Total Control Account Settlement Option

advertisement

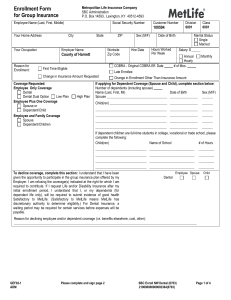

Total Control Account® Settlement Option Customer Agreement What Is the Total Control Account Settlement Option (“Account”)? It is a settlement option at Metropolitan Life Insurance Company ("MetLife," "we," "us" or "our") which although not a money market account, credits money market interest rates on life insurance, annuity, and matured endowment proceeds, and other amounts payable to the Account holder ("you," "your," "I" or "me"). You have total control of the money in your Account in that you can immediately make withdrawals of $250 or more up to the full value of your Account anytime, without penalty or loss of interest. The principal and interest in your Account are guaranteed by MetLife. These guarantees are subject to the financial strength and claims paying ability of MetLife. The Account is not FDIC insured. What Rate of Interest Will I Earn? MetLife will set the interest rate weekly. The rate we set will equal or exceed at least one of the following indices: the prior week’s Money Fund Report Averages™/Government 7-Day Simple Yield (a leading index of government money market mutual fund rates), or the “Bank Rate Monitor™” National Money Market Rate Index (a leading index of rates paid by 100 large banks and thrifts on money market accounts).* Subject to the terms of this Customer Agreement, we guarantee that the effective annual yield on your Account will not be less than 0.50%, even if money market yields fall below that level. Of course, you always have the right to immediately withdraw your entire Account balance. Is Interest Compounded Daily? Yes, interest is compounded every day of the year. It is credited to your Account once each month. How Can I Withdraw Money? Because the assets backing your Account are not held at a bank, your Account is a draft account and not a checking account. However, you can use these Account drafts that we supply to you (referred to here as "checks" or "checkbook") just as you would checks from a checking account at a bank. You may make withdrawals by written request, telephone (subject to MetLife’s current procedures), or by using the checks we supply to you. The checks are drawn on a bank account made available to you at a bank chosen by MetLife. Each withdrawal must be $250 or more. Your use of this Account is subject to the rules and regulations of the bank where the checks are drawn. Once you withdraw money from your Account, you may not put it back. How Much Does the Account Cost Me? There is no monthly service or maintenance fee for your Account, and there is no charge for withdrawals or for checks. Special services such as stop payment orders, photocopies of checks or statements, wire transfers, and dishonored checks are subject to the current applicable fees of the bank. The assets backing the Total Control Accounts are maintained in MetLife's general account and are subject to MetLife's creditors. MetLife will bear the positive or negative investment experience of such assets. Regardless of the investment experience of such assets, the interest credited to your Account will never fall below the guaranteed rate stated previously. Because MetLife bears the investment risk of the assets backing all Total Control Accounts, it may receive a profit from these assets. How Will I Know the Status of My Account? The letter you received with this Customer Agreement shows the amount of proceeds initially placed in your Account (“initial proceeds”), the date your Account opened and your Account number. We will also send you statements regularly, showing your Account balance and activity. Your Account balance is the initial proceeds plus any other insurance proceeds added to the Account plus interest credited, less any withdrawals and less any fees for special services charged by the bank. It is important for you to keep records of any withdrawals you make or any bank fees you incur so you know what your Account balance is at all times. This will help you reconcile your statement. What Happens if My Account Balance Falls Below $2,500? If your Account balance falls below $2,500, we may close your Account by sending you a check for the Account balance. What Happens if My Account Balance Falls Below $250? If your Account balance falls below $250, we will close your Account by sending you a check for the Account balance. If the Account balance is less than $1.00, a check will not be issued unless requested. Will I Receive My Canceled Checks With My Account Statement? No, your canceled checks are held by the bank. If you need to examine a particular check you may request a copy of it. There will not be a fee for the first check copy in each calendar year. Additional requests may incur a fee. * " MFR TM/Government 7-Day Simple Yield" is a trademark of iMoneynet, Inc., Westborough, MA 01581. The "Bank Rate Monitor" is a trademark of Bankrate, Inc., North Palm Beach, Fl, 33408. If either index becomes discontinued, is changed substantially or unavailable to us, we will select a suitable standard to replace it. JY8272.SCRE (06/10) What if I Write a Check for More Than My Account Balance? If your check is in excess of your Account balance at the time the bank receives your check, the bank will return your check marked “insufficient funds” and charge your Account the applicable fee for the dishonored check. Is My Account Protected From Claims of Creditors? To the extent permitted by applicable state and federal law, insurance or annuity proceeds held in your Account are not subject to the claims of your and/or the decedent’s creditors. Can My Account Be Assigned or Be Used as Collateral? No, you may not assign or transfer your Account to another person or entity, nor may it be used as collateral. What if Something Happens to Me? Subject to state law, in the event of your death, and upon receipt of proof and proper written claim, your Account balance will be transferred to the beneficiary or beneficiaries of your Account. Your beneficiary designation must be in writing and recorded with us at our Utica, New York office or any other office we specify, prior to your death. If we have not recorded a beneficiary or no beneficiary is alive at your death, payment will be made to your estate. Executors, personal representatives, guardians and minors generally may not designate a beneficiary. What is My Legal Relationship with MetLife? Your Account relationship with MetLife is that of debtor and creditor. This Customer Agreement and the Account Relationship do not create a fiduciary, quasi-fiduciary, or special relationship between us. Jeffrey A. Welikson Senior Vice President and Secretary Supplemental Agreement Form TCA/MIGRP (12-02) Metropolitan Life Insurance Company New York, NY 10010 Can I Add Funds to the Account? Only insurance proceeds and other funds payable under MetLife policies, contracts, or settlement options may be added to the Account. For your convenience, MetLife may make other services and products available to you for monies that may not be added to this Account. What Other Options Are Available From MetLife for My Proceeds? You may move all or a portion (subject to applicable minimums) of your Account balance into the Guaranteed Interest Certificate Option, if available, or into any other settlement option for which you then qualify. Other available settlement options are described in the booklet accompanying this Customer Agreement. When Can MetLife Change the Terms of This Agreement? MetLife guarantees that, except as may be required by law, the terms and conditions of this Customer Agreement will not change for at least six months from the date your Account was established. After six months, MetLife may change the terms of this Agreement by, for example, deleting features such as the use of a standard to set interest rates, or by imposing fees. If we decide to make changes we will notify you, at your last address as it appears on your Account records, at least 15 days before the changes are to become effective. Is This My Entire Agreement? Yes. Changes to this Customer Agreement may be made only in writing, signed by an authorized officer of MetLife. No provision can be waived or changed by any other employee, representative, or agent of MetLife. The rules and regulations concerning the use of the Account, however, are subject to change by the bank at any time upon 10 days written notice. C. Robert Henrikson Chairman, President and Chief Executive Officer JY8273.SCR (06/10)