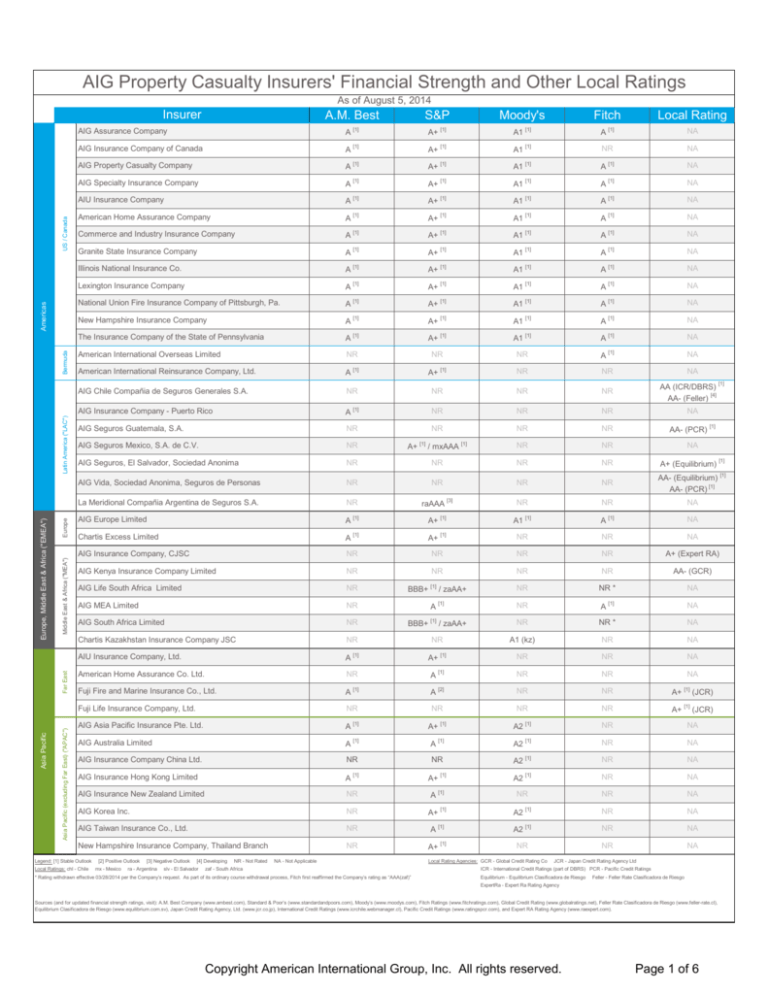

AIG Property Casualty Insurers' Financial Strength and Other Local Ratings

As of August 5, 2014

Insurer

AIG Assurance Company

US / Canada

Bermuda

Latin America ("LAC")

Europe

Middle East & Africa ("MEA")

Far East

Local Rating

A [1]

NA

[1]

[1]

[1]

NR

NA

A [1]

A+ [1]

A1 [1]

A [1]

NA

A

[1]

A+

[1]

A1

[1]

A

[1]

NA

A

[1]

A+

[1]

A1

[1]

A

[1]

NA

A

[1]

A+

[1]

A1

[1]

A

[1]

NA

Commerce and Industry Insurance Company

A

[1]

A+

[1]

A1

[1]

A

[1]

NA

Granite State Insurance Company

A [1]

A+ [1]

A1 [1]

A [1]

NA

[1]

[1]

[1]

[1]

NA

American Home Assurance Company

A+

A1

Illinois National Insurance Co.

A

Lexington Insurance Company

A [1]

A+ [1]

A1 [1]

A [1]

NA

A

[1]

A+

[1]

A1

[1]

A

[1]

NA

New Hampshire Insurance Company

A

[1]

A+

[1]

A1

[1]

A

[1]

NA

The Insurance Company of the State of Pennsylvania

A [1]

A [1]

NA

[1]

NA

A+

A1

A+ [1]

A

A1 [1]

American International Overseas Limited

NR

NR

NR

A

American International Reinsurance Company, Ltd.

A [1]

A+ [1]

NR

NR

NA

NR

NR

NR

NR

AA (ICR/DBRS) [1]

AA- (Feller) [4]

AIG Insurance Company - Puerto Rico

A

[1]

NR

NR

NR

NA

AIG Seguros Guatemala, S.A.

NR

NR

NR

NR

AA- (PCR) [1]

NR

NR

NA

NR

NR

A+ (Equilibrium) [1]

AIG Chile Compañia de Seguros Generales S.A.

Asia Pacific (excluding Far East) ("APAC")

Fitch

A1 [1]

A

National Union Fire Insurance Company of Pittsburgh, Pa.

Americas

Moody's

A+ [1]

AIG Property Casualty Company

AIU Insurance Company

Europe, Middle East & Africa ("EMEA")

S&P

A [1]

AIG Insurance Company of Canada

AIG Specialty Insurance Company

Asia Pacific

A.M. Best

AIG Seguros Mexico, S.A. de C.V.

NR

AIG Seguros, El Salvador, Sociedad Anonima

NR

A+

[1]

/ mxAAA

[1]

NR

AIG Vida, Sociedad Anonima, Seguros de Personas

NR

NR

NR

NR

AA- (Equilibrium) [1]

AA- (PCR) [1]

La Meridional Compañia Argentina de Seguros S.A.

NR

raAAA [3]

NR

NR

NA

[1]

NA

[1]

[1]

[1]

AIG Europe Limited

A

Chartis Excess Limited

A [1]

A+ [1]

NR

NR

NA

AIG Insurance Company, CJSC

NR

NR

NR

NR

A+ (Expert RA)

AIG Kenya Insurance Company Limited

NR

NR

NR

NR

AA- (GCR)

AIG Life South Africa Limited

NR

[1]

/ zaAA+

NR

NR *

NA

A

[1]

AIG MEA Limited

NR

AIG South Africa Limited

NR

A+

BBB+

A1

A

[1]

NR

A

BBB+ [1] / zaAA+

NR

NR *

NA

NA

Chartis Kazakhstan Insurance Company JSC

NR

NR

A1 (kz)

NR

NA

AIU Insurance Company, Ltd.

A [1]

A+ [1]

NR

NR

NA

American Home Assurance Co. Ltd.

NR

NR

NR

[1]

A

[1]

A

[2]

NA

[1]

Fuji Fire and Marine Insurance Co., Ltd.

A

NR

NR

A+

Fuji Life Insurance Company, Ltd.

NR

NR

NR

NR

A+ [1] (JCR)

AIG Asia Pacific Insurance Pte. Ltd.

A [1]

A+ [1]

A2 [1]

NR

NA

AIG Australia Limited

A [1]

A [1]

A2 [1]

NR

NA

[1]

NR

NA

A2 [1]

NR

NA

NR

NR

NA

[1]

NR

NA

A2 [1]

NR

NA

NR

NA

AIG Insurance Company China Ltd.

NR

NR

AIG Insurance Hong Kong Limited

A [1]

A+ [1]

AIG Insurance New Zealand Limited

NR

AIG Korea Inc.

NR

AIG Taiwan Insurance Co., Ltd.

NR

New Hampshire Insurance Company, Thailand Branch

Legend: [1] Stable Outlook [2] Positive Outlook [3] Negative Outlook [4] Developing NR - Not Rated

Local Ratings: chl - Chile mx - Mexico ra - Argentina slv - El Salvador zaf - South Africa

NR

NA - Not Applicable

* Rating withdrawn effective 03/28/2014 per the Company’s request. As part of its ordinary course withdrawal process, Fitch first reaffirmed the Company’s rating as “AAA(zaf)”

A

A+

[1]

[1]

A [1]

A+

[1]

A2

A2

NR

Local Rating Agencies: GCR - Global Credit Rating Co

(JCR)

JCR - Japan Credit Rating Agency Ltd

ICR - International Credit Ratings (part of DBRS) PCR - Pacific Credit Ratings

Equilibrium - Equilibrium Clasificadora de Riesgo

Feller - Feller Rate Clasificadora de Riesgo

ExpertRa - Expert Ra Rating Agency

Sources (and for updated financial strength ratings, visit): A.M. Best Company (www.ambest.com), Standard & Poor’s (www.standardandpoors.com), Moody’s (www.moodys.com), Fitch Ratings (www.fitchratings.com), Global Credit Rating (www.globalratings.net), Feller Rate Clasificadora de Riesgo (www.feller-rate.cl),

Equilibrium Clasificadora de Riesgo (www.equilibrium.com.sv), Japan Credit Rating Agency, Ltd. (www.jcr.co.jp), International Credit Ratings (www.icrchile.webmanager.cl), Pacific Credit Ratings (www.ratingspcr.com), and Expert RA Rating Agency (www.raexpert.com).

Copyright American International Group, Inc. All rights reserved.

Page 1 of 6

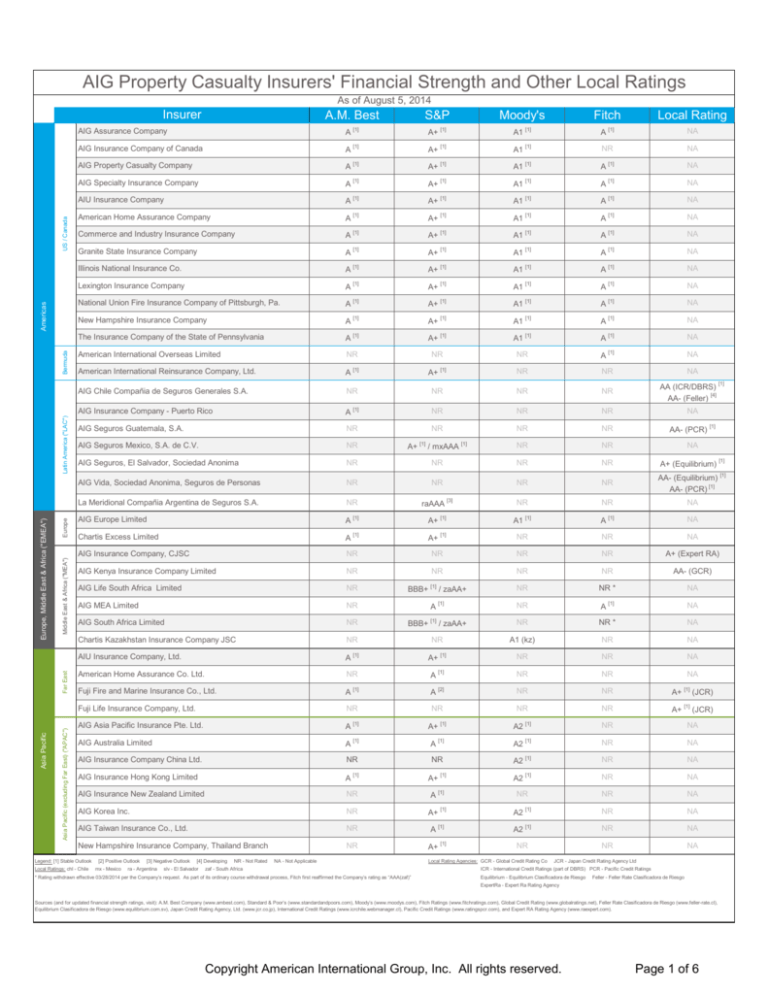

A Guide to Define Financial Strength and Other Local Ratings

Rating

Superior

A, A-

Excellent

B++, B+

Good

B, B-

Financial Strength Ratings

Descriptor

Opinion

Rating

AAA

Extremely Strong

AA

Very Strong

A

Strong

Fair

BBB

Good

C++, C+

Marginal

BB

Marginal

C, C-

Weak

B

Weak

D

Poor

CCC

Very Weak

E

Under Regulatory Supervision

CC

Extremely Weak

F

In Liquidation

R

Regulatory Action

S

Suspended

NR

Not Rated

Secure

A++, A+

Standard & Poor's

Financial Strength Ratings

Descriptor

Vulnerable

Vulnerable

Secure

Opinion

A.M. Best Company

AM Best Rating Outlooks & Modifiers

Standard & Poor's Rating Outlooks & Modifiers

Positive

Indicates a company's financial/market trends are favorable, relative to its current rating level and, if continued,

the company has a good possibility of having its rating upgraded.

Plus (+)

or

Minus (-)

Signs following ratings from 'AA' to 'CCC' show relative standing within the major rating categories.

Stable

Indicates a company is experiencing stable financial/market trends and there is a low likelihood that its rating will

change in the near term.

CreditWatch

CreditWatch highlights the potential direction of a rating, focusing on identifiable events and short-term trends

that cause ratings to be placed under special surveillance by Standard & Poor's.

Negative

Indicates a company is experiencing unfavorable financial/market trends, relative to its current rating level and,

if continued, the company has a good possibility of having its rating downgraded.

pi

Ratings based on an analysis of published financial information and additional information in the public domain.

They do not reflect in-depth meetings with an insurer's management nor do they incorporate material non-public

information, and are therefore based on less comprehensive information than ratings without a 'pi' subscript.

A modifier that generally is event-driven (positive, negative or developing) and is assigned to a company

whose Best's Rating opinion is under review and may be subject to change in the near-term, generally

defined as six months.

Ratings reflect qualitative and quantitative analyses using public data and information.

U

pd

Moody's

Rating

Fitch Ratings

Opinion

Financial Strength Ratings

Descriptor

Rating

Aaa

Exceptional

Aa

Excellent

A

Good

Baa

Adequate

BBB

Good

Ba

Questionable

BB

Moderately Weak

B

Poor

Caa

Very Poor

Ca

Extremely Poor

C

Lowest-rated Class

Secure

AAA

Vulnerable

Weak

Strong

Opinion

Financial Strength Ratings

Descriptor

Moody's Rating Modifiers

AA

Very Strong

A

B

CCC, CC, C

Very Weak

DDD, DD, D

Distressed

Fitch Rating Outlooks & Modifiers

Numeric modifier that indicates that the rating is in the mid-range of its generic rating category.

Plus (+)

or

Minus (-)

May be appended to a rating to denote relative status within major rating categories. Such suffixes are not

added to the 'AAA' category or to categories below 'CCC'.

Numeric modifier that indicates that the rating is in the lower end of its generic rating category.

NR

Indicates that Fitch Ratings does not publicly rate the issuer or issue in question.

Withdrawn

A rating is withdrawn when Fitch Ratings deems the amount of information available to be inadequate for rating

purposes, or when an obligation matures, is called, or refinanced.

1

Numeric modifier that indicates that the rating is in the higher end of its generic rating category.

2

3

Rating

Watch

Sources: A.M. Best Company (www.ambest.com), Standard & Poor’s (www.standardandpoors.com), Moody’s (www.moodys.com), and Fitch Ratings (www.fitchratings.com).

Outlook

Indicates a reasonable probability of a rating change and the likely direction of such change. These are

designated as "Positive", indicating a potential upgrade, "Negative", for a potential downgrade, or "Evolving",

if ratings may be raised, lowered or maintained. Rating Watch is typically resolved over a relatively short period.

Indicates the direction a rating is likely to move over a one to two-year period. Outlooks may be positive, stable,

or negative. A positive or negative Outlook does not imply a rating change is inevitable. Occasionally, Fitch may

be unable to identify the fundamental trend, and in these cases, the Rating Outlook may be described as "evolving".

Page 2 of 6

A Guide to Define Financial Strength and Other Local Ratings

Global Credit Ratings Co.

Financial Strength Ratings

Descriptor

Rating

Expert RA

Opinion

Reliability Ratings of Insurance Companies

Descriptor

Rating

AAA

Extremely strong financial security characteristics and is the highest FSR assigned by GCR.

Absolutely high

(the highest)

reliability

A++

In the short term, the company is extremely likely to ensure timely fulfillment of all of its financial obligations, both current and those arising in the course

of its operations. In the mid term, it is very likely that the obligations will be performed even in case of material adverse changes in macro-economic and

market parameters.

AA+, AA, AA-

Has very strong financial security characteristics, differing only slightly from those rated higher.

Very high

reliability

A+

In the short term, the company is very likely to ensure timely performance of all of its financial obligations, both current and those arising in the course of

its operations. In the mid term, it is very likely that the obligations will be fulfilled in case of stability of macro-economic and market parameters.

A+, A, A-

Has strong financial security characteristics, but is somewhat more likely to be affected by adverse business

conditions than assurers with higher ratings.

High reliability

A

In the short term, the company is very likely to ensure timely performance of all of its financial obligations, both current and those arising in the course of

its operations. In the mid term, the likelihood of performance of the obligations that require significant payments depends on stability of macro-economic

and market parameters.

BBB+, BBB, BBB-

Has good financial security characteristics, but is much more likely to be affected by adverse business

conditions than assurers with higher ratings.

Acceptable

reliability

B++

In the short term, the company is very likely to ensure timely performance of all of its current financial obligations, as well as new insignificant and

medium obligations arising in the course of its operations. Financial difficulties are slightly likely to occur, if the obligations that necessitate significant

payments arise. In the mid term, the likelihood of fulfillment of obligations depends on stability of macro-economic and market parameters.

BB+, BB, BB-

Has vulnerable financial security characteristics, which might outweigh its strengths. The ability of these

companies to discharge obligations is not well safeguarded in the future.

Sufficient

reliability

B+

In the short term, the company is very likely to ensure timely performance of all of its current financial obligations, as well as new insignificant and

medium obligations arising in the course of its operations. The likelihood of financial difficulties, if the obligations that necessitate significant payments

arise, is recognized as moderate. In the mid term, the likelihood of fulfillment of obligations largely depends on stability of macro-economic and market

parameters.

B+, B, B-

Possessing substantial risk that obligations will not be paid when due. Judged to be speculative to a high

degree.

Satisfactory

reliability

B

In the short term, the company is very likely to ensure timely performance of virtually all of its current financial obligations. The likelihood of the

company’s failure to perform financial obligations that arise in the course of its operations is high. In the mid term, the likelihood of fulfillment of

obligations largely depends on stability of macro-economic and market parameters.

CCC

Assurer has been, or is likely to be, placed under an order of the court.

Low reliability

C++

The company ensures timely performance of its current financial obligations; however, in the short term, the likelihood of the company’s default on

financial obligations that arise in the course of its operations is high, with the failure to the extent leading to revocation or suspension of the license.

Very low reliability C+

Unsatisfactory

reliability

Bankruptcy

License

revocation or

liquidation

The company ensures timely fulfillment of its current financial obligations; however, in the short term, the likelihood of the company’s default on financial

obligations that arise in the course of its operations is extremely high, with the failure to the extent leading to revocation or suspension of the license.

D

The company does not ensure timely fulfillment of a part of its current financial obligations to the extent leading to revocation or suspension of the

license.

The company undergoes bankruptcy.

E

The company is under liquidation or the company’s license is revoked.

C

Global Credit Ratings Co. Outlooks & Modifiers

Expert RA Outlooks & Modifiers

Positive

Rating symbol may be raised

Positive

Likelihood of mid term rating upgrade is high

Negative

Rating symbol may be lowered

Negative

Likelihood of mid term rating downgrade is high

Evolving

Rating symbol may be raised or lowered

Stable

Likelihood of mid term rating stability is high

Under

Review

Failure to carry out a full review of a rated entity within the designated timeframe, either through lack of information or delays in

finalization, may place the rating “Under Review". The rating status will typically extend for no longer than 1 month, until the

triggering event is resolved or the outcome is predictable with a high enough degree of certainty.

Developing

Two or more rating options (rating stability, upgrade or downgrade) are equally likely in the mid term

Rating

Watch

Rating is under review for possible change in the short-term

Sources: Global Credit Rating (www.globalratings.net) and Expert RA Rating Agency (www.raexpert.com).

Page 3 of 6

A Guide to Define Financial Strength and Other Local Ratings

Japan Credit Rating Agency, Ltd.

Feller Rate Clasificadora de Riesgo

Long-Term Rating

Descriptor

Rating

Rating

Descriptor

AAA

The highest level of capacity of the obligor to honor its financial commitment on the obligation.

AAA

The insurance obligations that present the highest capacity to meet the terms and conditions agreed upon, which would not be affected by possible

changes in the issuing company, in the industry, or the economy.

AA

A very high level of capacity of the obligor to honor its financial commitment on the obligation.

AA

The insurance obligations that have a high capacity to meet the terms and conditions agreed upon, which would not be significantly affected by possible

changes in the issuing company, in the industry to which it belongs or the economy.

A

A high level of capacity of the obligor to honor its financial commitment on the obligation.

A

The insurance obligations that have a good ability to meet the terms and conditions agreed upon, but this is likely to deteriorate slightly by possible

changes in the issuing company, in the industry to which it belongs or the economy.

BBB

An adequate level of capacity of the obligor to honor its financial commitment on the obligation. However, this

capacity is more likely to diminish in the future than in the cases of the higher rating categories.

BBB

The insurance obligations that have a sufficient capacity to meet the terms and conditions agreed upon, but this is likely to weaken by possible changes

in the issuing company, in the industry to which it belongs or the economy.

BB

Although the level of capacity to honor the financial commitment on the obligation is not considered prolematic

at present, this capacity may not perisist in the future.

BB

The insurance obligations have the capacity under the terms and conditions agreed upon, but this is susceptible to deteriorate by possible changes in the

issuing company, in the industry it belongs to, or the economy. The issuer may incur a delay meeting such obligations.

B

A low level of capacity to honor the financial commitment on the obligation, having cause for concern.

B

The insurance obligations that have a high capacity to meet the terms and conditions agreed upon, but this is variable and susceptible to damage by

possible changes in the issuing company, in the industry it belongs to, or the economy. The issuer may breach those obligations.

CCC

Thre are factors of uncertainty that the financial commitment on the obligation will be honored, and a possibility

of default.

C

The insurance obligations that do not have a sufficient capacity to meet the terms and conditions agreed upon. There is a high risk that the issuer fails to

comply with these obligations.

CC

A high default risk.

D

The insurance obligations that do not have capacity to meet the terms and conditions agreed upon, and fail to meet obligations.

C

A very high default risk.

E

The insurance obligations of issuers for which there is insufficient information.

D

In default.

Japan Credit Rating Agency, Ltd. Outlooks & Modifiers

Feller Rate Clasificadora de Riesgo Outlooks & Modifiers

Plus (+)

or

Minus (-)

Signs following ratings to indicate relative standing within each of the rating categories.

Positive

Potential to get a higher rating

'p' rating

Based on an analysis of information inculuding publicly available data and is given to entities that have not requested a rating,

but that have given the consent.

Negative

Potential to get a lower rating

Positive

Rating may be raised.

Stable

Classification is unlikely to change

Negative

Rating may be lowered.

Developing

Classification can improve, deteriorate, or remain the same

Stable

Rating is not likely to change.

Developing Rating may be raised or lowered, contingent upon an event.

Multiple

An issuer has multiple outlooks for its individual ratings, in which case JCR will describe any differences and provide the

rationale for these differences in its news release

Sources: Japan Credit Rating Agency, Ltd. (www.jcr.co.jp) and Feller Rate Clasificadora de Riesgo (www.feller-rate.cl).

Page 4 of 6

A Guide to Define Financial Strength and Other Local Ratings

Equilibrium Clasificadora de Riesgo

Rating

International Credit Ratings

Descriptor

Rating

Descriptor

Category A

The Bank/insurance Company has a strong financial and economic structure and has the greatest ability to pay

its obligations under the terms and conditions agreed upon, which would not be affected by possible changes in

the organization, in the industry it belongs, or the economy. Subcategories (A + or A-).

AAA

The insurance obligations that present the highest capacity to meet the terms and conditions agreed upon, which would not be affected by possible

changes in the issuing company, in the industry, or the economy.

Category B

The Bank/insurance Company has good financial and economic structure and has a good ability to pay its

obligations under the terms and conditions agreed upon, but this is likely to deteriorate slightly by possible

changes in the organization, in the industry it belongs to, or the economy. Subcategories (B + or B-).

AA

The insurance obligations that have a high capacity to meet the terms and conditions agreed upon, which would not be significantly affected by possible

changes in the issuing company, in the industry to which it belongs or the economy.

Category C

The Bank/insurance Company has a financial and economic structure with certain deficiencies and has a

moderate ability to pay its obligations under the terms and conditions agreed upon, but this is likely to weaken

by possible changes in the organization, in the industry it to belongs, or the economy. Subcategories (C + or C).

A

The insurance obligations that have a good ability to meet the terms and conditions agreed upon, but this is likely to deteriorate slightly by possible

changes in the issuing company, in the industry to which it belongs or the economy.

Category D

The Bank/insurance Company has a weak financial structure and shows a questionable ability to pay its

obligations under the terms and conditions agreed upon; there is a risk of default on their obligations.

BBB

The insurance obligations that have a sufficient capacity to meet the terms and conditions agreed upon, but this is likely to weaken by possible changes

in the issuing company, in the industry to which it belongs or the economy.

Category E

There is insufficient information to make an opinion on risk.

BB

Category E *

The Bank/insurance Company has not met its commitments under the terms in which they were agreed;

therefore unable to continue its operations.

B

The insurance obligations that have a minimum capacity to meet the terms and conditions agreed upon, but this is variable and susceptible to damage

by possible changes in the issuing company, in the industry it belongs to, or the economy. The issuer may breach those obligations.

C

The insurance obligations that do not have a sufficient capacity to meet the terms and conditions agreed upon. There is a high risk that the issuer fails to

comply with these obligations.

D

The insurance obligations that do not have capacity to meet the terms and conditions agreed upon, and fail to meet obligations.

E

The insurance obligations of issuers for which there is insufficient information.

The insurance obligations have the capacity under the terms and conditions agreed upon, but this is susceptible to deteriorate by possible changes in the

issuing company, in the industry it belongs to, or the economy. The issuer may incur a delay meeting such obligations.

Equilibrium Clasificadora de Riesgo Outlooks & Modifiers

International Credit Ratings Outlooks & Modifiers

Plus (+)

or

Minus (-)

Signs following ratings to indicate relative standing within each of the rating categories.

Positive

Less risky

Positive

Rating may be raised.

Negative

More risky

Negative

Rating may be lowered.

Stable

Classification is unlikely to change

Stable

Rating is not likely to change.

Obervation

Under observation

Sources: Equilibrium Clasificadora de Riesgo (www.equilibrium.com.sv) and International Credit Ratings (www.icrchile.webmanager.cl).

Page 5 of 6

A Guide to Define Financial Strength and Other Local Ratings

Pacific Credit Ratings

Rating

Descriptor

AAA

The insurance obligations that present the highest capacity to meet the terms and conditions agreed upon. Risk

factors are of minimal concern.

AA

The insurance obligations that have a very high capacity to meet the terms and conditions agreed upon. The risk

is moderate but may vary slightly due to economic conditions, the industry, or the Company.

A

The insurance obligations that have a high capacity to meet the terms and conditions agreed upon. There are

expectations of variable risk in the long term due to economic conditions, the industry, or the Company.

BBB

The insurance obligations that have a sufficient capacity to meet the terms and conditions agreed upon. There are

expectations of considerable risk in the long term due to economic conditions, the industry, or the Company.

BB

The insurance obligations that will possibly meet the terms and conditions agreed upon, but this is very

susceptible to deteriorate by possible changes in the issuing company, in the industry it belongs to, or the

economy. Not considered investment grade.

B

The insurance obligations that are risky (i.e. credit risk). There are expectations of high risk due to economic

conditions, the industry, or the Company.

CCC

The insurance obligations that present a substantial amount of credit risk.

DD

Insurance companies that are being liquidated or will be liquidated.

Pacific Credit Ratings Outlooks & Modifiers

Plus (+)

or

Minus (-)

Signs following ratings to indicate relative standing within each of the rating categories.

Positive

Potential to get a higher rating.

Negative

Potential to get a lower rating.

Stable

Rating is not likely to change.

Source: Pacific Credit Ratings (www.ratingspcr.com).

Page 6 of 6