Decentralised Economic Resource Allocation For Computational Grids

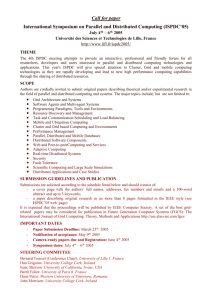

advertisement