國立政治大學商學院國際經營管理英語 碩士學位學程

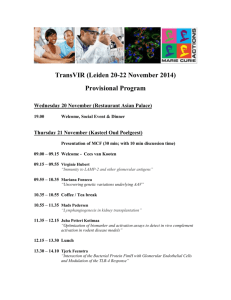

advertisement