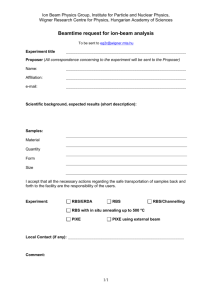

Forward-looking statements - Rbs

advertisement