Real Estate Undivided Fractional Interest Programs and Rev. Proc

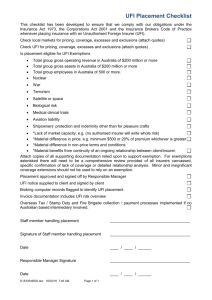

advertisement

Passthrough Entities/May–June 2002 Real Estate Undivided Fractional Interest Programs and Rev. Proc. 2002-22: Birth of an Industry? By Louis S. Weller and Neal D. Sacon 2002 L.S. Weller and N.D. Sacon Louis Weller and Neal Sacon discuss the requirements for organization of a UFI arrangement that complies with Rev. Proc. 2002-22, explore practical questions raised by these requirements and consider the potential impact and consequences of the revenue procedure. Background Today’s 500-pound gorilla of real estate tax planning is the like-kind exchange under Code Sec. 1031.1 As one of the last remaining shelters for taxable gains realized on real estate dispositions, like-kind exchanges have become a cottage industry among planners and real estate professionals focused on the needs of property owners looking for tax-effective means of selling assets. An entire industry of “qualified intermediaries” has arisen to service these transactions since the 1991 adoption of Treasury regulations establishing constructive receipt safe harbors for the conduct of deferred exchanges.2 More recently, as aging baby boomers have looked to exit from management-intensive property types into more passive forms of investment, a wave of triple-net leased corporate real estate has been marketed as replacement property to these buyers by a burgeoning specialty niche of brokers and principals. Although concrete data is hard to find, based on a survey conducted several years ago by Deloitte & Touche, billions of dollars annually flow into like-kind real estate exchange transactions.3 Many property owners wishing to divest themselves of management intensive assets and move into more passive ownership find it difficult to find properties that meet the economic criteria associated with Code Sec. 1031 and Louis S. Weller is a principal in Deloitte & Touche, LLP’s national real estate tax services group in San Francisco, California, where he leads the firm’s Transactions Planning Practice. Neal D. Sacon is a senior manager in Deloitte & Touche, LLP’s national real estate tax services group in Portland, Oregon. 23 Real Estate UFI Programs & Rev. Proc. 2002-22 that they can afford. It is difficult, for example, to find triple-net leased properties occupied by credit-worthy tenants in today’s market place for less than $1 million. Buying such a property involves evaluation of complex lease and finance documentation. As a result, purchase of these properties has been limited largely to the most sophisticated participants in the real estate world, rather than to “mom and pop.” In an effort to change this imbalance, various entrepreneurs have over the past few years begun to develop programs designed ers frequently enter into agreements both among themselves and with third parties regarding the operation of the real property, the core question presented in the like-kind exchange arena is whether a UFI arrangement should be characterized as a partnership under Code Secs. 761(a) and 7701(a)(2). If so, the UFI interests would be characterized as interests in a partnership and Code Sec. 1031(a)(2)(D) will prohibit their transfer or receipt in a Code Sec. 1031 tax-free exchange.4 If, on the other hand, the UFI interests are characterized as TIC interests under local law and the activities of the ownership [T]he practical utility of the revenue group do not rise procedure is that it suggests a framework for to the level required for UFI arrangements acceptable to the IRS. partnership or joint venture characterization under Code Sec. to allow smaller investors to ac761, then the UFI units should be quire portions of larger capable of being exchanged unreplacement properties through der Code Sec. 1031. group acquisition and ownership. To ensure a positive result, in the The key to these programs is qualiabsence of specific IRS guidance fication of the property interests on this issue, in 1999 and 2000 being sold to investors as direct several taxpayers sought rulings undivided interests in real estate, from the IRS that specific UFI arin order to take advantage of the rangements would not be treated principle that, for Code Sec. 1031 as partnerships for tax purposes. purposes, an undivided interest in These requests led to an internal real estate is like-kind to a fee indebate within the IRS and the Treaterest in real estate. Known as sury about what rules should “Undivided Fractional Interests” apply to these arrangements and, (UFIs) or “Tenancy in Common” as a direct result, the IRS aninterests (TIC interests), the key tax nounced in Rev. Proc. 2000-465 hurdle over which these programs that it would suspend issuing letmust jump is Code Sec. ter rulings addressing whether 1031(a)(2)(D), which excludes inCode Sec. 1031 applies to exterests in partnerships from the changes of UFI interests while it nonrecognition treatment acexamined the issue. In describing corded exchanges of like-kind the issues it intended to focus property by Code Sec. 1031(a)(1). upon, the IRS clearly emphasized Because real estate UFIs involve its concern for the problem of partcommon ownership and exploitanership characterization of UFI tion of an asset by multiple arrangements. In a prior article taxpayers and because UFI own- 24 published in this Journal, the authors provided suggestions on approaches the IRS should consider in undertaking this study.6 Rev. Proc. 2002-22 The product of the Rev. Proc 200046 examination has now been released as Rev. Proc. 2002-22,7 issued on March 19, 2002. This release provides guidance regarding the conditions under which the IRS will entertain a private letter ruling request that a UFI co-ownership arrangement relating to rental real property,8 such as a TIC interest, will not be treated as an entity separate from its owners (e.g., a partnership or corporation) under Reg. §301.7701-1(a). The guidance clarifies the criteria that the IRS views as distinguishing a real estate UFI arrangement from a partnership arrangement, and will enable sponsors to create rental real estate ownership structures that have ownership units capable of being exchanged for other interests in real estate in a like-kind exchange. Quite clearly and intentionally, this guidance does nothing to address similar issues that arise in connection with UFI arrangements for mineral properties or the more recent rise of UFI arrangements for corporate passenger aircraft. According to the IRS, requests for rulings on such issues will be considered under the more generic rule of Rev. Proc. 2002-1 and its annual successors.9 Although a number of UFI real estate investment programs currently are being marketed, it is likely that Rev. Proc. 2002-22 will expand the use of these investment vehicles because it provides clear insight into IRS thinking on applicable criteria that distinguish a UFI arrangement from a Passthrough Entities/May–June 2002 partnership. However, unlike the deferred exchange regulations issued in 1991, or the reverse exchange guidance released as Rev. Proc. 2000-37 in September 2000,10 the government chose not to create a “safe harbor” for UFI arrangements through this release. By its terms, the revenue procedure “provides guidelines for requesting advance rulings solely to assist taxpayers in preparing ruling requests.”11 The IRS approach is similar in this regard to the approach previously employed in Rev. Proc. 89-12 to specify the conditions under which the IRS would consider a ruling request on classification of an organization as a partnership for federal tax purposes.12 The list of information to be submitted is quite comprehensive and, in many cases, includes information that will not be available to sponsors of UFI programs prior to completion of the sale of UFI interests to ultimate co-owners.13 As with Rev. Proc. 89-12, it can be anticipated that the standards for rulings contained in Rev. Proc 2002-22 will be used more often as a basis for structuring arrangements and as a touchstone for legal opinions than as criteria for submitted private ruling requests. Rev. Proc. 2002-22 contains an essential caveat, which will doubtless engender much debate in the tax community. Section 3 expressly states that “[t]he guidelines set forth in this revenue procedure are not intended to be substantive rules and are not to be used for audit purposes.” There are at least two ways of looking at this statement, and it depends on whether the cup is half full or half empty. If the cup is half full, the IRS clearly has recognized that many UFI arrangements that do not meet its advance ruling standards still do not constitute partnerships, and planners can proceed with some confidence that structures with which they were comfortable before March 19, 2002, remain viable. If the cup is half empty, planners will be concerned that IRS field agents or even courts may be tempted to apply the ruling standards as de facto audit tests or even substantive rules despite the revenue procedure’s express admonition to the contrary. Nevertheless, the practical utility of the revenue procedure is that it suggests a framework for UFI arrangements acceptable to the IRS. This article discusses the requirements for organization of a UFI arrangement that complies with the revenue procedure. In addition, we explore a number of practical questions raised by these requirements and consider the potential impact and consequences of the revenue procedure. The Framework of UFI Arrangements Under Rev. Proc. 2002-22 Definitions Section 4 of Rev. Proc. 2002-22 contains several important definitions, which serve as a foundation for understanding its provisions: ■ “[C]o-owner” means any person that owns an interest in the Property as a tenant in common. ■ “[S]ponsor” means any person who divides a single interest in the Property into multiple co-ownership interests for the purpose of offering those interests for sale. ■ “[R]elated person” means a person bearing a relationship described in [Code ■ ■ Secs.] 267(b) or 707(b)(1), except that in applying [Code Secs.] 267(b) or 707(b)(1), the co-ownership will be treated as a partnership and each co-owner will be treated as a partner. “[D]isregarded entity” means an entity that is disregarded as an entity separate from its owner for federal tax purposes. Examples of disregarded entities include qualified REIT subsidiaries (within the meaning of [Code Sec.] 856(i)(2)), qualified subchapter S subsidiaries (within the meaning of [Code Sec.] 1361(b)(3)(B)), and business entities that have only one owner and do not elect to be classified as corporations. “[B]lanket lien” means any mortgage or trust deed that is recorded against the Property as a whole. Multiple Properties The revenue procedure contemplates that while most UFI arrangements will involve a single “Property,” some arrangements may involve multiple parcels of real estate leased to a single tenant pursuant to a single-lease agreement, where the multiple parcels are pledged a collateral for a single debt. The mere fact that multiple parcels are involved in the arrangement will not preclude the arrangement from receiving a favorable ruling, but the IRS has imposed particular conditions to these multiple parcel arrangements: (1) each co-owner must have an identical percentage interest in each parcel; (2) the co-owners’ interests in each parcel cannot be unbundled or transferred separately; and (3) the multiple parcels bear a relationship to 25 Real Estate UFI Programs & Rev. Proc. 2002-22 each other such that they “are properly viewed as a single business unit.”14 The first two requirements will generally not be a problem, although the “no unbundling” criteria does seem somewhat inconsistent with the general requirement, discussed below, that UFI owners be free to transfer their UFI interests. The third requirement is more problematic because it will require analysis in any multiple property arrangement of what constitutes a “single business unit.” Rev. Proc. 2002-22 implies that this criteria generally will be satisfied only by contiguous properties or by noncontiguous properties “where there is a close connection between the business use of one parcel and the business use of another parcel.” The example given is of an office building and a noncontiguous parking structure that serves the tenants of the office building. 15 Thus, it does not appear likely that separate noncontiguous rental properties leased to different tenants will satisfy the single business unit definition. Specific Criteria Section 6 of the revenue procedure describes the conditions that generally must be satisfied for the IRS to consider a ruling request. 16 The 15 enumerated conditions can be divided into four broad categories: (1) formation issues, e.g., the legal structure of the arrangement, the scope of the sponsor’s activities and the sponsor’s exit strategy; (2) allocation issues regarding revenue, expenses (i.e., profit and loss) and debt; (3) management and control issues, e.g., the scope of the co-owners’ activities, property management and 26 leasing; and (4) co-owner exit strategies, e.g., sale of the underlying property, puts, calls and options. These categories neatly describe the major business terms of most co-ownership agreements and section 6 thereby provides some practical advice on where the line between a TIC and a partnership/ joint venture can be drawn. It is important to note that the IRS expressly acknowledges the possibility that, under certain circumstances, failure to satisfy all criteria of section 6 will not preclude receipt of a favorable ruling on UFI status: The Service ordinarily will not consider a request for a ruling under this revenue procedure unless the conditions described below are satisfied. Nevertheless, where the conditions described below are not satisfied, the Service may consider a request for a ruling under this revenue procedure where the facts and circumstances clearly establish that such a ruling is appropriate.17 What is unknown, of course, is how much deviation from the section 6 criteria will be tolerated and under what facts and circumstances. The UFI World According to Section 6 Formation Issues TIC Under Common Law. The revenue procedure makes clear that the co-owners must hold their interests as TICs under local law. The corollary to this is that title to the property as a whole cannot be held by an entity (such as a partnership) recognized under local law. 18 It remains to be seen whether this may also apply to trusts or other title holding vehicles, such as Code Sec. 501(c)(2) title holding corporations. No Swaps and Drops. Furthermore, the revenue procedure provides that the IRS generally will not issue a ruling under this revenue procedure if the coowners held interests in the property through a partnership or corporation immediately prior to the formation of the co-ownership. 19 Thus, taxpayers who obtained their TIC interests via a distribution of real property from a partnership as part of a plan to allow individual partners to exchange their pro rata interests in the property will not be able to obtain rulings relating to these transactions, at least under this revenue procedure.20 Maximum Number. There can be no more than 35 co-owners.21 This number is consistent with prior law maximum numbers for subchapter S corporations 22 as well as current law maximum numbers for nonaccredited investors in a private placement securities offering.23 For this purpose, a husband and wife are treated as a single person and all persons who acquire interests from a co-owner by inheritance are also treated as a single person. Sponsor Fees on Purchase of UFI Interests. The amount of any payment to the sponsor for the acquisition of the co-ownership interest (and the amount of any fees paid to the sponsor for services) must reflect the fair market value of the acquired co-ownership interest (or the services rendered) and may not depend, in whole or in part, on the income or profits derived by any person from the property. Passthrough Entities/May–June 2002 Revenues, Expenses, Debt and Cash Flow Allocations Revenue and Expense Allocation. Each co-owner must share in all revenues generated by and all costs associated with the property in proportion to the co-owner’s undivided interest in the property. This is consistent with existing law under Reg. §1.761-2(a), which requires that all members of an entity eligible to elect out of treatment under subchapter K be able to separately compute their income without the necessity of computing partnership level taxable income. Debt Allocation. In dealing with debt secured by a blanket lien, the IRS took extremely conservative and, in the authors’ opinion, unjustified positions in view of the lack of authority regarding debt associated with co-ownership arrangements. According to the revenue procedure, co-owners must share in any indebtedness secured by a blanket lien in proportion to their undivided interests.24 This is one of the most important restrictions imposed by the revenue procedure and may be the one with the least theoretical support, as discussed below. Further, if the property is sold, any debt secured by a blanket lien must be satisfied and the remaining sales proceeds must be distributed to the co-owners.25 Creation of Blanket Liens. The co-owners must retain the right to approve creation or modification of any blanket lien, and any negotiation or re-negotiation of any indebtedness secured by a blanket lien must be with unanimous approval of the co-owners.26 Parties related to the co-owners, the sponsor, the manager or any lessee of the property may not make loans secured by blanket liens against the property.27 Net Revenue Distributions. If the co-owners employ a manager for the purpose of collecting revenue, then the manager must disburse to the co-owners their shares of net revenues within three months from the date of receipt of those revenues.28 Default Remedies. Neither the other co-owners, the sponsor, nor the manager may advance funds to a co-owner (i.e., a co-owner who fails to fund his or her pro rata share of negative cash flow or capital expenses) to meet expenses associated with the co-ownership interest, unless the advance is recourse to the coowner (and, where the co-owner is a disregarded entity, the owner of the co-owner) and is not for a period exceeding 31 days.29 Property Management, Operations and Decisions No Partnership Appearance. In connection with ownership and operation of a common property, the co-owners cannot hold themselves out as constituting a partnership or common business entity, including filing partnership tax returns, characterization of themselves as partners or use of a common fictitious or trade name.30 Scope of Co-Owner Activity. The co-owners’ activities must be limited to those customarily performed in connection with the maintenance and repair of rental real property (“customary activities”). The standards discussed in Rev. Rul. 75-374 are specifically referenced. Activities will be treated as customary activities for this purpose if the activities would not prevent an amount received by an organization described in Code Sec. 511(a)(2) from qualifying as rent under Code Sec. 512(b)(3)(A) and the regulations thereunder. In determining the co- owners’ activities, all activities of the co-owners, their agents and any persons related to the co-owners with respect to the property will be taken into account, whether or not those activities are performed by the co-owners in their capacities as co-owners. Sponsor’s Activities. If the sponsor or a lessee is a co-owner, then all of the activities of that party (or any related person) with respect to the property will be taken into account in determining whether the co-owners’ activities are “customary activities” undertaken by owners as TICs that do not rise to the level of partnership activities,31 but the activities of a co-owner or a related person with respect to the property (other than in the coowner’s capacity as a co-owner) will not be taken into account if the co-owner owns an undivided interest in the property for less than six months.32 Use of Management Agents. Coowners may enter into management or brokerage agreements, which must be renewable no less frequently than annually, with an agent who may be the sponsor or a co-owner (or any related person), but who may not be a lessee.33 The agreement needs to be approved unanimously by the co-owners.34 Compensation to a manager cannot be dependent on the co-owners’ income or net profits and cannot exceed fair market value for the manager’s services, a limitation that also applies to brokerage arrangements. 35 The management agreement may authorize the manager to maintain a common bank account for the collection and deposit of rents and to offset expenses associated with the property against any revenues before disbursing each co-owner’s share of net revenues. The management agreement may also: 27 Real Estate UFI Programs & Rev. Proc. 2002-22 Authorize the manager to prepare statements for the co-owners showing their shares of revenue and costs from the property. ■ Authorize the manager to obtain or modify insurance on the property, and to negotiate modifications of the terms of any lease or any indebtedness encumbering the property, subject to the approval of the co-owners. The manager must, however, disburse each co-owner’s share of net revenues within three months from the date of receipt or, apparently, no less frequently than quarterly.36 Leasing. The co-owners must retain the right to approve any leases of a portion or all of the property, and any sale, lease or release of a portion or all of the property must be by unanimous approval of the co-owners.37 All leasing arrangements must be bona fide leases for federal tax purposes. Rents paid by a lessee must reflect the fair market value for the use of the property. The determination of the amount of the rent must not depend, in whole or in part, on the income or profits derived by any person from the property leased (other than an amount based on a fixed percentage or percentages of receipts or sales), with reference to existing standards under standards applicable to real estate investment trusts, under Code Sec. 856(d)(2)(A), serving as the test. Miscellaneous Management Decisions. Except where unanimous consent is required in connection with employing a manager, sale, lease and financing decisions, the co-owners may agree to be bound by the vote of those co-owners holding more than 50 percent of the undivided ■ 28 interests in the property.38 A coowner who consents to be bound by a majority rule action may provide the manager or other person a power of attorney to execute a specific document with respect to that action, but may not provide the manager or other person with a global power of attorney. 39 Co-Owner Exit Strategies Sale of Underlying Property. Coowners must retain the right to approve the sale or other disposition of the property, and any sale must be agreed to by 100 percent of the co-owners. 40 Restraints on Alienation. In general, each co-owner must have the right to transfer, partition and encumber the co-owner’s undivided interest in the property without the agreement or approval of any person. However, restrictions on the right to transfer, partition or encumber interests in the property that are required by a lender and that are consistent with customary commercial lending practices are not prohibited.41 In addition, a co-owner may agree to offer the co-ownership interest for sale to the other co-owners, the sponsor or the lessee at fair market value (determined as of the time the partition right is exercised) before exercising any right to partition. Further, a co-owner many grant the other co-owners, the sponsor or the lessee a right of first offer (the right to have the first opportunity to offer to purchase the co-ownership interest) with respect to any potential transfer of the co-ownership interest in the property.42 In a parallel, but slightly different, formulation of permissible arrangements, a co-owner may also grant other owners an option to purchase the co-owner’s undivided interest (call option), provided that the exercise price for the call option reflects the fair market value of the property determined as of the time the option is exercised. For this call option purpose, the fair market value of an undivided interest in the property is equal to the co-owner’s percentage interest in the property multiplied by the fair market value of the property as a whole.43 Absolutely prohibited by the revenue procedure are “put” options in which a co-owner holds a right to sell the co-owner’s undivided interest to the sponsor, the lessee, another co-owner, the lender or any related person.44 The Good News What does all this mean? There is some good, some bad and definitely some ugly in Rev. Proc. 2002-22, which is quickly apparent. Definite Default Standards The guidance does create definite parameters for those seeking rulings and provides a coherent explanation of current IRS/Treasury thinking. It will, therefore, allow organizers of UFI programs and potential purchasers of UFI interests to proceed with increased certainty that specific arrangements either do or do not fit within the ruling guidelines and, thus, do or do not create a material risk of being characterized as partnerships. Further, the IRS’s position is generally consistent with prior authority relating to the subject, incorporating Rev. Rul. 75-374 and other extant principles relating to when co-owners will be deemed to be conducting a business. Limited Scope The revenue procedure has an expressly limited scope, which appears to narrowly target a particular variety of UFI arrangements Passthrough Entities/May–June 2002 and has no bearing on others. First, the revenue procedure applies only to rental real estate arrangements. This is important because the special considerations that may apply to UFI arrangements for mineral interests or aircraft can be the subject of further guidance or development through the normal ruling process without the limitations imposed by the real-estate centric elements of this pronouncement. Even more important, the revenue procedure does not displace existing substantive rules, and field agents and appellate conferees are expressly admonished of this intent. In the authors’ view, the consequence of this is that all but the most timid or uninformed will conclude that a two-party TIC arrangement need not conform to the requirements of section 6 of the revenue procedure where under existing law there was no real question about the characterization of the arrangement as a co-ownership. Related-Party Test In looking at arrangements between co-owners and third parties that might have partnership-like characteristics, the IRS took a sensible approach to the problem of related-party arrangements by incorporating the partnership rule under Code Sec. 707(b) instead of saying that a party related to any TIC would create a taint, regardless of the materiality of the interest held. Thus, loans or management arrangements with a party related to co-owners holding less than 50 percent of the interests in a property apparently will not be subject to the same taint as would apply to a co-owner or one related to a majority in interest of the co-owners. Recognizing that some UFI arrangements will involve more than a single property is beneficial, although, as discussed below, the limitation imposed by the single business unit concept appears inappropriate at least as a substantive guideline for UFI analysis. Reasonable Maximum Adoption of the maximum 35 coowner test, while perhaps not mandated by black-letter law, is a reasonable and quite workable limit that will not hinder formation of most UFI arrangements by sponsors or have any negative effect on nonsponsored TIC structures. Because the IRS potentially could have taken the position that any collective restraint on a co-owner’s rights with respect to his or her interest in a property was impermissible, the allowance of reasonable restrictive and collective management arrangements is good news. This allowance includes the right to adopt majority voting procedures for most operational issues (other than leasing, sale, finance and hiring a manager). Transfer Restrictions Even more reasonable are the permitted restrictions on the right to sell a co-owner’s interest or to institute partition actions. Despite the requirement that such rights be reserved to each co-owner, the ability to grant enforceable rights of first offer and of purchase at fair market value mean that UFI arrangements can be structured in a manner that assures co-owners that they have some control over successor ownership in the common property and can prevent forced sale of the property from being instituted by dissident minority interests, at least where there exists the capacity to buy out the minority. Similarly, UFI organizers will not be put in the position of having to refuse reasonable lender-imposed restrictions on transfer due to adverse income tax consequences to their UFI characterization. The Bad News Drop & Swap What is good news for some will be bad for others. One large group of real estate UFI arrangements is those that are created in so-called “drop and swap” transactions. These transactions occur when a partnership wants to dispose of property and partners wish to separate, with some or all of them wishing to undertake independent like-kind exchanges. One technique commonly used is for the partnership to distribute the property to be transferred to its partners in a liquidating distribution prior to the transfer. The former partners, now TICs, then separately sell or exchange their UFI interests. Among the key issues in these transactions are whether the UFI arrangement will be respected or re-characterized as a continuation of the old partnership or a creation of a new one.45 Apparently not wanting to deal with validating these transactions when other issues are almost always present (i.e., qualified use of the property, attribution of the sale back to the original partnership under the Court Holding Co. doctrine, etc.),46 the IRS expressly excluded UFI transactions where a partnership formerly had held the property from the purview of the rulings that may be sought. Multiple Properties While recognition that some UFI arrangements can involve multiple properties appears a useful provision, the revenue procedure may cast a pall over certain attempts to structure UFI arrangements where interests in multiple unre- 29 Real Estate UFI Programs & Rev. Proc. 2002-22 lated properties are bundled.47 These structures do not appear to qualify for favorable ruling reviews. The multiple property definition has a single business unit zinger, which apparently is not applicable if discrete, unconnected properties are involved. Practical Difficulty of Obtaining Advance Rulings The detailed information that must be submitted with a request for a ruling under the revenue procedure may make it impossible as a practical matter to obtain one in advance of the formation of a UFI arrangement. It seems disingenuous to require applicants to name all co-owners of a property in order to obtain a ruling because the names of all the co-owners may not be known until a sponsor finishes the marketing phase of selling off UFI interests. To date, anecdotal reaction indicates that this requirement, as well as the requirement that the applicant provide copies of all transaction documents relating to formation of a UFI arrangement (lending, leases, etc.), will mean that relatively few ruling requests will actually be filed. Avoiding Partnership Appearances While it may be easy enough to avoid filing partnership tax returns or otherwise formally denominating a co-ownership arrangement as a partnership, it is quite common for co-owners to use a fictitious business name in connection with operation of a rental property. Common examples are the creation of the “Blueacre Operating Account” or filing of a fictitious business statement listing the coowners doing business as “Blueacre Apartments” so that contracts can be signed in group name. 30 The revenue procedure appears to bar such conveniences and officials of the IRS appear to have confirmed this was intended.48 Unanimous Co-Ownership Decisions The list of decisions in which each co-owner must participate will create significant problems for many UFI arrangements and will require creative and clever design of these structures. Co-owners must each approve all leases, the selection of a property manager, any sale of the common property and any financing involving creation of a blanket lien, including refinancing transactions. As a practical matter this creates the potential for stalemate of major decisions by any co-owner, regardless of how small an interest is held. Such a potential rightfully will create anxiety in potential coowners and in lenders thinking about financing UFI property. Several avenues are available to planners seeking to reconcile a need for orderly management of UFI property and the requirements of the revenue procedure. One avenue is to assume that partition is the ultimate weapon for a stalemated TIC arrangement. If the parties cannot unanimously agree on a core decision, then the property should be subjected to court-ordered sale and the proceeds divided proportionately. Unfortunately, this places a great deal of power in any minority UFI owner willing to exercise the right to dissent from a sale, financing, lease or manager employment decision desired by all other co-owners. The IRS will doubtless be asked whether a co-owner can give prior consent to sale, leasing, finance or management decisions that meet pre-defined criteria. In other words, can a co-ownership agreement to which all co-owners are party contain provisions stating that the owners agree in advance to a sale at future date at a price equal to, say, an independently appraised property value? Can the co-owners agree in advance that they will consent to leases of space within the common property as long as the leases bear minimum rents and contain other predefined terms, such as amounts to be expended for tenant improvements, lease duration, etc.? In these cases, all co-owners would be consenting to the actions, but not contemporaneously with the timing of the action. It remains to be seen whether such pre-set criteria will pass muster. Another approach might be to require all co-owners to invest in a UFI property through limited liability companies in which the sponsor or a related party is the manager, but where the UFI owner holds 100 percent of profits, losses and capital interests. It remains to be seen whether giving decisionmaking power to the sponsor in this manner will be allowed. Debt Allocation As briefly mentioned above, perhaps the least justifiable requirements contained in the revenue procedure have to do with debt secured by a blanket lien. In attempting to prevent partnershiplike characteristics from being grafted into UFI arrangements via their financing structures, the IRS has prohibited use of economic arrangements that have nothing to do with tax abuse. There is nothing strange, for example, about a UFI arrangement in which different coowners wish to utilize different debt-equity ratios to acquire their pro rata share of the common property. It is typical for a lender providing financing to some co- Passthrough Entities/May–June 2002 owners to require that such financing be secured by the entire common property rather than an undivided interest; this is because the lender does not want to own an undivided interest if forced to foreclose on its security in the event of loan default. There is nothing strange about nonborrowing coowners being prepared to allow their UFI interests to serve as collateral for such a loan, so long as the nonborrowers are fully indemnified by the borrowers against loss as a result of any default. Example. Consider Dick and Terry who wish to purchase Blueacre for $100, with Dick willing to put up $50 cash and Terry able to borrow $50 from Howard, who requires receipt of a deed of trust to all of Blueacre. Terry’s share of net cash flow from Blueacre is sufficient to pay debt service on the $50 loan. Dick is willing to cooperate as long as Terry indemnifies Dick against any loss by reason of Dick pledging his interest in Blueacre to secure the loan from Howard. Terry should be able to service Howard’s loan and retire it on sale of the property (or of Terry’s interest). If proceeds from sale of Terry’s 50-percent interest are not sufficient to pay Howard, Terry must make up the difference. This system does not require any partnership-level computation of income or any allocation of debt. It should not affect characterization of Dick and Terry’s relationship as co-owners. Similarly, the requirement of section 6.07 of the revenue procedure that debts secured by blanket liens be retired on a sale of commonly owned property seems unnecessary. Consider the sale of property by a TIC where most or all of the co-owners wish to engage in a like-kind exchange and become co-owners of the replacement property. The holder of a loan secured by a blanket lien is willing to continue to extend credit to the group and to shift the lender’s security to the replacement property. Why should this scenario be prohibited? Further, in the modern world of securitized mortgaged debt and collateralized mortgage backed securities (CMBS), it is not uncommon to find absolute bars to debt prepayment for fairly lengthy periods after a CMBS loan is initiated. The solution when a mortgage lien must be removed is “defeasance,” a procedure in which cash or cash equivalent collateral is substituted for real estate collateral. It is not at all clear that defeasance is allowable under the mandate of section 6.07. The IRS’s rationale for the requirement of blanket lien debt payoff on a property sale simply does appear persuasive. While it is certainly understandable in light of various limitations on the character of related-party debt, the absolute limitation on related-party loans contained in section 6.14 will require careful vetting of the identity of co-owners and lessees. This will place UFI sponsors in the same position as currently applies to group investment sponsors subject to the related-party-debt-at-risk limitation of Code Sec. 465(b)(3). Capital Calls A rather peculiar required element of UFI arrangements complying with section 6 will be the limited remedies available to co-owners upon default of any owner to contribute required capital. Section 6.08 allows co-owners, sponsors and/or managers to advance funds to meet co-owner capital calls, but only where the advance is recourse to the “defaulting” partner and “is not for a period exceeding 31 days.” It is not clear what is supposed to happen if the advance is not repaid within that short period. If the only remedy of the advancing co-owners is to purchase the defaulting partner’s interest, then the requirement of fair market value payment appears to provide an advantage to the defaulting party. This is inconsistent with a currently common practice of subjecting a defaulting party to a “hair-cut” upon mandatory sale of its interest following default in making a required capital contribution. Scope of Co-Owner Activity Section 6.11 of the revenue procedure attempts to limit co-owner business activities to those “customarily performed in connection with the maintenance and repair of rental real property.” According to the revenue procedure, the activities of the co-owners, their agents and related parties will be taken into account. However, it is not clear how this rule will correlate with the principle that for attribution purposes the rule of Code Sec. 707(b)(1) and (b)(2) will apply, i.e., whether noncustomary activities by a one-percent coowner will be attributed to the entire UFI group. If so, business arrangements involving a one-percent co-owner directly will be poison, but business arrangements involving a party related to 49 percent of the co-owners will not. This may elevate form over substance. Sponsor Exit Strategies In an effort to recognize the sales cycle of UFI arrangements, the IRS 31 Real Estate UFI Programs & Rev. Proc. 2002-22 created a six-month safe harbor during which business activities, e.g., those activities that rise above the “customary activities” of Rev. Rul. 75-374, engaged in by co-owners will not taint a UFI arrangement. This appears to be primarily directed at UFI sponsors who hold UFI interests as they are being sold to unrelated co-owners. Because these rules are not intended as substantive principles, it appears that such limitations may apply only to UFI arrangements seeking rulings. However, if the marketplace adopts the six-month period as a default, this could have significant effects on the methods of marketing UFI arrangements. On the other hand, in most real estate group investments a sixmonth period should be more than sufficient time for a well-organized sponsor to sell all UFI interests. Adoption of fair market value requirements for such things as management fees,49 sponsor compensation, 50 co-owner buy-out options,51 lease rates52 and brokerage fees53 will put a premium on the methods used to determine such value. This could be particularly troublesome with respect to lease rates, because the requirement is not limited to related-party lessees, but is apparently global in an attempt to screen out the possibility of partnership arrangements between co-owners and lessees. However, the revenue procedure is silent as to the standards that may be employed to establish the fair market value of lease terms. One interesting question related to valuation arises from the requirement of section 6.15 of the revenue procedure that payments to a sponsor for a UFI interest be equal to the fair market value of that interest “and may not depend, in whole or in part, on the income or profits derived by any person from the Property.” This seems in- 32 nocuous. However, it is common in valuing commercial real estate, particularly net-leased real estate, to establish fair market value by reference to capitalized income from the property. If the revenue procedure admonition is taken literally, use of an income capitalization rate system for establishing UFI unit value may not be permissible—a very strange result when this is exactly the system typically used by the market to determine the value. Another potential problem with this requirement is its effect on variable pricing for co-ownership interests. In any UFI arrangement, the possibility exists that individual UFI interests might be offered by sponsor-sellers at different prices at different times. This could be due to changing property characteristics, e.g., execution of a favorable lease that raises property value or termination of an above market rate lease that lowers value. It remains to be seen whether the requirement of section 6.15 will allow for such variations, even though they should have no effect whatsoever on a determination that the eventual co-owners of a property are or are not partners. A minor, but potentially annoying, provision that restricts flexibility of UFI arrangements for reasons that do not seem compelling is mandatory distribution of co-owner net revenue shares on a quarterly basis if the property is managed by an agent. While this is, in general, probably not a difficult requirement to follow, it gives rise to the question of whether creation of a sinking fund or other reserve for future capital expenditures will be permitted. In other words, can a manager retain a share of co-owner revenues in order to create such a fund without violating the “distribute it all” mandate of section 6.12. The Ugly Of all the limitations described above, two initially stand out as creating the largest headaches for UFI sponsors: ■ The twin requirements of pro rata debt allocation on debt secured by blanket liens and of mandatory debt payoff on transfer of property have no substantive law support. The first of these will make it difficult to construct UFI arrangements capable of responding to separate debt/ equity ratio requirements on the part of different co-owners. ■ Unanimity of TIC decisionmaking on sale, finance, change of property manager and leasing decisions will test the mettle of planners. It is probably not practical or sound business practice to allow a one-percent owner to effectively block sale of a property or appintment of a manager. Planners are likely to explore the possibility of pre-approved terms of sale to which all owners consent in advance or other mechanisms providing advance assurance that a business plan that contemplates sale of a common property at a particular time or under particular circumstances can be carried out. Conclusion Rev. Proc. 2002-22 represents another effort, in a recent series of efforts, to provide rules for taxpayers exploring various techniques involving Code Sec. 1031. In general, it provides a reasonable pathway for sponsors of rental real estate UFI programs to offer these as replacement property alternatives in the marketplace. There are a number of problematic elements to Passthrough Entities/May–June 2002 this guidance, which will restrict the number of taxpayers actually submitting requests for rulings or who choose to comply in all respects with standards promulgated by the release. However, the IRS is to be commended for tackling the issue and attempting to create clear, concise standards for those taxpayers that wish the certainty of private letter ruling review while at the same time expressly acknowledging that alternate arrangements can and will work. With the issuance of Rev. Proc. 2002-22, it appears likely that the infant “industry” made up of UFI sponsors and programs will begin to grow and take orderly shape. ENDNOTES 1 2 3 4 5 6 7 8 9 10 11 12 13 Although Code Sec. 1031 applies to nonreal estate assets as well, this article focuses on real estate like-kind exchanges for reasons that will become apparent. Reg. §1.1031(k)-1(g). Louis S. Weller and Joyce L. Stanney, IRC Section 1031 Exchange Market Alive, Well and Thriving, 18 REAL EST. TAX DIGEST 10, Oct. 2000, at 359. There are, of course, many transactional structures to accomplish tax-deferred or taxfree transfers of partnership interests. These are frequently the topic of discussion in this Journal. This article does not, however, address such techniques under subchapter K. Rev. Proc. 2000-46, IRB 2000-44, 438. Louis S. Weller and Neal D. Sacon, Fractional Interests in Real Estate and Code Sec. 1031: Legitimate End Run or Illegal Formation, J. P ASSTHROUGH ENTITIES., Sept.-Oct. 2001, at 39. Rev. Proc. 2002-22, IRB 2002-14, 1. The revenue procedure is applicable only to UFI arrangements involving rental real property and thus inapplicable to other transactions in which the UFI arrangement is used, e.g., aircraft and equipment leasing, and was issued as ruling guidance only. Rev. Proc. 2002-22, supra note 5, section 1 (last sentence). Rev. Proc. 2000-37, IRB 2000-40, 308. Rev. Proc. 2002-22, supra note 5, section 3. Rev. Proc. 89-12, 1989-1 CB 798. See also Rev. Proc. 95-10, 1995-1 CB 501, which modified Rev. Proc. 89-12 to include classification of LLCs as partnerships. Rev. Proc. 2002-22, supra note 5, section 5.02, reads as follows: Required General Information and Copies of Documents and Supplementary Materials. Generally the following information and copies of documents and materials must be submitted with the ruling request: (1) The name, taxpayer identification number, and percentage fractional interest in Property of each co-owner; (2) The name, taxpayer identification number, ownership of, and any relationship among, all persons involved in the acquisi- 14 15 16 17 18 19 20 21 22 23 24 25 tion, sale, lease and other use of Property, including the sponsor, lessee, manager, and lender; (3) A full description of the Property; (4) A representation that each of the co-owners holds title to the Property (including each of multiple parcels of property treated as a single Property under this revenue procedure) as a tenant in common under local law; (5) All promotional documents relating to the sale of fractional interests in the Property; (6) All lending agreements relating to the Property; (7) All agreements among the co-owners relating to the Property; (8) Any lease agreement relating to the Property; (9) Any purchase and sale agreement relating to the Property; (10) Any property management or brokerage agreement relating to the Property; and (11) Any other agreement relating to the Property not specified in this section, including agreements relating to any debt secured by the Property (such as guarantees or indemnity agreements) and any call and put options relating to the Property. Rev. Proc. 2002-22, supra note 5, section 4. Id. Note that the revenue procedure as published contains two sections enumerated as “6.” “Conditions” are described in the first section 6. The effect of the procedure on other documents is described in the second section 6, which is probably properly numbered as section 7. Rev. Proc. 2002-22, supra note 5, section 6 preamble. Id., section 6.01. Id., section 6.03. See text infra note 45 for further discussion of this issue. Rev. Proc. 2002-22, supra note 5, section 6.02. Code Sec. 1361(b)(1)(A) prior to 1997 amendment. SEC Rules 505 and 506, 17 CFR 230.505(b)(2)(ii); 17 CFR 230.506(b)(2)(i). Rev. Proc. 2002-22, supra note 5, section 6.09. Id., section 6.07. 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 Id., section 6.05. Id., section 6.14. Id., section 6.12. Id., section 6.08. Id., section 6.03. Id., section 6.11. Id. Id., section 6.12. Id., section 6.05. Id., section 6.12. Id. Id., section 6.05. Id. Id. Id. Id., section 6.06. Id. Id., section 6.10. Id. For detailed discussion of this technique, see Charles H. Egerton and Joseph H. Wiser, Planning to Deal with the Recalcitrant Partner in a Code Sec. 1031 Exchange, J. PASSTHROUGH ENTITIES, Mar.-Apr. 1999, at 23-24. The doctrine of attribution of a property sale to an entity that agrees to sell the asset and then distributes the asset to the entity’s owners prior to the sale in an attempt to evade entity level taxation. Court Holding Co., SCt, 45-1 USTC ¶9215, 324 US 331, 65 SCt 707 (1945). See, e.g., TAM 9645005 (July 23, 1996). At least one sponsor of such a form of UFI arrangement has applied for a patent that describes a format for creating unit interests in multiple unrelated properties that are the subject of a single master lease. See U.S. Patent Office Patent No. 6,292,788 B1, filed Sept. 18, 2001. See Tax Analysts, TNT, Apr. 11, 2002, report of Apr. 10, 2002, meeting of the District of Columbia Bar Association Taxation Section comments by Jeanne Sullivan of the IRS Office of Passthroughs and Special Industries. Rev. Proc. 2002-22, supra note 5, section 6.12. Id., section 6.15. Id., section 6.06. Id., section 6.13. Id., section 6.12. This article is reproduced from the Journal of Passthrough Entities. To order or get more information about this bimonthly publication, call 1 800 449 8114 or visit tax.cchgroup.com. 33