processed foods

advertisement

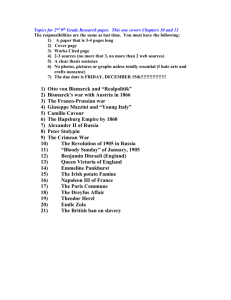

Processed Foods Zimbabwe Last Updated January 2011 Compiled By V. Bhonyongwa © Introduction Traditionally, the processed food and beverages sector in Zimbabwe was well established and highly diverse. This is because; the Zimbabwean economy has been supported by an agricultural sector that has been very successful. The success of agriculture has provided opportunities for agro-processing and value addition of agricultural produce. Besides its linkage to the agricultural sector the processed foods and beverages sector also have other strong backward/forward linkages with sectors such as packaging, technology, transport and distribution. The processed foods sector The sector is most described as the industry that manufactures semi-finished and finished products ready for human consumption. Currently there are over 102 manufacturers/processors in this sector. Production is located in the main cities of Harare, Bulawayo, Mutare and Gweru. The concentration of factories is high in Harare (about 63% of total number) and the other cities share the 37%. Processed foods can be defined as edible products that have gone through a process of value-addition. Typical processes that are common in Zimbabwe include; • Canning • Milling (Grinding) • Baking • Drying • Brewing • Oil expressing 2. Overview of the food Processing sector in Zimbabwe Sub sectors are: • Milling (products) produce • Confectionaries and bakery • Dairy products • Food additives • Beverages (alcahol and non alcahol) • Canned products • Tobacco cigarettes manufacturing Milling sector Major players (Big players) are Blue Ribbon, National Foods, Victoria Foods, GMB and Premier Milling. Company name Products Hs chapter /code Export destinations Zambia, Malawi, Botswana, Blue Ribbon • Wheat flour 1102.90 South Africa, DRC • Biscuits 1905/1901 • Maize-meal 1103.11 • Salt 2501.00 • Sugar beans, 0713.39 • Rice 2302.20 National Foods Victoria Foods Grain Board Marketing Premier Milling United Refineries Anchor Yeast • • • • • • • • • • • • • • • Flour cooking oil maize meal rice Wheat flour Snacks Rice Salt Millet Sorghum Sunflower Ground nuts Soya beans • kapenta, • beans, • salt • Rice • Cooking oil • Margarine 1102.90 1516.20/1512.11 1103.11 2302.20 1102.90 1905.90 2302.20 2501.00 Malawi, South Africa, Zambia, DRC, Namibia Botswana, Mozambique Botswana, Malawi Burundi, DRC Zambia 1008.20 1212.99/1214.90 Malawi Botswana DRC Zambia Mozambique South Africa Malawi Mozambique 2306.30/1512.11&19 1202.02/1202.20&10 1517.90/1507.90 0305.10/0304.90 0713.39 2501.00 2302.20 1516.20/1512.11 1517.90/1517.10 Zambia, Malawi, Botswana, Netherlands South Africa, Malawi, Botswana Mozambique, Zambia DRC • Active dried yeast, 2102.10/2102.20 Active brewer’s yeast 3004.50 Most entities in this sector are privately owned with the exception of GMB which is a parastatal. All the players have own brands and there are no franchises known yet. Inter linkages with other industries-backward and forward linkages; Most of these millers are only producers of Mealie-meal and flour. Some of them have own wholesales and retail outlets such as Victoria Foods and National Foods. There are also linkages in stockfeeds and packaging industries. Confectionaries and bakery The bakeries do both confectionaries and bread production. Except for a few that specializes with bread and biscuits only. Major players are Mitchell’s bakery, Lobels bread, Proton bakery, Bakers inn and Aroma bakery. Sugar Sugar manufacturers, both are big players i.e. Zimbabwe Sugar Refineries (Gold sugars) and Hippo Valley Estates. This is mainly caused by high initial working capital for machinery and raw materials. The following are retailers, importers and exporters of sugar, Country choice, Zimbabwe Sugar Sales, S & T Import & Export and Pantry Pride. HS chapter for sugar and confectionaries is chapter 17/18. HS chapter/code for bread and biscuits is 19. Confectionaries companies are: Company name Products Hs chapter /code Export destinations Gold sugars Hippo Valley Estates Crystal candy Bakers inn Proton bakery Lobels bread Dandy Zimbabwe M E Charhons Arenel sweets Mitchell’s bakery Lebena Biscuits Sugar 1701.91 Sugar syrup 1702.90 Sugar 1701.91 Sugar syrup 1702.90 1704.90 • Sweets, 1806.90/1806.20-90 • Chocolates, Chewing Gum, 1702.90 Syrups, 1806.31/1702.90 • Caramel, 1704.90 Biscuits, 1905.90/1901.20 1905.30 Bread 1905.40/1905.90 Bread Biscuits, Bread Sweets, Chocolates, Chewing Gum, Syrups, Caramel, • Biscuits, 1905.40/1905.90 1905.90/1901.20 1905.30 1905.40/1905.90 1704.90 1806.90/1806.20-90 1702.90 1806.31/1702.90 1704.90 1905.90/1901.20 1905.30 Botswana, Zambia South Africa, Malawi, Mozambique, Botswana, Zambia, Angola, DRC, Sweden, Denmark, Netherlands Botswana, Zambia South Africa Mozambique, Zambia Malawi, Tanzania, Botswana, Malawi, Zambia, Namibia, DRC, Mozambique • Sweets, 1704.90 • Chocolates, Chewing Gum, • Syrups, 1806.90/1806.20-90 • Caramel, 1806.31/1702.90 1704.90 • Sweets, 1704.90 • Chocolates, Chewing Gum, 1806.90/1806.20-90 • Syrups, 1702.90 • Caramel, Bread 1806.31/1702.90 1704.90 1905.90/1901.20 1905.30 1905.40/1905.90 Malawi, Mozambique Botswana, Namibia Zambia Biscuits, 1905.90/1901.20 Botswana, Malawi Biscuits, 1702.90 Botswana , Namibia Mozambique Iris Manufacturing, Chocolates • Biscuits, • Sweets, • Chocolates, Chewing Gum, • Syrups, Innscor Bakeries 1905.30 1806.90/1806.20-90 1905.90/1901.20 1905.30 1704.90 1806.90/1806.20-90 Namibia 1702.90 • Caramel, 1806.31/1702.90 1704.90 Biscuits, 1905.90/1901.20 1905.30 1905.40/1905.90 Bread DRC, Zambia Dairy products There are few companies in this sector. HS chapter/code for dairy products is 04. Company name Products Hs chapter /code Export destinations Botswana, Malawi, Zambia, Dairibord Zimbabwe • Fresh Milk, 0401.20 • • • • • • Long Life Milk, Fermented Milk, Cheese, Butter, Powdered Milk, Yoghurt, • Icecream Nestle (Pvt) Ltd 0403.90 0406.30/20/90/10/40 0405.00 0402.10 0403.10 1517.90 Zimbabwe • Maggi Soups, • 2104.10 • Infant Milk Formula, • 0401.20-20 Mozambique, Tanzania DRC, Botswana, Zambia, Malawi, Mozambique, Kenya Infant Milk Cereal, • Full Cream Milk • 0402.10 Powder, • Breakfast Cereals, • 1904.10 • Malt Extract, Lyons Zimbabwe • 1901.90 • Cocoa Based • 2202.90 Beverages, • 0402.99 • Condensed Milk • Tea, Coffee, 2106.90/10 • • • Cordials, Mayonnaise, Salad Cream, 0901.12/11/22/21 2208.90 2103.90 1517.90 Malawi, Mozambique Botswana, Namibia Zambia Food additives This sector has few players that are supplying the local market only. More investment into this sector is needed. HS chapter for additives is 21. Company name Four seasons foods Pure Enterprises Products • Tea, • Coffee, and spices, • Herbs Hs chapter /code 2101.20 2106.90/10 0901.12/11/22/21 1211.90 2101.20 2106.90/10 0901.12/11/22/21 1211.90 2101.20 2106.90/10 0901.12/11/22/21 1211.90 2101.20 2106.90/10 0901.12/11/22/21 1211.90 Export destinations Products Hs chapter /code • Clear and opaque 2203.00/2206.00 beer 2202.90 • Soft drinks 2208.20 • Spirits, 2207.10 • Wines, 2201.10/2201.90 • Water 2202.10 2208.90 • Cordials Export destinations Products • Canned fruits and vegetables, • Frozen vegetables, • Dried fruits and vegetables, • Fruit juices, • Jams and marmalades • Snacks Export destinations seasons • Tea, • Coffee, and spices, • Herbs Tanganda Tea Co • Tea, • Coffee, and spices, • Herbs ARDA Katiyo • Tea, • Coffee, and spices, • Herbs Botswana, Zambia, Namibia Germany, South Africa UK, Austria Sweden, Netherlands Italy Beverages Company name Delta Afdis Schweppes USA, UK, South Africa, Namibia, Botswana, Zambia Mozambique Zambia South Africa, Botswana, Zambia, Malawi, Mozambique, Mauritius UK Canned products Company name Cairns Foods Cold Company Colcom Storage • Sausages, • Canned meat products, biltong, cold meats, salami • Sausages, • Canned meat Hs chapter /code 2006.00 2001.90 2001.90 2009.90/80 Namibia, Mozambique, Botswana, Malawi, South Africa, Zambia, Sweden, UK, Mauritius, USA, Tanzania, DRC, Norway 2007.91 1905.90 1601.00 0210.90/0210.11-19 0208.90 1601.00 1601.00 0210.90/0210.11-19 U/Kingdom, DRC Tanzania DRC, Mauritius Angola, South Africa Olivine Industries Lake harvest products, biltong, cold meats, salami • Canned fruits and vegetables, • Frozen vegetables, dried fruits and vegetables, • Jams and marmalades 0208.90 1601.00 2006.00 • Dried fish, fish fillets 1604.11-20/0305.69 0302.11-19 2001.90 2001.90 2009.90/80 Namibia Botswana, Malawi, Zambia, Mozambique, Tanzania, South Africa 2007.91 UK, USA Germany, France Italy, Portugal Belgium, Netherlands SA, Zambia Tobacco Tobacco is part of the processed foods, it also have the sector giants, i.e. Company name Products Hs chapter /code Export destinations DRC, Zambia, Botswana, British American • Cigarettes 2401.20 South Africa, China, tobacco Netherlands, Savanna tobacco Processors (Pvt) Ltd • Cigarettes 2401.20 Zambia, Botswana, South Africa, Cut Rag Processors (Pvt) Ltd • Cigarettes 2401.20 Netherlands, Zambia, Botswana, South Africa, DRC, China, Stage of industrial development. The industry has few developed players and the rest upcoming players are still in the process of acquiring machinery and equipment in order to fully commercialise their operations. However, persistent droughts and economic downturn that have robbed the country for years had frustrated development in this sector. Of late the economy is regaining on a slow pace. Geographical distribution of companies • They are all situated in main cities and towns i.e. Harare, Mutare and Bulawayo. The Quality of processed products continue to improve with some local brands becoming household names beyond Zimbabwe’s borders e.g. Mazoe Orange Crush, Zambezi Lager, Mukuyu Wines, Sun Jam, gold and red seal, among others. Also there are companies scattered around the country who re-pack imported products such as rice and salt and locally produced dried fish (kapenta) and beans into their brands. Large packers include: • Grain Marketing Board-Silo brands • National Foods-red seal, gold seal, mahatma, • Victoria Foods • Blue Ribbon Foods-Chibataura • Pro brands 4. Production The processed foods and beverages sector relies heavily on the agricultural sector for raw materials. Major ingredients/raw materials such as grain, meat (beef & pork), fruit & vegetables, sugar, oil seeds (soyabean and sunflower) and milk have traditionally been produced in Zimbabwe with imports being regarded as top-ups. However, since 2001 agricultural output has been on a negative trend and thus impacted negatively on the performance of the processed foods sector. Availability of raw materials has a huge bearing on productivity in this sector. Production has gone down in the last few years due to lack of continuity on the farms after the land reform programme and the shortage of inputs like seed and fertilisers. The amount of rainfall received during the cropping season also affects the quantity and quality of the inputs for the processed foods sector. The sector has some big companies that are slightly gaining market share and are now improving their production efficiency to enable themselves to fight competition, for example Delta beverages managed to acquire new bottling line machines for alcohol (beer) and soft drinks that gave the company any edge to outcompete imports from the market. Other vital raw materials for the sector include packaging materials, additives and preservatives. Some packaging materials are designed and manufactured in Zimbabwe from the raw materials, (e.g. plastic and tinplate) being imported. Technical skills for the sector are also locally available since the processes are fairly simple. Locally available Food Science courses (up to university level) also complement the sector. During recent years the major production constraint has been the inadequacy of local inputs (raw materials) due to poor performance by the agricultural sector. The other challenge is that of technological backwardness, mostly caused by failure to re-equip (modernise machinery and equipment). Multi currency The introduction of multi-currency (use of ZRand and US Dollar) gave breath to all the manufacturing companies, even though working capital is still a challenge to many organisations. Key inputs in to the processed food manufacturing (major): • • • • • • • Agriculture produces. e.g. 1. Horti culture-(all horti culture produce with exception of cut flowers) 2. Animal husbandry (ranching- meat, pork) 3. Fishing-fish Concentrate- Beverages-drink (coke) Preservatives Packaging. Industrial catalysts (Acids). Flavours Packaging. –It is a necessity since all manufactured products are required to be protected from unfavourable environment • Imports- machinery, spares and lubrications. Quality standards The manufacturers (processors) are aware of the food quality standards that should be adhered to. A number of companies in the sector are certified under; • Standards Association of Zimbabwe (SAZ) • ISO 9001:2000 quality standard • Hazard Analysis Critical Control Points (HACCP) • ISO 22000 Food Safety Management Standard Some other companies are working on the EOSH (Environmental) certification e.g. Olivine and Schweppes. Labeling Just like packaging, most of the labeling products and services are available within the country. It is a statutory requirement that consumer packaging should include: • Name & address of producer, packager or importer • List of ingredients, including additives and colorants • Quantity of the ingredients (QUID) • Net weight/net volume • Expiration date of the product • Storage instructions • Usage instructions NB Also guarantee that the product has not been subject to: • • • Child labour Has caused pollution Harmed the environment (use of banned pesticides) 5. Exports Zimbabwe has been the bread basket of the region exporting both unprocessed and processed food products to neighbouring countries. These export markets have however remained the main destination for the processed foods & beverages sector. Major markets are Zambia, South Africa, Malawi, Mozambique and DRC. Proximity, similarity of cultures and practices and the duty concessions under the COMESA and SADC Trade protocols are the major market access factors. Zimbabwe is rich in raw materials (inputs) that are locally produced; exporters do not have challenges in producing the Rules of Origin under both trading blocs. Most of the processed foods manufactured in Zimbabwe are export quality products. Of recent, the government introduced a regulation that governs all basic goods (groceries) not to be exported as the nation is struggling to feed the nation. The export destinations for the processed foods are shown in the table previous shown above. 6. Challenges • • • • • • • • Capacity utilisation is low due to shortage of local inputs Outdated technology being used in food processing, packaging and labeling Insufficient working capital for production, banks are not giving long term loans. Producers are fighting stiff competition on the market. Price is the major tool being used by importers since they are pricing their products lowly due to low production cost, therefore, living the majority with no option but to do impulse buying. Production cost is too high therefore making it difficult for price strategy and to break through into regional markets. High operational costs- maintenance for machinery (high tools and spares costs). Electricity and water cuts High raw materials costs. 7. Sector needs The following factors remain the most challenges that need to be addressed; • Working capital to finance their operations. i.e. The working capital remain the main challenge for all the manufacturers since the operation costs are high that results in pricing strategy being difficult, since competitors priced their products lowly due to low operational costs. • The manufacturers are requesting favourable payment terms for raw materials from suppliers • Product quality (quality management) to be improved • Breakthrough in to external markets (exports) • Power and water cuts to be addressed • Electricity costs to be revised downwards 8. Programme of intervention/action a. ZimTrade to organise workshops on the following topics: i. Export training –8 module handouts ii. Quality management iii. Capacity building b. Help the companies to identify the source of working capital (loans and credit lines). c. SMEs to be nurtured very well and help to produce quality products d. Encourages Research and Development, for companies to continuously be innovative and research more information about new arrivals in the market that can be: new information, new machinery, new distribution pattern and new technologies 9. Sector Associations (Key sector cluster) The associations that represent the interests of manufacturers are: • The Grocery Manufacturers’ Association • The National Bakers’ Association • Alcoholic Beverages Manufacturers Association • Zimbabwe Tea Growers Association • Grain Millers Association • Processed Food Sub Sector Association Chairman Kwirirai Chigerwe of Tanganda tea kwirirai@tanganda.co.zw Tel; 263-4-703786/9 Fax; 263-4-705785 Cell; 263-712-278814 • Zimbabwe Poultry Association The Administrator Mr. Mario Beffa Tel; 756600, 772915, 777391 or 0912 307 566. Chairman Mr Solomon Zawe Tel; 781604, 0912 800 269 or 0712 800 269.