Conflict of Laws - Ikard Golden Jones PC

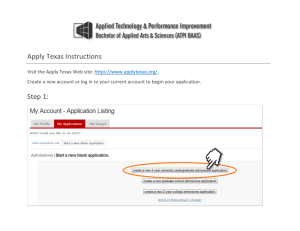

advertisement