Westpac Flexible Income Plan (PDF 415kb) (Opens in new window)

advertisement

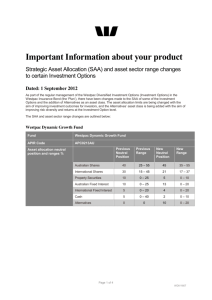

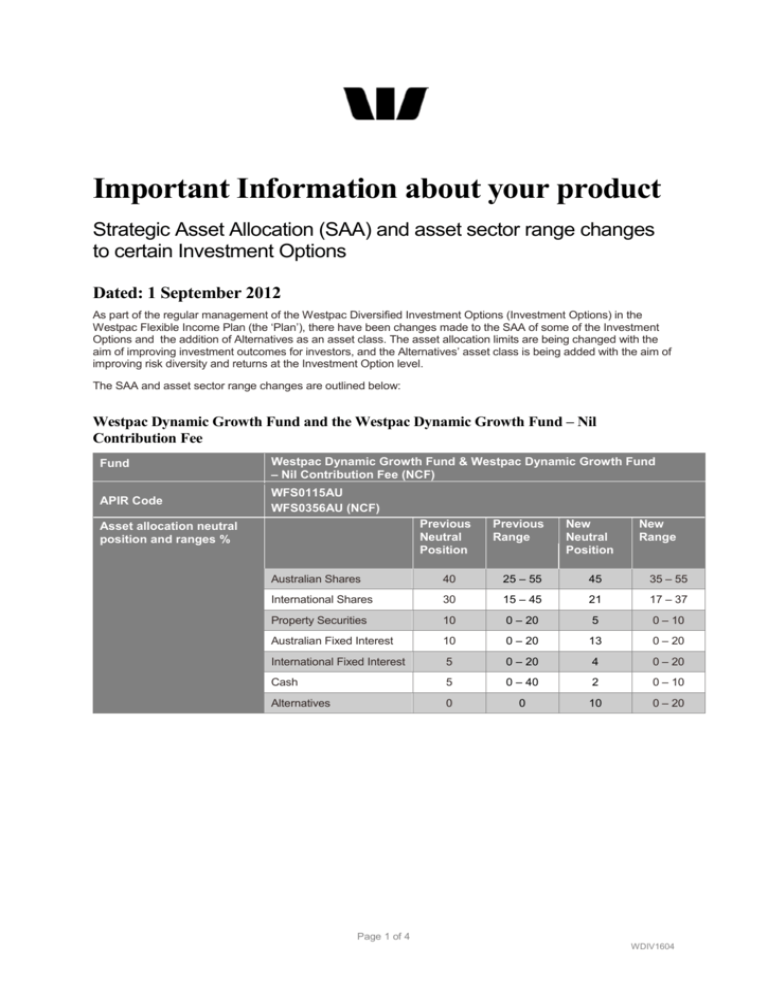

Important Information about your product Strategic Asset Allocation (SAA) and asset sector range changes to certain Investment Options Dated: 1 September 2012 As part of the regular management of the Westpac Diversified Investment Options (Investment Options) in the Westpac Flexible Income Plan (the ‘Plan’), there have been changes made to the SAA of some of the Investment Options and the addition of Alternatives as an asset class. The asset allocation limits are being changed with the aim of improving investment outcomes for investors, and the Alternatives’ asset class is being added with the aim of improving risk diversity and returns at the Investment Option level. The SAA and asset sector range changes are outlined below: Westpac Dynamic Growth Fund and the Westpac Dynamic Growth Fund – Nil Contribution Fee Fund Westpac Dynamic Growth Fund & Westpac Dynamic Growth Fund – Nil Contribution Fee (NCF) APIR Code WFS0115AU WFS0356AU (NCF) Previous Neutral Position Asset allocation neutral position and ranges % Previous Range New Neutral Position New Range Australian Shares 40 25 – 55 45 35 – 55 International Shares 30 15 – 45 21 17 – 37 Property Securities 10 0 – 20 5 0 – 10 Australian Fixed Interest 10 0 – 20 13 0 – 20 International Fixed Interest 5 0 – 20 4 0 – 20 Cash 5 0 – 40 2 0 – 10 Alternatives 0 0 10 0 – 20 Page 1 of 4 WDIV1604 Westpac Balanced Growth Fund and the Westpac Balanced Growth Fund – Nil Contribution Fee Fund Westpac Balanced Growth Fund & Westpac Balanced Growth Fund – Nil Contribution Fee (NCF) APIR Code WFS0113AU WFS0354AU (NCF) Previous Neutral Position Asset allocation neutral position and ranges % Previous Range New Neutral Position New Range Australian Shares 33 23 – 43 39 28 – 48 International Shares 22 12 – 32 14 12 – 32 Property Securities 10 0 – 20 5 0 – 10 Australian Fixed Interest 20 10 – 30 25 5 – 32 International Fixed Interest 10 0 – 20 5 0 – 20 Cash 5 0 – 20 2 0 – 10 Alternatives 0 0 10 0 – 20 Westpac Moderate Growth Fund and the Westpac Moderate Growth Fund – Nil Contribution Fee Fund Westpac Moderate Growth Fund & Westpac Moderate Growth Fund – Nil Contribution Fee (NCF) APIR Code WFS0117AU WFS0359AU (NCF) Previous Neutral Position Asset allocation neutral position and ranges % Previous Range New Neutral Position New Range Australian Shares 17 7 – 27 21 5 – 25 International Shares 10 0 – 20 5 0 – 18 Property Securities 8 0 – 20 3 0 – 10 Australian Fixed Interest 30 20 – 40 48 20 – 55 International Fixed Interest 10 0 – 20 10 5 – 35 Cash 25 15 – 35 5 0 – 40 Alternatives 0 0 8 0 – 20 Page 2 of 4 WDIV1604 Westpac Conservative Growth Fund and the Westpac Conservative Growth Fund – Nil Contribution Fee Fund Westpac Conservative Growth Fund & Westpac Conservative Growth Fund – Nil Contribution Fee (NCF) APIR Code WFS0114AU WFS0355AU (NCF) Previous Neutral Position Asset allocation neutral position and ranges % Previous Range New Neutral Position New Range Australian Shares 10 5 – 15 11 5 – 15 International Shares 5 0 – 10 3 0 – 10 Property Securities 5 0 – 20 2 0 – 20 Australian Fixed Interest 25 10 – 30 33 20 – 50 International Fixed Interest 10 0 – 20 10 0 – 20 Cash 45 40 – 60 33 30 – 50 Alternatives 0 0 8 0 – 20 Alternative investments refer to investments that do not fall within the main asset classes. Alternative investments can be based on publicly traded securities like shares and bonds, commodities and derivatives including through hedge funds, absolute return funds and commodity investment funds. Some alternative investments are based on private securities; these include venture capital and private equity. Investment strategies that may be found in some alternative investments include the use of gearing, short selling (selling something you do not own with a view to buying it back later at a lower price) and more extensive use of derivatives. Like shares, property, fixed interest and cash, alternative investments are subject to certain risks that may include periods of large market falls, high volatility or reduced liquidity (i.e. the ability to sell investments immediately). Use of gearing in alternative investments may magnify both gains and losses and the variability of returns. Other risks associated with alternative investment strategies may include a heavy reliance on key individuals and being based in a country or countries where the level of regulatory supervision is lower than in Australia. Although we do not charge a performance fee directly, for Plans with exposure to alternative investments, certain underlying hedge fund managers are entitled to recover performance fees from the underlying alternative investments. Typically, performance fees allow the investment manager to share in the investment return achieved above that of a relevant benchmark. Where the underlying managers are entitled to performance fees, these fees are not deducted from the Plan directly and do not form part of the issuer fee set out in the Product Disclosure Statement (PDS) for the Plan. Underlying performance fees impact investors by reducing the returns generated by the Plan’s underlying investments and therefore the value of your investment in the Plan. These arrangements vary between investment managers and may change, from time to time. Page 3 of 4 WDIV1604 For more information Talk to your financial planner or contact Customer Relations on 131 817 between 8.00am – 6.30pm (Monday to Friday, Sydney time) Current as at 1 September 2012. The information in this flyer is factual only and does not constitute financial product advice. Before acting on this information you should seek financial and taxation advice to determine its appropriateness to your objectives, financial situation and needs. This flyer provides an overview or summary only and it should not be considered a comprehensive statement on any matter or relied upon as such. Westpac Securities Administration Limited ABN 77 000 049 472 AFSL 233731 is the trustee of and issuer of interests in the Westpac Master Trust - Superannuation Division (incorporating the Westpac Flexible Income Plan) ABN 81 236 903 448. An Annual Report, PDS, fund fact sheet and/or Financial Services Guide (as applicable) is available for the Plan and can be obtained by calling Customer Relations on 131 817. You should obtain and consider the relevant PDS before deciding whether to acquire, continue to hold or dispose of interests in the Plan. An investment in the aforementioned Westpac Diversified Investment Options is not an investment in, deposit with or any other liability of Westpac Banking Corporation ABN 33 007 457 141 (the Bank) or any other company in the Westpac Group. It is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. Neither the Bank nor any other company in the Westpac Group has issued, stands behind or otherwise guarantees the capital value or investment performance of the aforementioned Investment Options. Page 4 of 4 WDIV1604