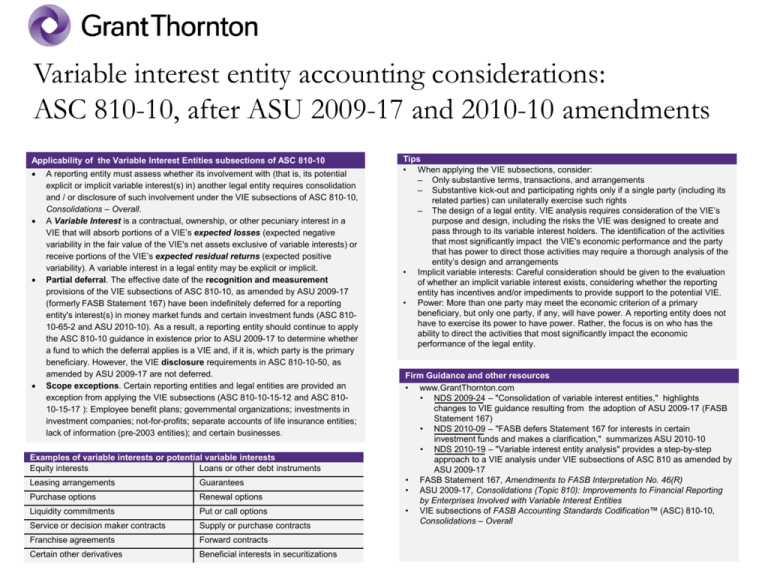

Variable interest entity accounting considerations:

ASC 810-10, after ASU 2009-17 and 2010-10 amendments

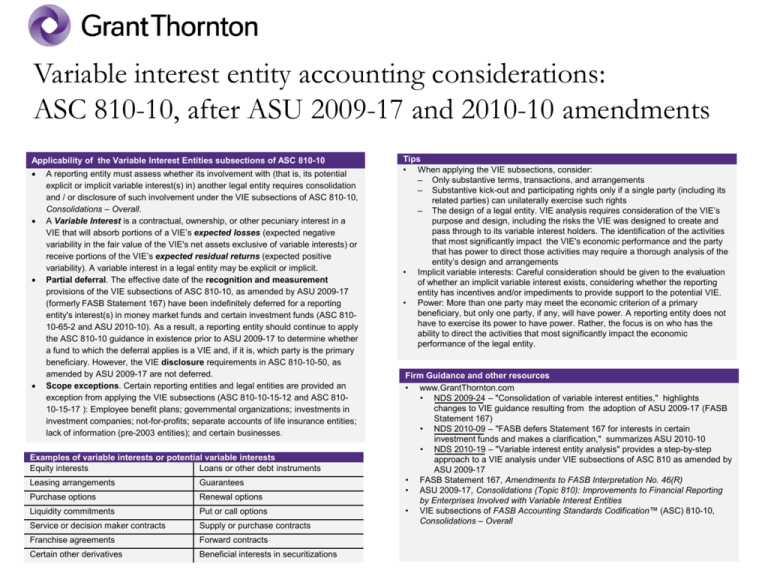

Applicability of the Variable Interest Entities subsections of ASC 810-10

•

•

•

•

A reporting entity must assess whether its involvement with (that is, its potential

explicit or implicit variable interest(s) in) another legal entity requires consolidation

and / or disclosure of such involvement under the VIE subsections of ASC 810-10,

Consolidations – Overall.

A Variable Interest is a contractual, ownership, or other pecuniary interest in a

VIE that will absorb portions of a VIE’s expected losses (expected negative

variability in the fair value of the VIE's net assets exclusive of variable interests) or

receive portions of the VIE’s expected residual returns (expected positive

variability). A variable interest in a legal entity may be explicit or implicit.

Partial deferral. The effective date of the recognition and measurement

provisions of the VIE subsections of ASC 810-10, as amended by ASU 2009-17

(formerly FASB Statement 167) have been indefinitely deferred for a reporting

entity's interest(s) in money market funds and certain investment funds (ASC 81010-65-2 and ASU 2010-10). As a result, a reporting entity should continue to apply

the ASC 810-10 guidance in existence prior to ASU 2009-17 to determine whether

a fund to which the deferral applies is a VIE and, if it is, which party is the primary

beneficiary. However, the VIE disclosure requirements in ASC 810-10-50, as

amended by ASU 2009-17 are not deferred.

Scope exceptions. Certain reporting entities and legal entities are provided an

exception from applying the VIE subsections (ASC 810-10-15-12 and ASC 81010-15-17 ): Employee benefit plans; governmental organizations; investments in

investment companies; not-for-profits; separate accounts of life insurance entities;

lack of information (pre-2003 entities); and certain businesses.

Examples of variable interests or potential variable interests

Equity interests

Loans or other debt instruments

Leasing arrangements

Guarantees

Purchase options

Renewal options

Liquidity commitments

Put or call options

Service or decision maker contracts

Supply or purchase contracts

Franchise agreements

Forward contracts

Certain other derivatives

Beneficial interests in securitizations

Tips

• When applying the VIE subsections, consider:

– Only substantive terms, transactions, and arrangements

– Substantive kick-out and participating rights only if a single party (including its

related parties) can unilaterally exercise such rights

– The design of a legal entity. VIE analysis requires consideration of the VIE’s

purpose and design, including the risks the VIE was designed to create and

pass through to its variable interest holders. The identification of the activities

that most significantly impact the VIE's economic performance and the party

that has power to direct those activities may require a thorough analysis of the

entity’s design and arrangements

• Implicit variable interests: Careful consideration should be given to the evaluation

of whether an implicit variable interest exists, considering whether the reporting

entity has incentives and/or impediments to provide support to the potential VIE.

• Power: More than one party may meet the economic criterion of a primary

beneficiary, but only one party, if any, will have power. A reporting entity does not

have to exercise its power to have power. Rather, the focus is on who has the

ability to direct the activities that most significantly impact the economic

performance of the legal entity.

Firm Guidance and other resources

• www.GrantThornton.com

• NDS 2009-24 – "Consolidation of variable interest entities," highlights

changes to VIE guidance resulting from the adoption of ASU 2009-17 (FASB

Statement 167)

• NDS 2010-09 – "FASB defers Statement 167 for interests in certain

investment funds and makes a clarification," summarizes ASU 2010-10

• NDS 2010-19 – "Variable interest entity analysis" provides a step-by-step

approach to a VIE analysis under VIE subsections of ASC 810 as amended by

ASU 2009-17

• FASB Statement 167, Amendments to FASB Interpretation No. 46(R)

• ASU 2009-17, Consolidations (Topic 810): Improvements to Financial Reporting

by Enterprises Involved with Variable Interest Entities

• VIE subsections of FASB Accounting Standards Codification™ (ASC) 810-10,

Consolidations – Overall

Variable Interest Entity (VIE) Determination

•

•

•

A variable interest entity (VIE) is a legal entity subject to consolidation

according to the provisions of the VIE subsections of ASC 810-10. A legal entity is

any legal structure used to conduct activities or to hold assets.

Characteristics of a VIE. A legal entity is a VIE if it has any of the following

characteristics (ASC 810-10-15-14)

– Insufficient equity investment at risk

– The holders of the equity investment at risk lack any of the following:

• power through voting or similar rights to direct the activities that most

significantly impact the legal entity's economic performance

• obligation to absorb the legal entity's expected losses

• right to receive the legal entity's expected residual returns

– Substantially all of the legal entity's activities involve or are conducted on

behalf of an equity investor with disproportionately few voting rights compared

to that investor's total economic interest (including but not limited to the

investor's equity interests) in the legal entity

Reconsideration of VIE determination: A reporting entity must reconsider

whether a legal entity is a VIE when specified events occur (ASC 810-10-35-4 )

Examples of legal entities that could be VIEs

Corporations, including S Corporations

Limited liability companies

Joint ventures

Limited partnerships

Master limited partnerships

Real estate partnerships

Oil and gas partnerships

Investment partnerships

Venture capital funds

Private equity funds

Commercial paper conduits

Other securitization vehicles

Trusts and grantor trusts

Research and development ventures

VIE consolidation and presentation

• The primary beneficiary of a VIE is the variable interest holder that has both of

the following characteristics of a controlling financial interest in the VIE (ASC

810-10-25-38A):

– Power: The power to direct the activities that most significantly affect the

VIE’s economic performance

– Economics: The obligation to absorb losses or the right to benefits that could

potentially be significant to the VIE

• Related parties. If neither the reporting entity nor one of its related parties has

both characteristics of a primary beneficiary, but, as a group, the reporting entity

and its related parties (that also hold variable interests in the same VIE) have

those characteristics, then the primary beneficiary is the single party within the

related party group that is most closely associated with the VIE(ASC 810-1025-44)

• Reconsideration of primary beneficiary determination. A reporting entity must

continuously reassess whether it is the primary beneficiary of a VIE

• Initial consolidation. No goodwill is recognized if the VIE is not a business.

• Presentation. The reporting entity must present separately on the face of the

statement of financial position certain assets and liabilities of a consolidated VIE

(ASC 810-10-45-25)

Disclosure

The VIE subsections of ASC 810-10-50 require significant disclosures for a reporting

entity that

• is the primary beneficiary of a VIE

• has a variable interest in a VIE but is not the primary beneficiary

Selected terms and definitions

Term

Definition

Expected losses

A legal entity that has no history of net losses and expects to continue to be profitable in the foreseeable future can be a variable interest entity (VIE).

A legal entity that expects to be profitable will have expected losses. A VIE's expected losses are the expected negative variability in the fair value of

its net assets exclusive of variable interests and not the anticipated amount or variability of the net income or loss.

Expected residual returns

A variable interest entity’s (VIE's) expected residual returns are the expected positive variability in the fair value of its net assets exclusive of variable

interests.

Equity investment at risk

Investments in the legal entity that meet all of the following:

• are classified as equity under U.S. GAAP

• participate significantly in the profits and losses of the entity, even if those investments do not carry voting rights

• were not issued in exchange for subordinated interests in another VIE

• are not amounts provided to (or financed for) the equity investor directly or indirectly by the legal entity or by other parties involved with the legal

entity, unless the provider is a parent, subsidiary, or affiliate of the investor that must be included in the same set of consolidated financial

statements as the investor.

This Grant Thornton LLP publication provides information and comments on current accounting issues and developments. It is not a comprehensive analysis of the subject matter covered and is not intended to provide accounting

or other advice or guidance with respect to the matters addressed in the publication. All relevant facts and circumstances, including the pertinent authoritative literature, need to be considered to arrive at conclusions that comply

with matters addressed in this publication.

For additional information on topics covered in this publication, contact your Grant Thornton LLP adviser, or visit www.GrantThornton.com.

© Grant Thornton LLP

All rights reserved

U.S. member firm of Grant Thornton International Ltd