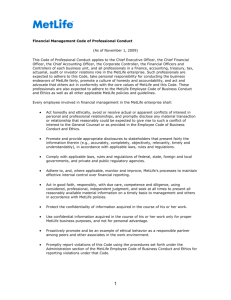

“At MetLife, we`re leading the global transformation of an industry we

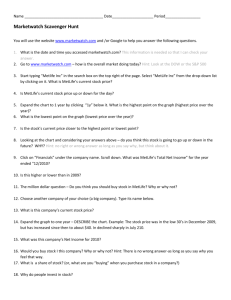

advertisement

“At MetLife, we’re leading the global transformation of an industry we’ve long defined. United in purpose, diverse in perspective, we’re dedicated to making a difference in the lives of our customers.” MetLife Investments is a premier asset manager with breadth across various asset sectors and global markets, and strong asset-liability management capabilities. With a $450 billion combined domestic and international general account portfolio and a multi-billion dollar annual cash flow, Investments is an important contributor to MetLife’s financial performance. The primary objective of Investments is to maximize MetLife’s long-term economic value by investing in assets that support the company’s liabilities and produce a consistent stream of operating earnings. The Municipal Bond unit is looking to hire a new credit analyst at the Associate Director level. MetLife’s municipal bond portfolio has grown to about $15 billion in assets. We expect to continue to grow the portfolio. THE ROLE: Provide credit analysis and monitoring of municipal credits. Provide analysis of specific municipal sectors. Communicate credit views and ideas to PM and trader(s). Key Relationships: Portfolio Manager, Traders, and Research peers. Key Responsibilities: Analyze municipal credits for purchase/sale, with specific emphasis on A and Baa rated credits. Make buy/sell investment recommendations based on credit views. This includes writing detailed credit memos for new purchases and annual credit reviews. Present credit analyses to management credit committee. Develop and maintain relationships with Street analysts, rating agencies, issuers and other research entities as appropriate. Proactively contribute credit and relative value ideas within the Unit by keeping abreast of all aspects of the municipal market, including new developments, issuance, and new structures. Required: Master’s degree or CFA and Bachelor’s degree. 5+ years of financial industry experience. Preferred: 3 years municipal credit experience in general obligation or revenue bonds with an understanding of municipal markets highly preferred. Ability to work effectively with and through others at all levels of the organization. Proficiency in Open Bloomberg, Excel, Word. Solid quantitative and analytical skills. Strong organization skills. Excellent oral and written communication skills. Please apply to the following URL: https://erecruit.hrms.metlife.com/psc/EREC/ERECRUIT/ERECRUIT/s/WEBLIB_ERECRUIT.EXTERNAL_GATE WAY.FieldFormula.IScript_ApplyForJob?&JobOpeningId=87960&SiteId=110&PostingSeq=1