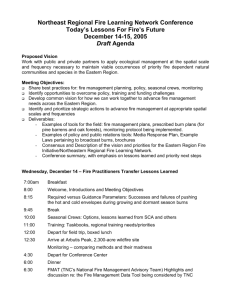

annual report 2012 - Eastern Housing Ltd.

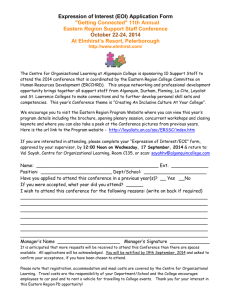

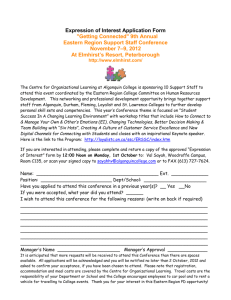

advertisement