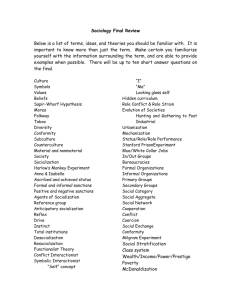

Institutions and Organizational Socialization: Integrating

advertisement