The Internal Ratings-Based (IRB) Approach to Credit Risk

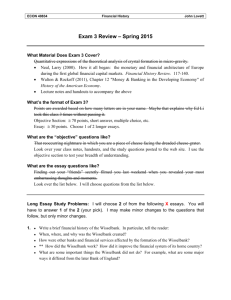

advertisement