IRS Volunteer Handbook

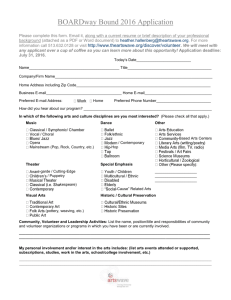

advertisement