Report Annual - Walmart Chile

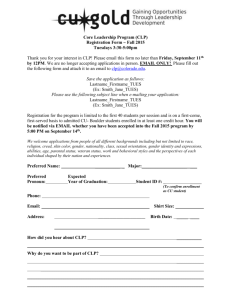

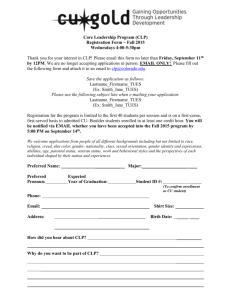

advertisement