Corporate Card - Westpac program roles

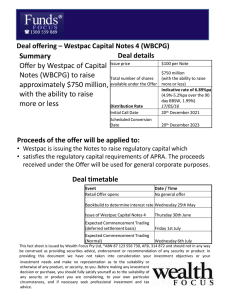

advertisement

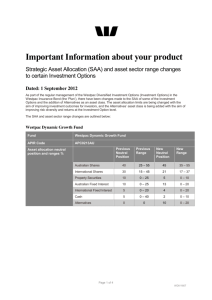

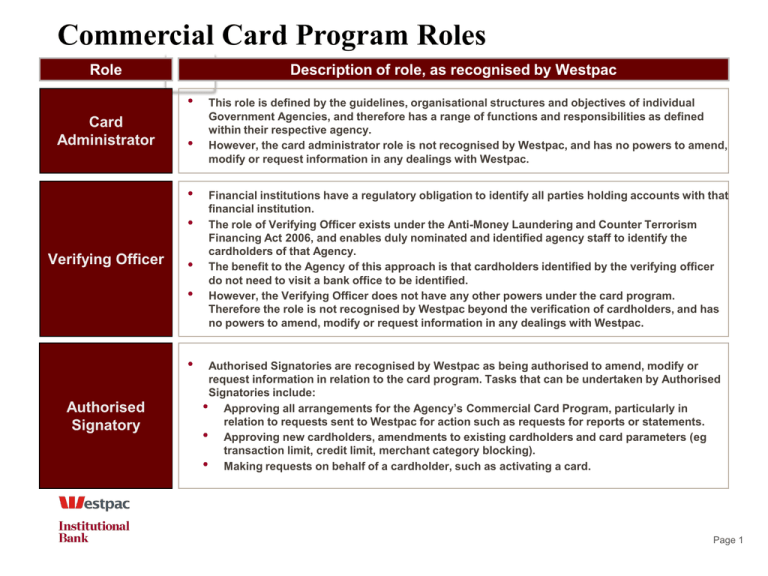

Commercial Card Program Roles Role Description of role, as recognised by Westpac • Card Administrator • • • Verifying Officer • • • Authorised Signatory This role is defined by the guidelines, organisational structures and objectives of individual Government Agencies, and therefore has a range of functions and responsibilities as defined within their respective agency. However, the card administrator role is not recognised by Westpac, and has no powers to amend, modify or request information in any dealings with Westpac. Financial institutions have a regulatory obligation to identify all parties holding accounts with that financial institution. The role of Verifying Officer exists under the Anti-Money Laundering and Counter Terrorism Financing Act 2006, and enables duly nominated and identified agency staff to identify the cardholders of that Agency. The benefit to the Agency of this approach is that cardholders identified by the verifying officer do not need to visit a bank office to be identified. However, the Verifying Officer does not have any other powers under the card program. Therefore the role is not recognised by Westpac beyond the verification of cardholders, and has no powers to amend, modify or request information in any dealings with Westpac. Authorised Signatories are recognised by Westpac as being authorised to amend, modify or request information in relation to the card program. Tasks that can be undertaken by Authorised Signatories include: • Approving all arrangements for the Agency’s Commercial Card Program, particularly in relation to requests sent to Westpac for action such as requests for reports or statements. • Approving new cardholders, amendments to existing cardholders and card parameters (eg transaction limit, credit limit, merchant category blocking). • Making requests on behalf of a cardholder, such as activating a card. Page 1