carried forward from 2011. Listed on Form 1040, line 21, or Form 1040NR, line 21

3 2012 charitable contributions. Organization limit:

Cash or other property

Capital Gain

50%

30%

30%

20%

4 Investment interest expense, Form 4952, accumulative total..........................................................

5 Foreign tax credit from 2012 only, Form 1116. Enter amount carried back, if any........

6 Mortgage interest credit, Form 8396

2010

2011

2012

7

8

9

10

DC first-time homebuyer credit, Form 8859..........................................................................

Prior year minimum tax credit, Form 8801, cumulative total ........................................................

AMT limited qualified electric vehicle credit from 2012 only ..........................................................

Nonrecaptured net section 1231 losses

2008

2009

2010

2011

2012

Oc 2012 CCH Small Firm Services. All rights reserved.

USW10403

031-01-6074

W-2 DETAIL REPORT - 2012

Employer

EIN

------------------------ ----------

TP|SP

-----

Mount Peace Associates I 11-0123456

X

Gross

Wages

-------

Federal

With.

-------

FICA

-------

35689

----35689

1026

---1026

1499

---1499

Medicare

-------

517

--517

St

--

MA

State

Wages

-------

State

With.

-------

35689

----35689

860

--860

Locality

---------

Local

With.

-------

2012 Form 1 MA1200111045

Massachusetts Resident Income Tax Return

FOR FULL YEAR RESIDENTS ONLY

For the year January 1 - December 31, 2012 or other taxable

Yr. beginning

Ending

MARY

BERINGER

1040 WILSON LANE

031-01-6074

WORCESTER

MA 01601

Apt. no.

State Election Campaign Fund:

j

j

j

j

j

j

Fill in if veteran of U.S. armed forces who served in Operation Enduring Freedom, Iraqi Freedom or Noble Eagle

Taxpayer deceased

Fill in if under age 18

1. Filing status (select one only):j

X

$1 You

$1 Spouse TOTAL j

You j

Spouse

You

Spouse

You j

Spouse

Name/address changed since 2011

Fill in if noncustodial parent

Fill in if filing Schedule TDS

Single

Married filing joint

Married filing separate return

Head of household j

You are a custodial parent who has released claim to exemption for child(ren)

2. Exemptions

a. Personal exemptions

2a

3

b. Number of dependents. (Do not include yourself or your spouse.)

Enter number j

x $1,000= 2b

c. Age 65 or over before 2013

You +

Spouse =

j

x $700= 2c

d. Blindness

You +

Spouse =

j

x $2,200= 2d

e. 1. Medical/dental j

2. Adoption j

1 + 2 = 2e

f. Total exemptions. Add lines 2a through 2e. Enter here and on line 18

j 2f

3. Wages, salaries, tips

j 3

4. Taxable pensions and annuities

j 4

5. Mass. bank interest:a. j

-b.exemption

= 5

6. Business/profession or farm income or loss

j 6

7. Rental, royalty and REMIC, partnership, S corp., trust income/loss

j 7

8a. Unemployment

j 8a

8b. Mass. lottery winnings

j 8b

9. Other income from Schedule X, line 5

j 9

10. TOTAL 5.25% INCOME

10

SIGN HERE. Under penalties of perjury, I declare that to the best of my knowledge and belief this return and enclosures are true, correct and complete.

Your signature

Date

Spouse's signature

Date

May the Dept. of Revenue discuss this return with the preparer shown here?

I do not want preparer to file my return electronically

Print paid preparer's name

PETER

H VILES

j

j

9800

35689

35689

Yes

(this may delay your refund)

Date

Check if self-employed

10122013

Paid preparer's signature

6800

3000

Paid preparer's SSN

j

Paid preparer's phone

Paid preparer's EIN

j

PETER H VILES

PRIVACY ACT NOTICE AVAILABLE UPON REQUEST

10/12/2013 11:38:11

MA1$$$$1

2012 Form 1, pg. 2 MA1200121045

Massachusetts Resident Income Tax Return

031-01-6074

11a.

11b.

12.

13.

14.

15.

16.

17.

18.

19.

20.

21.

22.

23.

24.

25.

26.

27.

28.

29.

30.

31.

Amount paid to Soc. Sec. Medicare, R.R., U.S. or Mass. Retirement

j 11a

Amount your spouse paid to Soc. Sec., Medicare, R.R., U.S. or Mass. Retirement

j 11b

Child under age 13, or disabled dependent/spouse care expenses

j 12

Number of dependent member(s) of household under age 12, or dependents age 65 or over (not you or your spouse) as of

12/31/12, or disabled dependent(s)

Not more than two. a.j 1

x $3,600 = j 13

.

Rental deduction. a. j

. 2 = j 14

Other deductions from Schedule Y, line 17

j 15

Total deductions. Add lines 11 through 15

j 16

5.25% INCOME AFTER DEDUCTIONS. Subtract line 16 from line 10. Not less than ``0"

17

Exemption amount

18

5.25% INCOME AFTER EXEMPTIONS. Subtract line 18 from line 17. Not less than ``0"

19

INTEREST AND DIVIDEND INCOME

j 20

TOTAL TAXABLE 5.25% INCOME. Add lines 19 and 20

21

TAX ON 5.25% INCOME. Note: If choosing the optional 5.85% tax rate, fill in and multiply line 21 and the

amount in Sch. D, line 21 by .0585 j

22

12% INCOME. Not less than "0."

a. j

x .12 = 23

TAX ON LONG-TERM CAP. GAINS. Not less than ``0". Fill in if filing Sch. D-IS j

j 24

Fill in if any excess exemptions were used in calculating lines 20, 23 or 24

j

Credit recapture amount

j

BC

EOA

LIH

HR

j 25

Additional tax on installment sale

j 26

If you qualify for No Tax Status, fill in and enter "0" on line 28

j

TOTAL INCOME TAX. Add lines 22 through 26

28

Limited Income Credit

j 29

Other credits from Schedule Z, line 13

j 30

31

INCOME TAX AFTER CREDITS. Subtract the total of lines 29 and 30 from line 28. Not less than "0"

BE SURE TO INCLUDE THIS PAGE WITH FORM 1, PAGE 1

10/12/2013 11:38:11

MA1$$$$2

2000

3600

5600

30089

9800

20289

20289

1064

1064

1064

2012 Form 1, pg. 3 MA1200131045

Massachusetts Resident Income Tax Return

031-01-6074

32. Voluntary Contributions

a. Endangered Wildlife Conservation

j 32a

b. Organ Transplant Fund

j 32b

c. Massachusetts AIDS Fund

j 32c

d. Massachusetts U.S. Olympic Fund

j 32d

e. Massachusetts Military Family Relief Fund

j 32e

f. Homeless Animal Prevention on Care

j 32f

Total: Add lines 32a through 32f

32

33. Use tax due on out-of-state purchases. If no use tax due enter "0"

j 33

0 b. Spouse j

0

34. Health care penalty a. You j

a + b = 34

35. INCOME TAX AFTER CREDITS PLUS CONTRIBUTIONS AND USE TAX. Add lines 31 through 34

35

36. Massachusetts income tax withheld

j 36

37. 2011 overpayment applied to your 2012 estimated tax

j 37

38. 2012 Massachusetts estimated tax payments

j 38

j 39

39. Payments made with extension

40. Earned Income Credit. a. No. of qualifying childrenj 0 Amount from U.S. return

j

x .15 = j 40

41. Senior Circuit Breaker Credit

j 41

42. Other Refundable Credits

j 42

43. TOTAL. Add lines 36 through 42

43

44. Overpayment. Subtract line 35 from line 43

j 44

45. Amount of overpayment you want applied to your 2013 estimated tax

j 45

46. Refund. Subtract line 45 from line 44. Mail to: Massachusetts DOR, PO Box 7001, Boston, MA 02204

j 46

Direct deposit of refund. Type of accountj

RTN #j

47.

account #

0

0

1064

860

860

checking

savings

j

Tax due. Pay online at www.mass.gov/dor/payonline. Mail to: Mass. DOR, PO Box 7002, Boston, MA 02204

Interest j

Penalty j

M-2210 amt. j

BE SURE TO INCLUDE THIS PAGE WITH FORM 1, PAGE 1

10/12/2013 11:38:11

MA1$$$$3

j

204

47

j

EX enclose

Form M-2210

2012 Schedule DI MA12SDI11045

MARY

BERINGER

031-01-6074

Schedule DI. Dependent Information

COREY

SON

Is dependent a qualifying child for earned income credit?

JOHNSON

ASIA

DAUGHTER

Is dependent a qualifying child for earned income credit?

ANGIE

PARENT

Is dependent a qualifying child for earned income credit?

JOHNSON

JESSE

033-01-6074

j X 10301996

032-01-6074

j X 02101995

034-01-6074

05201934

j

Is dependent a qualifying child for earned income credit?

j

Is dependent a qualifying child for earned income credit?

j

Is dependent a qualifying child for earned income credit?

j

Is dependent a qualifying child for earned income credit?

j

Is dependent a qualifying child for earned income credit?

j

Is dependent a qualifying child for earned income credit?

j

Is dependent a qualifying child for earned income credit?

j

10/12/2013 11:38:11

MADI$$$1

2012 Schedule HC MA1202911045

Schedule HC, Health Care Information, must be completed by

all full-year residents and certain part-year residents (see instr.).

Note: Schedule HC must be enclosed with your Form 1 or Form

1-NR/PY. Failure to do so will delay the processing of your return.

MARY

BERINGER

1a. Date of birth

j 12261953

1b.

Spouse's date of birth

031-01-6074

j

1c. Family size

j

4

j

2. Federal adjusted gross income

2

49884

3. Indicate the time period that you were enrolled in a Minimum Creditable Coverage (MCC) health insurance plan(s). The Form MA 1099-HC

from your insurer will indicate whether your insurance met MCC requirements. Note: MassHealth, Commonwealth Care, Commonwealth

Care Bridge, Medicare, and health coverage for U.S. Military, including Veterans Administration and Tri-Care, meet the MCC requirements.

If you did not receive a Form MA 1099-HC from your insurer, or you had insurance that did not meet MCC requirements, see the special

section on MCC requirements in the instructions.

X Full-year MCC

See instructions if, during 2012, you turned 18, you

j 3a You:

Part-year MCC

were part-year resident or a taxpayer was deceased.

j 3b Spouse:

Full-year MCC

Part-year MCC

If you filled in the full-year or part-year MCC space, go to line 4. If you filled in No MCC/None, go to line 6.

No MCC/None

No MCC/None

4. Indicate the health insurance plan(s) that met the Minimum Creditable Coverage (MCC) requirements in which you were enrolled in 2012, as

shown on Form MA 1099-HC (check all that apply). If you did not receive this form, fill in line(s) 4f and/or 4g and see instructions. Fill in if you

were enrolled in private insurance and MassHealth, Commonwealth Care or Commonwealth Care Bridge, and enter your private insurance

information in line(s) 4f and/or 4g and go to line 5.

X You

4a. Private insurance (completes line(s) 4f and/or 4g below). If more than two, complete Schedule HC-CS

Spouse

4b. MassHealth, Commonwealth Care or Commonwealth Care Bridge. Fill in and go to line 5

You

Spouse

4c. Medicare (including a replacement or supplemental plan). Fill in and go to line 5

You

Spouse

4d. U.S. Military (including Veterans Administration and Tri-Care). Fill in and go to line 5

You

Spouse

4e. Other government program (enter the program name(s) only in lines 4f and/or 4g below). Note: Health

You

Spouse

Safety Net is not considered insurance or minimum creditable coverage.

4f. Your Health Insurance. Complete if you answered line(s) 4a or 4e and go to line 5.

BLUE CROSS / BLUE SHIELD

96-0000061

4g. Spouse's Health Insurance. Complete if you answered line(s) 4a or 4e and go to line 5.

Fill in if you were not issued Form MA 1099-HC

031016074

Fill in if you were not issued Form MA 1099-HC

5. If you had health insurance that met MCC requirements for the full-year, including private insurance, MassHealth, Commonwealth Care or

Commonwealth Care Bridge, you are not subject to a penalty. Skip the remainder of this schedule and continue completing your tax return.

Otherwise, go to line 6.

If you had Medicare (including a replacement or supplemental plan), U.S. Military (including Veterans Administration and Tri-Care), or other

government insurance at any point during 2012, you are not subject to a penalty. Skip the remainder of this schedule and continue

completing your tax return. Otherwise, go to line 6.

10/12/2013 11:38:11

MAHC$$$1

2012 Schedule INC MA12INC11045

MARY

BERINGER

031-01-6074

Form W-2 and 1099 Information

A.FEDERAL ID

NUMBER

B.STATE TAX

WITHHELD

D.TAXPAYER SS

WITHHELD

C.STATE WAGES/

INCOME

11-0123456

860

35689

1499

TOTALS

860

35689

1499

10/12/2013 11:38:11

MAINC$$1

E.SPOUSE SS

WITHHELD

F. SOURCE OF

WITHHOLDING

W2

MAPV$$$1

Social Security number

j

j

Form PV

DETACH HERE

Massachusetts

Department of Revenue

Amount enclosed

Income Tax Payment Voucher - 2012

Spouse's Social Security number

031-01-6074

Year end date

12/12

204.00

Check which form you filed:

MARY

BERINGER

X

1040 WILSON LANE

WORCESTER MA 01601

Form 1

Form 1-NR/PY

Nonresident Composite Return

Name/address changed since 2010

Pay online at www.mass.gov/dor/payonline. Or, return this voucher with check or money order payable to:

Commonwealth of Massachusetts, and mail to: Massachusetts Department of Revenue, PO Box 7003, Boston, MA 02204.

031016074 2 020518 3 00000020400 8 1212 0140 136 5

V# 1045