Retail Store Execution: An Empirical Study

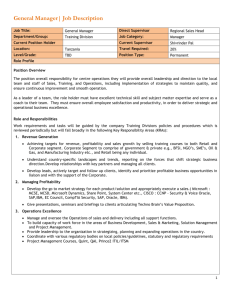

advertisement