9-37, 9-38, 9-39

advertisement

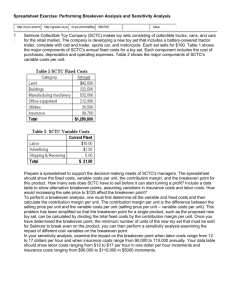

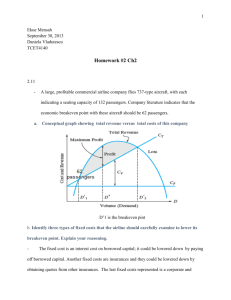

9-37 CVP Analysis; Strategy 1. BE units = F ÷ (p − v) = $225,000 ÷ ($45 − $30)/unit = 15,000 units BE $ = F ÷ CMR = F ÷ [(p − v) ÷ p] = $225,000 ÷ [($45 − $30) ÷ $45] = $225,000 ÷ 0.33333 = $675,000 2. πB= Sales − variable costs − fixed costs = [Q × (unit contribution margin)] − F = [20,000 units × ($45 − $30)/unit] − $225,000 = $300,000 − $225,000 = $75,000 Contribution Income Statement: Sales (20,000 units × $45.00/unit) = Less: Variable costs (20,000 units × $30.00/unit) = Contribution Margin = Less: Fixed costs = Operating income = $900,000 $600,000 $300,000 $225,000 $75,000 3. Margin of safety (MOS) = 32,000 − 15,000 = 17,000 hats MOS ratio = 17,000 ÷ 32,000 = 53.125% Both the MOS and the MOS ratio refer to the extent to which sales could fall before losses are realized. In this sense, they are rough measures of operating risk and are therefore helpful in addressing inherent uncertainty in the profit-planning process. 4. BE units = F ÷ contribution margin per unit = ($225,000 + $106,500) ÷ ($45 − $25.50) = $331,500 ÷ $19.50/unit = 17,000 units πB= Sales − variable costs − fixed costs = [Q × (unit contribution margin)] − F = [20,000 units × ($45.00 − $25.50*)/unit] − ($225,000 + $106,500) = $390,000 − $331,500 = $58,500 *$30.00 − $4.50 5. A key strategic issue is that Hank’s sales staff is a critical success factor for the business, especially in the growing and competitive environment of Hank’s business. His knowledgeable and courteous staff help to bring in and retain customers. If the salary/commissions plan would alienate his sales staff, the plan could be a big mistake. Hank should proceed with caution, and be sure that his sales staff will be as highly motivated under the salary plan as they were under the commission plan. The decision can also be viewed as an ethical issue: what responsibility does Hank have to his staff? Is he properly considering what is due their loyalty to him in prior years, and how the decision will affect their families, for better or worse? Finally, there is the issue of operating risk associated with moving to a cost structure characterized by relatively higher fixed costs (traded-off against lower variable costs). • Possible benefits: o If variable costs (such as variable labor costs) are high, this strategy may minimize total costs. o Upside potential: once the breakeven point is reached, percentage changes in sales volumes are magnified in terms of their effect on operating income. • Possible costs/disadvantages: o Increased operating (business) risk (e.g., generally speaking, there will be a higher breakeven point) o If sales volume recedes, these reductions are magnified in terms of decreasing operating income (that is, there will likely be greater losses when times are not so good) o In combination with a high level of financial leverage, total (combined or composite) leverage, and therefore total risk, can be magnified o Locking into a high level of fixed costs (e.g., a certain technology) may reduce future flexibility (e.g., ability to embrace new technologies or ability to react to short-term fluctuations in demand) o Increased fixed costs on top of an existing high level of fixed costs can dramatically increase operating risk. o Increased fixed costs (e.g., those associated with insourcing) may expose the company to increased risk or exposure to production slow-downs or stoppages, as experienced in 2011 in Japan as a consequence of the earthquake/tsunami that hit the country). 9-38 Profit Planning: Multiple Products 1. Break-even in units: weighted-average contribution margin approach a. Overall breakeven point = F ÷ weighted-average contribution margin/unit Weighted-average unit contribution per unit = ($15 × 80%) + ($40 × 20%) = $20 per unit Break-even point = $400,000 ÷ $20/unit = 20,000 units b. Breakdown of breakeven units: Product A: 20,000 × 80% = 16,000 Product B: 20,000 × 20% = 4,000 2. Use Goal Seek (in Excel) to calculate the breakeven point, in terms of total units: Step One: Set Up the Equation for Operating Income Step Two: Run Goal Seek Step Three: Results (after running Goal Seek) 3. Breakeven point in units: “Sales basket” approach (assume that each basket consists of 4 units of Product A and 1 unit of Product B). a. Overall breakeven point (in baskets) = F ÷ contribution margin/basket Contribution margin per sales basket = (4 × $15) + (1 × $40) = $60 + $40 = $100 per “basket” Number of “baskets” needed to breakeven = = $400,000 ÷ $100/basket = 4,000 “baskets,” or 4,000 baskets × 5 units per basket = 20,000 units b. Breakdown of breakeven units: Product A: 4,000 “baskets” × 4 units/basket = 16,000 units Product B: 4,000 “baskets” × 1 unit/basket = 4,000 units 4. Distribution of breakeven point in terms of sales dollars (based on weighted-average contribution margin ratio, where the individual product weights are based on relative sales dollars, not physical unit, of each product in the standard sales mix). a. Breakeven ($) = F ÷ weighted-average cm ratio Relative sales dollars (not units), based on standard sales mix: Product A: 18,000 units × $80/unit = $1,440,000 Product B: 4,500 units × $140/unit = $630,000 Weights: Product A: $1,440,000 ÷ $2,070,000 = 0.6956522 Product B: $630,000 ÷ $2,070,000 = 0.3043478 Weighted-average contribution margin ratio: A: 0.69565 × ($15/$80) = 0.6956522 ×0.1875 = 0.13043478 B: 0.30435× ($40/$140)= 0.3043478 ×0.2857 = 0.08695652 0.21739130 Breakeven point in overall dollars ($) = $400,000 ÷ 0.21739130 = $1,840,000 b. breakdown of total breakeven sales dollars, by product: Product A: mix % x breakeven sales, in $ = 0.6956522 × $1,840,000 = $1,280,000 Product B: mix % x breakeven sales, in $ = 0.3043478 × $1,840,000 = $560,000 5. For the multiproduct firm, there is no breakeven point independent of the sales mix assumption. For the multiproduct firm, we typically assume that the outputs are sold in some standard mix, based either on relative physical units or relative sales dollars. If the individual products differ in terms of their contribution margin per unit (or contribution margin ratio), then the weighted-average contribution margin (and contribution margin ratio) will vary in response to changes in the sales mix. This, in turn, affects the breakeven point since that point is defined as the ratio of fixed costs to the weighted-average contribution margin per unit (or, the weighted-average contribution margin ratio). Of course, if the unit contribution margins are the same for each product, then the assumed mix has no impact on the breakeven calculation. Note, however, that this is a trivial example. 6. Change in the breakeven point (in total units) in response to a 10% change in fixed costs: New level of fixed costs = $400,000 + $40,000 = $440,000 Original level of fixed costs = $400,000 $ change in fixed costs = $40,000 Percentage change in fixed cost = $40,000 ÷ $400,000 = 10.00% New breakeven point = $440,000 ÷ $20.00/unit = 22,000 units Original breakeven point = 20,000 units Change in breakeven point = 2,000 units Percentage change in breakeven point = 2,000 ÷ 20,000 = 10.00% As seen from the above, the percentage change in fixed cost (here 10%) led to an identical percentage change in the breakeven point. Because of the linear cost functions assumed in a conventional CVP model, this finding can be generalized: with everything else held constant, a given percentage change (+ or -) in the amount of fixed costs leads to an equivalent percentage change in the breakeven point. 9-39 CVP Analysis/Profit Planning 1. BE in units = F ÷ (p − v) = $324,000 ÷ ($90 − $63) = 12,000 units Contribution margin ratio = (p – v) ÷ p = $27 ÷ $90 = 30% BE sales dollars = 12,000 × $90 = $1,080,000 Alternatively, B/E in dollars = F ÷ cm ratio = $324,000 ÷ 0.30 = $1,080,000 2. Required sales, in units and in dollars, to achieve pre-tax profit goal of $30,000: # units = (F + πB) ÷ cm per unit = ($324,000 + $30,000) ÷ $27/unit = $354,000 ÷ $27/unit = 13,111.11 units required sales, in $ = required sales in units × selling price/unit = 13,111.11 units ÷ $90/unit = $1,180,000 OR, required sales in $ = (F + πB) ÷ cm ratio = $354,000 ÷ 0.30 = $1,180,000 3. Required sales to achieve after-tax profit goal: after-tax profit goal = $25,000 conversion of after-tax profit goal into pre-tax dollar equivalent: $25,000 ÷ (1 – t), where t = combined income tax rate \ = $25,000 ÷ (1 – 0.4) = $41,666.67 Required sales (in units) to achieve after-tax profit target = (F + targeted pre-tax profit) ÷ cm per unit = ($324,000 + $41,666.67) ÷ $27.00 = $365,666.67 ÷ $27.00 = 13,544 units (rounded up) Required sales, in $, to achieve after-tax profit target = required sales volume, in $ × selling price/unit = 13,544 units × $90/unit = $1,218,960 4. Contribution income statement: Sales (13,544 units × $90/unit) = $1,218,960 Less: Variable cost (@ $63/unit) = $853,272 Contribution margin (@ $27/unit) = $365,688 Less: Fixed costs $324,000 Pre-tax (operating) income = $41,688 Less: Income tax (@40%) = $16,675 Profit after tax = $25,013 Note: Difference of $13 is due to rounding up in terms of sales volume in units. 5. Profits will decrease by $19,500, from -$27,000 to - $46,500 Sales Variable Costs $ Contribution Margin Fixed Costs Operating Loss Original 990,000 $ 693,000 297,000 324,000 $ $ (27,000) $ 135,000 94,500 40,500 60,000 After change $ 1,125,000 $ 787,500 $ $ (19,500) $ 337,500 384,000 (46,500) Or, = Increase in CM – Increase in Fixed Costs = ($135,000 × 0.3) − $60,000 = ($19,500) 6. Profit will decrease $109,400, from a loss of $27,000 to a loss of $136,400: Planned reduction in selling price/unit = Estimated increase in sales volume (units) = Estimated increase in fixed costs = Sales Variable Costs Contribution Margin Fixed Costs Operating Income (Loss) $ $ $ $ $ Original 990,000 693,000 297,000 324,000 (27,000) $ $ $ $ $ Change 79,200 138,600 (59,400) 50,000 (109,400) 10% 20% $50,000 $ $ $ $ $ New 1,069,200 831,600 237,600 374,000 (136,400) 7. The total reduction in variable cost is $5 × 11,000 = $55,000, while the increase in fixed costs is $30,000, resulting in a net savings of $25,000.