Frequently Asked Questions about the Accounting Major at the

advertisement

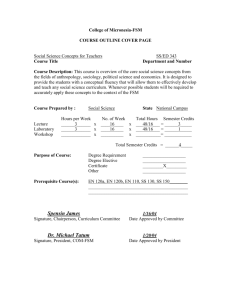

Frequently Asked Questions about the Accounting Major at the Rutgers Business School Undergraduate-New Brunswick (RBSUNB) (updated March 14, 2006) Note: References are made in this document to the Student Guide to the Rutgers Undergraduate New Brunswick Accounting Program. That Student Guide and updated versions of this Frequently asked Questions document can be found on-line at http://business.rutgers.edu/undergrad/nb/ Question 1 What is the minimum cumulative GPA required for admittance as an accounting major into the RBSUNB-Accounting Program? Answer 1 This is not a simple question to answer since the minimum cumulative GPA depends upon how many students apply in a particular year to the accounting major and to RBSUNB. RBSUNB admits approximately 400 students per year (admittance is only during the Fall semester). The percentage of these students who have been admitted as accounting majors has ranged from as low as 20% to as high as 41% during the past ten years. Shown below for the past five years are the number of accounting majors admitted into RBSUNB accounting major and the minimum cumulative GPA required for admittance for each of these years. There are no exceptions to this minimum cumulative GPA requirement. Semester When Admitted Fall Fall Fall Fall Fall Fall 2001 2002 2003 2004 2005 2006 Number of Accounting Majors 84 89 108 113 110 105* Minimum GPA for Admission 3.15 3.30 3.20 3.25 3.15 3.10 Accounting Majors as a % of Total Students Admitted into RBSUNB 21% 22% 27% 28% 27% 26% *approximately Question 2 I am not a student in the Rutgers Business School undergraduate-New Brunswick (RBSUNB) and wish to take accounting courses at Rutgers New Brunswick. How may I do so? Answer 2 If you intend to apply to the RBSUNB but have not yet been admitted you may take only one accounting course (33:010: 272, Introduction to Financial Accounting) during the regular fall and spring semesters. Students not admitted to RBSUNB can always take the second accounting course (33:010:275, Introduction to Managerial Accounting) during the summer. Those admitted into the accounting major should think twice about taking Managerial Accounting in the summer. See answer 3 for why. 1 Question 3 I am a sophomore who has just been admitted to RBSUNB as an accounting major. I will be dual majoring in another subject as well. How might I less lessen my junior year course load in both the Fall and Spring of the junior year so that I can timely complete required major courses in my second major. In this regard is it a good idea to complete 33:010: 275 Introduction to Managerial Accounting in the summer between my sophomore and junior year? Answer 3 Thank you for your inquiry in which you raise questions as to how you might lessen your junior year course load in both the Fall and Spring so that you can timely complete required major courses in your second major. In responding I assume that the courses in your non-accounting major are not available in the summer. The question you ask about taking 33:010:275 Introduction to Managerial Accounting in the summer and have it counted toward your accounting major requirements in the same way as if you had been taking this course during the Spring Semester of your junior year (which is when almost all accounting majors complete this course), is a good one. Doing this is acceptable (subject to the caveats described in numbers 1 and 2 below) and will reduce by one course the number of required accounting courses you otherwise would need to take during the Spring semester of your junior year. Although acceptable you should consider the following before doing this: 1. The summer class in managerial accounting is just a little more than five weeks— whereas the regularly scheduled managerial course, offered in the Spring, will cover the material in the managerial accounting class during a regular semester of 14 weeks. Although both the summer class and the regularly scheduled Spring semester course in managerial accounting, in theory cover the same content it may be more difficult to learn as much in a shorter period as in a longer one. 2. The managerial accounting class being offered in the Spring semester of the junior year precedes by one semester the cost accounting class (010:451) which is offered in the Fall semester of the senior year. I mention this since the Cost Accounting class builds heavily upon the concepts learned in the managerial accounting class. Although a summer separates the Fall semester of the senior year and the Spring semester of the junior year a student who took the managerial accounting class in the summer of the year between the sophomore and junior year will not have as fresh in their mind the concepts from the managerial accounting class as they enter the cost accounting class in the Fall semester of the senior year as a student who took managerial in the Spring Semester of their junior year. This concern, while mitigated by completing managerial accounting in the following summer, that is, in the summer between the junior and senior year when presumably the knowledge from the managerial accounting class is very fresh for someone entering the cost accounting class in the fall semester of the senior year, is tempered by the concern raised in #1 above. There are alternative ways to lessen the total number of accounting and core RBSUNB credits otherwise required for the Spring semester of the junior year. Specifically consider taking one or more of the following courses in the upcoming summer between your sophomore and junior year 33:620:300 Principles of Management 33:630:301 Principles of Marketing 33:623:386 Operations Management. 2 In regard to what you can do to lessen your Fall load by taking summer courses (I assume, once again, the courses in your other major are not available during the summer) you can consider the following: 1. Take 623:385 Statistical Methods in Business. This core course RBSUNB core course is one that accounting majors are usually scheduled for in the fall semester of the junior year. 2. Take 390:300 Introduction to Financial Management. This RBSUNB core course is also one that accounting majors are usually scheduled for in the Fall of their junior year. You might, however, want to take this course in the regular fall semester, particularly, if you intend in the following summer to take the two finance courses recommended for accounting majors wanting to fulfill the 150 credit-hour requirement (33:390:380 Investment Analysis and 33:390:400 Corporate Finance) because it is a strong foundation course for these subsequent finance courses. Basically, what I am saying is that given a choice for the summer between taking 623:385 Statistical Methods in Business and taking 390:300 Introduction to Financial Management, I would opt for the Statistical Methods in Business Course particularly if you are strong in statistics. The strategies I am outlining above will place you in fewer classes with other students who otherwise would be in your cohort-scheduled group. That is if you’re taking any of the five courses offered in the summer, as described above, that is one less course you will be taking with only other accounting majors. Whether you will learn more or less by taking in the summer the courses described above is a matter of conjecture. In our accounting classes we work hard to make sure our courses are somewhat generic in the sense that regardless who is teaching a specified accounting course (e.g., Introduction to Financial Accounting, Intermediate Accounting I, Advanced Accounting, etc) the students learn the same material. That said with the exception of the Introduction to Financial Accounting and Introduction to Managerial Accounting classes the Department does not generally offer any other accounting classes in the summer. One final comment: The junior year is a difficult one for accounting majors. During the Fall semester in particular I often hear students complain about the heavy workload particularly in the Accounting Information Systems course. In the Fall you will be automatically registered in five courses (Intermediate I, Accounting Information Systems, Introduction. to Financial Management, Statistical Methods in Business and Business Forum)—a total of 13 credits—it is a full load in terms of the amount of time needed to do well. If you wind up taking in the summer let say’s Statistical Methods in Business or even Introduction to Financial Management that means you will need to complete another course in the Fall if you are to remain a full-time student. I mention this since I understand that the three full-time New Brunswick liberal arts college—Douglass, Livingston and Rutgers require students to be full-time. In light of this be careful. If you take only 13 credits in the fall and wind up doing so by substituting a course in your second major, for say Statistical Methods in Business or Introduction to Financial Management, because you may have taken one of these core RBSUNB courses in the summer make sure that the course you substitute for one of these RBSUNB core courses is one you will be able to successfully complete since you will need at least 12 credits to remain a full-time student. Question 4 I have just been admitted into the accounting major and will begin my accounting studies in the fall. I received my cohort schedule for the Fall semester of the junior year and see that I have only been scheduled for 13 credits. Do you advise that I register for another course? 3 Answer 4 “The junior year is a difficult one for accounting majors. During the Fall semester in particular I often hear students complain about the heavy workload particularly in the Accounting Information Systems course. In the Fall you will be automatically registered in five courses (Intermediate I, Accounting Information Systems, Introduction. to Financial Management, Statistical Methods in Business and Business Forum)—a total of 13 credits—it is a full load in terms of the amount of time needed to do well. If you wind up taking in the summer let say’s Statistical Methods in Business or even Introduction to Financial Management that means you will need to complete another course in the Fall if you are to remain a full-time student. I mention this since I understand that the three full-time New Brunswick liberal arts college— Douglass, Livingston and Rutgers require students to be full-time. In light of this be careful. If you take only 13 credits in the fall and wind up doing so by substituting a course in your second major, for say Statistical Methods in Business or Introduction to Financial Management, because you may have taken one of these core RBSUNB courses in the summer make sure that the course you substitute for one of these RBSUNB core courses is one you will be able to successfully complete since you will need at least 12 credits to remain a full-time student.” The caveat included in the above quote was included in my response because for many students taking these 13 credits will give them little time for much else. The work in the two accounting classes that you will take as a junior: Intermediate I and AIS in particular will take a great deal of time. Some students can take these five courses (the Business Forum course is only one credit and involves very little work) plus an additional one giving them a total of six and do very well. For most students though taking 13 credits this coming fall semester will keep them plenty busy. One final thought: Sometimes students don’t do well in the accounting curriculum because they spend too much time on outside activities, working to make money, extra-curricular activities, etc. These things are of course important and when done in moderation can significantly add to a student’s attractiveness to an employer. Remember to keep your focus and do well in the courses that you take, not only in exams, but also in terms of what you contribute to the classes you take. Question 5 What if my cumulative GPA at the end of the summer prior to the time when I am scheduled to enter RBSUNB falls below the minimum cumulative GPA for entry? Answer 5 This is a big problem. You will not be admitted into RBSUNB during that Fall semester. For example, for admittance into RBSUNB in the Fall of 2005 a minimum GPA of 3.15 was required. Students whose cumulative GPA was less than 3.15 by the end of summer 2004 were not admitted. Question 6 Which of the following three options is best in terms of satisfying the 150 credit-hour CPA requirement? (1) go for a Master’s Degree in accounting upon my graduation as an accounting major. (2) obtain 150 credit-hours on the undergraduate level (3) go for an MBA degree right after I get my undergraduate degree in accounting. Answer 6 4 The Department strongly encourages students to pursue the first option. Our Master’s of Accountancy (MAccy) program in Financial Accounting, which will begin in the summer of 2006, fills this need. It is designed for graduating college accounting majors who intend to become CPAs and need to earn 30 additional credits to satisfy the State’s 150 credit-hour requirement for certification. The MAccy program in financial accounting requires 30 credits with classes beginning on a full-time basis in the summer immediately following graduation and continuing on a part-time basis thereafter. Twelve credits are earned during the first summer session, when students are enrolled on a full-time basis. The balance is earned part-time. Advanced standing is available for qualified students. The first summer term is taught in two five-week sessions. Two courses are taught in each session. The four summer session courses are: • • • • 22:010:645 22:835:626 22:010:642 22:010:644 Decoding of Corporate Financial Communication Advanced Auditing & Accounting Information Systems Special Topics: Contemporary Issues in Cost Management Special topics: Accounting in the Digital Era The balance of credits is electives taken on a part-time basis on either the Rutgers Newark or New Brunswick/Piscataway campuses. Students choose from available MBA electives (accounting as well as other subjects), subject to the approval of the director. Some accounting electives will be offered online. Advanced standing will be granted for students who meet the following conditions: A student may receive two (2) credits for every three (3) credits of undergraduate upper-division course work completed with a B or better in business core areas of study, up to a maximum of nine (9) credits and subject to the following conditions: 1. Only those business courses that were not counted toward the undergraduate degree requirements will be considered. This generally means that a student earned more than 120 undergraduate credits, those additional credits were not used to satisfy the undergraduate degree requirements, and the additional credits were business courses. 2. Courses must have been completed at an AACSB accredited institution such as Rutgers. 3. Advanced standing must be authorized by the program director. Additional information about this program is available on the RBS website www.business.rutgers.edu or from Professor J. Don Warren, Director, MAccy Program in Financial Accounting, e-mail: jdonwarren@rbs.rutgers.edu. Professor Warren can be reached by telephone on the New Brunswick Campus at (732) 445-4370 or on the Newark Campus at (973) 353-5340. RBS also offers two specialized MAccy Degrees. One in governmental accounting (designed for those interested in this specialization) and another in taxation for those interested in that specialization. The department urges all our accounting majors to take the second tax course (010:422) Topics in Income Taxation and (010:433) Government and not for profit accounting even though neither course is required they are very useful for the CPA exam and for assessing interest in these specialized areas. 5 Option 2 is a good option for students who decide to earn 150 credit-hours within our undergraduate program. See pages 6-8 of the student guide to our New Brunswick undergraduate accounting program to see how might be done. You certainly could go on for an MBA degree, as you describe in option 3, as soon as you get your undergraduate degree. There are many MBA programs which will admit applicants directly out of an undergraduate program although some, and especially the top ones, will not admit applicants who do not have a number of years of solid work experience. What sets the best known MBA program apart from schools in the second tier and below is often the higher management positions held by those who get into these top programs as well as a requirement for relatively high GMAT scores. Depending on the MBA program you certainly will have over 150 credits once you have completed both our undergraduate accounting program and an MBA. Question 7 In regard to the 150 credit-hour CPA requirement if I decide to simply take more undergraduate courses rather than go for a Master’s Degree in Accounting should I double major or just take some extra courses in courses? How does the MBA Program in Professional Accounting that the Rutgers Business School offer in Newark fits into all of this? Answer 7 You may find answers to some of these questions in the Student Guide to the Rutgers Undergraduate New Brunswick Accounting Program. Read in particular Part V on pages 6-8 entitled “Recommendations to Accounting Undergraduate Majors in the Rutgers Business School-New Brunswick (RBSUNB) in regard to the 150 credit-hour requirement”. Please also read Section VII (2) on page 10 in regard to the MBA Program in Professional Accounting. If you are interested in becoming a CPA (which almost all of our undergraduate students are) you should complete 150 credit-hours. Our department encourages undergraduate accounting majors to either go into our MAccy Degree in Financial Accounting or complete on the undergraduate level the additional credits needed in order to earn 150 credit-hours. In order to earn 150 credithours while maintaining good grades it is advised that accounting majors earn their undergraduate degree over five years rather than the traditional four. This is particularly so for those students who do not regularly take summer session courses. In order to earn 150 credit-hours the Department suggests four options (which are not mutually exclusive) shown in our student guide on pages 6-8 as a means by which our RBSUNB accounting majors might earn these additional credits while enriching their education, employment and CPA certification prospects. The curriculum for the MBA program in Professional Accounting is much like that of our undergraduate program in accounting with students completing on the graduate level such courses as Intermediate Accounting, Advanced Accounting, Taxation and Auditing. This program provides students with the advantage of earning both an undergraduate degree and an MBA Degree while meeting the 150 credit-hour requirement which many states either impose or soon will impose in order to sit for the CPA exam. In contrast students graduating from our undergraduate accounting program will not meet the 150 credit-hour requirement at the time they 6 earn their undergraduate degree unless they take sufficient additional courses beyond those required in the accounting major and by their liberal arts college so that they wind up with at least 150 credithours. Question 8 I am a newly admitted accounting major and am interested in becoming a member of Beta Alpha Psi. Would you please tell me more about Beta Alpha Psi? Answer 8 Beta Alpha Psi is the National Honorary Fraternity in Accounting. Admission requires high academic standards, attendance at required meetings and public service such as tutoring or preparing tax returns (for free) for low income people. In order to be admitted into Beta Alpha Psi at the end of the junior year an accounting major must have a minimum of a 3.0 average GPA in the accounting courses taken during the fall semester (Intermediate Accounting I and Accounting Information Systems) and a minimum cumulative GPA of 3.0 at the end of that semester. Initiates who meet this requirement can be initiated during Beta Alpha Psi’s Spring Initiation and Dinner which is usually held in early April. Students whose cumulative GPA is below this standard at the end of fall semester of their junior year can still be admitted into Beta Alpha Psi as a senior provided that their cumulative and accounting GPA are at least 3.0 in the Fall semester just preceding their initiation. Continued participation in Beta Alpha Psi activities is also required. Although Beta Alpha is required to have a faculty advisor the greatest amount of work for this organization falls upon its five officers: a President, Vice President-Special Projects, Vice President-General, Treasurer and Secretary. While participation in Beta Alpha Psi can be quite time consuming it is a high quality organization that helps students become better qualified professionals. Question 9 What is New Jersey’s status in regard to the 150 credit-hour requirement . Answer 9 See page 4 of the Student Guide to the Rutgers Undergraduate New Brunswick Accounting Program. Question 10 How can I apply for the CPA exam and where can I obtain further Information about New Jersey’s CPA requirements? Answer 10 See page 4 of the Student Guide to the Rutgers Undergraduate New Brunswick Accounting Program. Question 11 What is the Nation-wide status of the 150 credit-hour CPA requirement? Answer 11 See page 4 of the Student Guide to the Rutgers Undergraduate New Brunswick Accounting Program. Question 12 Why are there so many different rules about who can take the CPA exam and become licensed in 7 a particular state? Answer 12 See page 4 of the Student Guide to the Rutgers Undergraduate New Brunswick Accounting Program. Question 13 What is the relationship between the 150 credit-hour requirement and public versus private accounting? Answer 13 See page 5 of the Student Guide to the Rutgers Undergraduate New Brunswick Accounting Program. Question 14 What recommendations does the Department make in regard to how accounting undergraduate majors in the RBSUNB might complete the 150 credit-hour requirement? Answer 14 See pages 5-8 of the Student Guide to the Rutgers Undergraduate New Brunswick Accounting Program. Question 15 What other programs besides the undergraduate program in Accounting are offered by the Department? Answer 15 See pages 10-12 of the Student Guide to the Rutgers Undergraduate New Brunswick Accounting Program. 8