tenure buyouts: the case for capital gains treatment

advertisement

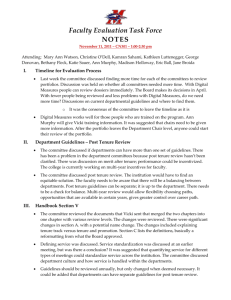

TENURE BUYOUTS: THE CASE FOR CAPITAL GAINS TREATMENT John O. Everett Virginia Commonwealth University and William A. Raabe Ohio State University and Julie Gentile California State University – Long Beach January, 2004 TENURE BUYOUTS: THE CASE FOR CAPITAL GAINS TREATMENT ABSTRACT In the increasingly common case where a faculty member accepts a buyout of tenure rights toward the end of his or her career, an interesting tax question arises. Does the relinquishment of tenure involve a “sale or exchange” of a capital asset, qualifying for long-term capital gains treatment? Or should the transaction be viewed as one generating ordinary income to “replace” normal compensation that would otherwise be received in the future? Tax Court dicta indicate that the compensation received should be reported as ordinary gross income. But statutory and judicial law effective since the Tax Court decision support an interpretation that some portion of the benefits constitute a payment for a property right, triggering capital gain treatment, a much more taxpayer-friendly result. An analogy to the capital gain result may be found elsewhere in the Code, suggesting the authors’ position that the tenure buyout represents at least in part the payment for the exchange of an asset. 1 TENURE BUYOUTS: THE CASE FOR CAPITAL GAINS TREATMENT A combination of tightening state budgets and reduction in private donations during tough economic times has caused many universities to investigate creative ways to provide increased flexibility in spending and hiring decisions. One of the tools that has become increasingly popular in recent years to gain such flexibility is the “early out” incentive package, where faculty members meeting certain age and/or service criteria are offered a supplemental financial package to retire early. This financial incentive is often structured as additional cash or enhanced retirement benefits created by adding service years and/or current age years to the retirement formula. There can be a number of reasons why a university would offer such a package. For example, the incentive program may be designed to free up dollar resources by eliminating faculty lines to restore spending plans lost to budgetary cuts. Or the offer may be used as a method of opening tenure-track positions when additional faculty lines are otherwise not available. This might be the case, for example, when a department wants to change the faculty mix as the school’s mission changes. These incentive packages usually have one thing in common: the faculty member who accepts such an offer must relinquish tenure. Faculty members accepting such offers are being compensated for surrendering tenure, and such payments (cash or additional retirement pay credit) will have tax consequences. This brings up an interesting tax question: does the relinquishment of tenure involve a “sale or exchange” of a capital asset, qualifying for long-term capital gains treatment? Or should the transaction be 2 viewed as one generating ordinary income to “replace” normal compensation that would otherwise be received in the future? This question has been addressed directly only once by the courts in a 1983 case, Merrill J. Foote v. Commissioner.1 The Tax Court ruled that tenure was not a capital asset and the taxpayer’s surrender of tenure was not a sale or exchange. Lacking these two prerequisites for capital gains treatment, the court ruled that the payment must be taxed as ordinary income. However, the taxpayer represented himself in this case, and although the Tax Court found Foote’s arguments to be “ingenious and well presented,” questions can be raised about the nature of his defense. Furthermore, several developments after this case cast doubt on the reasoning for the court opinion. The purpose of this paper is to examine the question of whether a case can be made for reporting amounts received for the relinquishment of tenure as a capital gain eligible for preferential tax rates. First, we review the evolving judicial history of tax cases involving the relinquishment of contract rights, along with relevant administrative pronouncements. The next section presents a detailed analysis of the Foote case. This is followed by a summary of key legislative and judicial findings that may have a bearing on the tax reporting for such payments. Lastly, we make the case for capital gains for tenure buyouts by critically examining the key factors used by the IRS and the courts to deny capital gains treatment in cases involving the relinquishment of contract rights. RELINQUISHMENT OF CONTRACT RIGHTS: AN EVOLVING JUDICIAL AND ADMINISTRATIVE HISTORY In many transactions involving the transfer of tangible assets, there is little question as to the character of the resulting gain or loss. However, for certain intangible 1 Merrill J. Foote v. Commissioner, 81 T.C. 930 (1983). 3 assets, the distinction between capital gains and ordinary income is not readily apparent. This is especially true in the case of the relinquishment of contract rights, where a taxpayer voluntarily surrenders a guaranteed right for some form of compensation. This murky area of tax law was contemplated by Judge Friendly in Sirbo Holdings, Inc. v. Commissioner2 as follows: The problem with respect to the tax treatment of payments for the termination of contract rights having a property flavor is among the most frustrating in income tax law . . . There is deep disappointment at the failure of decisions to fulfill the goals of predictability and of principled decision-making and at the enormous expenditures of professional and judicial time in accomplishing nothing more than a debatable decision of a particular case. The judicial history of this issue indicates a shifting emphasis on the key determinants of its tax treatment. Inevitably, most of these cases can be reduced to two key questions: both must be answered affirmatively to receive capital gains treatment. First, is the property transferred a capital asset as defined in I.R.C. §1221? Given the importance of capital asset status, it is somewhat surprising to discover that the term "capital asset" is not defined in a positive fashion in the Code. Rather, Congress describes eight properties in I.R.C. §1221 that will not be treated as capital assets. However, any properties unmentioned in I.R.C. §1221 are not automatically granted capital asset status, even though Reg. §1.1221-1(a) states that the term ". . . includes all classes of property not specifically excluded by section 1221." For example, in Corn Products Refining Co. v. Commissioner,3 the Supreme Court ruled that corn futures contracts were such an integral part of the taxpayer’s day to day operations that gain on the sale of such futures should be reported as ordinary income. 2 Sirbo Holdings, Inc. v. Commissioner, 509 F.2d. 1220, 1223 (CA-2, 1975). 3 Corn Products Refining Co. v. Commissioner, 350 U.S. 46 (1955). 4 A second question regarding capital gains treatment asks if the transfer is a “sale or exchange.” In defining short-term and long-term gains and losses, I.R.C. §1222 uses the phrase". . . gain [or loss] from the sale or exchange of a capital asset. . . ". On the other hand, I.R.C. §1001(a), in defining gain or loss in general, uses the phrase ". . . the gain [or loss] from the sale or other disposition of property. . .". This variation in phrasing indicates that a transfer of property may be sufficiently complete to require gain or loss recognition, yet not constitute a sale or exchange. Given the importance of the phrase "sale or exchange," it is somewhat surprising that the Code never defines the terms. The lack of precision in defining the terms “capital asset” and “sale or exchange” has caused much controversy over the years. In addressing the relinquishment of contract rights, the major judicial decisions can be grouped into one of three rationales: (1) the “disappearing asset” theory, (2) the “equitable interest” theory, or (3) the “substitute for ordinary income” theory. The “Disappearing Asset” Theory The earliest cases involving the relinquishment of contract rights seemed to focus on the sale of exchange requirement. Specifically, the courts noted that a “sale or exchange” implies a transfer of property to a person who will make use of it, rather than a transfer that terminates the transferring taxpayer’s interest and may also extinguish the property itself. The latter transactions became known as the “disappearing asset” cases, where the contract right does not survive the transfer. 5 One of the earliest cases involving a disappearing asset was General Artists Corporation v. Commissioner,4 where a musical booking agent assigned his management contracts to another booking agent as a prelude to their cancellation so that the transferee could enter into new contracts with other performers. The Court ruled that the original contract right was extinguished with the transfer, and thus the transfer could not be classified as a sale or exchange. The same rationale was used in Commissioner vs. Starr Brothers,5 where a distributor terminated its exclusive contract with a manufacturer. The Court of Appeals for the 2nd Circuit, the same court in the two cases cited above, applied the same logic five years later in Commissioner v. Pittson Company.6 In this case, a coal distributor surrendered for $500,000 its contract right to purchase all coal produced by a certain mine for 10 years at an 8% discount. The Appeals Court held that the payment was ordinary income because there was no sale or exchange, but merely the release of a contract right (i.e., the termination of the rights of one party and the duties of the other party). The “Equitable Interest” Theory One of the problems with the “disappearing asset” theory is that taxpayers such as Pittson would likely be able to receive capital gains treatment if the contract right had been sold to a third party, such as another distributor. In that case, the right more closely resembles “property”, in that the contract right survives the transfer. This concern led the courts to examine more closely the attributes associated with the contract right. 4 General Artists Corporation v. Commissioner, 205 F.2d. 360 (CA-2, 1953), cert. denied, 346 U.S. 866 (1953). 5 Commissioner v. Starr Brothers., 204 F.2d. 673 (CA-2, 1953). 6 Commissioner v. Pittson Co., 252 F.2d. 344 (CA-2, 1958), cert. denied, 357 U.S. 919 (1958). 6 In Commissioner v. Ferrer,7 the entertainer Jose Ferrer had an exclusive right to dramatic productions based on the novel Monsieur Toulouse, concerning the life of Henri de Toulouse-Lautrec. In this case, the court determined that Ferrer had originally acquired three basic “rights:” (1) a lease to the exclusive theatrical production rights of “Monsieur Toulouse”; (2) a contingent royalty interest to a share of any film rights; and, (3) a power, incident to the lease to prevent any disposition of the motion picture, radio and television rights. The court ruled that the payment for surrender of the royalty interest in the movie rights was taxed as ordinary income, since these represented a “substitute” for ordinary income. On the other hand, the Court ruled that the taxpayer had acquired an “equitable interest” in the copyright and should be granted capital gains treatment for the payment allocable to the surrender of the production rights. In arriving at this conclusion, the court specifically criticized the disappearing asset theory by noting that the tax law should not be concerned with whether the taxpayer’s rights are “. . . passed to a stranger or to a person already having a larger estate.”8 The court also concluded that “Ferrer’s negative power, as an incident to the lease, to prevent any disposition of the motion picture, radio and television rights until after production of the play, was also one which . . . would be protected in equity unless he had contracted to the contrary, and would thus constitute an ‘equitable interest’ in this portion of the copyright.”9 The court specifically noted that this “negative power” 7 Commissioner v. Ferrer, 304 F.2d. 125 (CA-2, 1962). 8 Ibid., at 136. 9 Ibid, at 131. 7 clouded the transferee’s title by limiting the transferee’s ability to act independently unless such power was also acquired as part of the transfer. Finally, the court expressed some frustration in the lack of guidance in dealing with these issues. Judge Friendly noted: This controversy concerns the tax status of certain payments received by Jose Ferrer with respect to the motion picture “Moulin Rouge” portraying the career of Henri de Toulouse-Lautrec. The difficulties Mr. Ferrer must have had in fitting himself into the shape of the artist can hardly have been greater than ours in determining whether the transaction here at issue fits the rubric “gain from the sale or exchange of a capital asset.”10 The “equitable interest” theory as related to certain negative contractual powers was also the focus in Anderson v. U.S.11 In this case, the sole shareholder of a hotel corporation had acquired a Holiday Inn franchise in Rochester, Minnesota. In conjunction with an expansion of the franchise, the taxpayer had obtained written assurance from Holiday Inn that if another Holiday Inn franchise were to be awarded in Rochester, he would be given a 30-day right to acquire that franchise asset himself. Five years after this agreement was reached, the taxpayer released Holiday Inn from this commitment in exchange for a $100,000 lump-sum payment and a 20 percent annual share of the management fee received by Holiday Inn from its operation of a new Rochester facility. The court in Anderson found that the contractual right of first refusal was a capital asset, likening the right to those held by Jose Ferrer to prevent any disposition of the motion picture, radio and television rights. The court noted that “Holiday Inn’s power to act independently in this respect was thus limited, and Anderson would have had access 10 Ibid., at 126. 8 to equitable remedies in the event Holiday Inn attempted to act independently of Anderson in granting Rochester franchises."12 After establishing the capital asset status of the right, the Court then ruled that the transfer was a sale or exchange because the release added to Holiday Inn’s rights by removing an obstacle to granting additional franchises. The “Substitute for Ordinary Income” Theory The more recent cases on extinguishing contract rights have focused on situations where the payments appear to be substitutes for ordinary income. This theory was hinted at in Ferrer, when the court ruled that the payment for surrender of the royalty interest in the movie rights was a “substitute” for ordinary income (e.g., royalties), and should be taxed as such. One of the earliest cases to espouse this theory was Hort v. Commissioner.13 The Supreme Court held that a payment received by a landlord in consideration of the landlord’s termination of the tenant’s lease was to be treated as ordinary income. In effect, the Court reasoned that the taxpayer was being paid to forego an amount of ordinary income in the future. Similarly, in Commissioner v. P.G. Lake,14 the Supreme Court held that the consideration received for an assignment of a carved-out working interest in an oil well represented a substitute for what would otherwise be received in the future as ordinary 11 Anderson v. U.S., 468 F.Supp. 1085 (D.C., Minnesota, 1980), affirmed in an unpublished opinion (CA-8, May 6, 1980). 12 13 14 Ibid., at 1098. Hort v. Commissioner, 313 U.S. 28 (1941). Commissioner v. P.G. Lake, 356 U.S. 260 (1958). 9 income. Once again, the Court noted that the taxpayer was merely converting future income into present income. Finally, in Bisbee Baldwin Corporation v. Tomlinson,15 the taxpayer owned a contract to service mortgages for institutional investors, receiving a percentage of the balance of each mortgage processed. The institutional investors paid the taxpayer to cancel the contract, and the Appeals Court ruled that the payment represented consideration for the taxpayer’s right to earn future commissions income. Thus, the payment was taxed as ordinary income. IRS Guidance on the Relinquishment of Contract Rights The earliest IRS guidance on the issue of relinquishing contract rights was Rev. Rul. 56-531,16 where the relinquishment of “simple contract rights” was held not to involve the sale or exchange of a capital asset. Although the IRS did not define “simple contract rights,” they did distinguish such rights from “possessary rights in real estate,” which was said to be entitled to capital gains treatment In Rev. Rul. 70-203,17 proceeds received by a taxpayer for the release of a restrictive covenant prohibiting the use of certain land for other than residential purposes were entitled to capital gain treatment. In this ruling, the IRS did not categorize the covenant as a “possessary right in real estate;” instead, this ruling was predicated on the nature of the property rights sold, and is consistent with the “equitable interest” rationale of the Ferrer case relating to the possession of certain negative powers. 15 16 17 Bisbee Baldwin Corporation v. Thomlinson, 320 F.2d. 925 (CA-5, 1963). Rev. Rul. 56-531, 1956-2 C.B. 983. Rev. Rul. 70-203, 1970-1 C.B. 171. 10 However, in Rev. Rul. 75-52718 the IRS applied ordinary income treatment to a payment received by a building owner for early termination of a supplier’s contract to furnish heat to the taxpayer’s building. The heating contractor made the payment to be free of a disadvantageous contract, and in that respect, the transaction may be viewed as an indication that the building owner’s contract rights had appreciated in value. This raises the question of whether this IRS position would withstand judicial scrutiny, as the contract right seems to have much in common with the “negative power” associated with an equitable interest, as addressed in the Ferrer case and Rev. Rul. 70-203. In Rev. Rul. 75-4419, the IRS ruled that a lump-sum payment received by a railroad employee as consideration for relinquishing employment security rights is ordinary income in the taxable year of receipt, and that such payment constitutes wages for purposes of income tax withholding. In this case, the employee surrendered seniority rights related to job security and additional pay in return for a cash settlement and a reassignment of job duties. The Service noted in the ruling that the payment was for the “past performance of services reflected in the employment rights.” Although this set of facts is closer to the tenure question, there is one critical difference; the “seniority rights” vanished after the payment was accepted. In this respect, the ruling appears to be based on the “vanishing asset” line of cases discussed earlier. THE FOOTE CASE 18 Rev. Rul. 75-527, 1975-2 C.B. 30. 19 Rev. Rul. 75-44, 1975-1 C.B. 15. This ruling was cited favorably in James Greenwall v. U.S., 85 AFTR 2d 2000-766, Frank J. Slattery v. U.S., 16 Cl. Ct. 79 (1989), and Associated Electric Cooperative Inc. v. U.S., 42 Fed. Cl. 867 (1999). 11 The only tax case addressing the issue of tenure as a capital asset was heard by the U.S. Tax Court in 1984. Against the backdrop of this judicial and administrative history regarding the relinquishment of contract rights, the court ruled in Merrill J. Foote v. Commissioner20 that payments received by the taxpayer in exchange for the relinquishment of tenure should be reported as ordinary income, relying primarily on the “substitute for income” theory. Merrill Foote was a Professor of Management Science at Southern Methodist University (SMU). He had been accorded tenure status largely by default, as the university failed to perform the required administrative steps to review his performance after six years of service. After friction developed between Foote and the university, the two parties agreed that Foote would resign his tenure appointment in exchange for $45,640, to be paid in monthly installments throughout 1977 and 1978. Under the agreement, the taxpayer had no further obligations to SMU. Foote reported these payments as long-term capital gains, assigning a zero basis to the tenure rights he relinquished. The IRS disallowed this treatment and the taxpayer brought an action in the U.S. Tax Court, choosing to represent himself. The IRS argued that the consideration paid was for the termination of a contract right to receive income for the performance of personal services, and that such payments were therefore merely substitutes for ordinary income. The taxpayer countered by arguing that tenure rights were more valuable than merely a guaranteed income stream from SMU, in that “. . . the aggressive exploitation of the business potential of tenure can produce income and capital 20 Merrill J. Foote v. Commissioner, supra note 1. 12 appreciation far in excess of a teaching salary.”21 After acknowledging that this argument was “ingenious and well-represented,” the court rejected this theory, noting that tenure only provided the opportunity to gain ordinary income, and it did not matter whether the source of the income was from teaching at SMU or from outside consulting. Foote did not argue that tenure itself constituted a property right, but both parties and the court seemed certain that an exchange had occurred, leading to the cash payments. One of the key arguments used by the court in justifying ordinary income treatment was the assumption that tenure was a personal right that cannot be transferred to, or utilized by another. The Court noted that Foote’s tenure rights “were not transferred to the promisor; they merely came to an end and vanished.”22 Thus, neither party took the necessary broad view that the university issues through the tenure process property rights, beyond the conditional lifetime payment of a continuing salary. Somewhat oblivious to the environment of the modern university, the court failed to see that tenure is a valuable recruiting and retention tool, in the human resources sense. If SMU has a limited number of tenure appointments, they were in effect acquiring from Foote the ability to hire another professor more in keeping with its perceived mission and staffing plan. In this respect, the tenure right at least may be viewed as a “negative power” associated with an equitable interest in property. DEVELOPMENTS SUBSEQUENT TO THE FOOTE CASE Although Foote is the only case thus far to address the tenure issue, two developments occurring after the decision may have some relevance to the tax 21 Ibid., at 933. 22 Ibid., at 934. 13 implications associated with the tenure-buyout issue. Specifically, an employment tax case addressed the surrender of tenure rights, and a statutory change mandated sale or exchange treatment for certain transactions. The North Dakota State University Employment Tax Case In North Dakota State University v. U.S.,23 the Court of Appeals for the 8th Circuit upheld a District Court determination that a public university’s payments to tenured faculty members under an early retirement program did not constitute wages and, thus, were not subject to FICA tax or income tax withholding. The Court noted that tenure was a recognized property right, rather than a mere employment right, which the faculty members relinquished in exchange for the payments. In making this decision, the court discussed two rulings issued earlier by the IRS regarding payments for the cancellation of an employment contract. In Rev. Rul. 58301,24 the lump sum payment received by an employee for the cancellation of his employment contract constituted gross income to the recipient, but not “wages” for federal employment and income tax withholding purposes. But in Rev. Rul. 74-252,25 dismissal payments related to an employee’s involuntary termination and established by contract as six months of salary were treated as wages for both income tax and employment and income tax withholding purposes. To distinguish the latter position, the Service noted that in the 1958 ruling, the taxpayer had interests in his employment 23 North Dakota State University v. U.S., 255 F.3d. 299 (CA-8, 2001). 24 Rev. Rul. 58-301, 1958-1 C.B. 23. 25 Rev. Rul. 74-252, 1974-1 C.B. 287. 14 contact “in the nature of property”, whereas the payments in the 1974 situation were compensation made “under the contract.” The IRS contended that tenure rights are not contract rights than can be relinquished, because the tenure rights have no economic value that can be bought and sold. The IRS had earlier taken this litigating position in TAM 9711001(January 25, 1995), where the Service ruled that a cash tenure buyout was considered wages for FICA purposes because it was based on the faculty member’s past performance of services. But the Eighth Circuit disagreed, granting that tenure rights have their own value. Absent fiscal constraints or adequate cause, a tenured faculty member could not be terminated. The tenure policies required that specific due process rights and procedures be afforded a tenured faculty before any termination . . . We hold that payments made to tenured faculty under NDSU’s Early Retirement Program were made in exchange for the relinquishment of their contractual and constitutionallyprotected tenure rights rather than as remuneration for services to NDSU. Thus, the payments are not subject to FICA taxation.26 Although this decision provides strong support for the notion that tenure should be treated as “property,” one must recall that the definition of “taxable income” for income tax purposes is not necessarily the same as the definition of “taxable wages” for employment tax and income tax withholding purposes. As pointed out by the U.S. Supreme Court in Central Illinois Public Service Company,27 the term wages is a more expansive concept: To require the employee to carry the risk of his own tax liability is not the same as to require the employer to carry the risk of the tax liability of its employee. Required withholding, therefore, is rightly much narrower than subjectability to income taxation. 26 27 North Dakota State University v. U.S., at 304. Central Illinois Public Service Company, 438 U.S. 21l, 25 (1978). 15 And as mentioned earlier, the IRS took the position in Rev. Rul. 58-301 that a lump sum payment received by an employee for the cancellation of his employment contract was gross income to the recipient but did not constitute “wages” for federal employment and income tax withholding purposes. This 1958 ruling appears to be based on the “substitute for ordinary income” theory. There were apparently no special powers or other rights of first refusal associated with the employment contract. But the 1958 ruling by itself does not preclude the application of capital asset treatment for a tenure buyout. If gross income is created due to such an exchange, it still separately must be classified as ordinary or capital. Rev. Rul. 58-301 does not address this issue at all. Despite the varying definitions of income and wages, the Eighth Circuit provides a compelling argument for treating tenure as a recognized property right, and not merely an employment right. Of particular interest in this regard is the discussion concerning the due process rights granted by tenure that are above and beyond the normal employment contact. The Court specifically noted that, under the tenure agreement at North Dakota State University, tenure could only be terminated due to extreme fiscal emergencies or adequate cause related to performance, and all times the faculty member was guaranteed “due process.” This due process power resembles the “negative power” described in the Ferrer case, and such a classification would possibly elevate the “property right” to an “equitable interest in property” that qualifies as a capital asset under the Ferrer and Anderson decisions. 16 The Statutory Expansion of “Sale or Exchanges” Provided by Sec. 1234A As illustrated above, the treatment of various terminations of contract rights has not been consistent over the years. Similar transactions in some cases have been treated as sales or exchanges and in other cases produce ordinary income. This lack of consistency in some cases effectively provided taxpayers with an election as to how to treat a particular payment by shading the facts to fit the sale or exchange decisions (for asset treatment) or fit decisions involving transactions outside the sale or exchange provisions (to obtain ordinary treatment, especially when losses are involved). This potential gaming of the system led Congress to enact I.R.C. §1234A in 1981. This provision reads in its entirety as follows: Section 1234A. Gain or loss attributable to the cancellation, lapse, expiration, or other termination of – (1) a right or obligation (other than a securities futures contracts as defined in section 1234B) with respect to property which is (or an acquisition would be) a capital asset in the hands of the taxpayer, or (2) a section 1256 contract (as defined in section 1256) not described in paragraph (1) which is a capital asset in the hands of the taxpayer, shall be treated as gain or loss from the sale of a capital asset. The preceding sentence shall not apply to the retirement of any debt instrument (whether or not through a trust or other participation arrangement). Although this provision was intended to prevent ordinary loss treatment for certain losses incurred by commodity futures traders, the reach of the statute is quite broad. Clearly, the surrender of a contract right falls under this provision. This was not an issue in the Foote case, since the tax years involved in that decision were 1977 and 1978. 17 Does this mean that any gain recognized from a buyout of tenure is thus capital gain or loss? Not quite; note in the wording of I.R.C. §1234A that the property must be a “capital asset” in the hands of the taxpayer. But at a minimum, I.R.C. §1234A seems to grant “sale or exchange” treatment to the tenure buyout, one of the two conditions for capital gains treatment. THE CASE FOR CAPITAL ASSET TREATMENT FOR TENURE BUYOUTS It appears that three hurdles must be cleared to justify capital asset treatment for the surrender of tenure as part of an early retirement incentive program: (1) meet the sale or exchange requirement, (2) meet the capital asset requirement, and (3) overcome the substitute for ordinary income argument. The Sale or Exchange Requirement In a number of cases, the courts have taken the position that the relinquishment of a contract right does not satisfy the “sale or exchange” requirement. In particular, the lack of a sale or exchange argument was closely aligned with the “disappearing asset” theory that was applied to the earliest cases involving relinquishment of contract rights. The Tax Court in the Foote decision relied somewhat on the “disappearing asset” theory by assuming that Foote’s tenured position “did not pass to the University, but was extinguished.” But this is a somewhat dubious assumption, as it ignores the fact that the university was “purchasing” from Foote the ability to hire another professor more in keeping with its conceptual and staffing goals, rather than simply being released from the obligation to continue to pay Foote to teach and publish. In times of shrinking budgets, a litigious employment environment, and limited numbers of tenure appointments, early 18 retirement incentives may be the only practical means of changing the faculty mix, say when there is a need for more or different qualified faculty members for accreditation or reaccredidation, increased extramural funding, or program realignment. In addition, the decision in Ferrer rejected the disappearing asset litmus test by focusing more on the nature of the rights transferred. Of particular relevance to the tenure question is the portion of the Ferrer decision devoted to the taxpayer’s power to enjoin disposition of motion picture rights. In describing this “negative power” associated with the covenant, the court noted the following: A contract like Ferrer’s “imposes an encumbrance on the motion picture rights.” Ferrer’s dissipation of the cloud arising from the negative covenant seems analogous to the tenant’s relinquishment of a right to prevent his landlord from leasing to another tenant in the same business, held to be the sale or exchange of a capital asset in Ray.28 In using this example, the court was explicitly recognizing that this “negative power” possessed by Ferrer had value (an “equitable interest”) and would survive the transfer. An analogy can be made to the due process rights associated with tenure. These rights effectively prohibit the university from terminating a faculty member holding a tenure position without due process justified by fiscal exigencies or adequate cause related to performance. The covenant of tenure may thus act as an encumbrance that prevents the university from taking alternative actions with the tenured position. And since the tenured faculty line usually survives the buyout in some form, it has value to the university and thus would justify “sale or exchange” treatment. The relinquishment of a tenured position also appears to fit squarely within the parameters of I.R.C. §1234A, which was enacted after the years in question in the Foote 28 Ferrer, at 131. 19 case. This provision grants sale or exchange treatment to the cancellation or other termination of a right or obligation with respect to property that is a capital asset in the hands of the taxpayer. In summary, both the Ferrer decision and I.R.C. §1234A provide support for treating the relinquishment of tenure as a “sale or exchange.” However, the sale or exchange must also involve a right or obligation related to property that is classified as a capital asset. The Capital Asset Requirement In Commissioner v. Gillette Motor Transport, Inc.,29 the Supreme Court provided the following often-cited explanation of capital asset status: Not everything can be called property in the ordinary sense and which is outside the statutory exclusions qualifies as a capital asset. This Court has long held that the term “capital asset” is to be construed narrowly in accordance with the purpose of Congress to afford capital-gains treatment only in situations typically involving the realization of appreciation in value accrued over a substantial period of time, and thus to ameliorate the hardship of taxation of the entire gain in one year. The Eighth Circuit Court of Appeals argues in North Dakota State University v. Commissioner that tenure is a valuable property right: “. . . payments to tenured faculty were in exchange for the relinquishment of a property or contract interest rather than for compensation. . .”.30 Thus tenure has a separate value above and beyond ordinary compensation for teaching and other duties, and that this value rises to the level of an “equitable interest.” The value of the tenure right is also supported by the implied negative power covenant that prevents a university from unilaterally terminating the position. Most 29 Commissioner v. Gillette Motor Transport, Inc., 364 U.S. 130 , 134 (1960). 20 universities offering early retirement packages do so because they desire to either free up tenure slots (perhaps for more qualified faculty) or use the savings for other university pursuits. In either case, the fact that the university is willing to offer a “bonus” for the tenured position indicates that this status has value and should be treated as an “equitable interest.” But is this “equitable interest” a capital asset? That is, in terms of the logic of the Gillette Motor Transport, Inc. definition, will the sale or exchange of this property involve the realization of appreciation in value accrued over a substantial period of time? The tenure position had little value to either party until tenure was actually granted to the employee; performance reviews prior to the tenure process could be used by the university to terminate the employment without the same due process concerns existing after tenure is granted. But once tenure is granted, the employment line has value to both the faculty member and the university, as evidenced by the incentive offer by the university to “acquire” it. Therefore, it seems reasonable to assume that this right has increased in value over time. As long as a specific faculty member fills a tenure slot, the “encumbrance” or “negative covenant” will prevent the university from terminating the position without due cause. In summary, the bundle of rights known as “tenure” is both current compensation and a promise of protection for the future. It is that promise that is being negotiated by the parties in the retirement setting. It has a separate value and is “sold off” as part of the negotiations. It is a property right, and thus it should be accorded capital asset treatment. 30 North Dakota State University v. U.S., at 302. 21 The Substitute for Ordinary Income Argument Even if the sale or exchange and capital asset hurdles are cleared, it is still possible that the IRS may argue that the payment for the relinquishment of tenure is a substitute for ordinary income. The Tax Court focused on this principle in the Foote case, noting that the taxpayer’s argument that tenure conferred the ability to earn additional income (presumably through consulting) simply meant he was foregoing more ordinary income by surrendering tenure. Foote’s decision to base his entire defense on this ability as a tenured professor to generate additional income was highly questionable. This allowed the Court to easily link the payment for tenure as being for more ordinary income, much like the Supreme Court in Hort described the lease cancellation payment as a substitute for ordinary income. By ignoring the “equitable interest” possibilities associated with tenure, especially the due process rights before termination, Foote effectively handed the court an easy rationale for denying capital gains treatment. This in turn allowed the court to all but ignore the obvious value of a tenured position to the university. There can be no argument that part of the “bundle” of rights that accompany the grant of tenure includes a conditional right to continued employment that generates ordinary income. However, this right to a salary is specifically spelled out in the annual employment contract, and tenure should be viewed as a separate property right “on top” of the right to annual compensation for services rendered. Recall that in Rev. Rul. 74-252, the Service ruled the dismissal payments related to an employee’s involuntary termination and established by contract as six months of salary were wages for both income tax and employment and income tax withholding purposes. The 22 payments were subject to both taxes because the severance payment was specified in the employment contract. In contrast, the Service ruled in Rev. Rul. 58-301 that a negotiated lump sum payment received by an employee for the cancellation of his employment contract was for the taxpayer’s interests in his employment contact that were “in the nature of property.” Though these two rulings concerned employment tax issues, the distinction between payments made under a contract and negotiated payments outside of an employment contract seems relevant for the tenure question. Specifically, the employment contract of a faculty member typically does not provide contractual language for payments or other incentives offered for “surrendering tenure.” This is a separate negotiation for a property right, and as such, does not represent a substitute for ordinary income. REPORTING ISSUES If a tenured faculty member reports early retirement package payments as longterm capital gain, there are a number of practical reporting issues that must be resolved. How will the gain be reported? Is there any “basis recovery” involved? Nature of the Gain There are provisions in the Internal Revenue Code that offer capital gain treatment and that may be analogous to the relinquishment of tenure. For example, if relinquishing tenure is viewed as “selling it back to the university,” then perhaps the transaction resembles an I.R.C. §302(b)(3) redemption of stock in complete termination of an ownership interest. 23 Consistent with the idea of a “complete redemption,” the retiring faculty member generally must sign an agreement restricting any future employment opportunities with the university. Such a requirement resembles the Code rule that a redeeming shareholder must agree to a 10-year “quarantine” from the redeeming company in order to waive the attribution rules. Perhaps a more interesting Code analogy for capital gains treatment are the I.R.C. §83 rules related to compensation for services rendered when non-cash property is received. The default result under I.R.C. §83(a) is to include in gross income the value of the property received, less any contribution by the service provider. Going forward, that asset then produces capital gain or loss as the value of the transferred asset changes. The employer’s compensation deduction is allowed when the employee recognizes the ordinary compensation income. I.R.C. §83 applies when a corporation transfers stock or options to an employee in exchange for his/her services. The triggering event for gross income occurs at the earlier of the date the property is received, or when there is removed any substantial risk of forfeiture with respect to the stock. Reg §1.83-3(b). Example - In Year 1, Sally provides engineering services to BigCo as an employee. BigCo compensates her with some of its own shares, under the condition that she not sell the shares until Year 4. The shares are worth $10 in Year 1 and $14 in Year 4. Sally’s compensation income of $14 is recognized in Year 4 when Sally’s ownership in the shares is fully vested. When Sally sells the shares for $17 in Year 5, she recognizes $3 capital gain. 24 The employee can change this result by making a Sec. 83(b) election. This election accelerates the income recognition, thereby capping the amount of ordinary income. This is attractive when the employee anticipates continued increases in the value of the capital asset. Example – If Sally from the previous Example makes a timely election under Sec. 83(b), she recognizes $10 per share in Year 1 as ordinary compensation income. Upon sale of the shares in Year 5, Sally recognizes $7 of capital gain. The same logic of I.R.C. §83(b) could apply to the relinquishment of tenure. Table 1 presents a comparison of the I.R.C. §83(b) rules as they relate to stock compensation of an employee and the relinquishment of tenure by a faculty member. In the context of tenure, the granting of tenure may be viewed as the event in which the noncash compensation (e.g., tenure) is received and a I.R.C. §83(b)-type of election is made. At this point, the newly-earned tenure position has a separate and distinct value, as restrictions related to its award to the faculty member have been removed. This tenure right is valuable to both the faculty member and the university, since it represents an “equitable interest” associated with the negative power held by the faculty member. At this point, a capital asset is created when compensation is paid in the form of an intangible “ownership” asset (e.g., tenure). If the university subsequently negotiates to “buy back” this tenure, then any gain is attributable to (and clear evidence of) an increase in the value of this tenure right. Thus, the Code allows that an intangible asset received in a compensatory arrangement can be deemed capital in nature. In the university/tenure rights setting, there is little interest in the timing of the employer’s wage deduction, but the result is clear. 25 Because of the intangible asset received compensation for services rendered is received in the form of a capital asset. Measure of Tax Basis in Tenure Rights If the I.R.C. §83(b) analogy is accepted, is there any tax basis that attaches to tenure? Trying to establish a non-zero tax basis in computing the gain or loss due to a tenure buyout may be a somewhat aggressive position, and receiving capital gains on the entire payment with no basis recovery is certainly preferable to reporting all incentive payments as ordinary income. The Code does not allow the accumulation of basis, e.g., for education and development expenditures, as an individual prepares to sell services to another through an employment or consulting arrangement. Technically, payments for such services enter gross income net of a zero basis in the time and effort rendered under the arrangement. In theory, a faculty member who is hired on a tenure-track position can command more salary than a faculty member who is not on the tenure track. Therefore, an argument might be made that any “excess” compensation received before tenure is granted (and already taxed as ordinary income) establishes a tax basis in the tenure position. This is in turn “recognized” as ordinary income when tenure is granted (an I.R.C. §83(b) type of election), and a basis in tenure is established. Such a position is tenuous at best. Is There a Partial Ordinary Income Element? As mentioned earlier, it is generally accepted that the “bundle” of rights that accompanies the grant of tenure includes a conditional right to continued employment that generates ordinary income. The central assumption of this paper is that the salary 26 right is specifically spelled out in the annual employment contract, and tenure should be viewed as a separate property right “on top” of the annual compensation. But is it possible to argue that at least a portion of the early retirement payment relates to the surrender of ordinary income? For example, many universities have “collateral” faculty positions, where terminally qualified faculty perform teaching services outside the tenure structure. And some universities may distinguish “research” faculty from “teaching” faculty, with only the former placed on a tenure track. Typically, the tenure-track position would involve higher compensation than a non-tenure track position with similar teaching responsibilities. If the IRS is unsuccessful in arguing that the entire early retirement payment is taxed as ordinary income, could they argue that a portion of the payment should be allocated to “above-normal” tenure-track earnings? As an example, assume that a tenured faculty member is hired at a salary of $100,000, and a terminally qualified, collateral faculty member with similar teaching responsibilities is paid only $70,000. In this case, the IRS might argue that 30% of the early-retirement payment relates to “above normal” earnings attaching to a tenure-track position (a payment to forego ordinary income specifically related to tenure) and the remaining 70% of the payment is for the separate property right. The IRS case for an ordinary income element may also be strengthened if the university does not plan to fill the tenure-track position subject to the buyout. In tightening economic times and shrinking budgets, eliminating tenure lines may be the only way for a university to general additional operating funds. In such cases, the tenure position “vanishes,” and the IRS may apply the rationale of Rev. Rul. 75-44 mentioned 27 earlier, where the payment received by a railroad employee for the surrender of seniority rights that vanished was ruled to be ordinary income. CONCLUSION In 1988, the U.S. Tax Court ruled in Merrill J. Foote v. Commissioner that payments made to a faculty member for the relinquishment of tenure should be reported as ordinary income, noting that there was no sale or exchange of a capital asset. By focusing on the“substitute for ordinary income” analogy, the Court ignored the potential value of the tenure position to the university. Foote and the Tax Court also ignored the equitable interest theory developed in the Ferrer case that has dominated recent decisions concerning the relinquishment of contract rights. Two events occurring after the Foote case should change this result in similar cases in the future. First, in North Dakota State University, the Court of Appeals for the 8th Circuit ruled that a public university’s payments to tenured faculty members under an early retirement program did not constitute wages subject to FICA tax or income tax withholding. The Court noted that tenure was a recognized property right, and not a mere contract employment right. Secondly, I.R.C. §1234A, enacted in 1981, specifically includes within the definition of a “sale or exchange” the lapse, cancellation, or relinquishment of any contract right. This clearly applies to the relinquishment of tenure. These recent events provide more support to the argument that tenure is a property right that is separate and identifiable from the contract, and as such should be recognized as a capital asset that has appreciated in value since tenure was granted. If this logic is accepted, then the “substitute for ordinary income” is of little relevance. 28 The mere offer of the tenure buyout establishes both that the intangible right of tenure has a value distinct from the simple rendering of future services, and that the university and the professor are in a position to make an exchange triggering gain or loss. And I.R.C. §1234A seems to provide sale or exchange treatment as required for capital gains for the relinquishment of contract rights. When buttressed with the “equitable interest” logic of the Ferrer case, where the taxpayer has a negative power through due process considerations, it appears that the taxpayer can apply capital asset treatment to the relinquishment of tenure. 29 Table 1 A Comparison of the I.R.C. §83(b) Election and the Relinquishment of Tenure Event I.R.C. §83(b) Election Relinquishing Tenure 2001 - A, an employee is hired by BB Company. Professor C is hired as an assistant professor at DD University. 2007 – BB Company transfers 1,000 shares of restricted stock to employee A, worth $40,000. DD University grants tenure to C. No tax consequences to Employee A or BB, the employer. No tax consequences to Professor C, the assistant professor. Employee A makes a Sec. 83(b) election to be taxed currently on the $40,000 value of the stock received. A’s basis in the stock is now $40,000. Any subsequent gain recognized by A on a sale of the stock will be reported as longterm capital gain. 2021 – Employee A sells the BB stock for $70,000. Professor C receives $70,000 from DD University as an early retirement incentive. Employee A recognizes a $30,000 long-term capital gain on the sale of the stock ($70,000 - $40,000). BB Company has no deduction related to this transaction. Professor C now possesses a valuable tenure right and makes an implied Sec. 83(b) election. This tenure right has a present value of zero, so no gross income results. C continues to be taxed on the salary as ordinary income. C has a zero basis in the “tenure” right. Professor C recognizes a $70,000 long-term gain ($70,000 - $0) on the relinquishment of tenure. 30