Disclosure of liquidation balance sheet - Publikations

advertisement

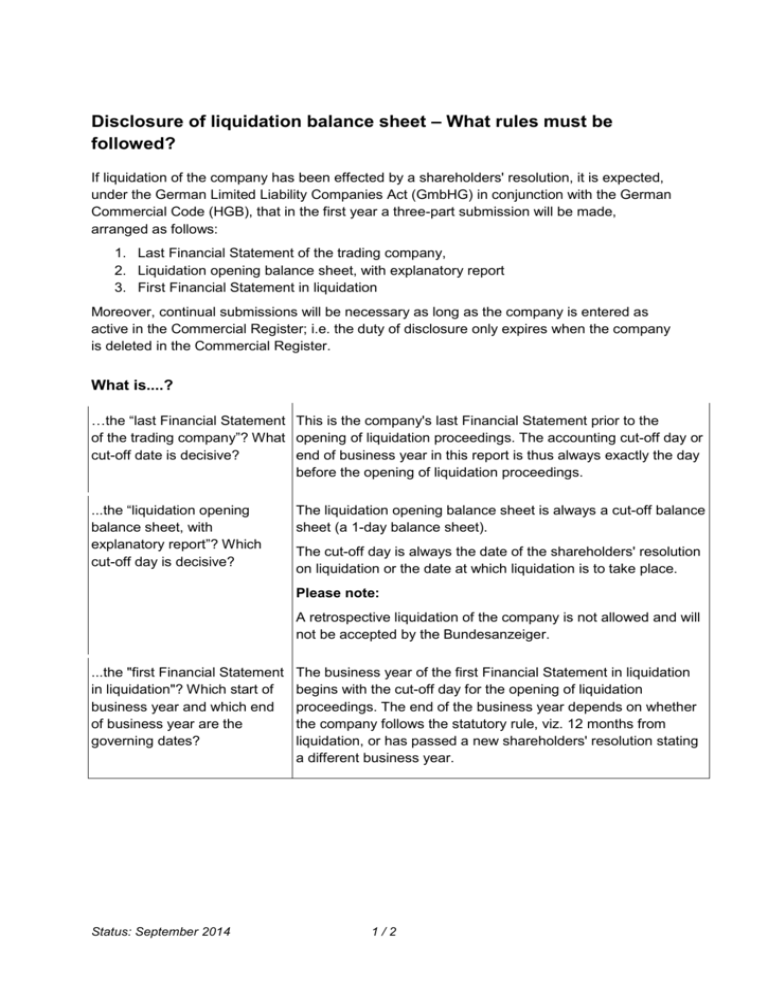

Disclosure of liquidation balance sheet – What rules must be followed? If liquidation of the company has been effected by a shareholders' resolution, it is expected, under the German Limited Liability Companies Act (GmbHG) in conjunction with the German Commercial Code (HGB), that in the first year a three-part submission will be made, arranged as follows: 1. Last Financial Statement of the trading company, 2. Liquidation opening balance sheet, with explanatory report 3. First Financial Statement in liquidation Moreover, continual submissions will be necessary as long as the company is entered as active in the Commercial Register; i.e. the duty of disclosure only expires when the company is deleted in the Commercial Register. What is....? …the “last Financial Statement This is the company's last Financial Statement prior to the of the trading company”? What opening of liquidation proceedings. The accounting cut-off day or cut-off date is decisive? end of business year in this report is thus always exactly the day before the opening of liquidation proceedings. ...the “liquidation opening balance sheet, with explanatory report”? Which cut-off day is decisive? The liquidation opening balance sheet is always a cut-off balance sheet (a 1-day balance sheet). The cut-off day is always the date of the shareholders' resolution on liquidation or the date at which liquidation is to take place. Please note: A retrospective liquidation of the company is not allowed and will not be accepted by the Bundesanzeiger. ...the "first Financial Statement in liquidation"? Which start of business year and which end of business year are the governing dates? Status: September 2014 The business year of the first Financial Statement in liquidation begins with the cut-off day for the opening of liquidation proceedings. The end of the business year depends on whether the company follows the statutory rule, viz. 12 months from liquidation, or has passed a new shareholders' resolution stating a different business year. 1/2 Example: Liquidation as of 23 August 2013, originally the business year under the company's statutes was 1 January to 31 December. Submissions, cut-off days: Statutory regulation Return to business year pursuant to original statutes (under non-formal shareholders' resolution): New business year (under shareholders' resolution as passed) as of 30 September: Last Financial Statement of trading company: 01.01.2013 – 22.08.2013 Liquidation opening balance sheet 23.08.2013 – 23.08.2013 First Financial Statement in liquidation 23.08.2013 – 22.08.2014 23.08.2013 – 31.12.2013 23.08.2013 – 30.09.2013 Successive Financial Statement 23.08.2014 – 22.08.2015 01.01.2014 – 31.12.2014 01.10.2013 – 30.09.2014 If you are to deviate from the statutory rule for the end of the business year, a resolution is compulsory. Any change to the balance-sheet cut-off day must be entered in the Commercial Register. Return to the original business year under the company's statutes can only be effected by a non-formal resolution. You can glean detailed information from the German Ministry of Justice on the internet at http://www.bundesjustizamt.de. Status: September 2014 2/2