Property Law Act 1974 - Queensland Legislation

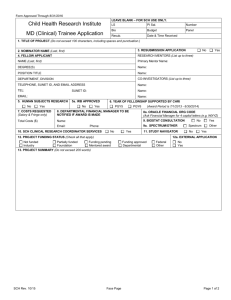

advertisement